Arizona Agreement to Partition Real Property among Surviving Spouse and Children of Decedent

Description

How to fill out Agreement To Partition Real Property Among Surviving Spouse And Children Of Decedent?

If you wish to complete, obtain, or produce authorized papers templates, use US Legal Forms, the biggest selection of authorized types, which can be found on the Internet. Make use of the site`s simple and easy convenient search to discover the papers you need. A variety of templates for organization and personal uses are sorted by classes and suggests, or search phrases. Use US Legal Forms to discover the Arizona Agreement to Partition Real Property among Surviving Spouse and Children of Decedent in just a few clicks.

When you are presently a US Legal Forms consumer, log in in your bank account and then click the Download option to obtain the Arizona Agreement to Partition Real Property among Surviving Spouse and Children of Decedent. You can even entry types you earlier delivered electronically inside the My Forms tab of your respective bank account.

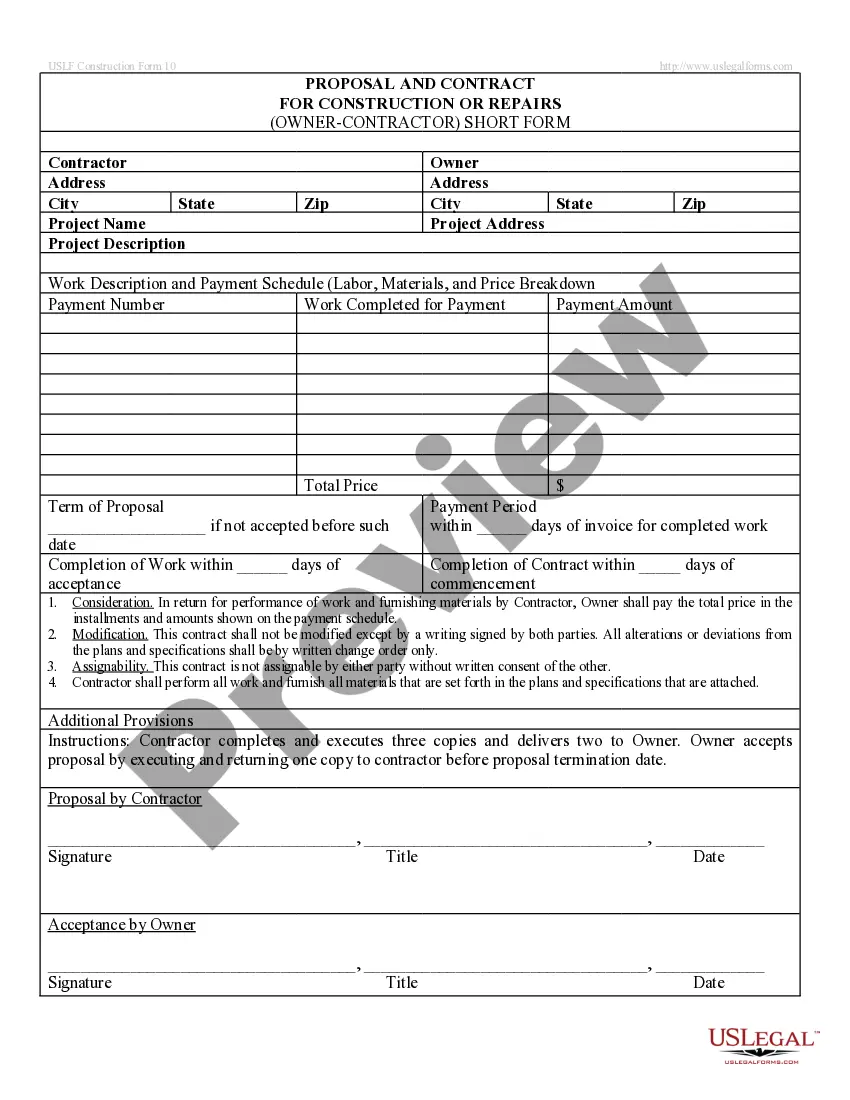

If you work with US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for that appropriate metropolis/land.

