Arizona Employee Lending Agreement

Description

How to fill out Employee Lending Agreement?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a vast array of legal document templates that you can download or print.

While using the website, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Arizona Employee Lending Agreement within minutes.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

If you are satisfied with the form, confirm your selection by clicking the Get Now button. Then, choose your payment plan and provide your information to sign up for the account.

- If you already have an account, Log In and download the Arizona Employee Lending Agreement from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously obtained forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are simple instructions to help you begin.

- Ensure you have selected the correct form for your area/state.

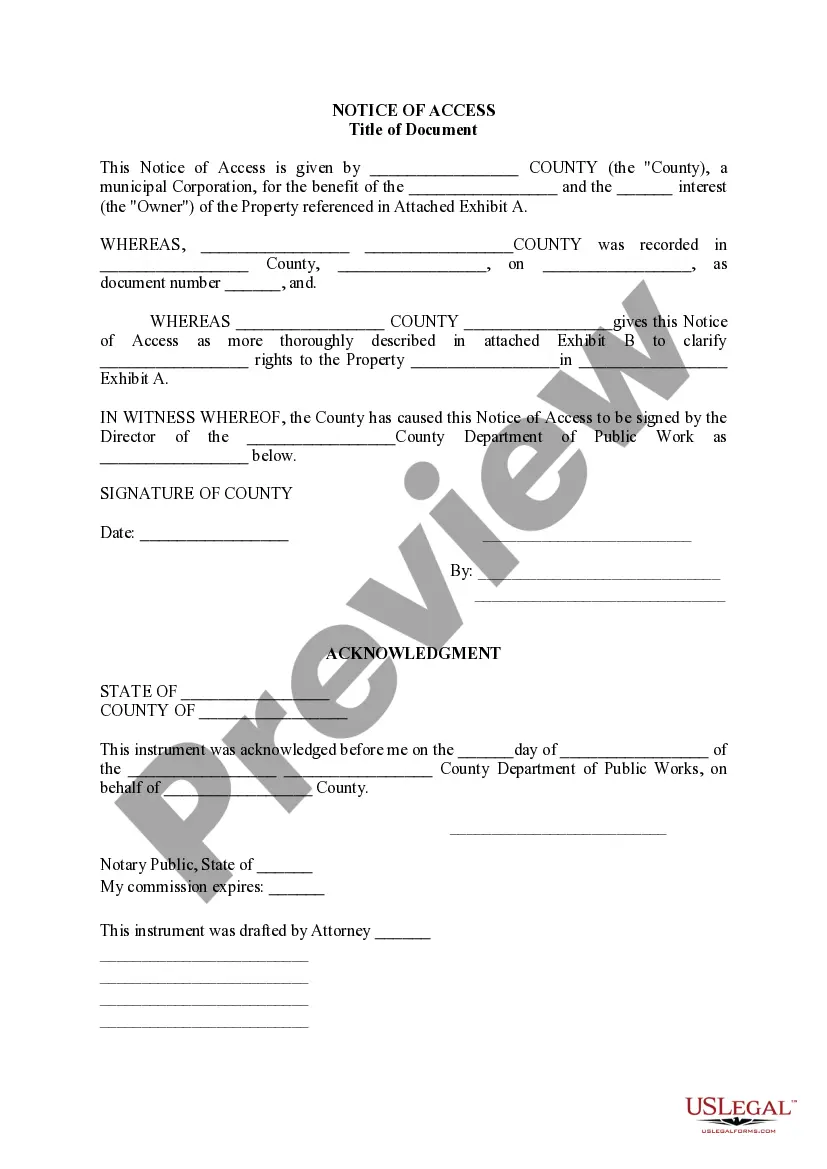

- Click on the Preview button to examine the content of the form.

Form popularity

FAQ

Employee or Employer Out-of-State Withholding (Remote Worker) Withholding of Arizona state income tax from the commencement of employment is required for any resident employee physically working in the state of Arizona regardless of where the employer is based.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

What is the best percentage for Arizona withholding Reddit? Your tax burden is $1,195, or 2.98%. If you want to owe a little bit at the end of the year, pick the 2.7% withholding - you'll owe an additional 0.28% ($112) in April. If you want a little back, pick 3.36% and you'll get 0.38% ($152) back in April.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.

To keep your withholding the same as last year, choose a withholding percentage of 1.8% (40,000 x . 018 = 720) and withhold an additional $10.77 per biweekly pay period (1,000 - 720 = 280 / 26 = 10.77). Be sure to take into account any amount already withheld for this year.

How to fill out a W-4 formStep 1: Personal information.Step 2: Account for multiple jobs.Step 3: Claim dependents, including children.Step 4: Refine your withholdings.Step 5: Sign and date your W-4.» MORE: See more about what it means to be tax-exempt and how to qualify.

The federal withholding tax has seven rates for 2021: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The federal withholding tax rate an employee owes depends on their income level and filing status. This all depends on whether you're filing as single, married jointly or married separately, or head of household.