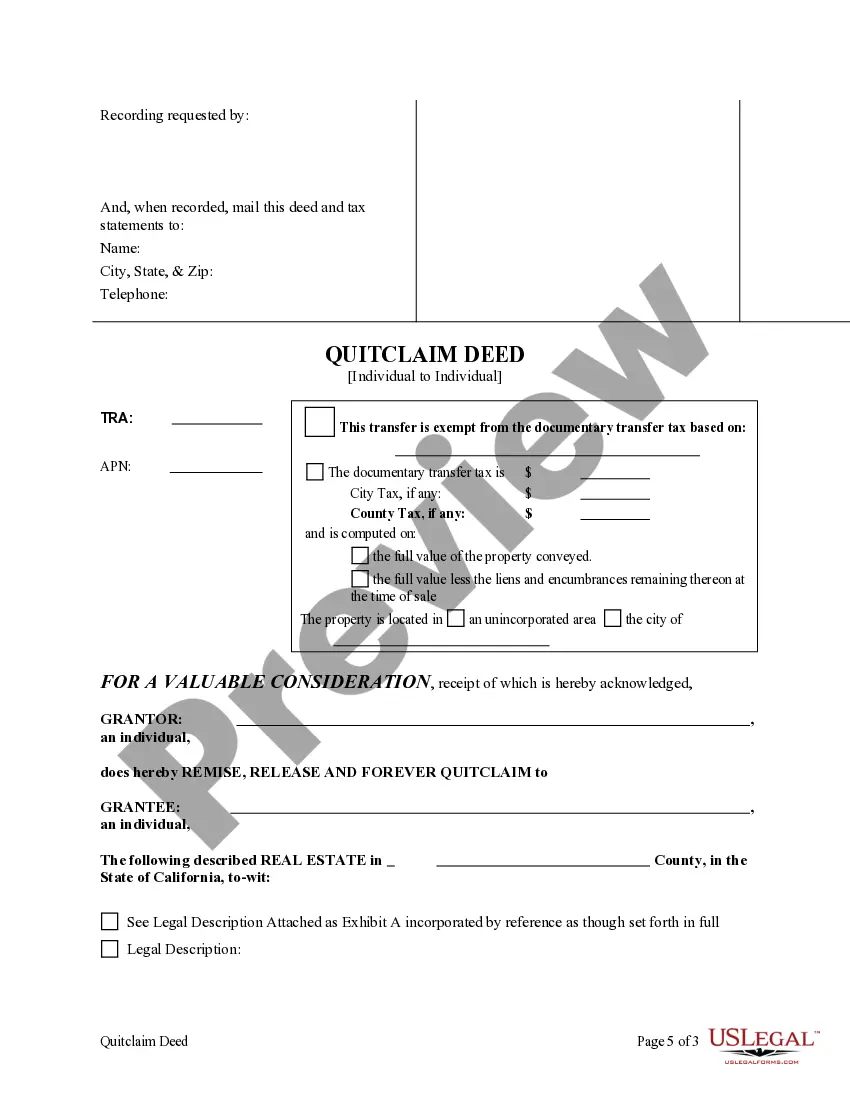

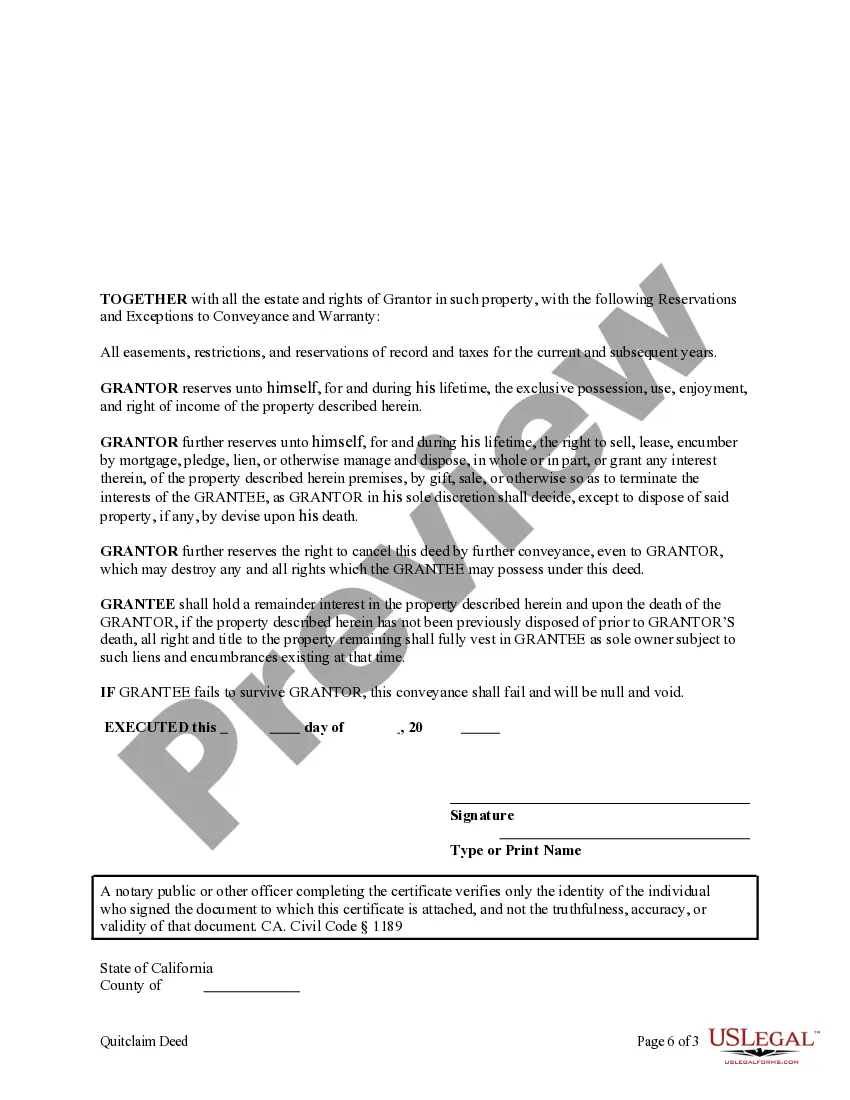

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantee is an individual. Grantor conveys the property to Grantee subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. The Grantee must survive the Grantor or the conveyance is null and void. This deed complies with all state statutory laws.

California Life Quitclaim Application

Description Ca Enhanced Deed Contract

How to fill out Quitclaim Deed Form Document?

If you're trying to find accurate California Enhanced Life Estate or Lady Bird Quitclaim Deed from Individual to Individual copies, US Legal Forms is what exactly you need; locate documents developed and inspected by state-accredited lawyers. Employing US Legal Forms not merely keeps you from worries relating to legal forms; furthermore, you conserve effort and time, and funds! Downloading, printing out, and filling in a proficient web template is much cheaper than asking legal counsel to accomplish it for you personally.

To begin, complete your sign up process by adding your electronic mail and building a secret password. Stick to the steps below to make your account and find the California Enhanced Life Estate or Lady Bird Quitclaim Deed from Individual to Individual template to deal with your circumstances:

- Utilize the Preview solution or look at the document description (if available) to make certain that the template is the one you want.

- Check out its applicability where you live.

- Click Buy Now to make an order.

- Go with a recommended pricing program.

- Create your account and pay out with the bank card or PayPal.

- Choose a convenient file format and download the the form.

And while, that’s it. In a few easy clicks you get an editable California Enhanced Life Estate or Lady Bird Quitclaim Deed from Individual to Individual. Once you make an account, all future purchases will be processed even simpler. When you have a US Legal Forms subscription, just log in profile and then click the Download option you see on the for’s page. Then, when you should employ this sample again, you'll always manage to find it in the My Forms menu. Don't waste your time comparing hundreds of forms on various platforms. Get precise templates from just one trusted service!