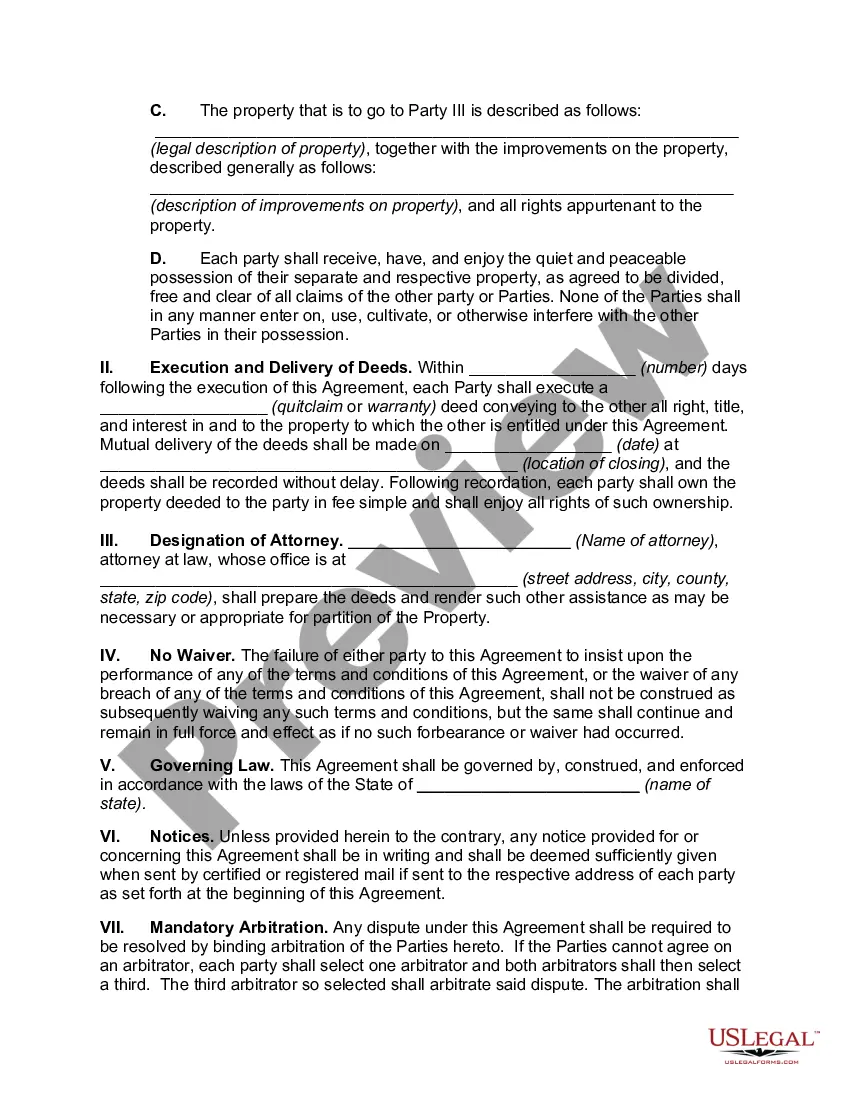

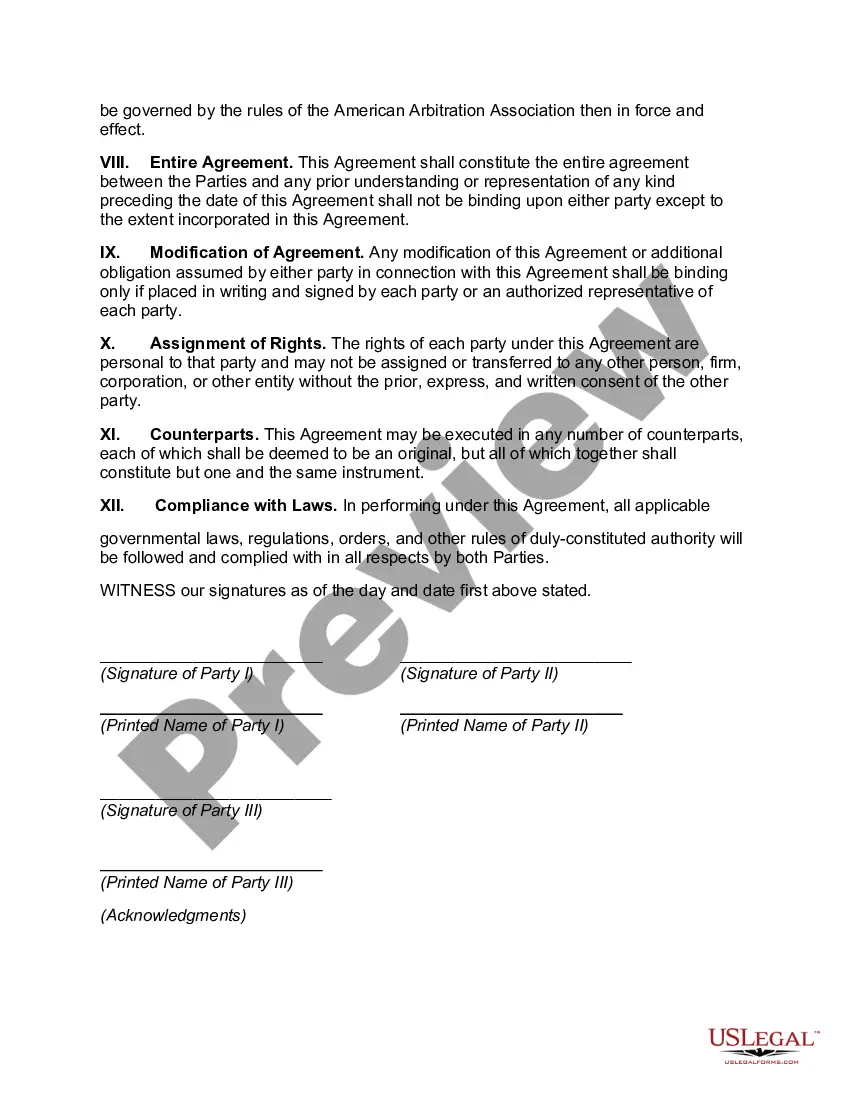

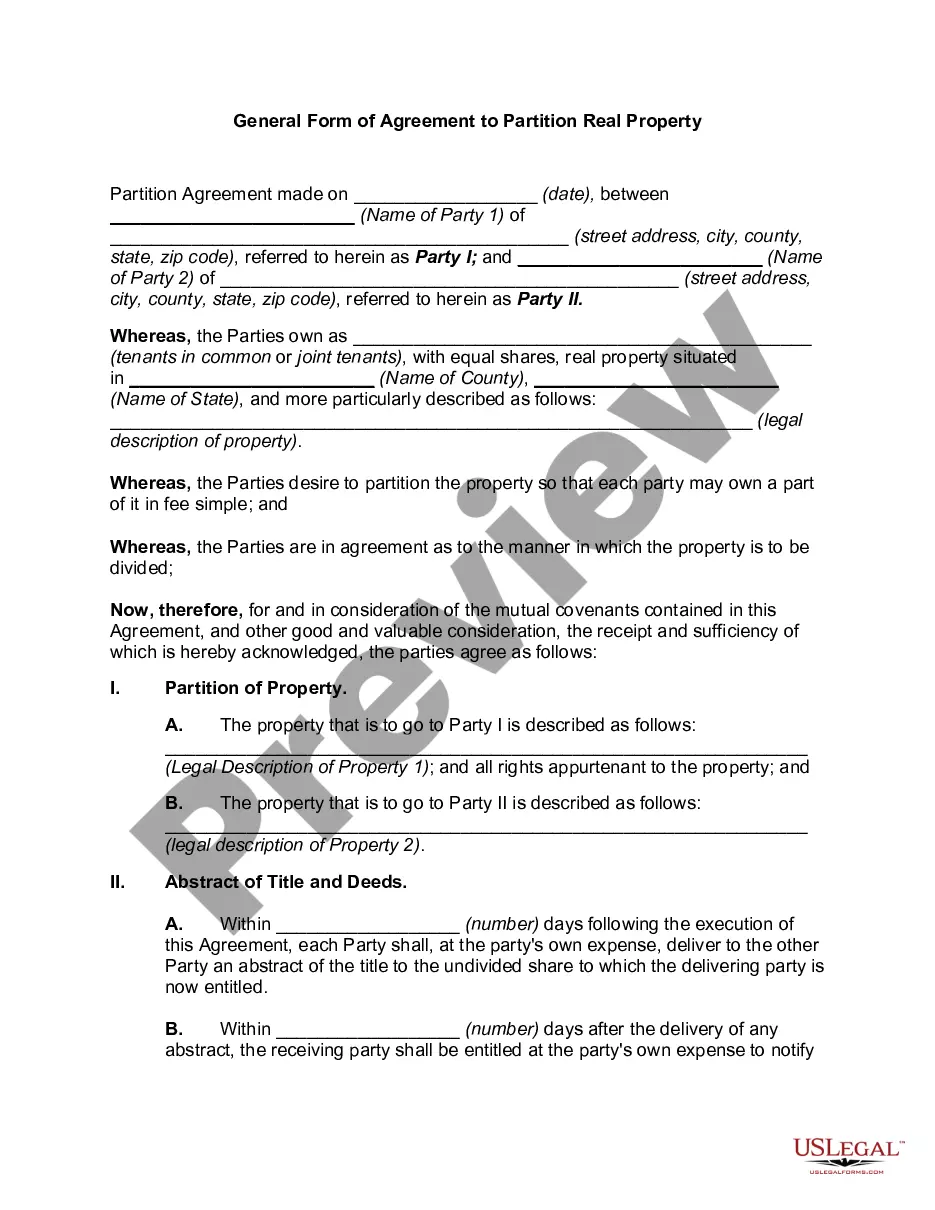

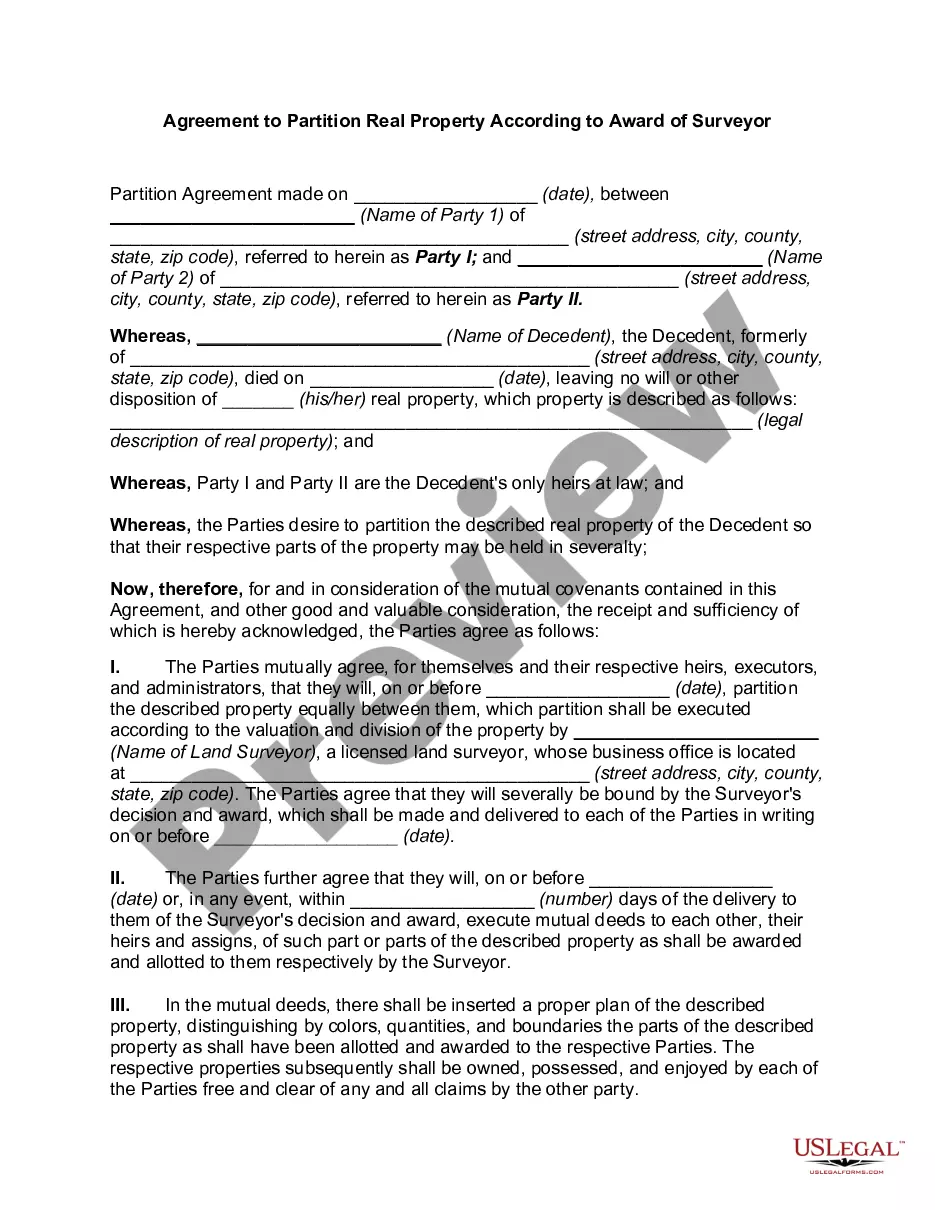

- Step 2. Make use of the Preview choice to check out the form`s articles. Never forget to read the outline.

- Step 3. When you are not happy with all the kind, make use of the Look for industry near the top of the screen to discover other types of your authorized kind format.

- Step 4. Upon having discovered the form you need, click the Buy now option. Opt for the costs plan you prefer and add your credentials to sign up for the bank account.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal bank account to finish the financial transaction.

- Step 6. Choose the structure of your authorized kind and obtain it in your product.

- Step 7. Total, edit and produce or sign the Arizona Agreement to Partition Real Property among Surviving Spouse and Children of Decedent.

Every single authorized papers format you buy is your own property forever. You might have acces to every kind you delivered electronically within your acccount. Go through the My Forms area and decide on a kind to produce or obtain yet again.

Contend and obtain, and produce the Arizona Agreement to Partition Real Property among Surviving Spouse and Children of Decedent with US Legal Forms. There are many expert and status-particular types you can utilize for your organization or personal requirements.

