Arizona Self-Employed Window Washer Services Contract

Description

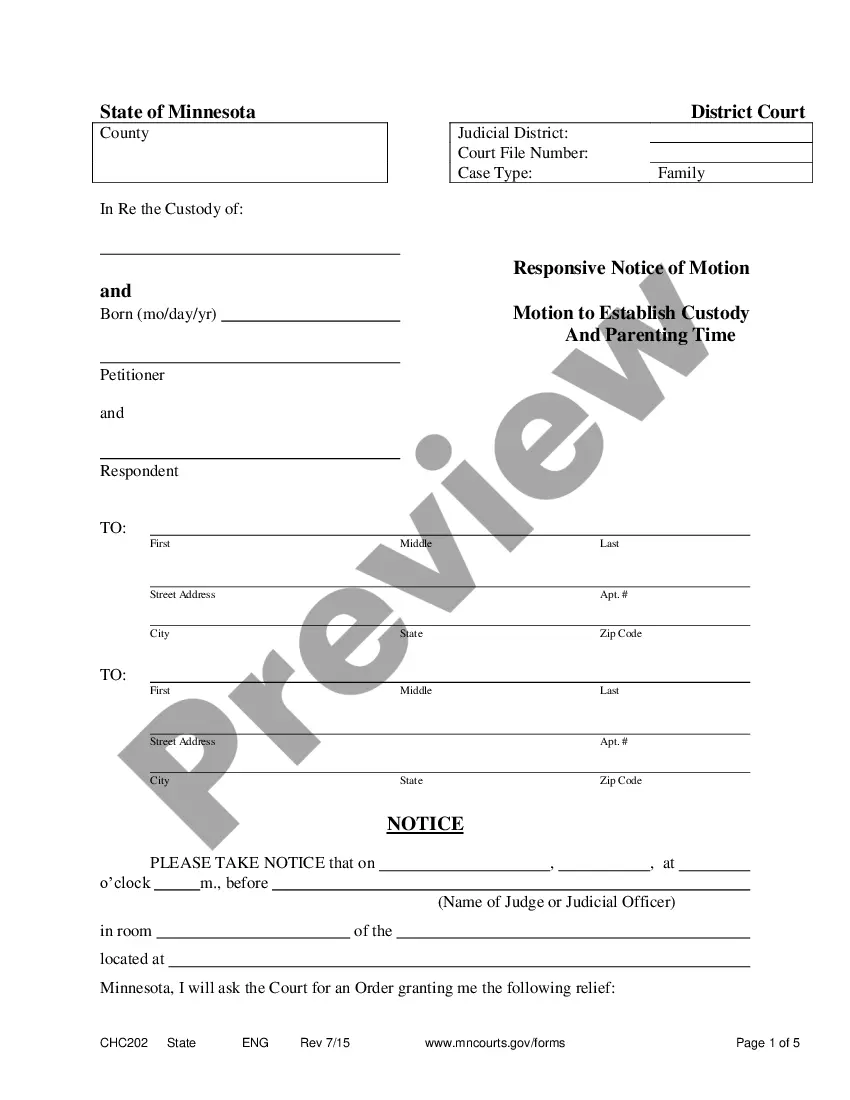

How to fill out Self-Employed Window Washer Services Contract?

You can utilize numerous hours online trying to locate the sanctioned document template that satisfies the state and federal criteria you need.

US Legal Forms provides thousands of legal forms that are reviewed by experts.

You can easily obtain or print the Arizona Self-Employed Window Washer Services Contract from our service.

Review the form description to confirm you have selected the appropriate form. If available, use the Preview option to view the document template as well. To find another version of the form, utilize the Search field to locate the template that meets your needs and specifications. Once you have found the template you desire, click Acquire now to proceed. Select the pricing plan you wish, enter your details, and register for your account on US Legal Forms. Complete the payment. You can use your credit card or PayPal account to cover the legal document. Choose the format of the document and download it to your device. Make modifications to the document if possible. You can complete, edit, sign, and print the Arizona Self-Employed Window Washer Services Contract. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Download option.

- Afterward, you can complete, modify, print, or sign the Arizona Self-Employed Window Washer Services Contract.

- Every legal document template you obtain is yours permanently.

- To retrieve another copy of any acquired form, navigate to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

Form popularity

FAQ

To start a window cleaning business in Arizona, you typically need a general business license. Depending on your location, specific local regulations may also require additional permits or registrations. It’s beneficial to formalize your business with an Arizona Self-Employed Window Washer Services Contract, as this not only outlines your services but can also demonstrate professionalism to clients. Remember to check local requirements to ensure compliance as you grow your business.

Yes, window cleaning can be a profitable business, especially in areas with a high demand for such services. Many self-employed window washers find that they can establish a loyal customer base, leading to regular income. Additionally, creating an Arizona Self-Employed Window Washer Services Contract helps streamline operations, ensuring you have clear agreements with clients. This clarity can contribute to your profitability by minimizing misunderstandings and retaining customers.

As an independent contractor, you'll need to compile several documents for filing taxes and demonstrating your business legitimacy. Generally, this includes your income records, expense receipts, and relevant tax forms like Schedule C to report income, along with a 1099 form from clients. Keeping organized records will support your claims and strengthen your position outlined in the Arizona Self-Employed Window Washer Services Contract.

Choosing between a 1099 and W-9 form depends on your position as a contractor. Clients will require a W-9 form from you to issue a 1099 for payments made throughout the year. Therefore, filling out the W-9 form is essential for reporting purposes, facilitating clarity in your Arizona Self-Employed Window Washer Services Contract while ensuring accurate tax filings.

Yes, if you operate a cleaning service in Arizona, you typically need a business license to comply with local laws. This requirement helps regulate the industry and ensures that your business adheres to required standards. By securing your business license, you enhance your legitimacy in the field and support the terms within your Arizona Self-Employed Window Washer Services Contract.

Independent contractors should complete several essential documents. This includes a client contract outlining the services provided, such as the Arizona Self-Employed Window Washer Services Contract, and tax forms like W-9 for reporting income. Ensuring that you have all necessary paperwork in order can prevent future misunderstandings and keep your business operations streamlined.

An independent contractor should fill out Form W-9 to provide their taxpayer identification details to clients. This form is important for tax reporting purposes, particularly when you receive payments that necessitate a Form 1099 at tax time. Properly completing Form W-9 will ensure smooth financial transactions in your Arizona Self-Employed Window Washer Services Contract.

Yes, in Arizona, independent contractors typically require a business license to operate legally. This license demonstrates that the contractor complies with local regulations and is authorized to provide services. If you plan to offer window washing services, it's essential to check with your local city or county office for specific licensing requirements. Having the proper license can complement your Arizona Self-Employed Window Washer Services Contract.

Independent contractors must follow specific legal requirements to operate in Arizona. They need to establish their business officially, which may include registering their business name. Additionally, they should comply with tax regulations and report their income correctly. When entering into an Arizona Self-Employed Window Washer Services Contract, it is crucial to understand all obligations and rights involved.

To acquire a commercial window cleaning contract, focus on marketing your services effectively. Building a portfolio and connecting with businesses in your area can greatly enhance your chances. Using an Arizona Self-Employed Window Washer Services Contract will present your terms clearly and professionally to potential clients.