Arizona Material Return Record

Description

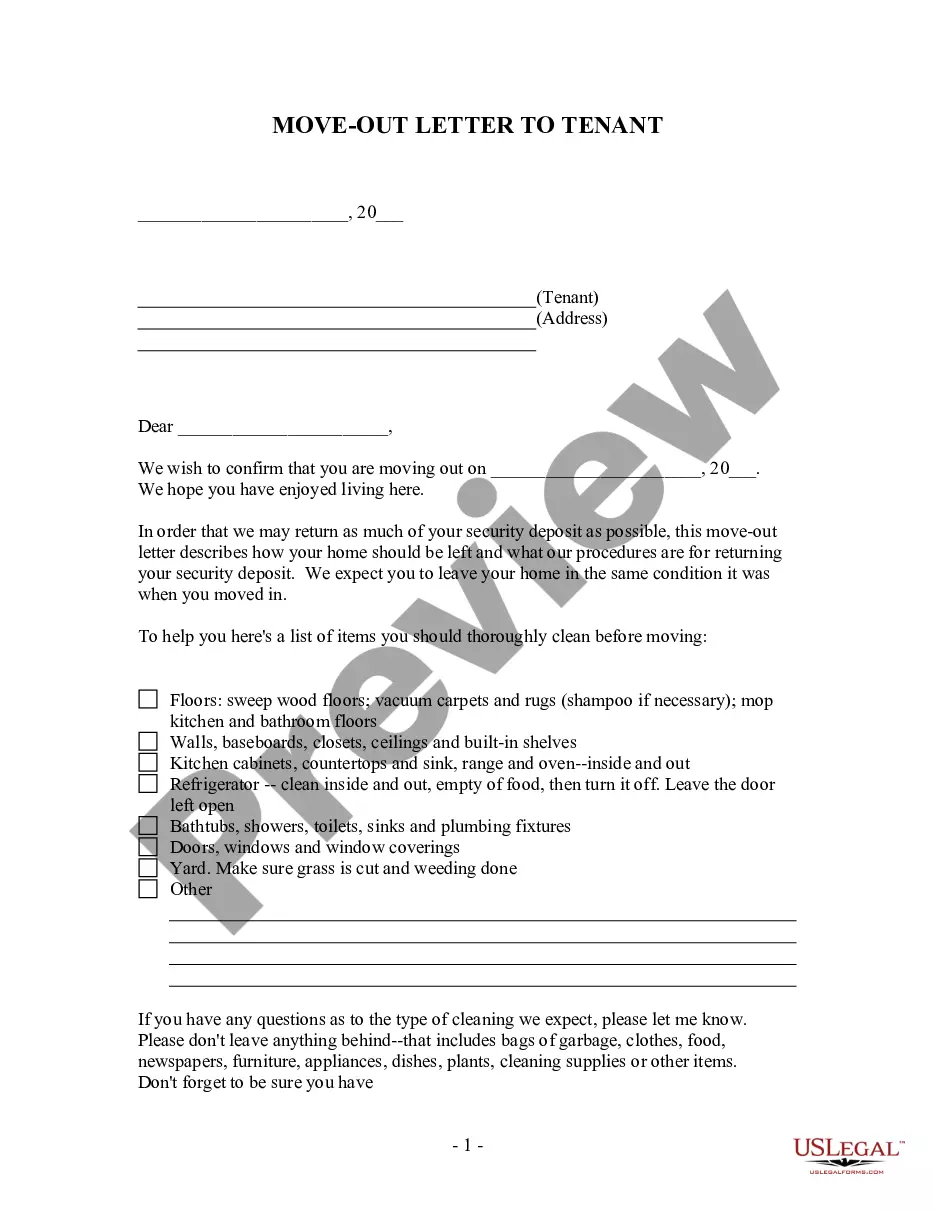

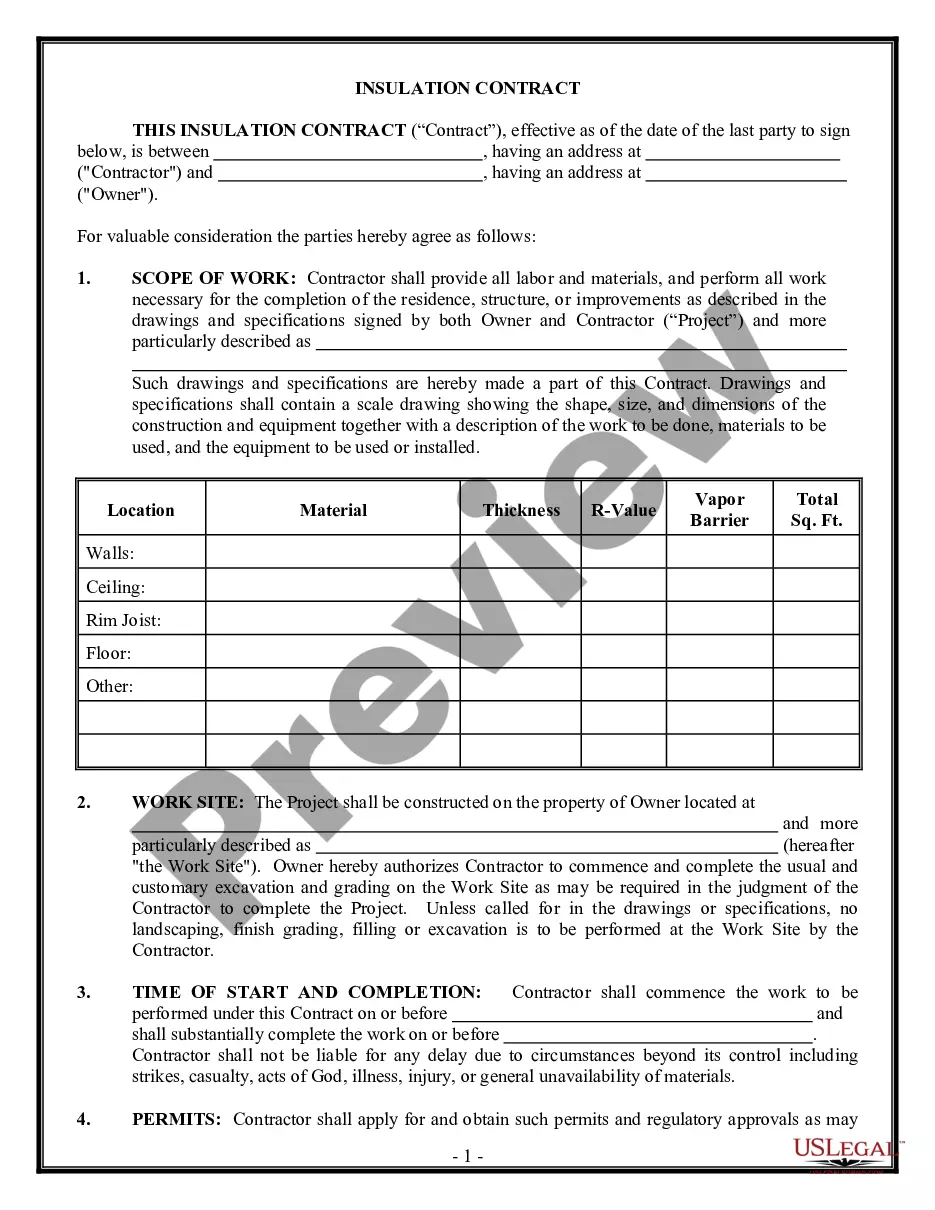

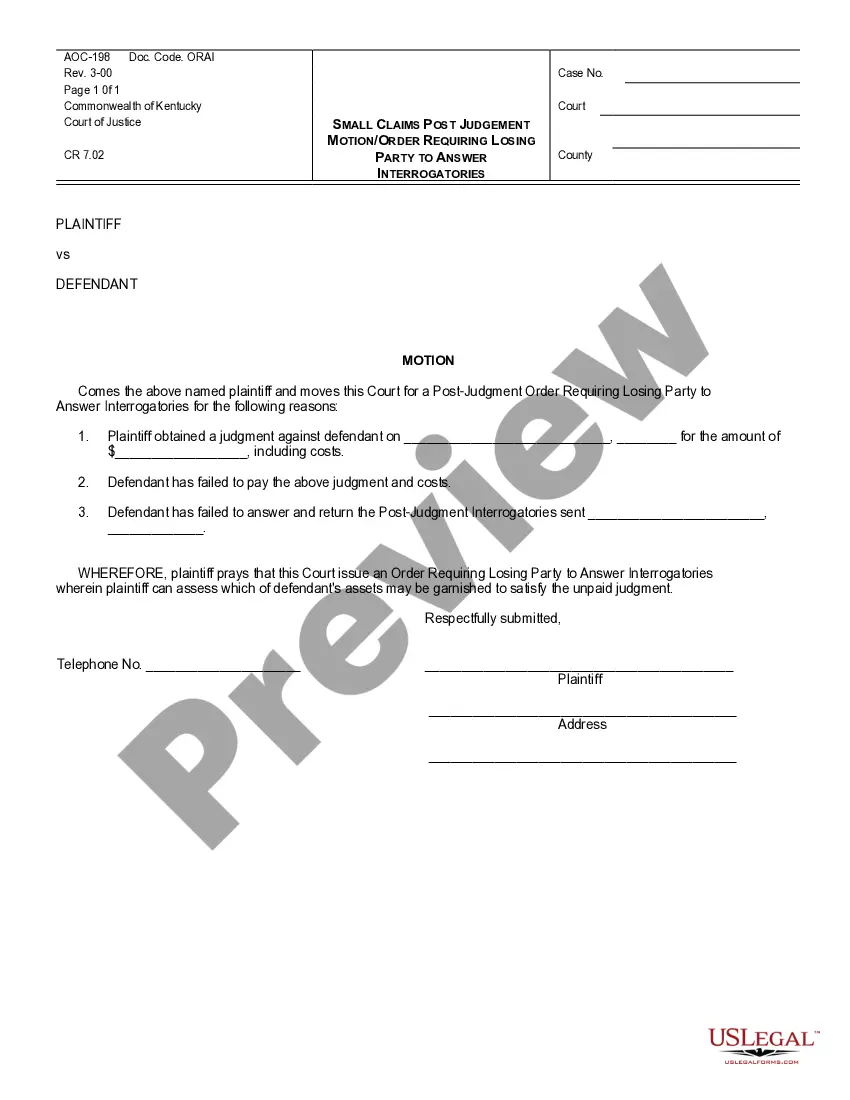

How to fill out Material Return Record?

If you want to summarize, obtain, or produce legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website’s straightforward and user-friendly search to locate the paperwork you require.

A selection of templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click on the Buy now button. Select the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the purchase. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the Arizona Material Return Form in just a few moments.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Arizona Material Return Form.