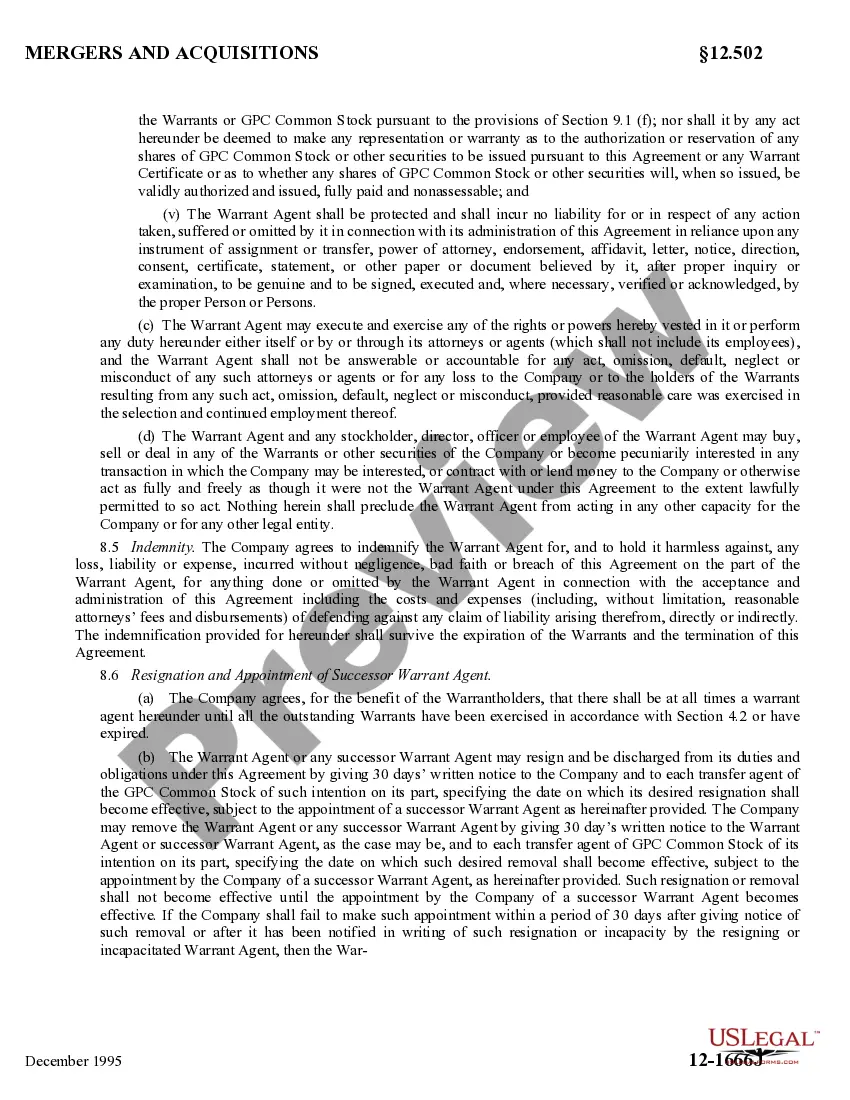

Arizona Second Warrant Agreement by General Physics Corp.

Description

How to fill out Second Warrant Agreement By General Physics Corp.?

If you want to total, acquire, or printing legitimate document layouts, use US Legal Forms, the greatest collection of legitimate varieties, that can be found on-line. Utilize the site`s simple and easy handy research to get the paperwork you will need. A variety of layouts for business and specific functions are categorized by groups and states, or search phrases. Use US Legal Forms to get the Arizona Second Warrant Agreement by General Physics Corp. in a handful of mouse clicks.

In case you are already a US Legal Forms consumer, log in to your profile and click the Down load key to get the Arizona Second Warrant Agreement by General Physics Corp.. You can even gain access to varieties you previously saved from the My Forms tab of your own profile.

Should you use US Legal Forms initially, follow the instructions below:

- Step 1. Ensure you have chosen the shape for that correct city/nation.

- Step 2. Utilize the Review method to look through the form`s content. Don`t forget about to read through the explanation.

- Step 3. In case you are not satisfied with the develop, make use of the Look for field on top of the display to locate other models in the legitimate develop format.

- Step 4. After you have discovered the shape you will need, select the Purchase now key. Opt for the costs plan you prefer and add your credentials to register for the profile.

- Step 5. Method the deal. You can utilize your bank card or PayPal profile to accomplish the deal.

- Step 6. Choose the file format in the legitimate develop and acquire it on your own gadget.

