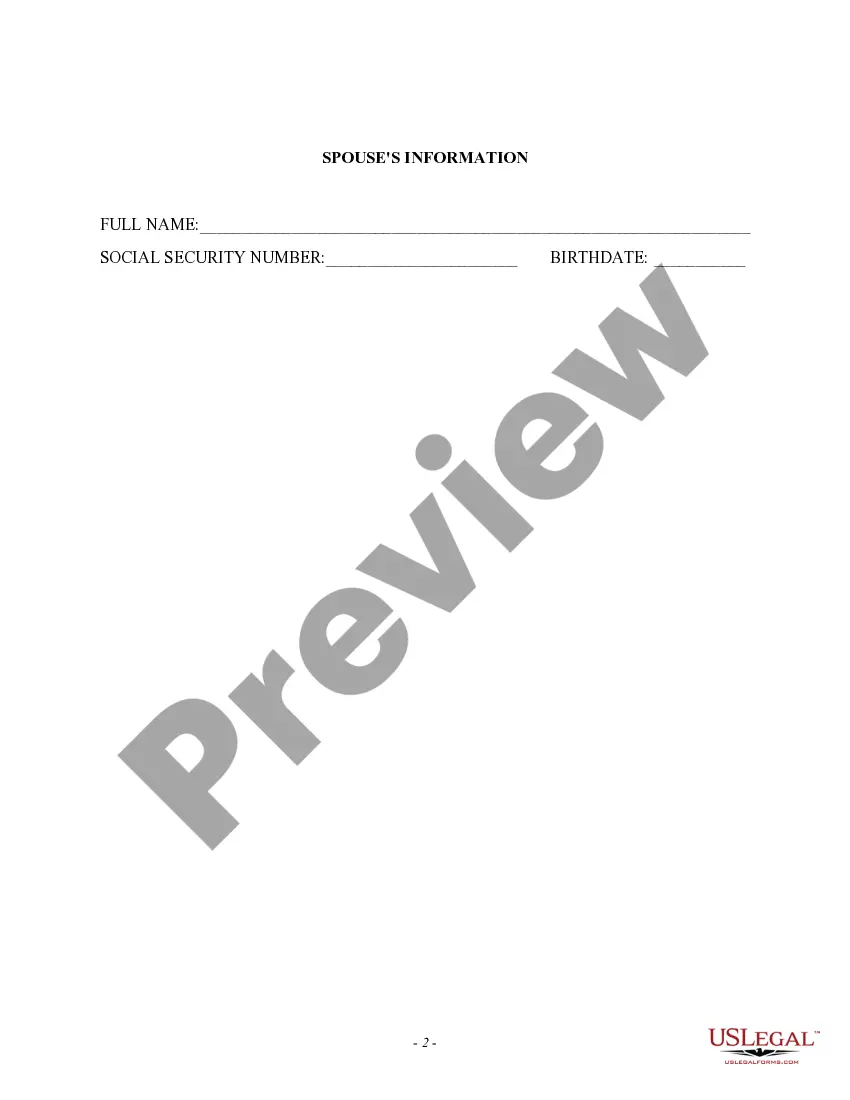

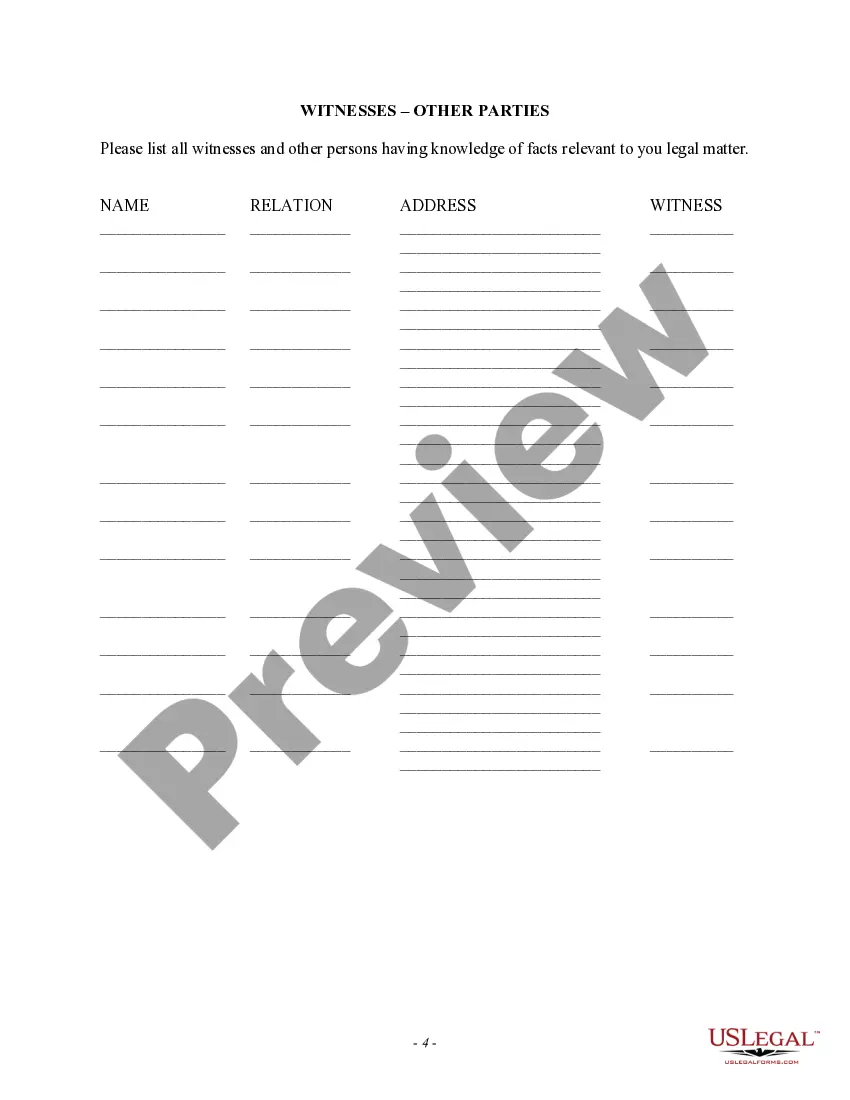

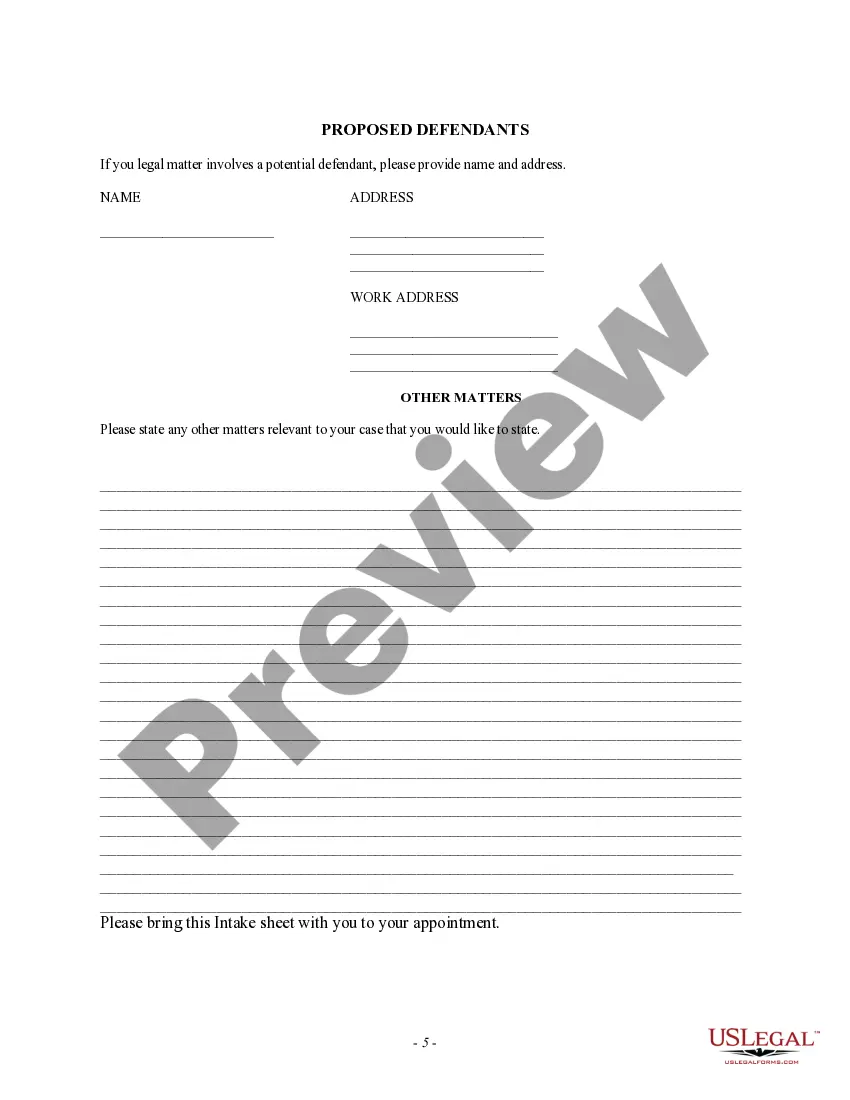

Arizona Proposed Client Intake Sheet - General

Description

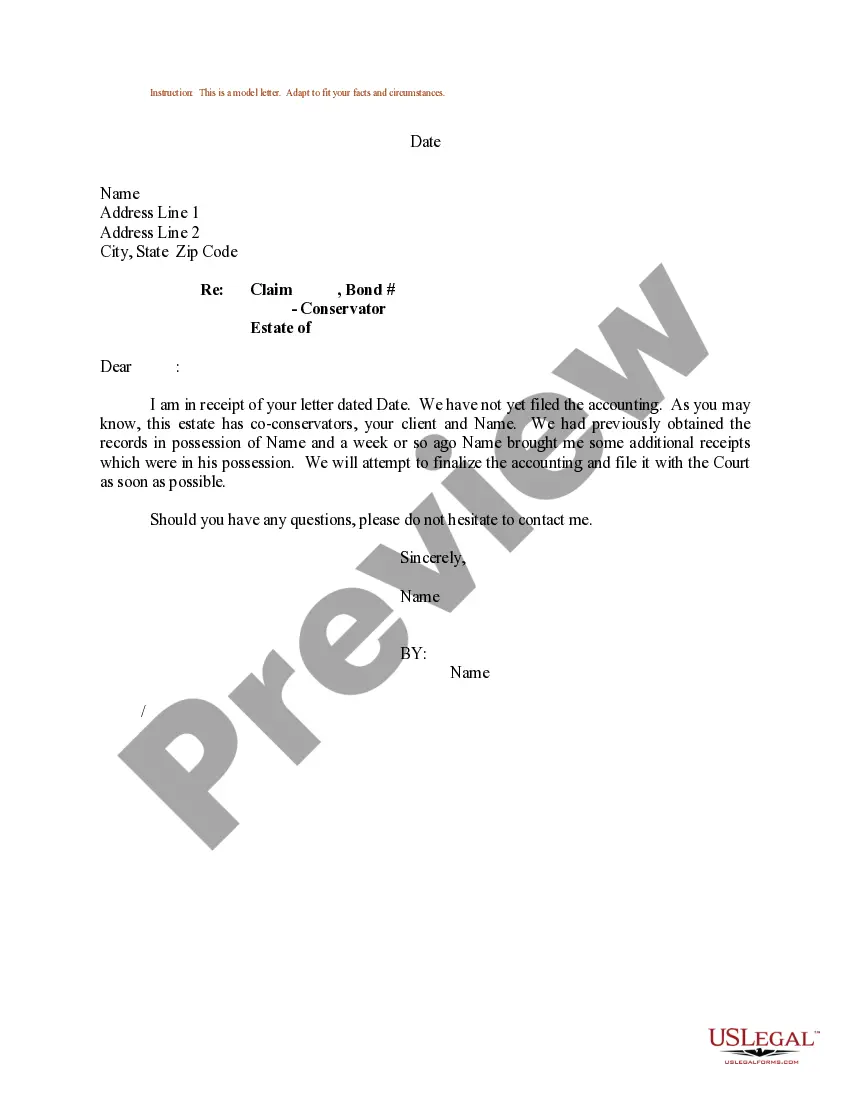

How to fill out Proposed Client Intake Sheet - General?

Discovering the right authorized papers web template might be a battle. Naturally, there are a variety of themes available on the Internet, but how can you find the authorized kind you want? Use the US Legal Forms website. The services provides 1000s of themes, such as the Arizona Proposed Client Intake Sheet - General, which you can use for enterprise and private requires. Each of the forms are checked by experts and satisfy federal and state demands.

Should you be already listed, log in to your bank account and then click the Obtain option to get the Arizona Proposed Client Intake Sheet - General. Make use of your bank account to appear from the authorized forms you possess ordered earlier. Proceed to the My Forms tab of your bank account and get one more duplicate in the papers you want.

