Arizona Social Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Social Worker Agreement - Self-Employed Independent Contractor?

Are you in a position in which you need to have paperwork for either organization or personal functions nearly every day? There are a lot of legitimate record web templates accessible on the Internet, but discovering ones you can rely on is not easy. US Legal Forms offers a large number of develop web templates, such as the Arizona Social Worker Agreement - Self-Employed Independent Contractor, that are created in order to meet state and federal specifications.

When you are already familiar with US Legal Forms internet site and have a merchant account, just log in. Afterward, you are able to acquire the Arizona Social Worker Agreement - Self-Employed Independent Contractor web template.

Unless you provide an profile and need to begin using US Legal Forms, abide by these steps:

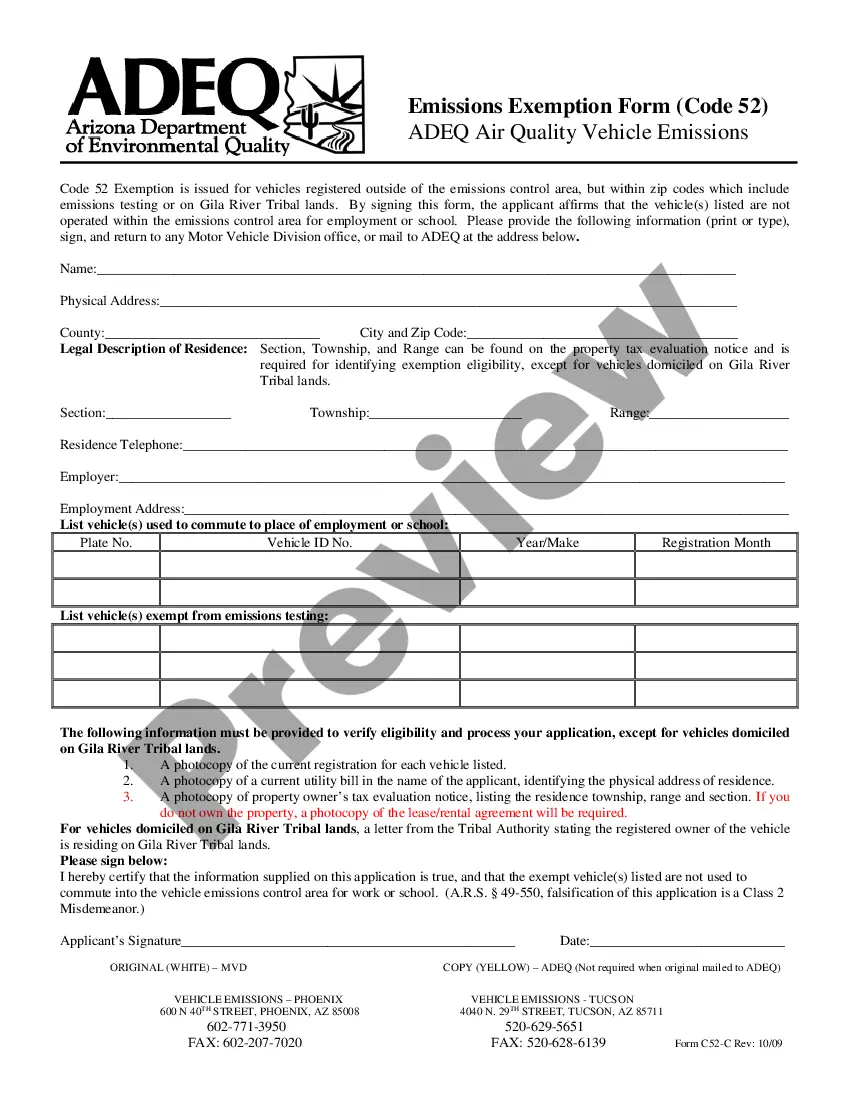

- Discover the develop you will need and ensure it is for your correct town/state.

- Take advantage of the Preview option to check the form.

- Look at the information to actually have selected the right develop.

- In case the develop is not what you are trying to find, make use of the Research discipline to discover the develop that fits your needs and specifications.

- When you obtain the correct develop, click on Buy now.

- Select the rates program you need, submit the required information and facts to produce your bank account, and purchase the transaction utilizing your PayPal or bank card.

- Select a convenient data file structure and acquire your duplicate.

Discover all of the record web templates you have purchased in the My Forms food list. You can get a more duplicate of Arizona Social Worker Agreement - Self-Employed Independent Contractor any time, if possible. Just select the essential develop to acquire or print out the record web template.

