This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

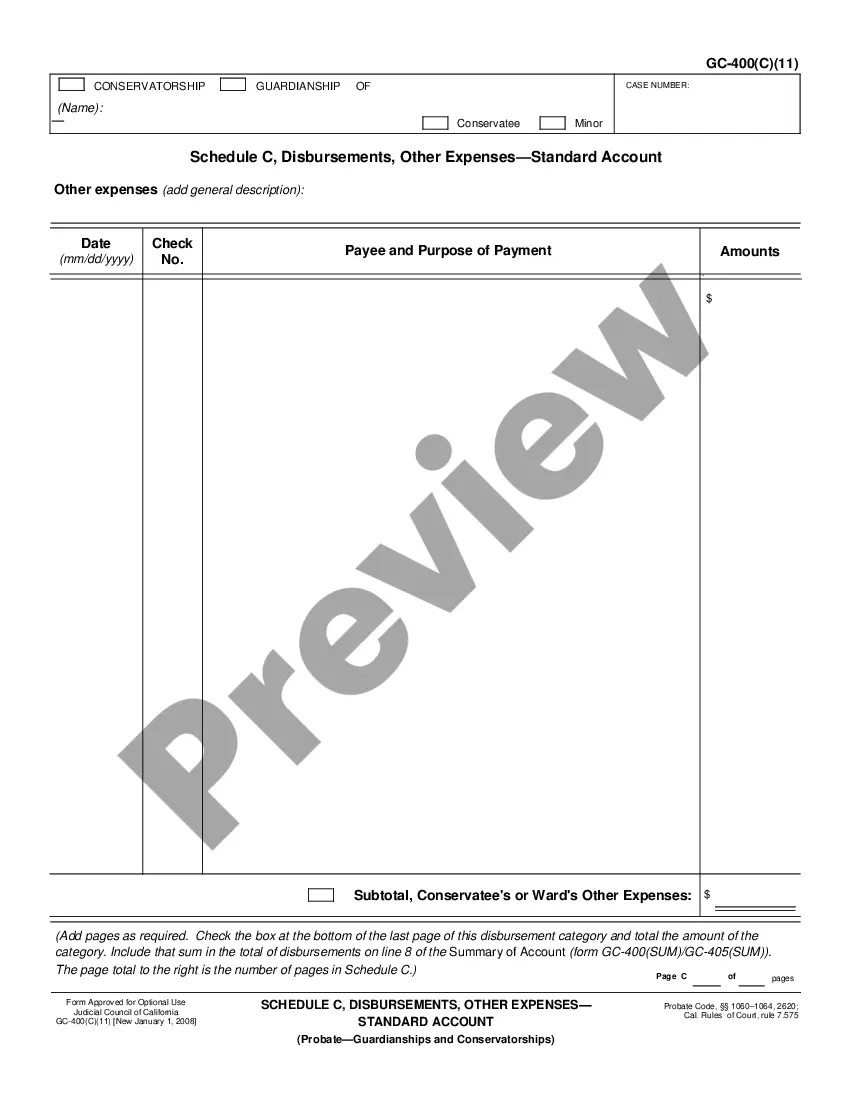

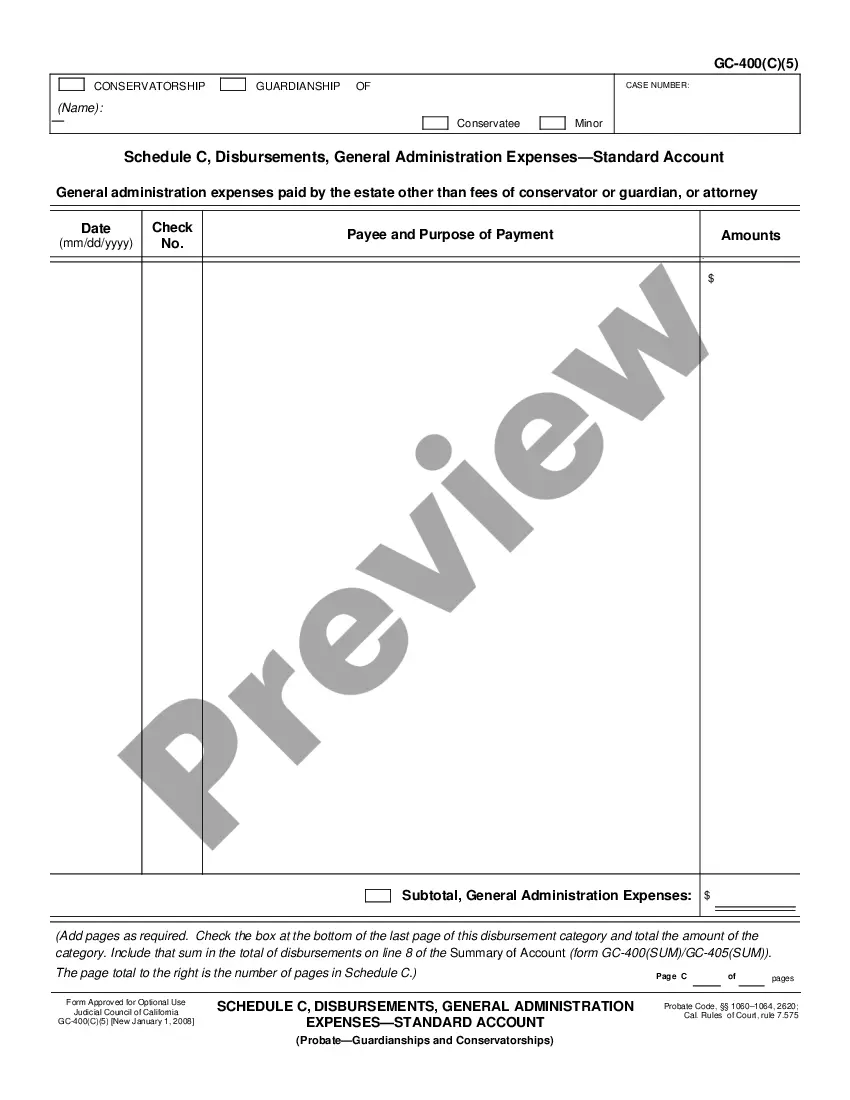