Should you be a fresh consumer of US Legal Forms, allow me to share simple instructions for you to stick to:

- Very first, be sure you have chosen the correct kind to your town/region. You can look through the shape while using Review option and look at the shape information to make sure it will be the right one for you.

- If the kind fails to satisfy your preferences, make use of the Seach area to find the correct kind.

- When you are positive that the shape is proper, click on the Buy now option to get the kind.

- Opt for the prices strategy you want and enter in the required information. Create your bank account and pay money for the transaction with your PayPal bank account or Visa or Mastercard.

- Choose the document format and down load the authorized papers web template to your system.

- Total, modify and printing and sign the attained Arizona Proposed Client Intake Sheet - General.

US Legal Forms will be the largest library of authorized forms in which you will find a variety of papers themes. Use the service to down load skillfully-made files that stick to condition demands.

Form popularity

FAQ

Filing an Arizona TPT return is a two-step process comprised of submitting the required sales data (filing a return) and remitting the tax dollars (if any) to the ADOR. The filing process forces you to detail your total sales in the state, the amount of TPT due, and the location of each sale.

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

Enter your annual gross taxable wages, the number of paychecks you receive each year, your annual withholding goal, the amount already withheld for this year, the number of paychecks remaining in this year, and select the largest percentage on line 10 that is less than line 9.

Transaction Privilege (Sales) Tax License (TPT) Some businesses would need a business license, but don't have taxable business activity so don't need a TPT License from the Arizona Department of Revenue, and vice versa.

Arizona originally adopted TPT in 1933 when the rate for selling tangible personal property at retail was 2 percent. That rate is currently 5.6 percent. On top of the state TPT, there may be one or more local TPTs, as well as one or more special district taxes, each of which can range between 0 percent and 5.6 percent.

If you want to change your current amount withheld, you must file this form to change the Arizona withholding percentage or to change the extra amount withheld. What Should I do With Form A-4? Give your completed Form A-4 to your employer. Electing a Withholding Percentage of Zero.

While a buyer might experience it similarly, Arizona's Transaction Privilege Tax (TPT) is different from most other states' sales and use tax. Rather than a tax on a sale paid by the buyer, TPT is a tax for ?the privilege of doing business? in the state of Arizona and levied on the seller.

Businesses that perform the following activities are subject to TPT and must be licensed. retail sales. restaurants/bars. hotel/motel (transient lodging) commercial lease. amusements. personal property rentals. contracting. severance (metal mining)