This is an official California Judicial Council family law form, which may be used in domestic litigation in California. Enter the information as indicated on the form and file with the court as appropriate.

California Earnings Assignment Order for Spousal Support - Family Law

Description

How to fill out California Earnings Assignment Order For Spousal Support - Family Law?

If you are seeking accurate California Earnings Assignment Order for Spousal Support - Family Law templates, US Legal Forms is precisely what you require; access documents provided and verified by state-certified attorneys.

Utilizing US Legal Forms not only protects you from issues regarding legal documents; you also save time and money!

And that’s it. With just a few simple clicks you have an editable California Earnings Assignment Order for Spousal Support - Family Law. Once you create an account, all future requests will be handled even more easily. With a US Legal Forms subscription, simply Log In to your profile and click the Download button visible on the form’s page. Then, whenever you need to use this template again, you will always find it in the My documents section. Don't waste your time and energy searching through hundreds of documents on various websites. Obtain professional paperwork from one reliable service!

- Downloading, printing, and filling out a professional template is significantly less expensive than hiring a lawyer to do it for you.

- To begin, complete your registration process by entering your email and creating a secure password.

- Follow the steps below to set up your account and obtain the California Earnings Assignment Order for Spousal Support - Family Law template to address your needs.

- Use the Preview feature or review the document details (if available) to ensure that the sample is the one you want.

- Verify its legality in your state.

- Click Buy Now to place your order.

- Choose a preferred payment plan.

- Create an account and pay using your credit card or PayPal.

- Select a convenient format and download the document.

Form popularity

FAQ

Several factors can disqualify an individual from receiving spousal support in California. These may include a significant change in financial circumstances, cohabitation with a new partner, or an inability to demonstrate need based on income and assets. Additionally, if one party's behavior contributes to the dissolution of the marriage, this may also impact eligibility. Understanding your rights and obligations with a reliable resource like uslegalforms can provide clarity regarding a California Earnings Assignment Order for Spousal Support - Family Law.

Yes, California follows a guideline formula for determining spousal support, particularly during divorce proceedings. This formula considers various factors, including the duration of the marriage, the income of both parties, and the standard of living established during the marriage. While guidelines provide a baseline, each case is unique and can pivot based on specific circumstances. Consulting with an attorney can help you apply these factors effectively in the context of a California Earnings Assignment Order for Spousal Support - Family Law.

In California, an ex-spouse cannot directly pursue your new spouse's income for spousal support under a California Earnings Assignment Order for Spousal Support - Family Law. However, if you have a court-ordered support obligation, your income can be affected by new relationships. It is important to keep in mind that the court focuses on your financial situation, not that of your new spouse. Seeking professional guidance can help you navigate these complexities.

