Arizona Depreciation Schedule

Description

How to fill out Depreciation Schedule?

If you need to finalize, acquire, or print authentic document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Leverage the website's straightforward and convenient search feature to find the documents you require.

Numerous templates for both commercial and personal use are categorized by types and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the purchase. You can use your Visa or MasterCard or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it onto your device.

- Employ US Legal Forms to locate the Arizona Depreciation Schedule with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to access the Arizona Depreciation Schedule.

- You can also reach forms you have previously saved within the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, please adhere to the guidelines outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

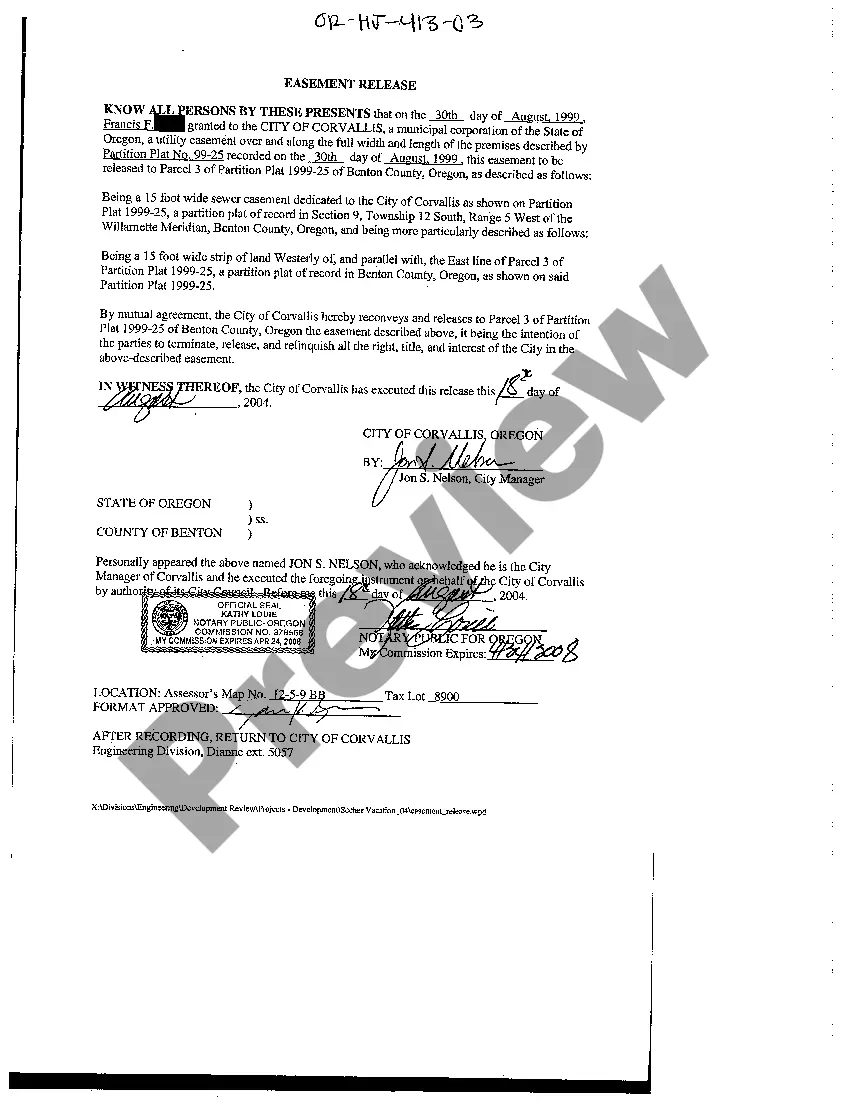

- Step 2. Use the Review option to evaluate the form's contents. Do not forget to read the information.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find alternate versions of the legal form template.

Form popularity

FAQ

The bill does not add any new non-conformity additions or subtractions. However, additions and subtractions created for prior non-conformity adjustments for issues such as bonus depreciation are still in place. The instructions issued with the 2020 Arizona tax returns are correct.

You can continue to depreciate the property until one of the following conditions is met:You have deducted your entire cost or other basis in the property.You retire the property from service, even if you have not fully recovered its cost or other basis.

It was scheduled to go down to 40% in 2018 and 30% in 2019, and then not be available in 2020 and beyond. The Tax Cuts and Jobs Act, enacted at the end of 2018, increases first-year bonus depreciation to 100%. It goes into effect for any long-term assets placed in service after September 27, 2017.

For assets placed in service in 2013, Arizona law allowed a taxpayer that claimed bonus depreciation on the federal return to make an election to claim bonus depreciation on the Arizona income tax return. The Arizona bonus depreciation is 10% of the amount of bonus depreciation claimed on the federal income tax return.

168(k) bonus depreciation. (see ¶16-245) Additions ( A¶16-040) and subtractions ( A¶16-245) are also required because Arizona does not conform to the increased IRC Sec. 179 expense deduction allowed under federal law.

The states that do not conform simply do not allow bonus depreciation and no additional deduction for bonus depreciation is allowed....States that do not conform to the new rules:Arizona.Arkansas.California.Connecticut.District of Columbia.Florida.Georgia.Hawaii.More items...

A Brief Overview of Depreciation Depreciation is an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property. It is an annual allowance for the wear and tear, deterioration, or obsolescence of the property.

For Arizona income tax purposes, the taxpayer must make an addition to Arizona AGI for the entire amount of depreciation (bonus plus regular) taken on the federal return. The depreciation must then be recalculated under Arizona tax law and is then subtracted from income on the AZ Form 140, 140PY or 140NR.

When you sell a rental or business property, including a home for which you took a deduction for a home office, you incur depreciation, whether you claimed it or not.