Arizona Subordination Agreement with no Reservation by Lienholder

Description

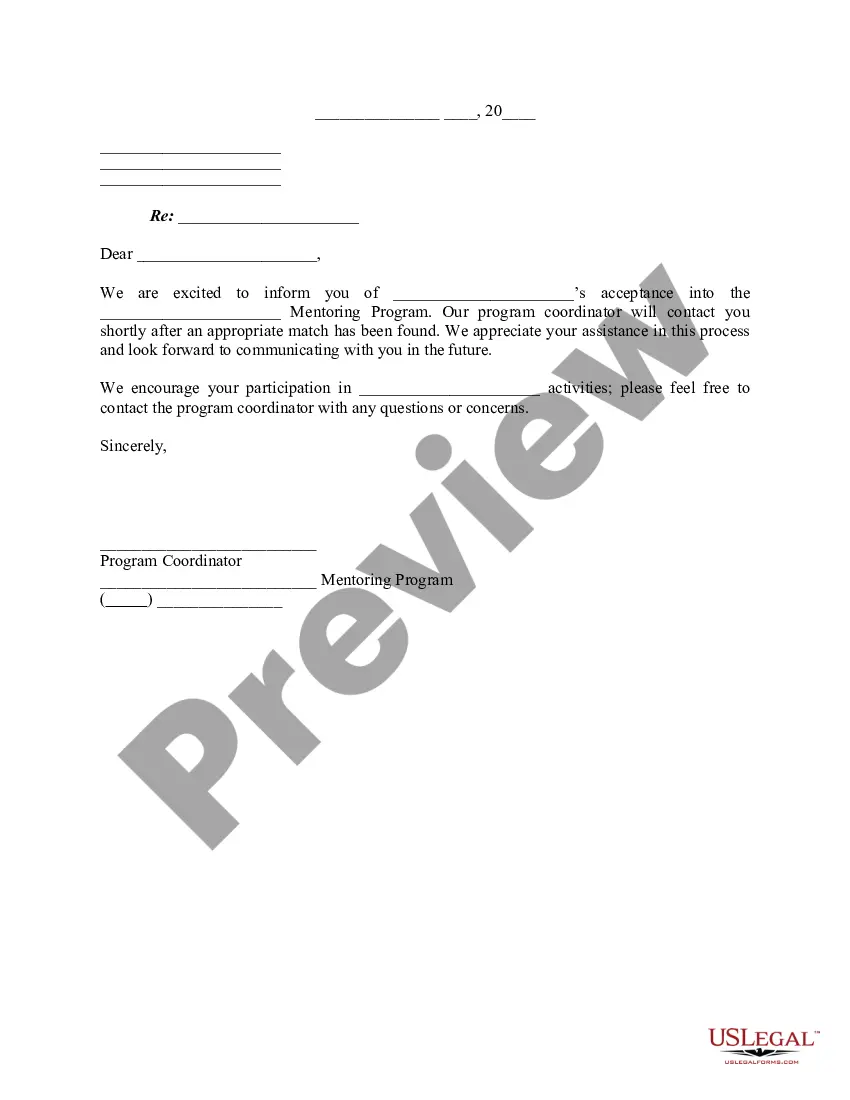

How to fill out Subordination Agreement With No Reservation By Lienholder?

Finding the right legitimate file template can be a have difficulties. Needless to say, there are a lot of layouts accessible on the Internet, but how do you discover the legitimate form you want? Use the US Legal Forms web site. The services delivers a large number of layouts, for example the Arizona Subordination Agreement with no Reservation by Lienholder, which can be used for company and private requirements. Every one of the varieties are checked out by pros and meet up with federal and state needs.

When you are currently authorized, log in for your account and then click the Down load option to get the Arizona Subordination Agreement with no Reservation by Lienholder. Make use of your account to appear with the legitimate varieties you possess acquired previously. Proceed to the My Forms tab of your account and obtain an additional copy of the file you want.

When you are a fresh end user of US Legal Forms, listed here are easy directions for you to follow:

- Very first, be sure you have selected the proper form for your town/area. It is possible to look over the shape while using Review option and study the shape description to guarantee this is basically the best for you.

- In case the form fails to meet up with your needs, use the Seach discipline to find the appropriate form.

- Once you are positive that the shape would work, select the Acquire now option to get the form.

- Choose the prices strategy you would like and type in the essential info. Build your account and buy your order using your PayPal account or charge card.

- Choose the document file format and down load the legitimate file template for your gadget.

- Full, edit and printing and signal the received Arizona Subordination Agreement with no Reservation by Lienholder.

US Legal Forms is definitely the most significant local library of legitimate varieties for which you will find various file layouts. Use the company to down load appropriately-produced files that follow state needs.

Form popularity

FAQ

Subordination agreements ensure that a primary lender will be paid in the event the borrower takes on more debt. As with most legal documents, subordination agreements need to be notarized in order to be official in the eyes of the law.

Lien subordination refers to the order in which claims on collateral are prioritized. This takes place most often among senior secured lenders and does not imply that one tranche of senior debt has payment preference over another. Lien Subordination vs Payment Subordination - Financial Edge fe.training ? free-resources ? credit ? lien-su... fe.training ? free-resources ? credit ? lien-su...

Payment subordination establishes the hierarchy of interest and principal payments in case of default or liquidation. Senior debt is paid first, followed by junior debt. Lien subordination does not imply payment subordination. In the case of default, payments must continue to be made to all senior lenders equally.

Broadly, there are two types of subordination: structural (common in the UK and mainland Europe) and contractual (common in the US). On a contractual subordination, loans are made to the same company but the senior creditor and junior creditor agree priority of payment by contract.

Two types of subordination agreements are: Executory Subordination and Automatic Subordination. These differ in the timing of when priority rights are given and the contractual performance required by the subordinated party. Subordination Agreement - Overview, Types, Purpose, Example corporatefinanceinstitute.com ? commercial-lending corporatefinanceinstitute.com ? commercial-lending

The creditor usually will require the debtor to sign a subordination agreement which ensures they get paid before other creditors, ensuring they are not taking on high risks. subordination agreement | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? subordination_agre... cornell.edu ? wex ? subordination_agre...

Subordination agreements may be included in existing deeds of trust or may be outlined in an independent contract. In situations where two deeds of trust are being recorded concurrently, the lien priority is typically handled by instructing the title company as to which security instrument will be recorded first. Loan Subordination 101: A Lender's Guide - Geraci Law Firm geracilawfirm.com ? loan-subordination-101-a-le... geracilawfirm.com ? loan-subordination-101-a-le...

Types of subordination arrangements An example is a trust document that includes a subordinate clause. This requires it to state that once the primary lien becomes active, a secondary lien becomes automatically subordinate. For instance, if a trust pays education funding as a first priority, the first lien is tuition.