Arizona Direction For Payment of Royalty to Trustee by Royalty Owners

Description

How to fill out Direction For Payment Of Royalty To Trustee By Royalty Owners?

You may devote several hours on the Internet trying to find the legal papers template that meets the federal and state needs you will need. US Legal Forms supplies a large number of legal varieties that are examined by professionals. You can actually download or produce the Arizona Direction For Payment of Royalty to Trustee by Royalty Owners from your support.

If you already possess a US Legal Forms account, it is possible to log in and click on the Down load key. After that, it is possible to complete, edit, produce, or sign the Arizona Direction For Payment of Royalty to Trustee by Royalty Owners. Every single legal papers template you acquire is yours eternally. To obtain yet another copy of the acquired type, go to the My Forms tab and click on the related key.

If you work with the US Legal Forms web site initially, adhere to the straightforward directions under:

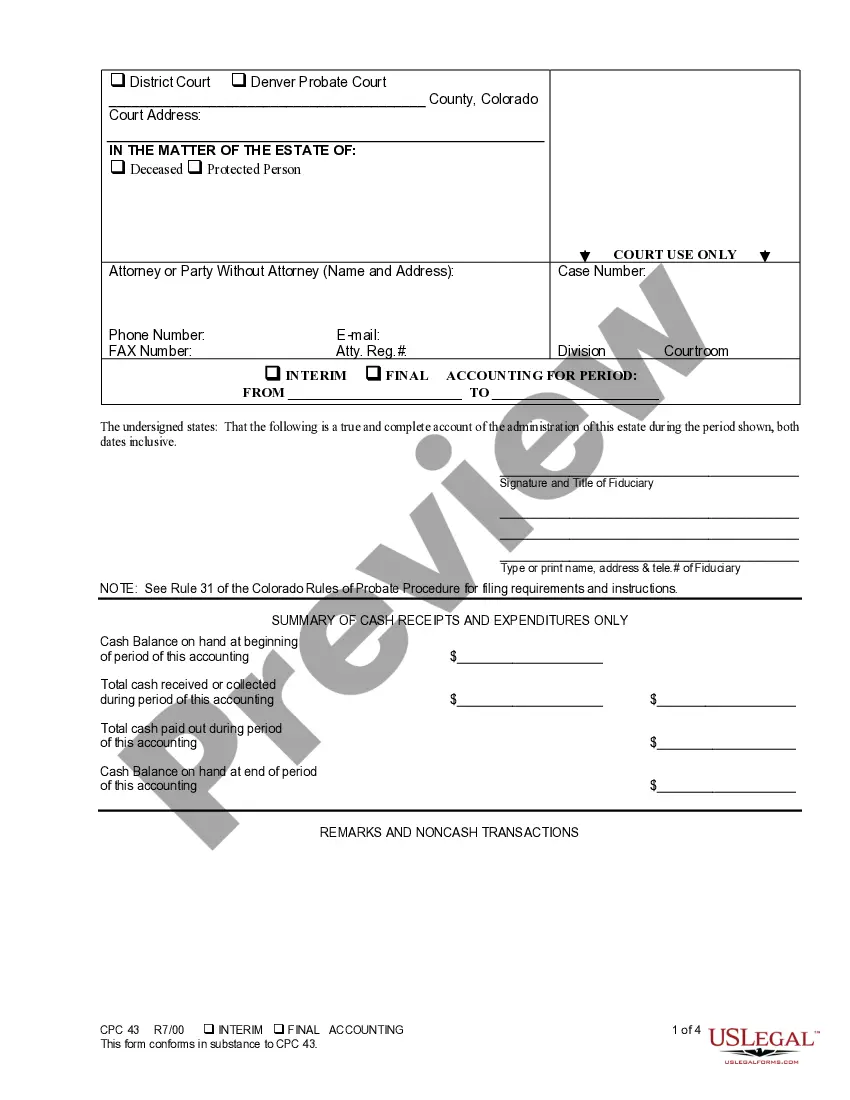

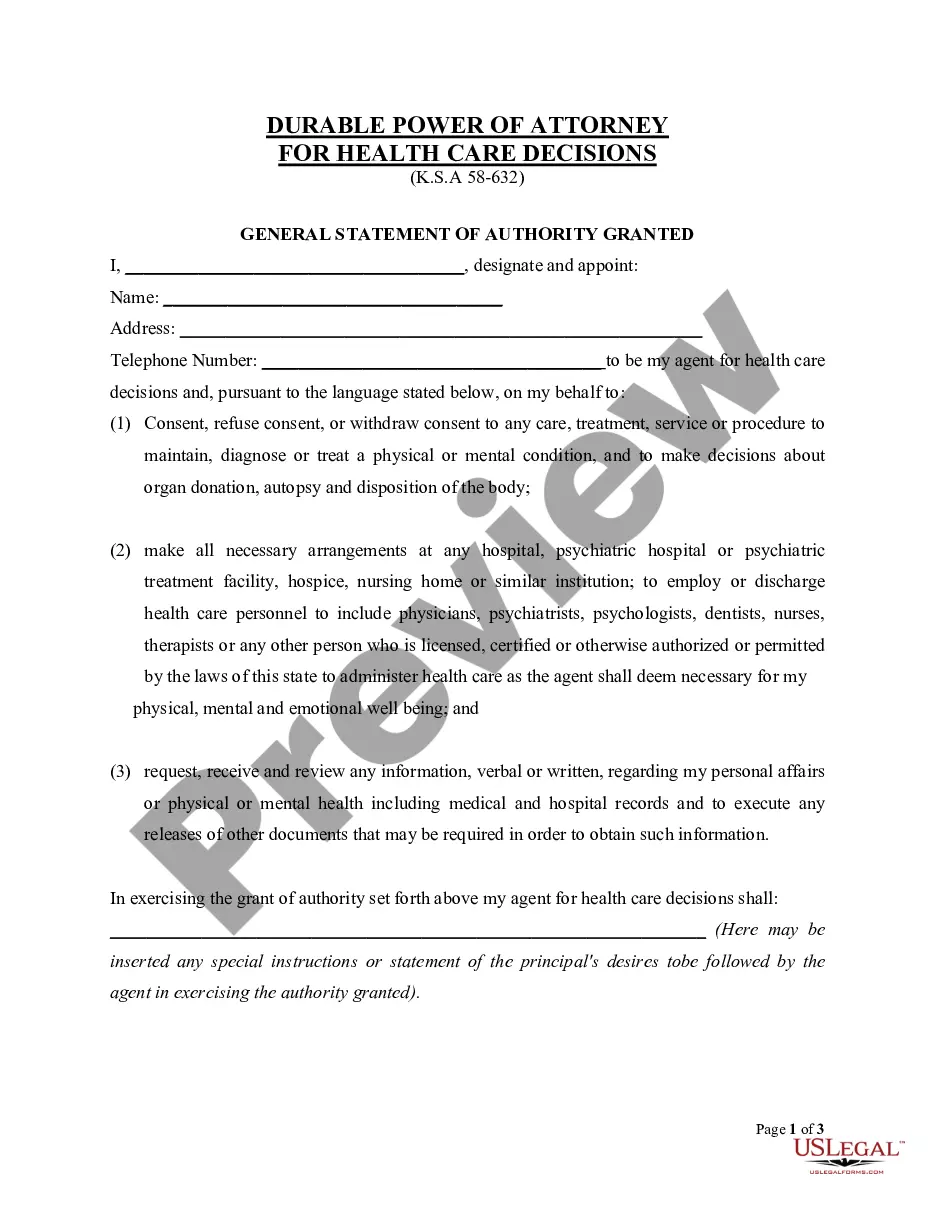

- First, ensure that you have selected the right papers template for your county/area of your choice. See the type explanation to make sure you have picked out the appropriate type. If offered, utilize the Review key to check throughout the papers template at the same time.

- In order to find yet another edition in the type, utilize the Search area to discover the template that meets your needs and needs.

- Once you have discovered the template you desire, just click Purchase now to proceed.

- Select the prices plan you desire, key in your references, and sign up for your account on US Legal Forms.

- Total the purchase. You can utilize your bank card or PayPal account to purchase the legal type.

- Select the formatting in the papers and download it for your product.

- Make alterations for your papers if possible. You may complete, edit and sign and produce Arizona Direction For Payment of Royalty to Trustee by Royalty Owners.

Down load and produce a large number of papers layouts making use of the US Legal Forms web site, which provides the most important variety of legal varieties. Use professional and status-distinct layouts to deal with your company or specific demands.

