This form is a Grant Deed transferring mineral rights where the Grantor is an individual and the Grantees are husband and wife. This deed complies with all state statutory laws.

California Grant Deed for Mineral Rights - Individual to Husband and Wife

Description

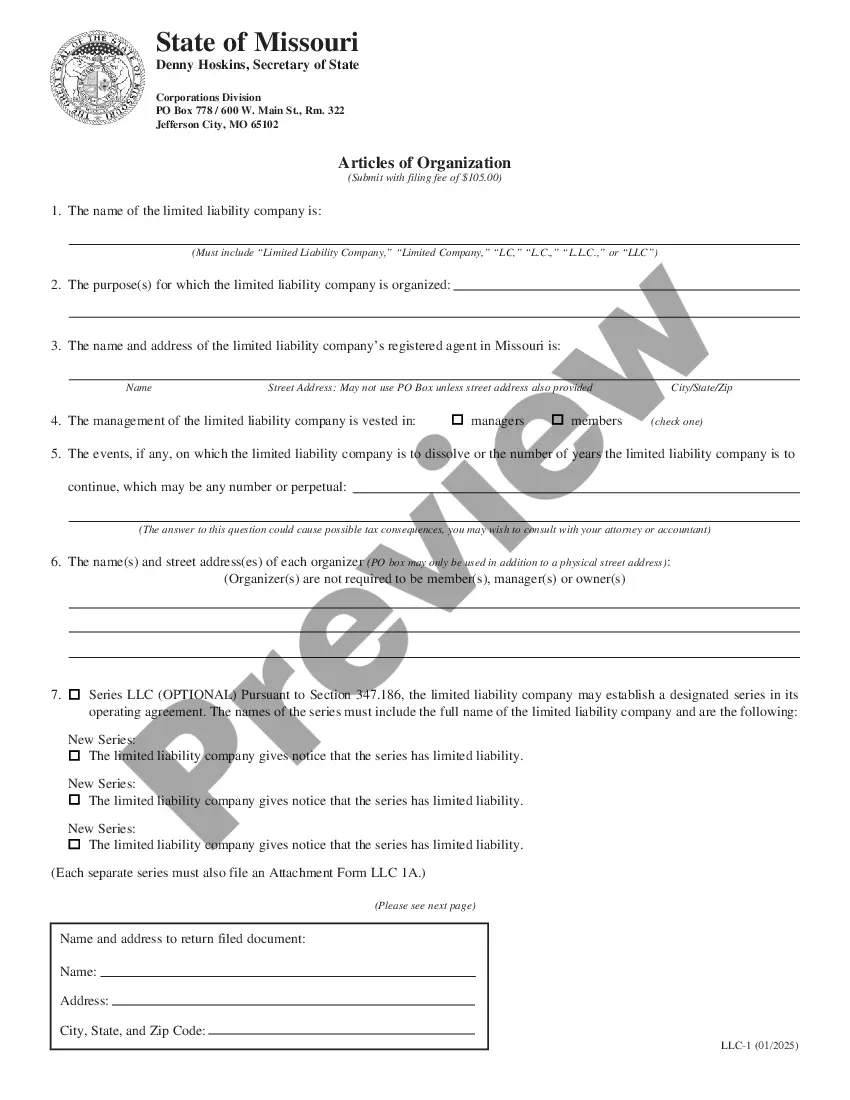

How to fill out California Grant Deed For Mineral Rights - Individual To Husband And Wife?

