Arizona Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association

Description

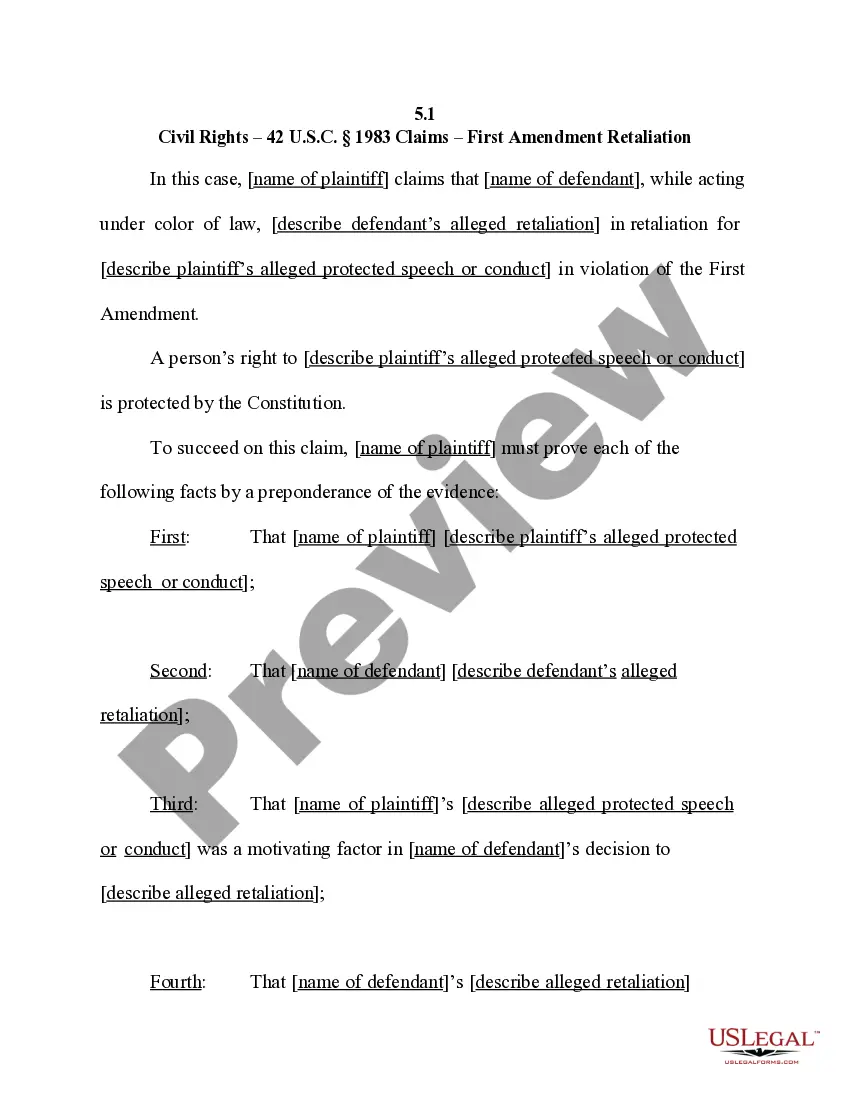

How to fill out Notice Of Meeting To Pass On Resolution To Incorporate Non-Profit Association?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal form templates that you can download or print. By using the website, you can discover thousands of forms for business and personal needs, organized by categories, states, or keywords.

You can quickly obtain the most recent forms like the Arizona Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association.

If you are a member, Log In to download the Arizona Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association from the US Legal Forms library. The Download button will be available for every form you view. You also have access to all previously acquired forms in the My documents section of your account.

Proceed to finalize the payment. Use a credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Arizona Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association. Every template you add to your account does not have an expiration date and is yours permanently. Therefore, to download or print another copy, simply access the My documents section and click on the form you need. Access the Arizona Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- Verify that you have selected the appropriate form for your city/county.

- Click the Review button to review the form's content.

- Check the form details to confirm that you have chosen the right form.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Acquire now button.

- Next, select the pricing plan you prefer and provide your information to register for the account.

Form popularity

FAQ

How Much Does It Cost to Incorporate an Arizona Nonprofit? You will pay a $40 state filing fee to register your nonprofit with the Arizona Secretary of State, and an additional $35 if you want to expedite the filing process (there is no filing fee for the Certificate of Disclosure described below).

In general, the SEC guidelines permit resolutions only from shareholders who have continuously held at least $2,000 of the company's stock for a year or longer. If a shareholder meets these requirements, then the board can choose to bring up the resolution for a vote at the next shareholder meeting.

The corporation is required to adopt bylaws. Bylaws are written rules that govern how the corporation operates internally, such as how the Board of Directors will be elected and what votes are required for a particular entity. anyone given authority to sign for that A.R.S. § 3140(37).

Examples of Actions that Need Corporate ResolutionsApproval of new board members and officers.Acceptance of the corporate bylaws.Creation of a corporate bank account.Designating which board members and officers can access the bank account.Documentation of a shareholder decision.Approval of hiring or firing employees.More items...

Forming a nonprofit does not take the place of obtaining a business license, tax registration certificate, and other required business permits.

Nonprofit corporations often deal with government agencies on issues of public concern, which may involve applying for grants, loans or other governmental approvals. In many situations, the government agency requires a corporate resolution to verify the board's approval for making the government application.

Labeling a vote a resolution means that the board believed the issue was important enough to separate it from standard voting issues. A resolution is considered an official board action and it requires a quorum. Board directors must document all official board actions, including resolutions, in their meeting minutes.

To legally establish your nonprofit corporation, you must file articles of incorporation for a nonprofit with the Arizona Corporation Commission. The Arizona Corporations Commission requires that your articles of incorporation include: the nonprofit's name. the "character of affairs" it intends to conduct in Arizona.

How to Form an Arizona Nonprofit CorporationChoose directors for your nonprofit.Choose a name for your nonprofit.Appoint a registered agent.File Arizona nonprofit Articles of Incorporation.Publish Notice of Incorporation.Prepare nonprofit bylaws.Hold a meeting of your board of directors.More items...

No, a nonprofit organization is not a C corporation. As mentioned above, nonprofits operate under section 501(c) of the Internal Revenue Code and many of them operate under a tax exempt status. C Corporations pay taxes under Chapter C of the IRS tax code, which is where the name comes from.