Arizona Stone Contractor Agreement - Self-Employed

Description

How to fill out Stone Contractor Agreement - Self-Employed?

US Legal Forms - one of the largest collections of valid documents in the USA - offers a broad selection of valid record templates that you can obtain or print.

While navigating the website, you can discover a vast number of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Arizona Stone Contractor Agreement - Self-Employed in moments.

If you already possess a subscription, Log In and obtain the Arizona Stone Contractor Agreement - Self-Employed from the US Legal Forms library. The Download button will be visible on every form you view. You gain access to all previously saved forms from the My documents tab in your account.

Make modifications. Complete, adjust, print, and sign the saved Arizona Stone Contractor Agreement - Self-Employed.

Every template you add to your account has no expiration date and belongs to you permanently. Therefore, if you wish to obtain or print another copy, simply visit the My documents section and click on the form you need. Access the Arizona Stone Contractor Agreement - Self-Employed with US Legal Forms, the most extensive collection of valid record templates. Utilize a vast array of professional and state-specific templates that meet your business or personal requirements.

- If you're using US Legal Forms for the first time, here are simple instructions to help you get started:

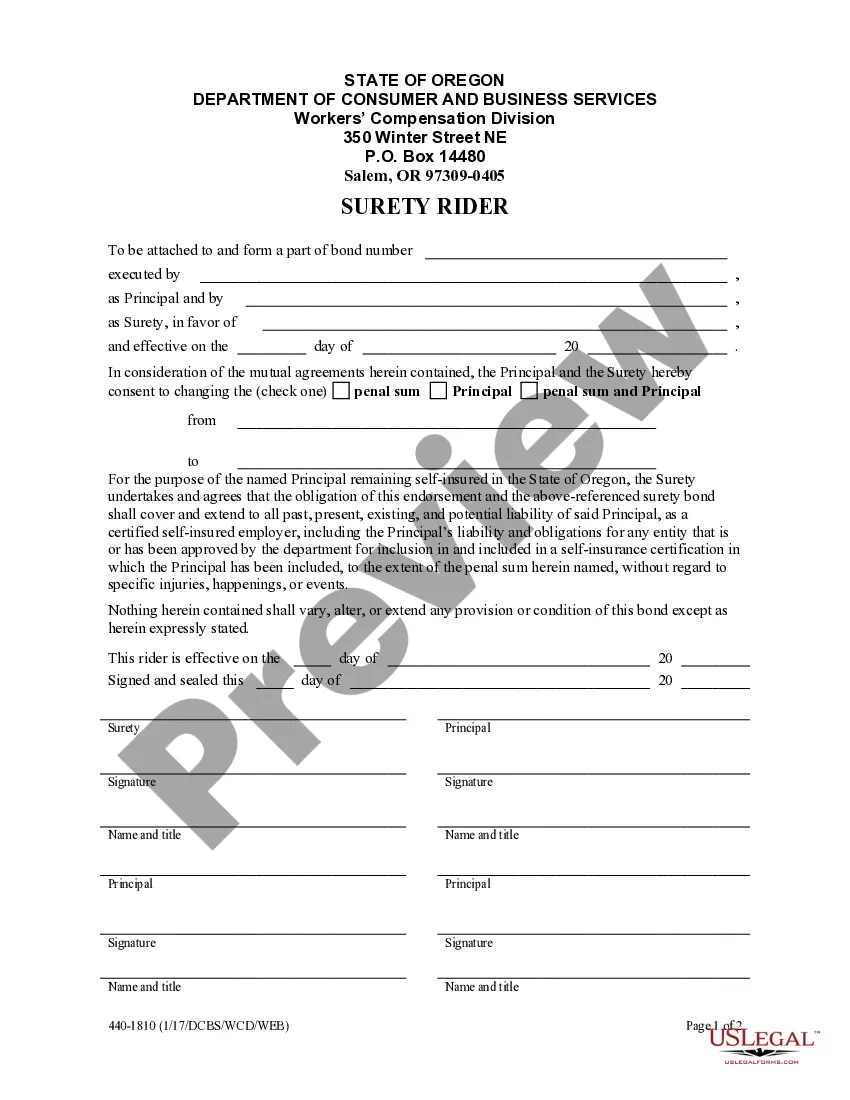

- Ensure you have selected the correct form for your region/area. Click the Preview button to review the form’s content. Check the form summary to confirm you have chosen the right form.

- If the form does not meet your needs, utilize the Search section at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you prefer and provide your information to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

Self-employed individuals typically run their own business and are not considered employees of another company. You may qualify as self-employed if you have a business structure, provide services on your own terms, and receive income from clients. Entering into an Arizona Stone Contractor Agreement - Self-Employed can help formalize this relationship and ensure that all parties understand their responsibilities.

Both terms are often used interchangeably, but there may be slight distinctions. 'Self-employed' is a broader term that encompasses any individual running a business on their own. When you use the term 'independent contractor' in your Arizona Stone Contractor Agreement - Self-Employed, it specifically highlights a contractual relationship with clients, making it clear and precise for business dealings.

Yes, receiving a 1099 form indicates that you are likely considered self-employed. This tax form is used to report payments made to independent contractors by businesses. When working under an Arizona Stone Contractor Agreement - Self-Employed, the 1099 provides proof of your self-employment status and can help you keep track of your earnings for tax purposes.

In Arizona, an operating agreement for an LLC is not legally required, but it is highly recommended. This document outlines the management structure and operating procedures of the business. By having an operating agreement, your Arizona Stone Contractor Agreement - Self-Employed can integrate seamlessly, providing additional structure to your self-employment arrangements.

Absolutely, an independent contractor is recognized as self-employed. This means that you operate your own business and can engage with multiple clients for various projects. If you are considering entering into an Arizona Stone Contractor Agreement - Self-Employed, it's a practical way to define the scope of your work and establish clear expectations with your clients.

Yes, an independent contractor is typically considered self-employed. This classification means that you are responsible for paying your own taxes and managing your own benefits. When working under an Arizona Stone Contractor Agreement - Self-Employed, you should understand your rights and obligations. This agreement outlines the specific terms of your work, giving you clarity and protection.

To prove you are an independent contractor, gather documentation that shows your work arrangement, such as your Arizona Stone Contractor Agreement - Self-Employed. Additionally, invoices, business cards, and proof of expenses can highlight your self-employed status. When clients require proof, these documents affirm your role and obligations. Resources like US Legal Forms can assist you in developing contracts and maintaining accurate records.

Yes, independent contractors in Arizona may need a business license depending on their specific services and location. Certain cities or counties have regulations that require a business license for contractors. It's essential to research local requirements to maintain compliance and avoid fines. Consulting US Legal Forms can provide you with the necessary steps to obtain a license and enhance your service credibility.

To create an Arizona Stone Contractor Agreement - Self-Employed, start by clearly identifying the parties involved. Include details such as the scope of work, payment terms, and timelines. It is crucial to outline each party's responsibilities to avoid future disputes. You can use US Legal Forms to access templates that simplify this process, ensuring that your agreement meets all legal requirements.