Arizona Employee Agreement Incentive Compensation and Stock Bonus

Description

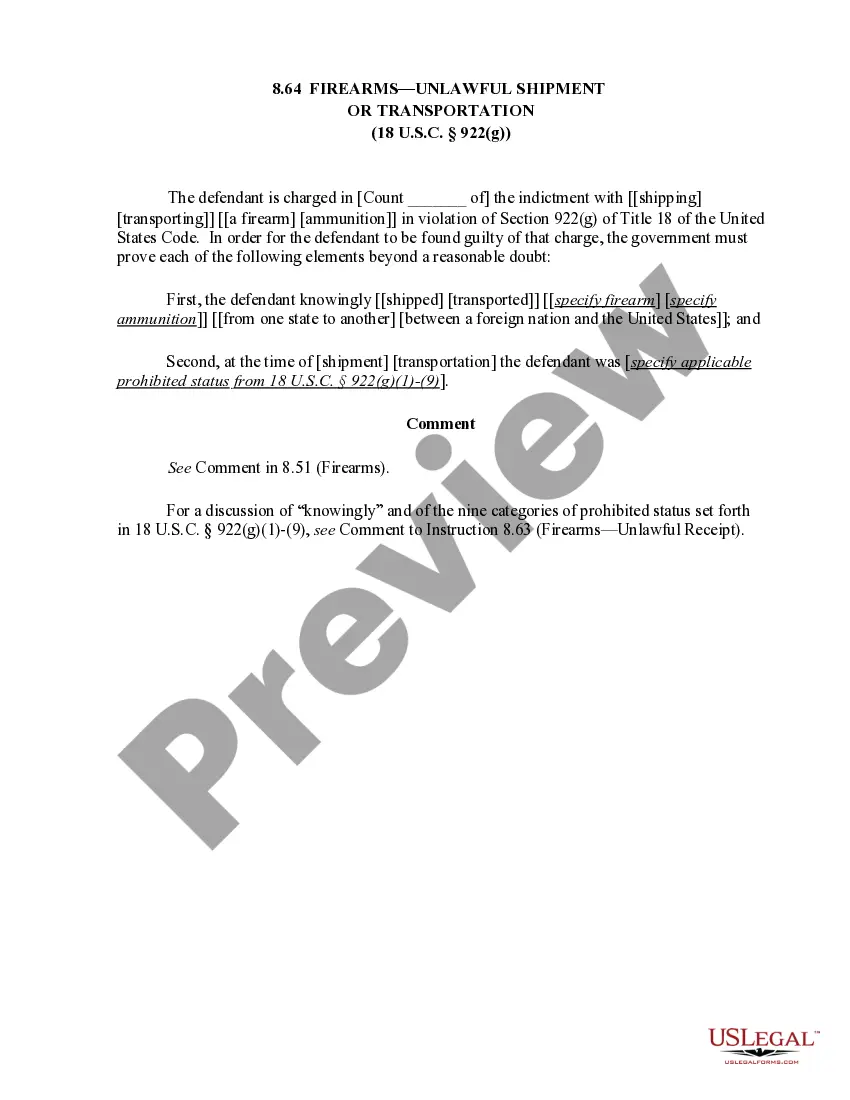

How to fill out Employee Agreement Incentive Compensation And Stock Bonus?

If you want to comprehensive, acquire, or printing legitimate document themes, use US Legal Forms, the greatest selection of legitimate forms, that can be found on the web. Utilize the site`s easy and practical lookup to obtain the papers you want. Numerous themes for organization and person reasons are categorized by classes and claims, or key phrases. Use US Legal Forms to obtain the Arizona Employee Agreement Incentive Compensation and Stock Bonus with a number of clicks.

In case you are presently a US Legal Forms client, log in for your account and click the Obtain option to have the Arizona Employee Agreement Incentive Compensation and Stock Bonus. You may also access forms you previously acquired within the My Forms tab of your account.

If you are using US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form to the proper town/land.

- Step 2. Utilize the Review solution to look over the form`s content. Don`t forget about to learn the outline.

- Step 3. In case you are not happy with all the develop, utilize the Look for industry at the top of the monitor to locate other models of your legitimate develop format.

- Step 4. Once you have discovered the form you want, select the Acquire now option. Pick the pricing strategy you prefer and include your accreditations to register on an account.

- Step 5. Procedure the purchase. You can utilize your charge card or PayPal account to complete the purchase.

- Step 6. Pick the format of your legitimate develop and acquire it on your own system.

- Step 7. Comprehensive, modify and printing or indicator the Arizona Employee Agreement Incentive Compensation and Stock Bonus.

Each and every legitimate document format you purchase is the one you have eternally. You may have acces to each develop you acquired inside your acccount. Click the My Forms area and choose a develop to printing or acquire once again.

Contend and acquire, and printing the Arizona Employee Agreement Incentive Compensation and Stock Bonus with US Legal Forms. There are thousands of specialist and express-certain forms you may use to your organization or person requirements.

Form popularity

FAQ

Payments are considered wages even if the employee is a casual worker, a day or contract laborer, part-time or temporary worker, or paid by the day, hour, or any other method or measurement. Wages include, but are not limited to: Salaries, hourly pay, piece rate, or payments by the job. Commissions and bonuses.

?Wages? means nondiscretionary compensation due an employee in return for labor or services rendered by an employee for which the employee has a reasonable expectation to be paid whether determined by a time, task, piece, commission or other method of calculation.

Code R20-5-1202(22). On-call time is compensable only when the employee is unable to use the time for his or her own purposes. If you can stay home, watch TV, or go out to eat, the time you are on-call is not compensable. AZ.

A bonus is a financial compensation that is above and beyond the normal payment expectations of its recipient. Bonuses may be awarded by a company as an incentive or to reward good performance.

Arizona is an employment-at-will state and a right-to-work state. This article explains the difference between these two laws. Under employment-at-will, either the employee or the employer can end the employment relationship at any time. Employment-at-will applies to all employees and employers in Arizona.

Under Labor Code 201, employers are liable to pay all wages owed (including bonuses) immediately following termination. If you quit, unpaid wages are owed either within 72 hours of your last day at work. If you give your employer 72 hours' notice, unpaid wages are owed on your last day.

Wages include sick pay, vacation pay, severance pay, commissions, bonuses and other amounts promised when the employer has a policy or a practice of making such payments. (Emphasis added). See, ARS § 23-350(5).

An Arizona employment contract agreement is a document used to create a legal bond between an employer and an employee. The agreement contains information on the employee's job including duties, pay, benefits, and employment period, and also protects the employer through non-disclosure and non-compete clauses.