Arizona Employee Evaluation Form for Taxi Driver

Description

How to fill out Employee Evaluation Form For Taxi Driver?

It is possible to invest hrs on the Internet attempting to find the lawful file template which fits the state and federal demands you want. US Legal Forms supplies a huge number of lawful forms that happen to be evaluated by specialists. It is possible to download or print out the Arizona Employee Evaluation Form for Taxi Driver from my assistance.

If you already have a US Legal Forms profile, you can log in and click on the Obtain key. After that, you can complete, change, print out, or sign the Arizona Employee Evaluation Form for Taxi Driver. Every single lawful file template you purchase is the one you have eternally. To have one more duplicate of any bought form, visit the My Forms tab and click on the related key.

Should you use the US Legal Forms internet site the first time, keep to the straightforward instructions below:

- Initially, ensure that you have chosen the proper file template to the county/area that you pick. See the form description to ensure you have picked out the proper form. If readily available, use the Preview key to look with the file template also.

- In order to locate one more model in the form, use the Look for industry to discover the template that meets your needs and demands.

- After you have located the template you need, simply click Buy now to move forward.

- Pick the rates prepare you need, type in your credentials, and register for a free account on US Legal Forms.

- Full the deal. You can use your Visa or Mastercard or PayPal profile to pay for the lawful form.

- Pick the file format in the file and download it in your product.

- Make alterations in your file if needed. It is possible to complete, change and sign and print out Arizona Employee Evaluation Form for Taxi Driver.

Obtain and print out a huge number of file templates using the US Legal Forms web site, which offers the most important assortment of lawful forms. Use professional and status-particular templates to handle your small business or individual requirements.

Form popularity

FAQ

Careerpilot : Job sectors : Transport : Job profiles : Taxi driver.

When you fill the form:Be honest and critical. Analyze your failures and mention the reasons for it.Keep the words minimal.Identify weaknesses.Mention your achievements.Link achievements to the job description and the organization's goals.Set the goals for the next review period.Resolve conflicts and grievances.

Mileage expense is one of the most significant expenses a taxi driver incurs. Luckily, it's deductible. One option taxi drivers have is to calculate the actual vehicle expenses they incurred for work, such as gas, registration, insurance, maintenance, repairs, lease payments and depreciation.

Below is a comprehensive list of the most common expenses a Taxi Driver can claim.Petrol or diesel costs.Repairs, servicing and running the taxi.The costs of your annual road tax and your MOT test.The cost of washing or cleaning your own taxi.Interest on any bank or personal loans taken out to purchase your taxi.More items...

Answer for Taxi Drivers as WorkersNo, all London taxi drivers are self-employed. Transport for London (TfL) is the regulatory body for taxi and private hire services in the Capital.

