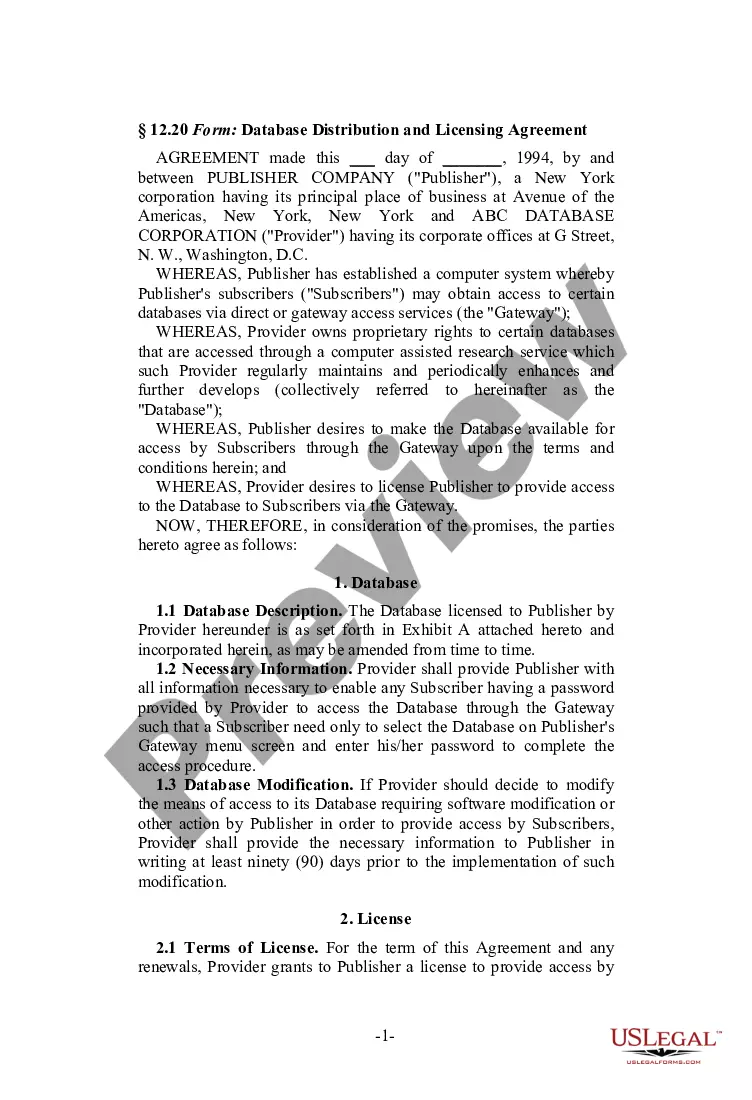

This due diligence workform is used to review property information and title commitments and policies in business transactions.

Arizona Fee Interest Workform

Description

How to fill out Fee Interest Workform?

If you require to complete, acquire, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms, which can be accessed online.

Employ the website's user-friendly and efficient search to locate the documents you need.

A range of templates for commercial and personal applications is organized by categories and claims, or by keywords and phrases.

Step 4. Once you have identified the form you require, click the Obtain now option. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to discover the Arizona Fee Interest Workform in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then select the Obtain option to find the Arizona Fee Interest Workform.

- You can also retrieve forms you previously acquired in the My documents section of your account.

- If you are a first-time user of US Legal Forms, adhere to the instructions outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form format.

Form popularity

FAQ

To make a PTE election for Arizona, you will need to file the appropriate forms with the Arizona Department of Revenue. Start by filling out the Arizona Fee Interest Workform, which guides you through the election process. Submit your completed form by the deadline, ensuring you keep a copy for your records.

Choosing your Arizona state tax withholding involves understanding your annual income and tax obligations. You can use the Arizona Fee Interest Workform to estimate your withholding needs based on your projected income. Adjust your W-4 as necessary to ensure that you withhold enough throughout the year for your state tax duties.

Making an Arizona PTE payment is straightforward. First, access the Arizona Fee Interest Workform on the state's tax website. Complete the form with your personal information and payment amount, then either submit it electronically or print it to send in via mail, ensuring that you meet any deadlines to avoid penalties.

To make your Arizona PTE payment, start by gathering your tax information and relevant documents. You can visit the Arizona Department of Revenue's website to access the Arizona Fee Interest Workform. Follow the instructions there to complete your payment online or to print it out for mailing, ensuring you include all necessary details for proper processing.

Taxable income in Arizona includes wages, interest, rental income, and most business income. It's essential to report all sources of income on your Arizona Fee Interest Workform to ensure compliance with state tax laws. Understanding what qualifies as taxable income will help you avoid penalties and ensure accurate filing.

The Transaction Privilege Tax (TPT) rate in Arizona can vary by location and business type. Generally, the rate ranges from 5.6% to 11.2%, depending on the city or county. Make sure to refer to your specific locality when completing your Arizona Fee Interest Workform to apply the correct TPT rate.

Certain types of income are exempt from Arizona state tax. This includes social security benefits, certain pensions, and some forms of disability income. When filing your Arizona Fee Interest Workform, check to see if your income may qualify for these exemptions.

Filing Form 120 late can lead to penalties in Arizona. Generally, the penalty can be $50 for each month your return is late, up to a maximum of $250. To avoid these penalties, it's crucial to file your Arizona Fee Interest Workform on time.

Yes, Arizona does tax interest income. When you earn interest from savings accounts, investments, or other sources, you must report it on your Arizona Fee Interest Workform. Ensure you include all interest income when filing your state taxes to avoid discrepancies.

Arizona is considered a destination state, influencing how sales and income tax laws apply to transactions within its borders. This classification can affect various aspects of tax reporting, especially for those with interest income. Utilizing the Arizona Fee Interest Workform can help clarify your obligations and make sense of tax implications. This form helps ensure you are compliant while optimizing your reporting process.