Arizona Log of Records Retention Requirements

Description

How to fill out Log Of Records Retention Requirements?

Are you in a position that you require documents for either business or particular functions nearly every day.

There are numerous legitimate form templates available online, but locating ones you can trust is challenging.

US Legal Forms provides thousands of form templates, including the Arizona Log of Records Retention Requirements, which are designed to comply with federal and state regulations.

When you find the appropriate form, click Buy now.

Choose the payment plan you prefer, provide the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Arizona Log of Records Retention Requirements template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

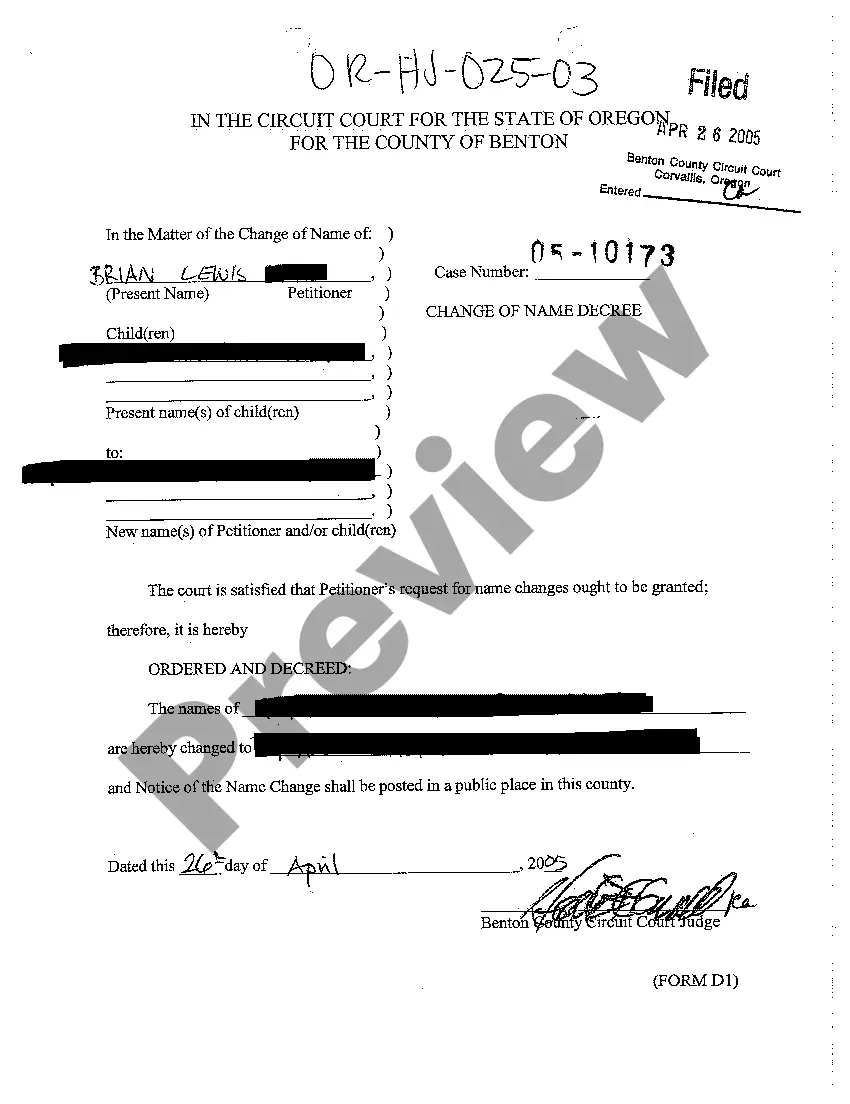

- Use the Preview button to check the form.

- Read the description to make sure you have selected the right form.

- If the form is not what you’re looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

How much should be the retention of internal audit and MRM records? The logical answer is a minimum of 3 years as that is the time frame of ISO certificate.

In the ACT, NSW and VIC, there is legislation outlining the minimum period of time which medical records should be kept: for an adult seven years from the date of the last health service. for a child until the age of 25 years.

Arizona Adult patients 6 years after the last date of services from the provider. 6 years after the last date of services from the provider, or until patient reaches the age of 21 whichever is longer.

HOW LONG DOES MY PROVIDER HAVE TO KEEP MY MEDICAL RECORD? Generally, Arizona law requires health care providers to keep the medical records of adult patients for at least 6 years after the last date the patient received medical care from that provider.

As a general rule of thumb, tax returns, financial statements and accounting records should be retained for a minimum of six years.

Minimum recommended GP record retention length GP records should be retained for 10 years after the death of a patient, and electronic patient records (EPRs) must not be deleted or destroyed for the foreseeable future.

Deceased patients' records are destroyed after 8 years unless the patient is a child, and then the records will be retained until the date when the child would have reached the age of 25.

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.