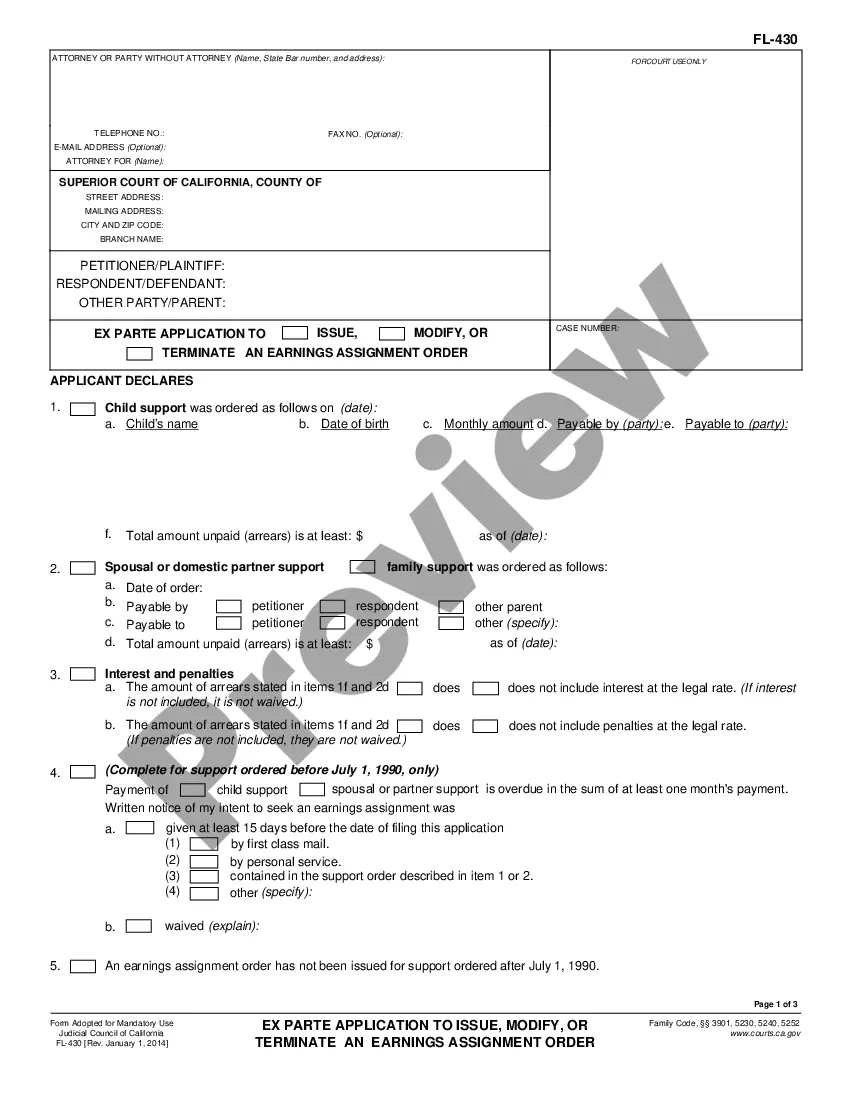

Form FL-430 is the California Judicial Council form used to request a spousal support order modification. When changes in financial situations occur, you might need to adjust your support arrangement. Utilizing this form as part of the California Earnings Assignment Order for Spousal Support - Family Law process ensures that all modifications are documented correctly, thus securing your legal rights and obligations.

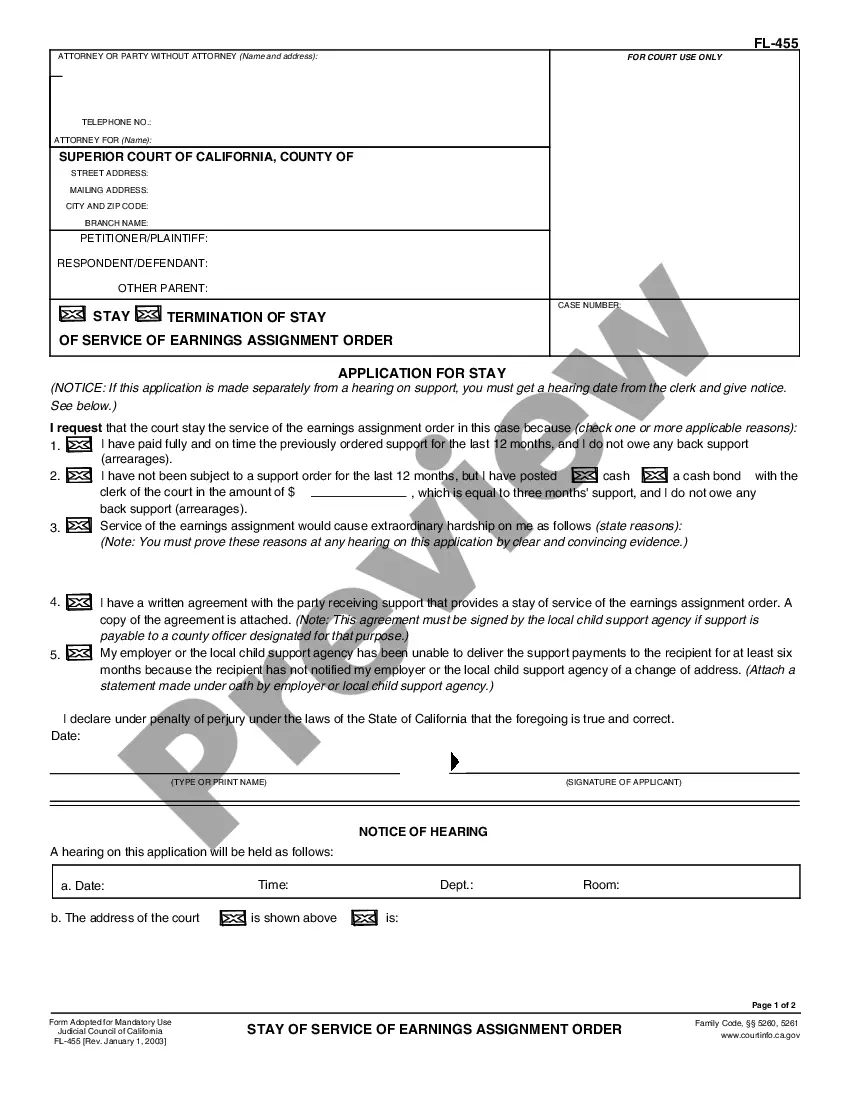

An earnings assignment is a legal mechanism in California that allows for the automatic deduction of spousal support from a person's income. This process ensures timely payments, providing financial security to the receiving spouse. The California Earnings Assignment Order for Spousal Support - Family Law simplifies the enforcement of support obligations, making it easier for both parties to meet their financial responsibilities.

