Arizona While You Were Out

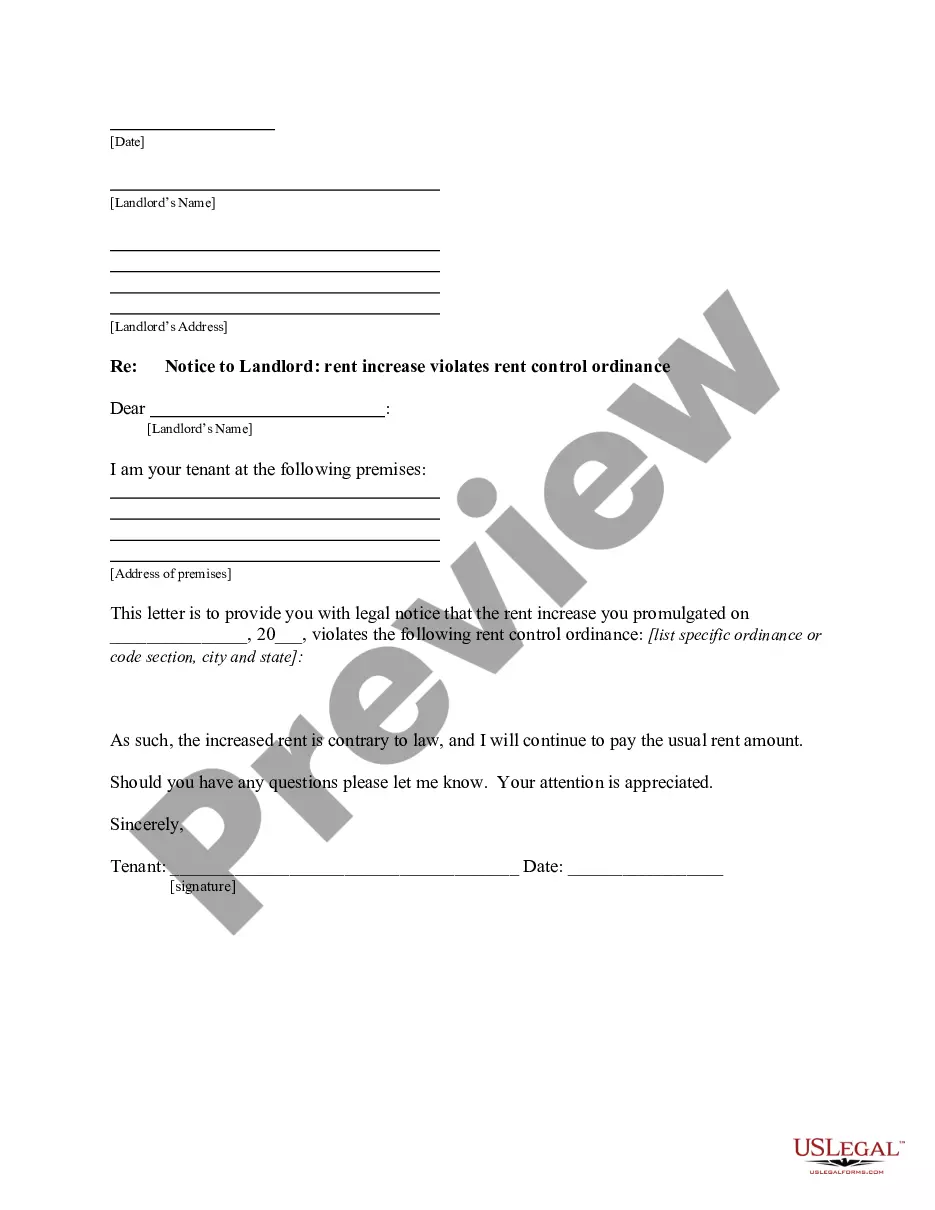

Description

How to fill out While You Were Out?

You might spend time online searching for the valid documents template that matches the federal and state requirements you will need.

US Legal Forms offers thousands of valid forms that are reviewed by experts.

You can actually download or create the Arizona While You Were Out from the service.

If available, utilize the Review button to look through the document template as well.

- If you already have a US Legal Forms account, you may Log In and then click the Obtain button.

- Then, you may complete, modify, print, or sign the Arizona While You Were Out.

- Each valid document template you obtain is yours forever.

- To retrieve another copy of any purchased form, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Review the form description to verify you have chosen the appropriate one.

Form popularity

FAQ

To fill out the Arizona title and registration application, gather necessary documents, including proof of identity and ownership. Complete the application form with accurate details about you and the vehicle. Arizona While You Were Out provides helpful tips to make this process easier, ensuring you don’t miss important steps.

Nonresidents are subject to Arizona tax on any income earned from Arizona sources. Nonresidents may also exclude income Arizona law does not tax. Individuals subject to tax by both Arizona and another state on the same income may also be eligible for a tax credit.

To keep your withholding the same as last year, choose a withholding percentage of 1.8% (40,000 x . 018 = 720) and withhold an additional $10.77 per biweekly pay period (1,000 - 720 = 280 / 26 = 10.77). Be sure to take into account any amount already withheld for this year.

Income Tax Filing Requirements. For tax years ending on or before December 31, 2019, Individuals with an adjusted gross income of at least $5,500 must file taxes, and an Arizona resident is subject to tax on all income, including from other states.

In the state of Arizona, full-year resident or part-year resident individuals must file a tax return if they are: Single or married filing separately and gross income (GI) is greater than $12,550; Head of household and GI is greater than $18,800; or. Married and filing jointly and GI is greater than $25,100.

Nonresident individuals must file income tax returns in both Arizona and their home state. Although it may appear as though a nonresident taxpayer is paying taxes twice on the same income because of reporting requirements, credits allowed offset that income.

If the employee does not complete the form, the employer must withhold Arizona income tax at the rate of 2.7% until the employee elects a different withholding rate.

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars for more information.

States who acknowledge you are not a resident won't require U.S. expats to pay state taxes or file a state tax return. Expats only need to file a state tax return along with a federal tax return if they are still receiving income (including pension or retirement income) from that particular state.

Minimum income to file taxes Single filing status: $12,550 if under age 65. $14,250 if age 65 or older.