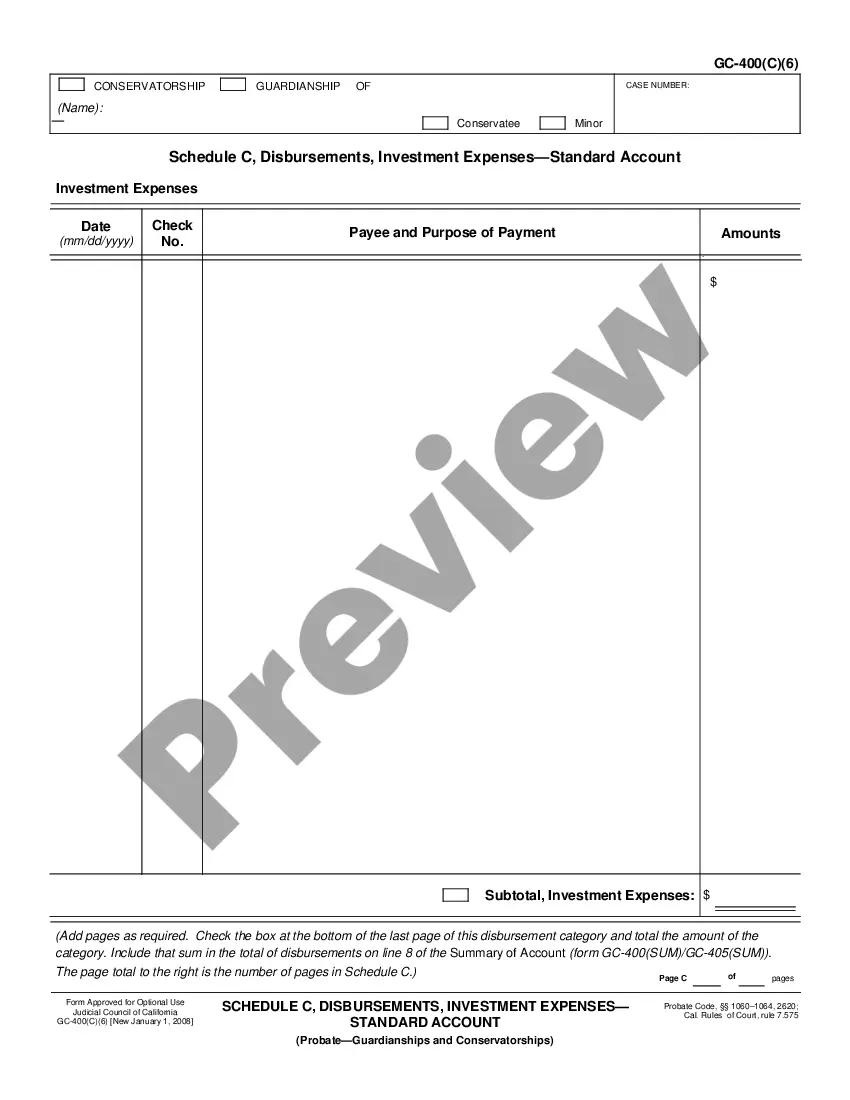

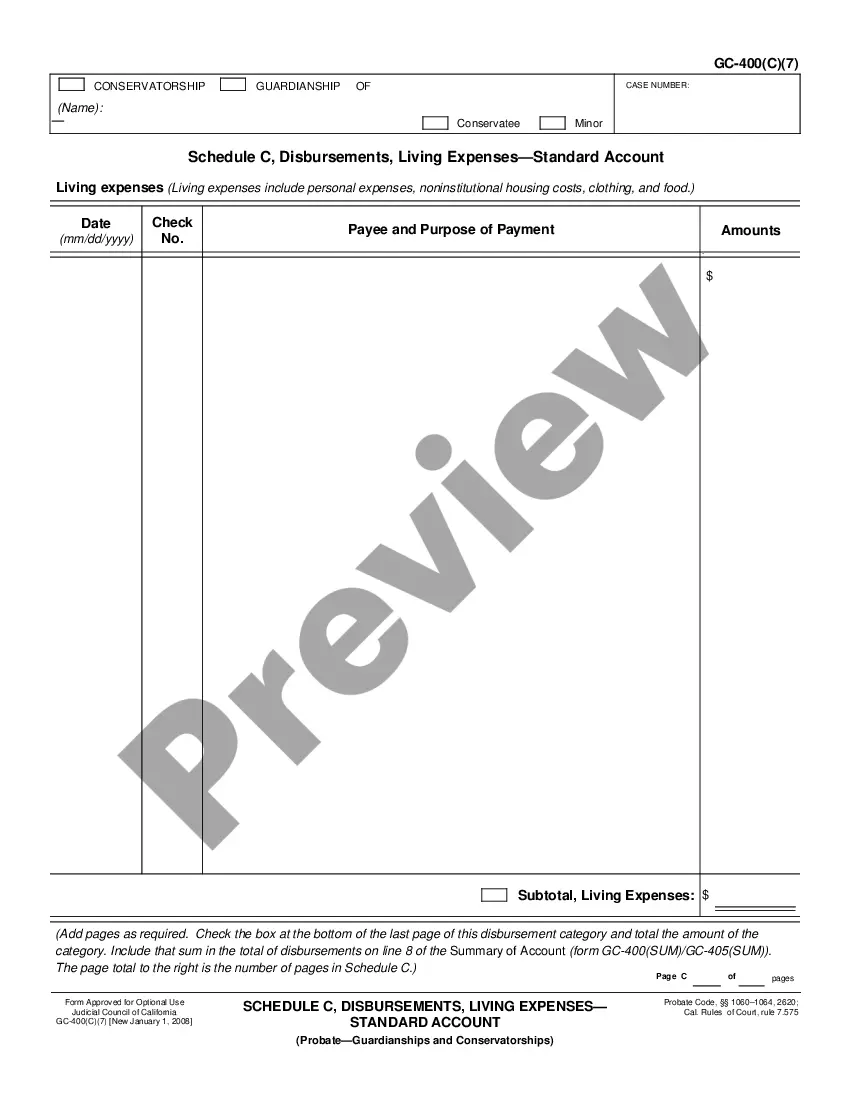

California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account

Description

How to fill out California Schedule C, Disbursements, Fiduciary And Attorney Fees-Standard Account?