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the content of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the document, utilize the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Nonresident individuals must file income tax returns in both Arizona and their home state. Although it may appear as though a nonresident taxpayer is paying taxes twice on the same income because of reporting requirements, credits allowed offset that income.

Individual. Form 140A - Arizona Resident Personal Income Tax Booklet.

Form 140 - Resident Personal Income Tax Form -- Calculating Personal income tax return filed by resident taxpayers. You may file Form 140 only if you (and your spouse, if married filing a joint return) are full year residents of Arizona.

Voters in November 2020 approved Proposition 208 with 51.7% of the vote. It imposed a 3.5% surcharge on taxable incomes over $250,000 for single filers and $500,000 for joint filers. The tax was set to be collected when people and businesses filed their 2021 taxes, due next month.

2022 Form 140NR Nonresident Personal Income Tax. Return. 2022 Schedule A(NR) Itemized Deduction.

140NR. Nonresident Personal Income Tax Return.

If you do not owe Arizona income taxes by the tax deadline of April 18, 2022, you do not have to prepare and file a AZ tax extension. In case you expect a AZ tax refund, you will need to file or e-File your AZ tax return in order to receive your tax refund money.

Yes. When mailing a paper state return, include a copy of the Federal 1040, second copies W-2(s) and any forms that have federal tax withheld. Attach these to the back of your state form.

Individual Estimated Income Tax Payment. FOR CALENDAR YEAR. 2020. 25a1 Check if this payment is on behalf of a Nonresident Composite return - 140NR.

AZ-140V. Arizona Individual Income Tax. Payment Voucher for Electronic Filing.