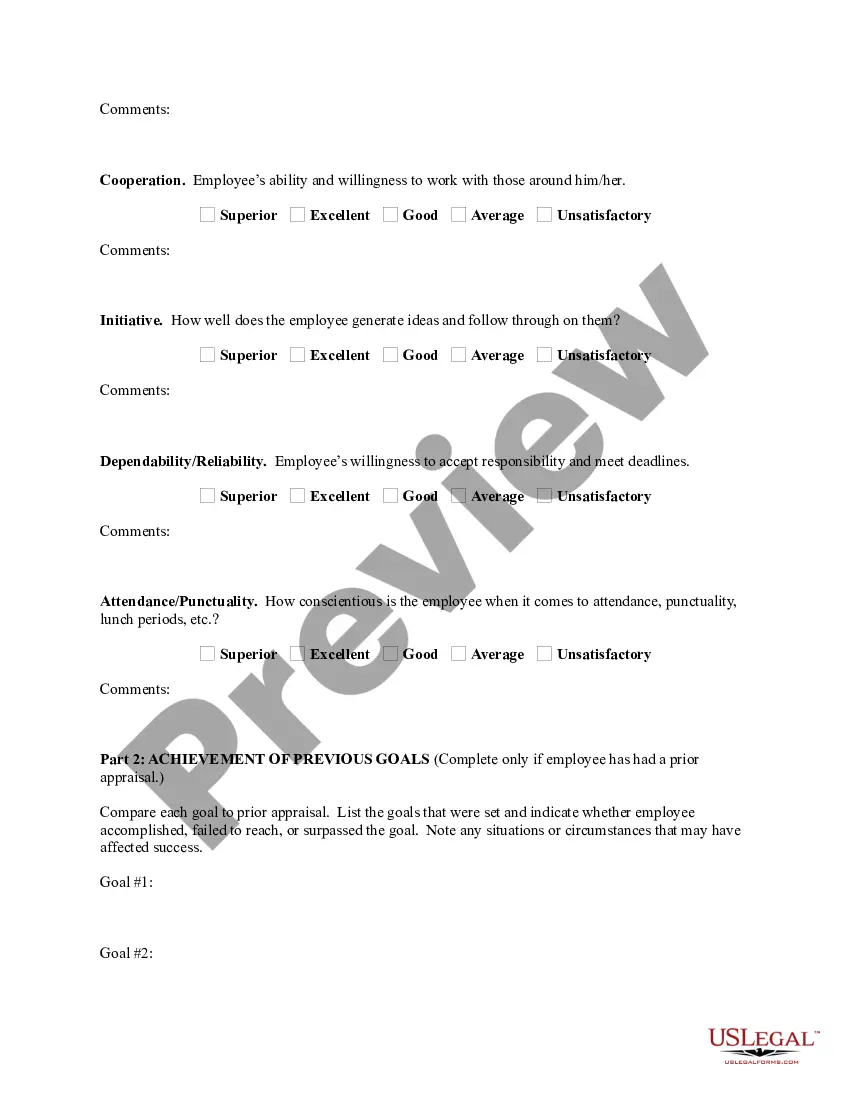

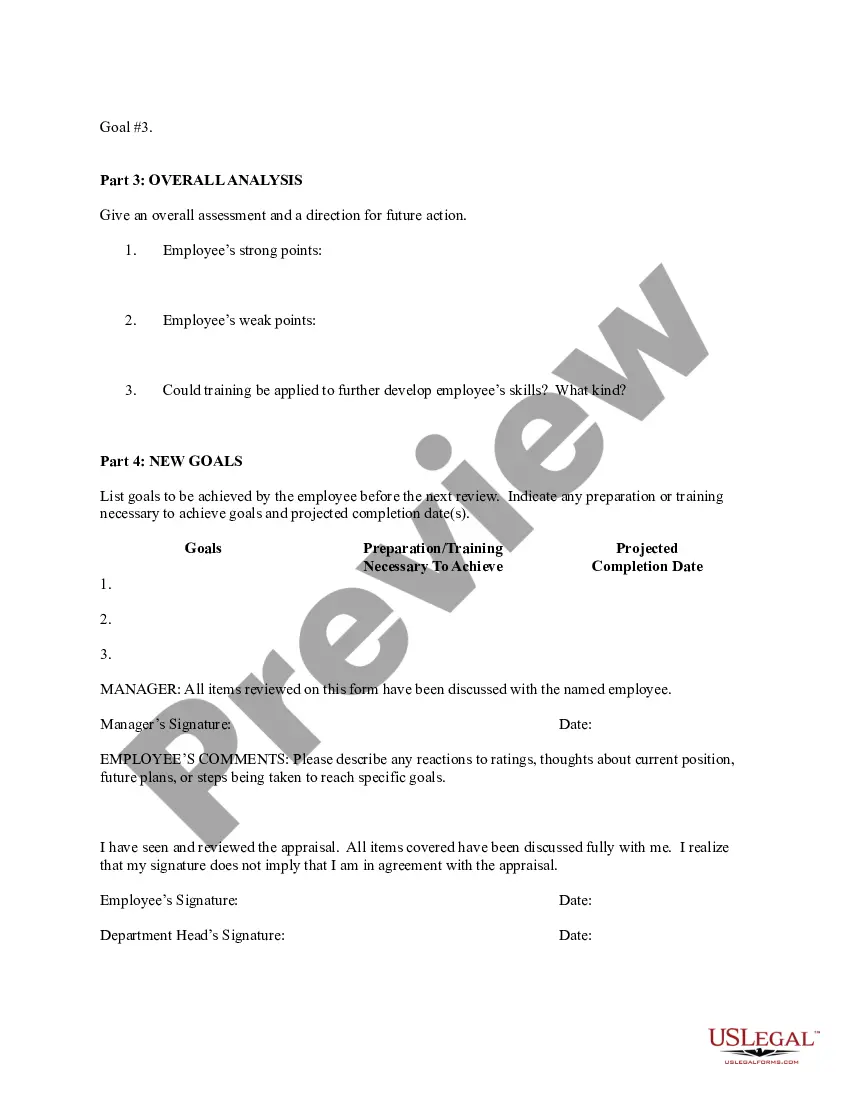

What to Include in an Employee Evaluation Form?Employee and reviewer information. The form must have basic information about both parties involved.Review period.An easy-to-understand rating system.Evaluation points.Goals.Extra space for comments.Signatures.Scorecard.More items...?

How to write an employee evaluationGather employee information. Gather required information related to the employee to get the full picture of their value to the company.List employee responsibilities.Use objective language.Use action verbs.Compare performance ratings.Ask open-ended questions.Use a point system.18-Jan-2022

What expenses can a taxi driver claim?Fuel costs, whether for petrol, diesel or an electric vehicle.Maintenance, servicing, MOT and repairs to your vehicle.Cost for road tax.Washing or cleaning your taxi.Licence and registration or membership fees relating to your business.More items...?15-Jun-2021

You can deduct common driving expenses, including fees and tolls that Uber and Lyft take out of your pay. Your biggest tax deductions will be costs related to your car. You may also want to deduct other expenses like snacks for passengers, USB chargers/cables, or separate cell phones for driving.

Self-Employment Tax Deduction. Social Security and Medicare Taxes.Home Office Deduction.Internet and Phone Bills Deduction.Health Insurance Premiums Deduction.Meals Deduction.Travel Deduction.Vehicle Use Deduction.Interest Deduction.More items...