If you're looking for accurate California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account forms, US Legal Forms is precisely what you require; locate documents created and authenticated by state-approved legal professionals.

Utilizing US Legal Forms not only spares you from the troubles associated with legal paperwork; it also saves you time, effort, and money! Downloading, printing, and filling out a professional document is significantly less expensive than hiring an attorney to do it for you.

And that's it. In just a few simple clicks, you have an editable California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account. After creating an account, all subsequent orders will be processed even more effortlessly. Once you have a US Legal Forms subscription, simply Log In to your account and click the Download button available on the form's page. Then, when you need to use this template again, you'll always be able to find it in the My documents section. Don't waste your time and effort searching through numerous forms on different websites. Obtain accurate templates from one secure source!

- To begin, complete your registration by providing your email and setting up a secure password.

- Follow the instructions given below to create your account and retrieve the California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account template to address your needs.

- Utilize the Preview feature or check the file description (if available) to ensure that the template is the one you desire.

- Verify its legitimacy in your state.

- Click Buy Now to place an order.

- Choose a preferred pricing plan.

- Create your account and make payment using your credit card or PayPal.

- Select a suitable format and save the form.

Form popularity

FAQ

Yes, you can file a lawsuit for breach of fiduciary duty in California. Such claims often center around the misuse of trust, misrepresentation, or failure to act in the best interest of another party. If you pursue this legal avenue, the California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account can help you outline and recover the necessary expenses. Engaging with legal services, like USLegalForms, can support you in navigating this complex area.

Remedies for breach of fiduciary duty in California can include compensatory damages, punitive damages, and the recovery of attorneys' fees. This is particularly relevant when dealing with the California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account, as it helps you itemize and recover your losses. The specifics of your case will determine the appropriate remedy. Consulting with professionals will provide clarity on the best path forward.

Yes, attorneys' fees are often recoverable for breach of contract in California. The law generally permits this if a contract stipulates that the prevailing party can recover their fees. Under the California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account, you can seek these fees through the legal process. To ensure you meet all necessary criteria, it may be beneficial to consult legal expertise.

In most cases, attorneys' fees are recoverable in California, especially if a contractual provision or statute allows for recovery. In the context of the California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account, understanding these avenues is crucial. If your case involves a breach of fiduciary duty or contract, documenting your claims can facilitate the recovery of your fees. Utilizing a professional like USLegalForms can help you manage this efficiently.

Yes, in California, you can pursue attorneys' fees if you establish a breach of fiduciary duty. The California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account allows for this when the court recognizes the breach. If you prove that the breach caused you damages, you may recover these fees in your legal action. Working with an experienced attorney can help you navigate this process effectively.

The American rule states that each party in a case pays their own attorney's fees unless a statute or contract specifically provides otherwise. In California, this rule applies widely, making it essential to understand how the law impacts your ability to recover fees. If you are uncertain about your rights concerning attorney fees, leveraging the California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account may provide clarity. Understanding these rules can significantly affect the financial outcome of your legal matters.

You should file a motion for attorney's fees in California after you have successfully completed a case or dispute where such fees are recoverable. It is essential to file the motion promptly and within the time frame set by the court. The California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account can help you track and determine your eligible fees. Consulting with a qualified attorney can ensure that you follow proper procedures.

You can claim attorney fees, but eligibility and procedure vary based on your situation and the nature of your case. Make sure to check your documentation and see if qualifying statutes or agreements allow for these fees to be included in the California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account. Platforms such as US Legal Forms can assist you in preparing the necessary documentation to support your request to claim these fees effectively.

In California, attorney fees for a quiet title action can be recoverable under certain conditions. When you prevail in your quiet title lawsuit, you may be able to claim these fees as part of your costs. It’s essential to reference the California Schedule C, Disbursements, Fiduciary and Attorney Fees-Standard Account, as it outlines how these fees may be categorized and processed. Using a platform like US Legal Forms can streamline the process of understanding and filing for these recoverable fees.