Use US Legal Forms, the most considerable assortment of legitimate varieties, to save time and steer clear of blunders. The service offers appropriately manufactured legitimate record web templates that you can use for a range of functions. Make a merchant account on US Legal Forms and start creating your lifestyle easier.

Form popularity

FAQ

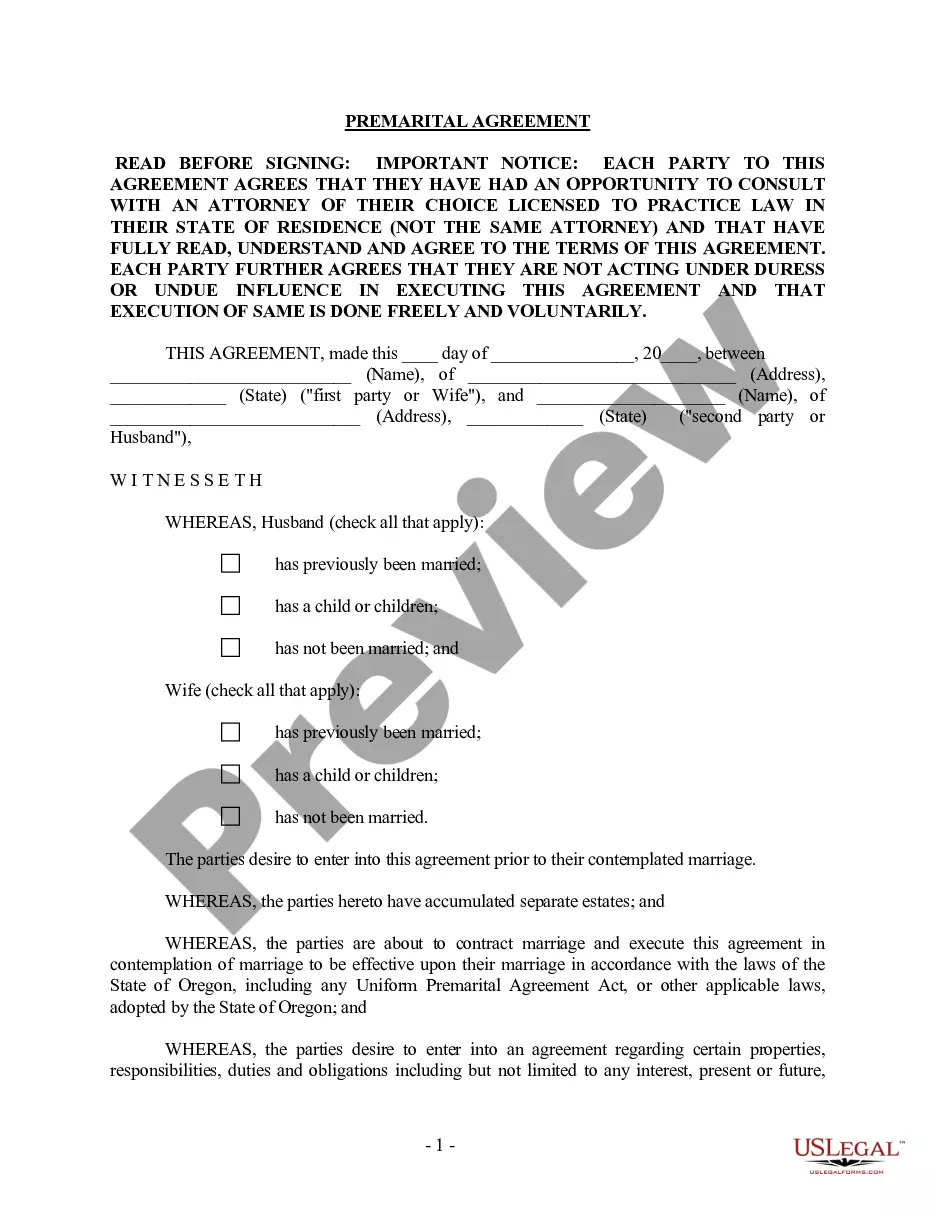

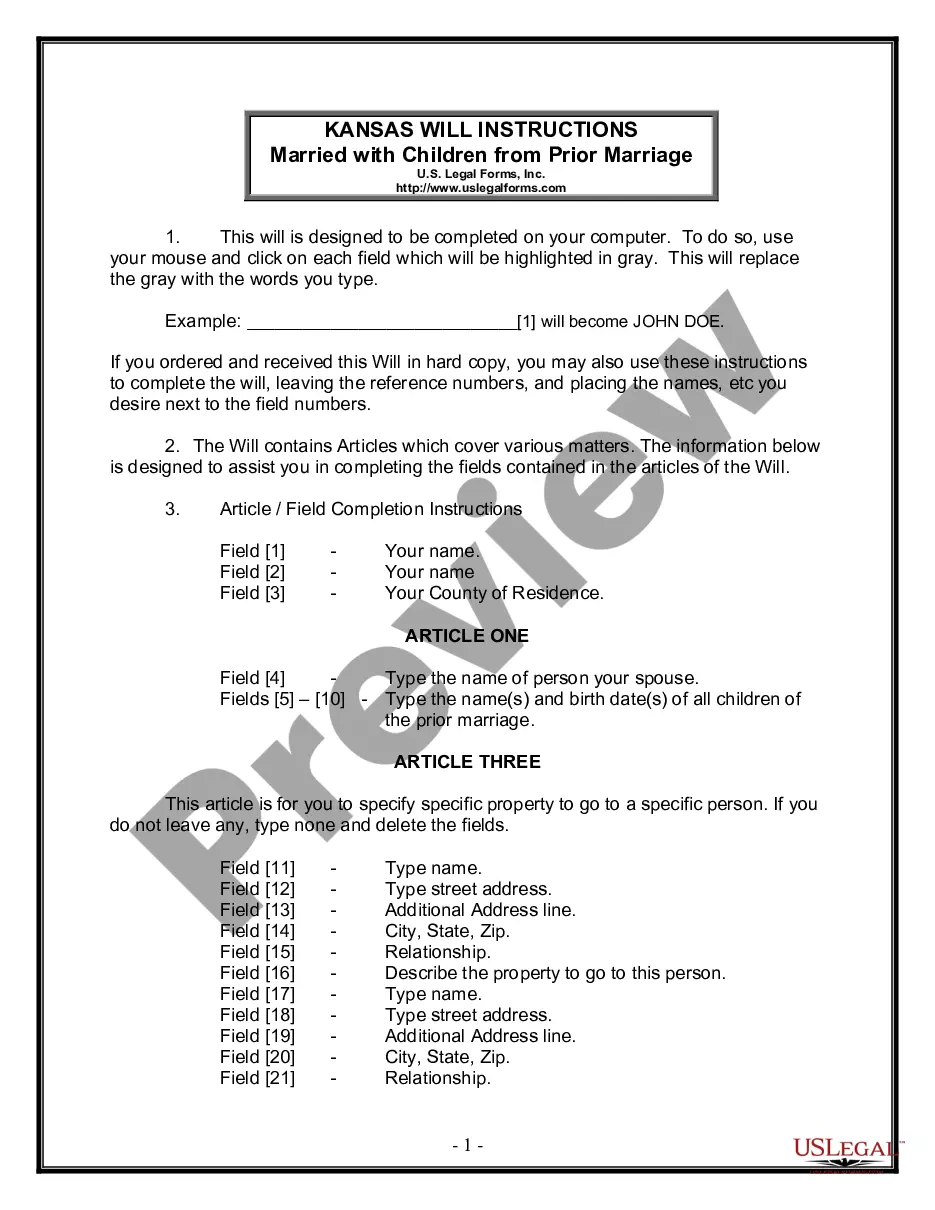

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Arizona allows employers to request that individuals classified as independent contractors sign a Declaration of Independent Business Status (DIBS). The execution of a DIBS is not mandatory in order to establish the existence of an independent contractor relationship between a business and an independent contractor.

Under normal circumstances (at least here in Arizona), businesses do not pay State or Federal unemployment taxes on compensation paid to independent contractors. As a result, independent contractors have not been eligible to apply for or receive unemployment benefits.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

An independent contractor is defined as an individual who contracts to work for others without having the legal status of an employee. By engaging independent contractors, employers can avoid many of the costs associated with hiring employees.

The new law allows Arizona employing units and independent contractors to establish their shared intent for the status of their relationship from its inception by permitting employing units to require their independent contractors to execute declarations affirming that their relationship with the business is as an

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

1099 employees don't have to paid overtime. Since they aren't on payroll, you can keep payroll and other taxes, including the unemployment tax, under control. They can't collect workers' compensation so you get a break on premiums as well.