Arizona Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

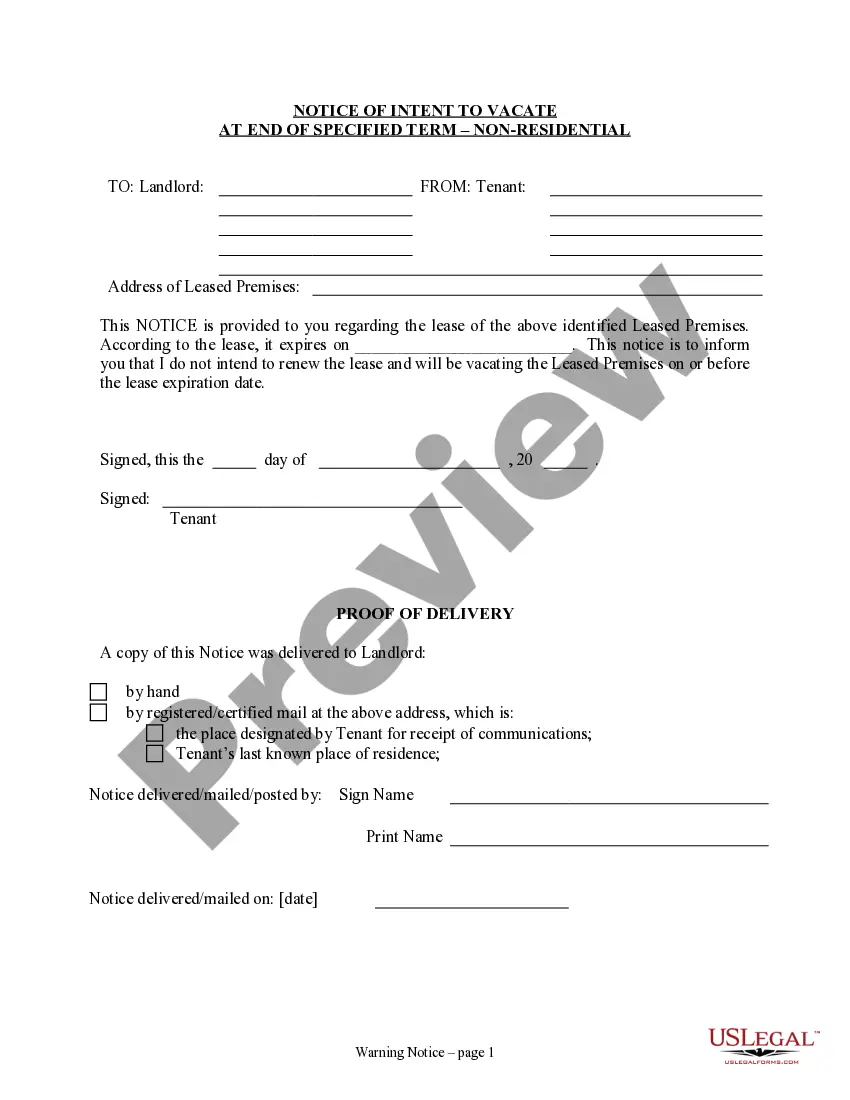

How to fill out Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

Are you in the placement where you need to have paperwork for possibly company or individual reasons nearly every day time? There are a variety of legal papers web templates available on the Internet, but getting types you can rely is not simple. US Legal Forms offers a huge number of develop web templates, much like the Arizona Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease, which can be published to satisfy state and federal needs.

In case you are previously acquainted with US Legal Forms website and have a merchant account, just log in. Afterward, you can acquire the Arizona Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease template.

Should you not offer an account and want to start using US Legal Forms, abide by these steps:

- Obtain the develop you want and ensure it is for the correct town/state.

- Make use of the Preview key to check the shape.

- Look at the outline to ensure that you have chosen the proper develop.

- In case the develop is not what you are seeking, make use of the Research industry to obtain the develop that meets your requirements and needs.

- Whenever you get the correct develop, simply click Buy now.

- Select the prices plan you want, complete the desired information to produce your money, and pay for an order with your PayPal or Visa or Mastercard.

- Pick a handy data file format and acquire your copy.

Find all of the papers web templates you might have purchased in the My Forms menu. You can obtain a extra copy of Arizona Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease any time, if needed. Just select the necessary develop to acquire or produce the papers template.

Use US Legal Forms, by far the most substantial collection of legal forms, to save lots of time as well as avoid blunders. The support offers expertly produced legal papers web templates which can be used for a variety of reasons. Create a merchant account on US Legal Forms and start generating your life a little easier.

Form popularity

FAQ

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

The right of governments to levy royalties from oil and gas companies derives from their ownership of natural resources. Through royalty payments, governments are compensated by oil and gas companies for the extraction of public natural resources.

Royalty Clause: The Lessor's only right to receive payments in addition to the Bonus Payment is through Royalties. Royalties are calculated as a percentage of the value of all minerals produced, typically 25%.

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.

Royalty Clause There are two types of royalties, a net and a gross royalty. Normally, the oil and gas lease contains a net royalty. If the lease provides for a net royalty, this means that post-production deductions will be taken from the royalty.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.