Arizona Compliance With Laws

Description

How to fill out Compliance With Laws?

US Legal Forms - one of the most significant libraries of legitimate forms in the United States - provides an array of legitimate papers templates you may download or printing. Utilizing the website, you will get a large number of forms for organization and personal uses, categorized by groups, suggests, or keywords.You can find the most recent types of forms such as the Arizona Compliance With Laws in seconds.

If you already have a monthly subscription, log in and download Arizona Compliance With Laws from your US Legal Forms local library. The Download button can look on every single form you see. You have access to all formerly delivered electronically forms in the My Forms tab of your respective bank account.

If you want to use US Legal Forms the very first time, allow me to share easy guidelines to help you get started off:

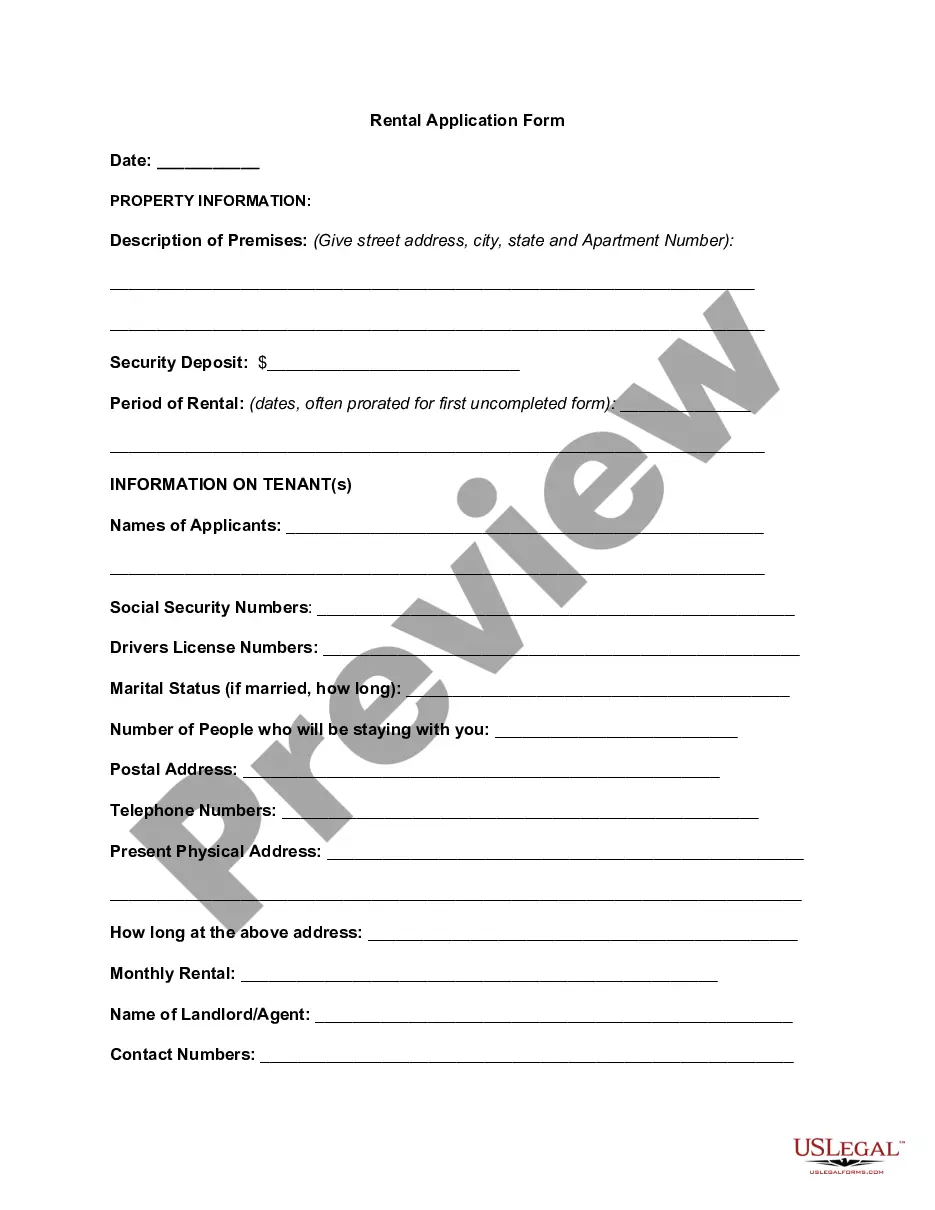

- Make sure you have picked the best form to your metropolis/state. Click the Preview button to review the form`s content material. See the form description to actually have chosen the correct form.

- In the event the form doesn`t satisfy your specifications, utilize the Research area towards the top of the monitor to get the one who does.

- Should you be content with the shape, confirm your option by clicking on the Buy now button. Then, select the prices plan you prefer and provide your qualifications to register to have an bank account.

- Procedure the deal. Utilize your credit card or PayPal bank account to finish the deal.

- Choose the format and download the shape in your device.

- Make changes. Fill out, modify and printing and indicator the delivered electronically Arizona Compliance With Laws.

Each and every format you included in your bank account does not have an expiration day and is the one you have for a long time. So, in order to download or printing one more version, just visit the My Forms section and then click in the form you want.

Gain access to the Arizona Compliance With Laws with US Legal Forms, the most considerable local library of legitimate papers templates. Use a large number of specialist and status-certain templates that fulfill your business or personal requirements and specifications.

Form popularity

FAQ

Changes to the 2023 tax rate structure mean changes to state withholdings from your paychecks. The new default withholding rate for AZ is 2 percent, so now is the time to review if this amount is appropriate for you. If you want to change this percentage, you can do so at any time during the year.

Employers required to make Arizona withholding payments on a quarterly, monthly, semi-weekly, or one-banking day basis file Arizona Form A1-QRT. File Arizona Form A1-QRT quarterly to reconcile Arizona withholding payments made during the calendar quarter.

To receive the Certificate of Compliance, you must meet the following requirements: Tax Clearance Application (Form 10523) is completed and signed. Be in compliance with all tax types (individual, transaction privilege tax, withholding, corporate, and partnership), and have no liabilities and/or delinquencies with ADOR.

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

ALL EMPLOYEES - ARIZONA STATE WITHHOLDING HAS BEEN UPDATED TO THE DEFAULT RATE 2.0% Any existing additional dollar amounts an employee had chosen to be withheld will not be changed.