- Step 7. Complete, edit and printing or indicator the Arizona Second Warrant Agreement by General Physics Corp..

Each legitimate document format you purchase is the one you have eternally. You have acces to each develop you saved with your acccount. Go through the My Forms portion and choose a develop to printing or acquire yet again.

Contend and acquire, and printing the Arizona Second Warrant Agreement by General Physics Corp. with US Legal Forms. There are many skilled and status-certain varieties you can use for your business or specific requires.

Form popularity

FAQ

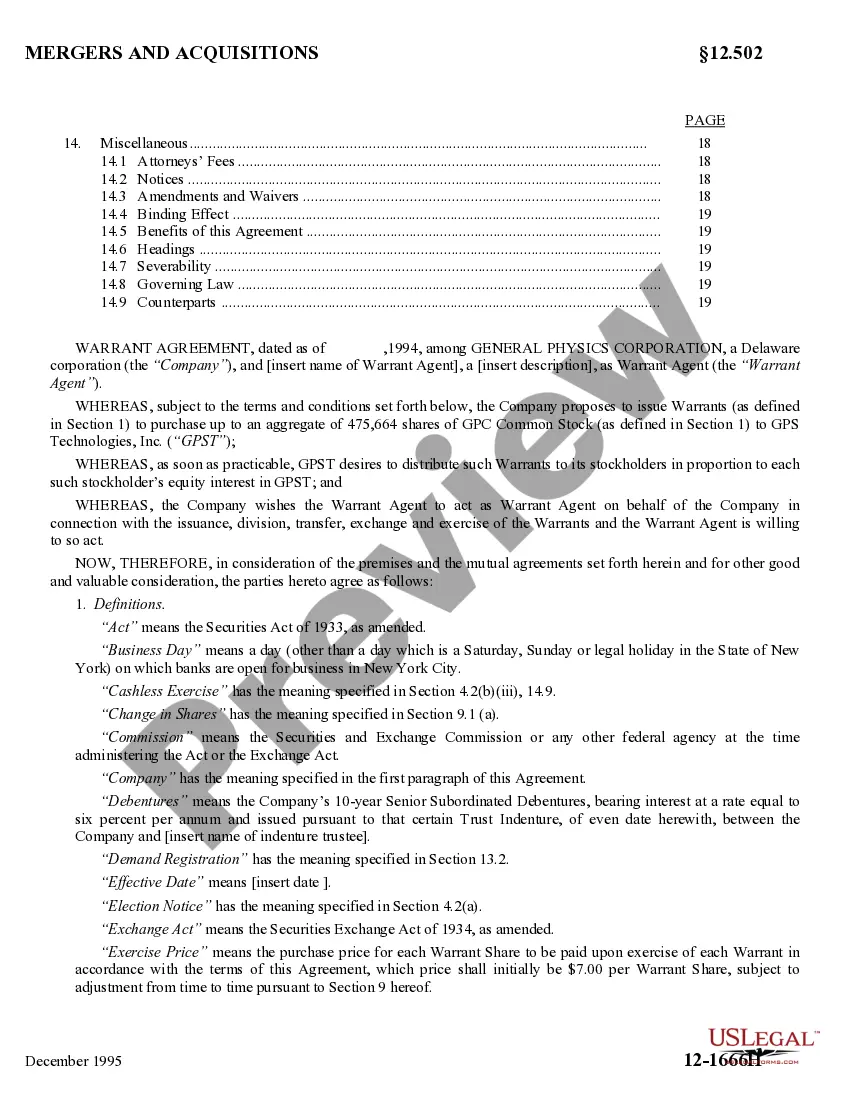

A warrant agreement is an agreement to purchase stock, also called a stock warrant. The agreement provides one party the right to purchase a company's stock at a specific price and at a specific date.

Warrants and call options are both types of securities contracts. A warrant gives the holder the right, but not the obligation, to buy common shares of stock directly from the company at a fixed price for a pre-defined time period.

What Is Warrant Coverage? Warrant coverage is an agreement between a company and one or more shareholders where the company issues a warrant equal to some percentage of the dollar amount of an investment. Warrants, similar to options, allow investors to acquire shares at a designated price.

A warrant is an agreement between two parties ? the ?issuer? (i.e., a company) and the ?holder? of the warrant ? that entitles the holder to purchase the issuer's stock at a specified price within a certain time frame.

Companies often issue stock warrants by attaching the warrant to a bond or other security that they use to raise capital. The warrant helps attract investors and also represents potential future capital for the issuing company.