Form popularity

FAQ

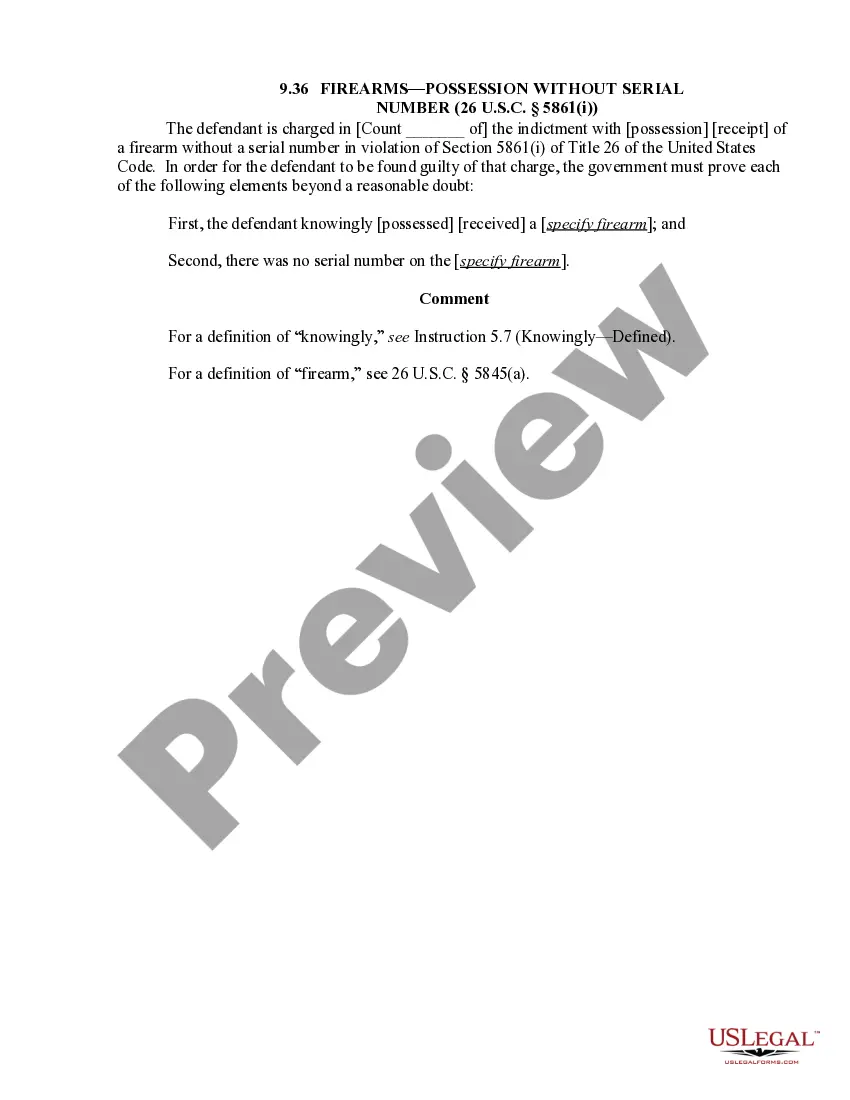

12-1211 - Compelling partition; complaint. A. The owner or claimant of real property or any interest therein may compel a partition of the property between him and other owners or claimants by filing a complaint in the superior court of the county in which the property, or a portion thereof, is situated.