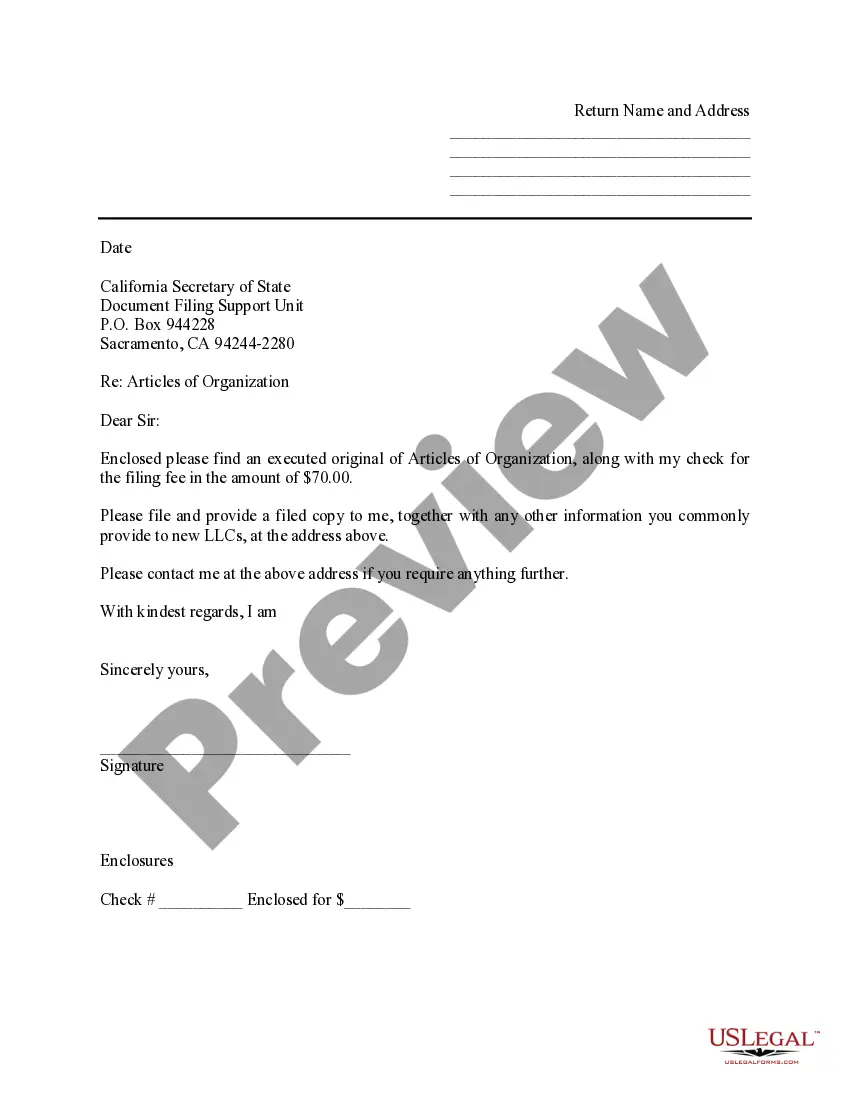

If you are looking for the appropriate California Grant Deed for Mineral Rights - Individual to Husband and Wife forms, US Legal Forms is exactly what you require; discover documents created and validated by state-certified attorneys.

Utilizing US Legal Forms not only prevents you from issues related to legal documentation; it also saves you time, effort, and money! Downloading, printing, and completing a professional form is genuinely more economical than hiring a lawyer to do it for you.

And that’s it. In just a few simple steps, you will obtain an editable California Grant Deed for Mineral Rights - Individual to Husband and Wife. Once your account is created, all future requests will be processed even more effortlessly. If you possess a US Legal Forms subscription, simply Log In to your account and click the Download button available on the form’s page. Then, when you need to use this template again, you will always find it in the My documents section. Don’t waste your time comparing numerous forms across various online sources. Purchase accurate documents from a single reliable platform!

- To begin, complete your registration process by providing your email and setting up a password.

- Follow the steps below to establish your account and access the California Grant Deed for Mineral Rights - Individual to Husband and Wife template suitable for your requirements.

- Use the Preview feature or review the document description (if available) to ensure that the template is what you need.

- Verify its relevance in your area.

- Click Buy Now to place an order.

- Select a recommended pricing plan.

- Set up your account and pay using a credit card or PayPal.

- Choose a suitable format and save the document.

Form popularity

FAQ

You can obtain a California Grant Deed for Mineral Rights - Individual to Husband and Wife from several sources. Check with your local county recorder's office for official forms or templates. Alternatively, platforms like USLegalForms offer easy access to reliable templates and guidance for preparing your deed. This can save you time and ensure your documents meet legal requirements.

Adding someone to a deed in California may trigger reassessment of property taxes due to transfer of ownership. Specifically, under California's Proposition 13, the addition may result in a new tax basis for property taxes. It is wise to consult a tax professional to understand how this might affect you and your spouse. This knowledge can help you plan better for any potential financial implications.