The FL 430 form is a crucial document used in California family law cases regarding spousal support. This form requests an earnings assignment order, allowing consistent payment of spousal support through wage garnishment. Completing and submitting the FL 430 form can help ensure that you receive the support that has been ordered by the court, making your financial planning easier.

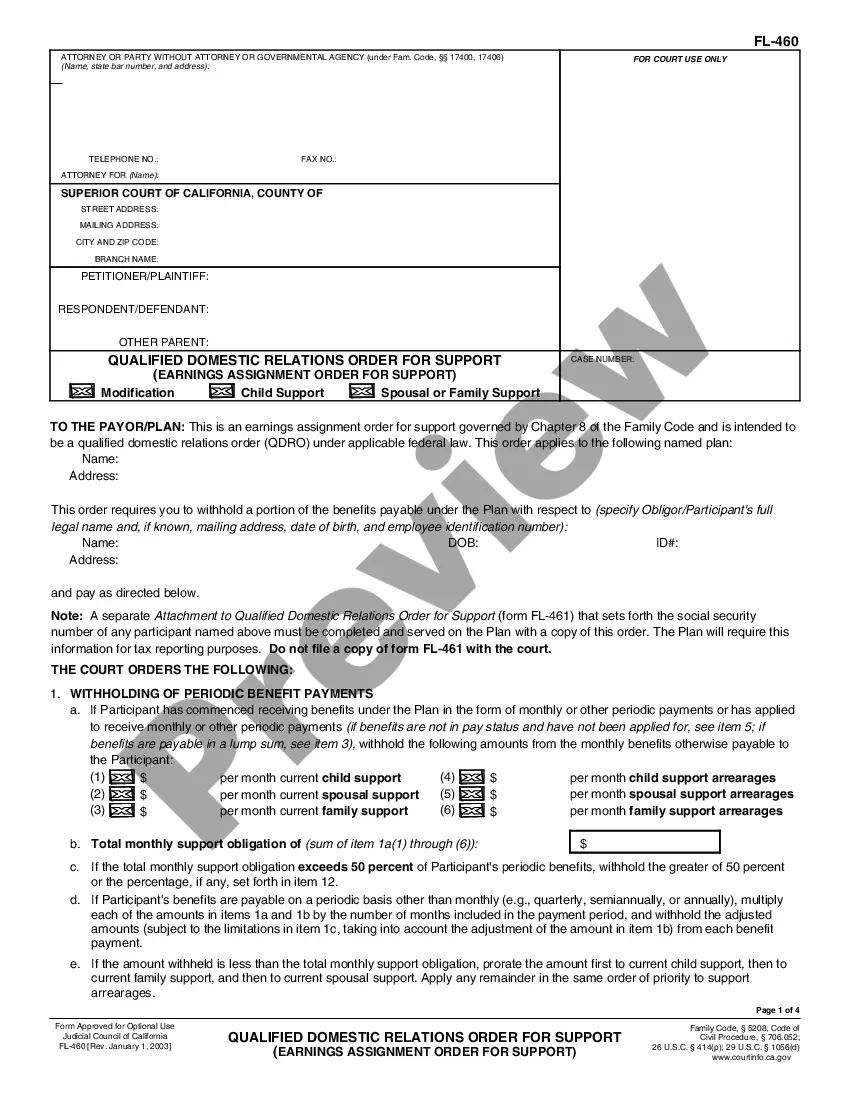

To enforce spousal support in California, you may need to take legal action if the other party fails to comply with the support order. This can include filing for contempt of court or seeking wage garnishment through the California Earnings Assignment Order for Spousal Support. Utilizing tools and resources from USLegalForms can provide you with the necessary forms and instructions to effectively manage enforcement.

Enforcing a spousal support order in California typically involves filing a motion with the court if payments are not being made. The California Earnings Assignment Order for Spousal Support can also play a crucial role in this process, as it automatically garnishes wages to ensure payment. Legal support from platforms like USLegalForms can guide you through this process, helping to secure the financial support you are entitled to.

To garnish wages for spousal support in California, you need to obtain a court order specifically for this purpose. Once the court issues the California Earnings Assignment Order for Spousal Support, you can submit it to the payer's employer, who will then withhold the designated amount from their paycheck. This legal process ensures that spousal support is collected directly and reduces the risk of non-payment.