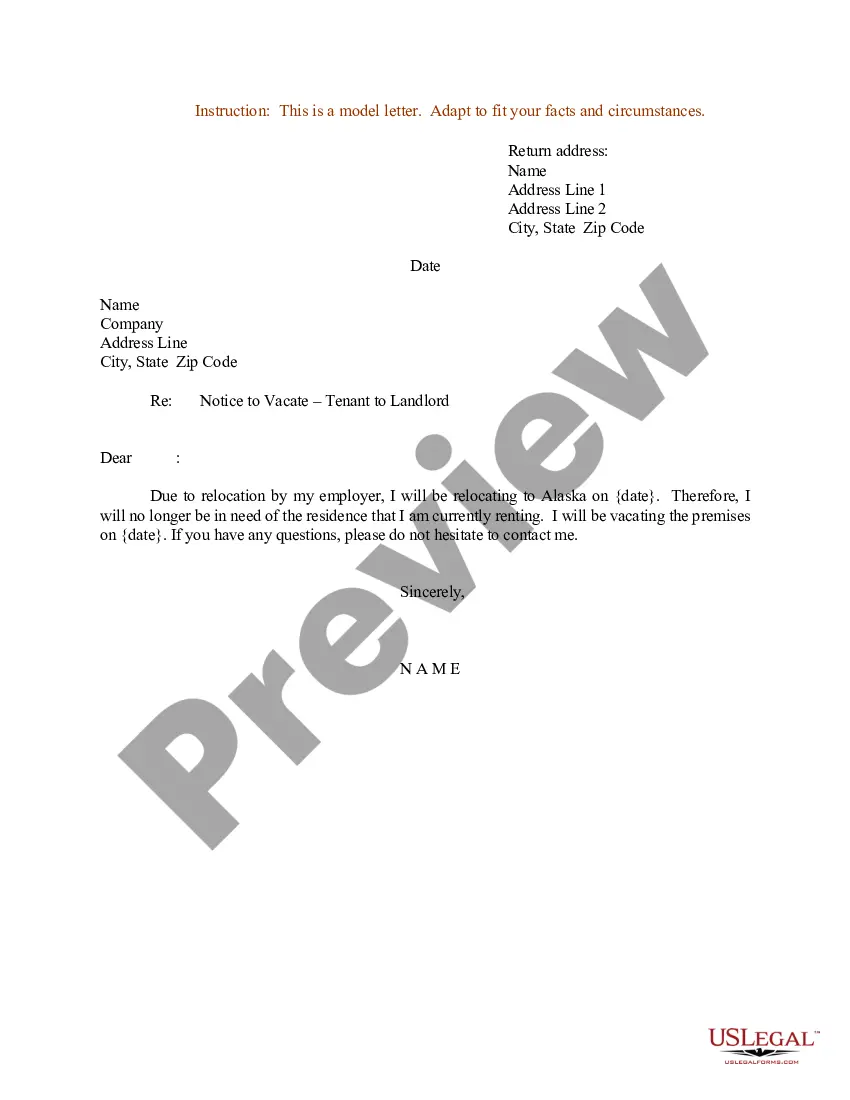

A right of survivorship deed allows married people to share a property title (co-ownership) where both have equal shares. When the first spouse passes away, the surviving spouse will own the property alone. By having a survivorship deed in place, probate can be avoided. Arizona is a community property state.

