Arizona Release of Oil and Gas Lease - Full Release

Description

How to fill out Release Of Oil And Gas Lease - Full Release?

Are you presently in a situation in which you will need papers for sometimes company or personal purposes just about every time? There are a variety of legitimate record templates available online, but finding types you can depend on is not simple. US Legal Forms delivers a large number of form templates, like the Arizona Release of Oil and Gas Lease - Full Release, which can be composed to fulfill federal and state demands.

When you are currently acquainted with US Legal Forms web site and also have your account, just log in. Next, you may obtain the Arizona Release of Oil and Gas Lease - Full Release template.

If you do not come with an bank account and want to begin using US Legal Forms, abide by these steps:

- Obtain the form you will need and ensure it is to the appropriate town/region.

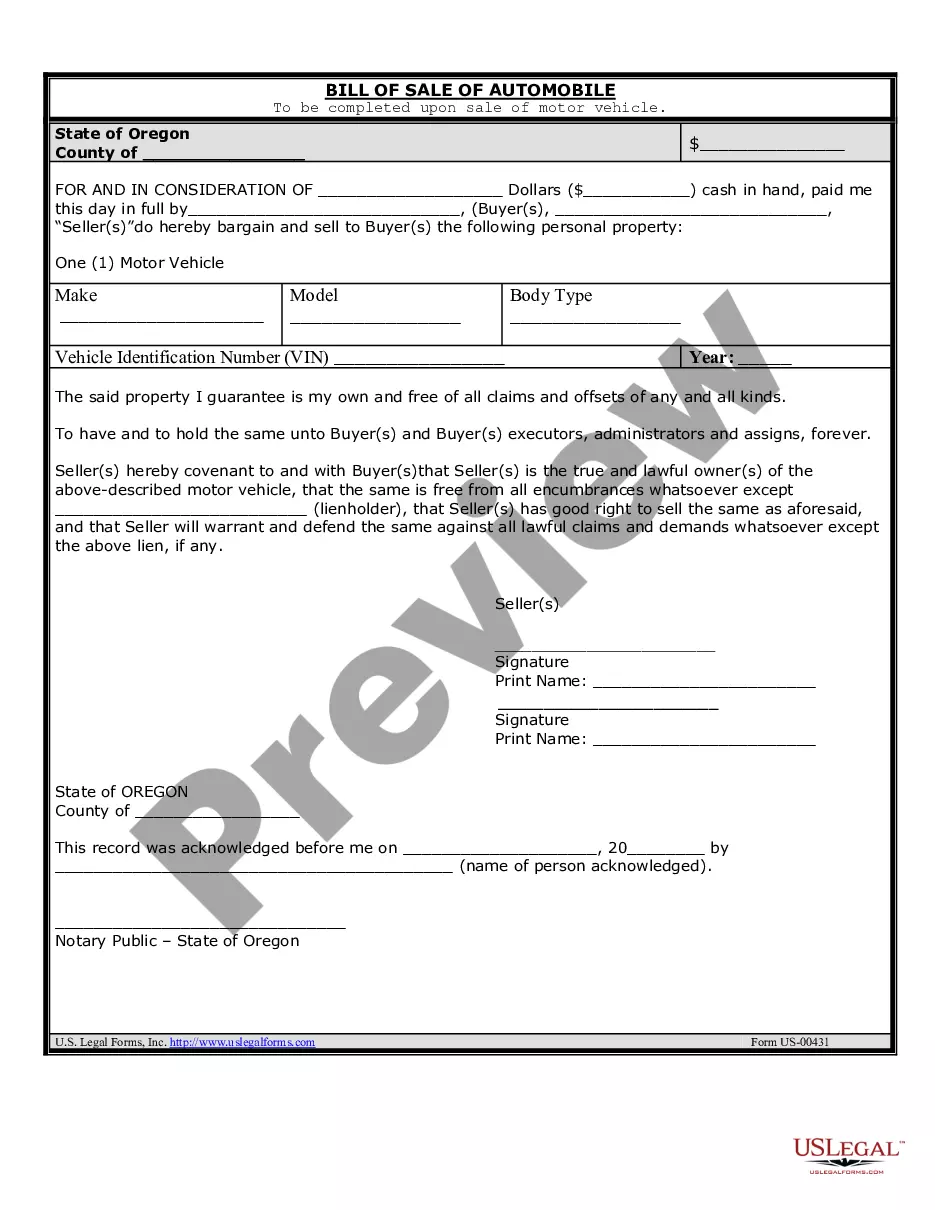

- Take advantage of the Preview button to review the shape.

- Look at the explanation to ensure that you have selected the appropriate form.

- In the event the form is not what you are looking for, make use of the Research area to get the form that suits you and demands.

- If you obtain the appropriate form, click on Get now.

- Opt for the pricing prepare you would like, complete the specified information and facts to make your bank account, and buy the transaction using your PayPal or Visa or Mastercard.

- Choose a convenient paper file format and obtain your copy.

Get all of the record templates you might have bought in the My Forms menus. You can aquire a additional copy of Arizona Release of Oil and Gas Lease - Full Release whenever, if necessary. Just go through the necessary form to obtain or produce the record template.

Use US Legal Forms, by far the most comprehensive selection of legitimate kinds, to save lots of efforts and stay away from errors. The support delivers expertly made legitimate record templates that can be used for a range of purposes. Create your account on US Legal Forms and start generating your daily life a little easier.

Form popularity

FAQ

in clause (or shutin royalty clause) traditionally allows the lessee to maintain the lease by making shutin payments on a well capable of producing oil or gas in paying quantities where the oil or gas cannot be marketed, whether due to a lack of pipeline connection or otherwise.

time payment to a lessor as consideration for signing a paidup oil & gas lease. The bonus is generally not written in the lease. It is normally paid on a per net mineral acre basis and should be paid in a simultaneous exchange of the signed lease.

Negotiating an oil and gas lease will require some research upfront. If you're a landowner interested in working with an oil and gas company, you should explore their history and experience. You'll want to work with a reputable company that works in your best interests, holds a high standard, and maintains insurance.

Ingly, when you see the words ?Paid-Up Lease,? this normally means that you will receive an upfront bonus for which the oil and gas company does not have to do anything during the initial or primary term of the lease.

RELEASE: releases of property rights and/or other legal rights that the owner would otherwise be entitled to under law. RELEASE LEASE: releases of oil & gas lease rights that a person would otherwise be entitled to under law.

time payment to a lessor as consideration for signing a paidup oil & gas lease. The bonus is generally not written in the lease. It is normally paid on a per net mineral acre basis and should be paid in a simultaneous exchange of the signed lease.

A surrender clause is a part of an oil and gas lease that allows the person leasing the land to give up their rights to some or all of the land they are leasing. This means they can stop using that land and won't have to do anything else related to it.

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.