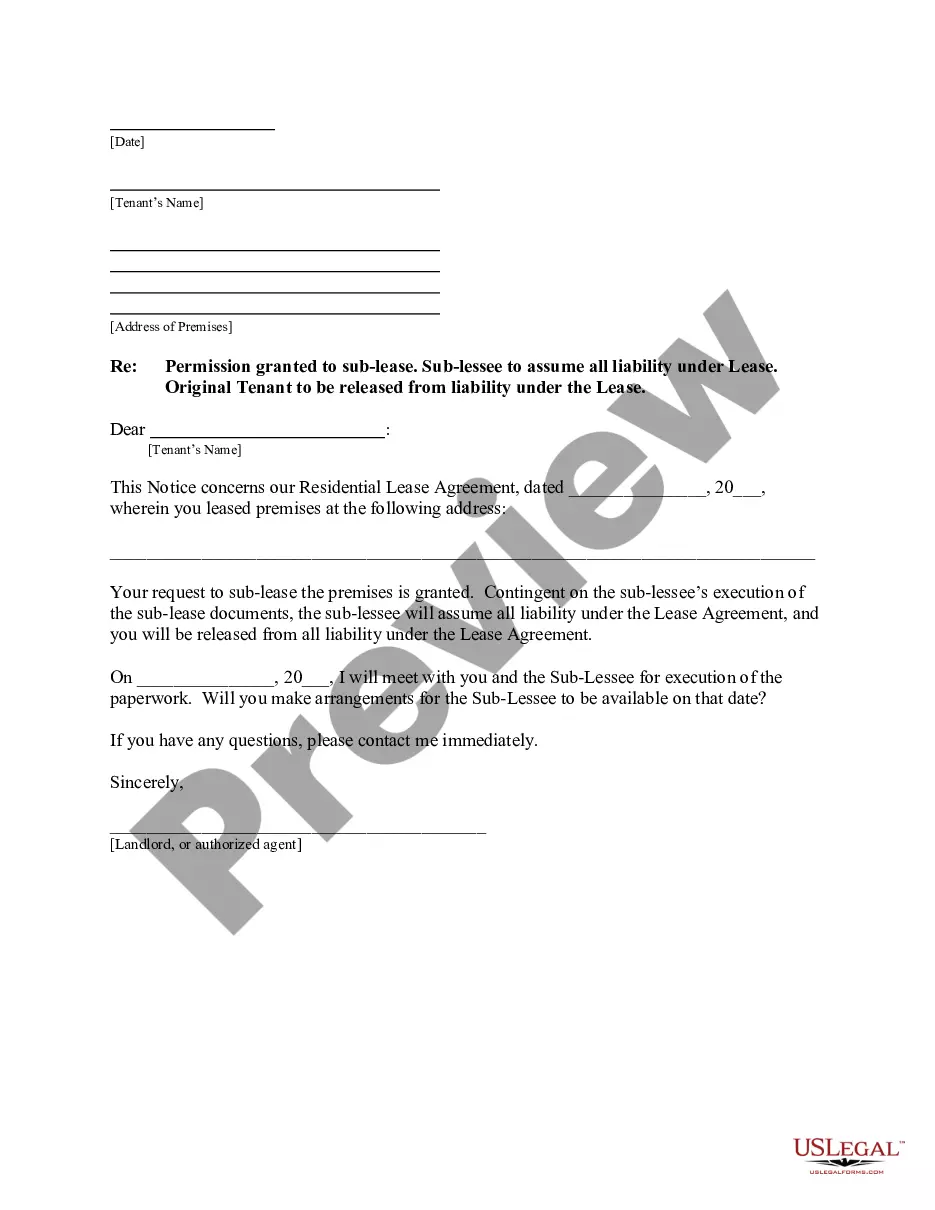

To deed mineral rights, you need to prepare a proper grant deed that specifies the mineral rights being transferred. If you're dealing with California Grant Deed for Mineral Rights - Individual to Husband and Wife, make sure to outline the rights clearly and include both parties' details. Sign and notarize the deed, then file it with your county recorder to make the transfer official and ensure protection of your rights in the minerals.

Amending a grant deed in California requires creating a new California Grant Deed for Mineral Rights - Individual to Husband and Wife that includes the desired changes. It is critical to properly identify the changes needed and ensure the deed is signed and notarized. Afterward, file the new deed with your local county recorder to replace the previous version legally. This way, you keep your ownership documents accurate and up-to-date.

To add a spouse to a deed in California, you will need to execute a new California Grant Deed for Mineral Rights - Individual to Husband and Wife. This deed needs to be signed by the current owner and notarized. Once completed, file the deed with the county recorder's office where the property is located. This ensures that legal ownership is updated to reflect the new arrangement.

Typically, the landowner is also the owner of the mineral rights, especially if no previous transactions have taken place. However, in many cases, mineral rights can be severed from surface rights, complicating ownership. In instances where rights have been sold, those owning the rights may be separate entities altogether. Therefore, understanding the history of your property is crucial in determining the ownership of mineral rights.

Mineral rights ownership can often be complex and varies depending on property history. If the rights were never sold or leased by prior landowners, you likely hold ownership as the current property owner. However, in many cases, mineral rights can be separated from surface rights. To accurately determine ownership, it might be useful to conduct a thorough title search, a service that professionals can assist you with.

Ownership of mineral rights in California depends on how the property title is structured. Typically, if you own the land, you also own the rights beneath it, including minerals. However, if those rights were sold or leased by previous owners, you may not have full ownership. To clarify your rights, reviewing your property's history with a qualified professional can be beneficial.

In California, mineral rights can last indefinitely, but they are generally tied to land ownership unless otherwise stipulated. If the rights are leased, the duration is defined by the lease agreement, which typically outlines specific terms. It is important to consider that the effective use or development of these rights can influence their longevity. Always consult legal professionals for clarification regarding a California Grant Deed for Mineral Rights - Individual to Husband and Wife.

To look up mineral rights in California, individuals can start by searching county recorder’s offices or the California State Lands Commission’s database. These resources often provide access to detailed property records, including mineral rights information. Utilizing platforms like US Legal Forms can streamline this process by offering templates and guidance relevant to acquiring a California Grant Deed for Mineral Rights - Individual to Husband and Wife.