In Arizona, joint accounts come with survivorship rights by default, meaning the surviving account holder(s) automatically inherit the deceased account holder's share unless specified otherwise.

Right to survivorship arises in properties with joint tenancy, or properties that two or more parties own together. When one party dies, right to survivorship determines the fate of the piece of real estate.

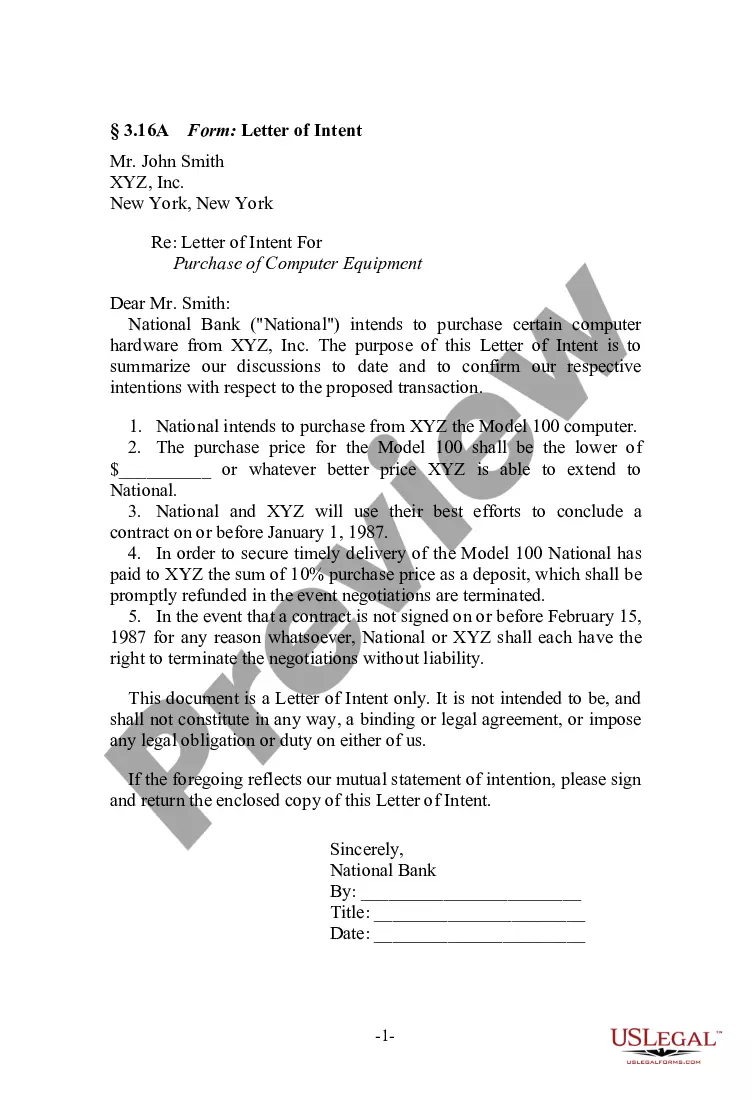

The main difference between joint tenants vs community property with right of survivorship lies in how the property is taxed after the death of a spouse. In joint tenant agreements, the proceeds from the sale of a property (after the death of a spouse) would be subject to the capital gains tax.

Community Property with Right of Survivorship is co-ownership by married persons providing for the surviving spouse to retain full title after the death of the other spouse. Allows for a stepped-up tax basis for Capital Gains Taxes to a surviving spouse.

Community Property with Right of Survivorship is an estate planning tool that attempts to avoid probate issues by automatically transferring the deceased spouse's one-half interest in the property to the surviving spouse. This is similar to Joint Tenancy with Right of Survivorship. A.R.S. 33-431.

What Is Community Property With Right Of Survivorship? Community property with right of survivorship is a legal distinction that allows two spouses to equally share assets through marriage as well as pass on assets to the other spouse upon death without going through probate.