Form popularity

FAQ

Royalties take the form of agreements or licenses that lay out the terms by which a third party can use assets that belong to someone else. Intellectual property comes in the form of copyrights, patents, or trademarks. Royalties can be earned on books, music, minerals, franchises, and many other assets.

Royalties are governed by legal agreements between the producers and users of the product or content, which establish the payment structure, as a fixed fee or a percentage of revenue, and establish the frequency of payments, such as quarterly or annually.

In many cases, royalty payments happen once a month, but exactly when and how much artists and songwriters get paid depends on their agreements with their record label or distributor - or collection societies and publishers in the case of songwriters.

It is recorded in the ledger as a debit to royalty expense and a credit to accrued royalties (assuming the royalties are to be paid at the end of the period). For example, an author might receive $1 per book for the first 10,000 sold, then $1.50 per book for any sales after that.

Royalty Fee The franchisor uses the royalty fees to support its existing franchisees and maintain and grow the franchise system. The royalty fee is usually paid weekly or monthly, and is most commonly calculated as a percentage of gross sales, typically ranging between 5 to 9 percent.

Royalty payments are negotiated once through a legal agreement and paid on a continuing basis by licensees to owners granting a license to use their intellectual property or assets over the term of the license period. Royalty payments are often structured as a percentage of gross or net revenues.

Royalty fee explained It's usually calculated as a percentage of your gross sales, but it can also be a fixed amount or based on other factors. The royalty fee covers the costs of the franchisor's ongoing services, such as marketing, training, research, and development.

Royalty tax reporting Royalty payments are tax reportable and are reported ing to the IRS instructions on the IRS Form 1099-MISC, Miscellaneous Income.