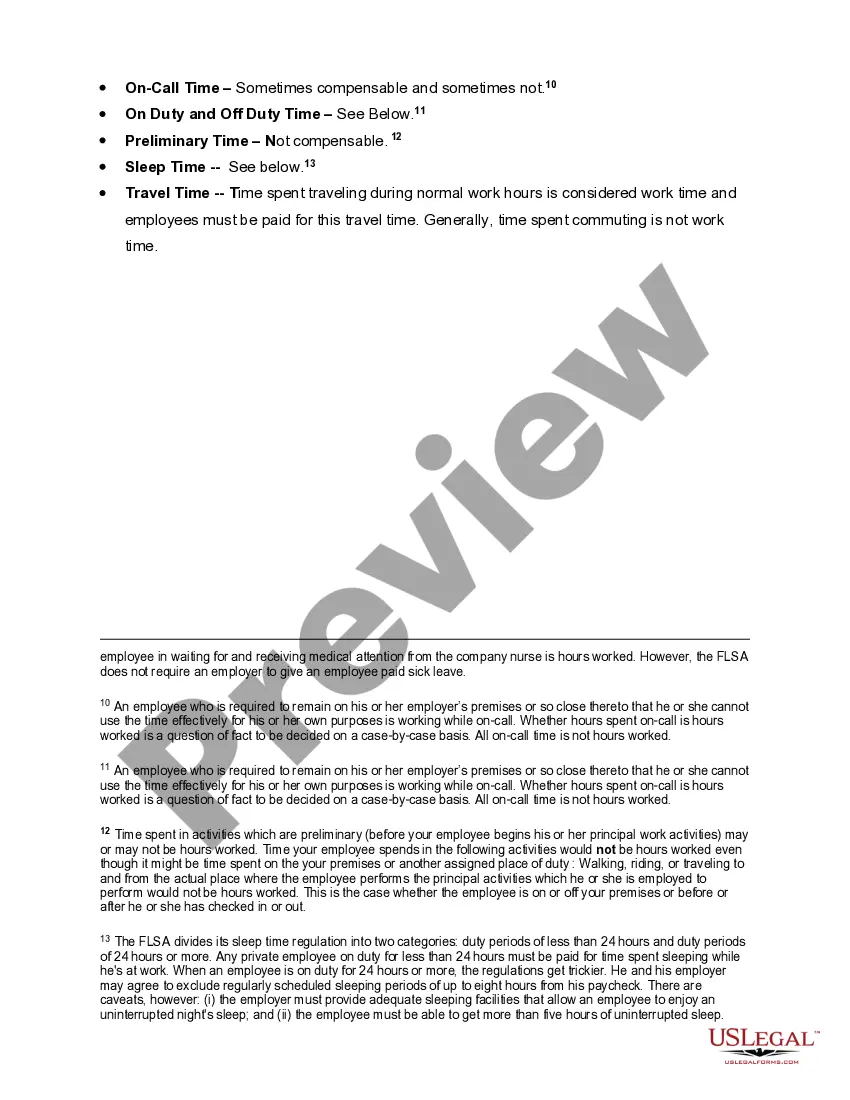

Arizona Compensable Work Chart with Explanation

Description

How to fill out Compensable Work Chart With Explanation?

Are you presently in a situation where you regularly require documents for either organizational or personal activities nearly every day.

Numerous legitimate document templates are available online, but finding ones you can trust isn't easy.

US Legal Forms offers a vast selection of document templates, such as the Arizona Compensable Work Chart with Explanation, designed to fulfill federal and state regulations.

Choose the pricing plan you'd prefer, provide the necessary information to create your account, and pay for the order using PayPal or a credit card.

Select a convenient file format and download your copy.

- If you're already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arizona Compensable Work Chart with Explanation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the template you need and ensure it is for your specific city/state.

- Use the Review button to look over the form.

- Read the description to verify you have selected the correct document.

- If the form isn't what you're looking for, utilize the Search box to find the document that fits your needs.

- Once you've found the right form, click on Purchase now.

Form popularity

FAQ

The 23 1501 law in Arizona concerns workers' compensation and the rights of employees in relation to work-related injuries. This law lays out the responsibilities of employers regarding employee safety and coverage for workplace injuries. For a comprehensive understanding, the Arizona Compensable Work Chart with Explanation can further elaborate on what constitutes compensable work under this law.

The determination of compensable work in Arizona relies on the nature of the work and the employee's classification. Employers should consult the Arizona Compensable Work Chart with Explanation to evaluate whether tasks performed fall under compensable criteria. If you are uncertain, seeking guidance through platforms like uslegalforms can provide clarity and legal support.

Salaried employees in Arizona do not have a set maximum number of work hours weekly, but they are often expected to fulfill their job responsibilities. Depending on their position, employees may be exempt from overtime regulations. To navigate this effectively, consult the Arizona Compensable Work Chart with Explanation for detailed insight into how compensable work is interpreted.

To determine FLSA exempt status, you need to examine the nature of the employee's job duties, salary level, and method of payment. Generally, exempt employees are those in managerial, professional, or administrative roles who meet certain criteria. The Arizona Compensable Work Chart with Explanation can provide clarity on roles and responsibilities to help identify whether an employee is exempt.

Workers' compensation in Arizona provides financial benefits to employees who suffer work-related injuries or illnesses. Employers are required to carry workers' comp insurance to cover medical expenses and lost wages. To fully understand your rights and the process, refer to the Arizona Compensable Work Chart with Explanation for clear guidance on what constitutes compensable work.

Work hours are typically determined by company policies, employee contracts, and applicable labor laws. In Arizona, you can use the Arizona Compensable Work Chart with Explanation to better understand how different types of work hours count towards compensation. It's important to review these resources to ensure proper reporting and compliance.

Not every workers' compensation case in Arizona results in a settlement, as various factors influence each situation. Some claims may go through negotiations, while others could escalate to hearings. Utilizing the Arizona Compensable Work Chart with Explanation can clarify the potential outcomes of your case. Knowing your options and rights can assist you in making informed decisions throughout the process.

Filing a workers' compensation claim in Arizona starts with notifying your employer about your injury. Then, you will need to fill out a claim form and submit it to the insurance company or the Arizona Industrial Commission. The Arizona Compensable Work Chart with Explanation can help you understand the criteria for what constitutes compensable injuries. It is crucial to follow all steps accurately to ensure your claim is properly processed.

Line 29a on Arizona Form 140 refers to specific deductions related to income adjustments when filing your state taxes. Understanding this line is essential to accurately report and utilize your benefits from workers' compensation, particularly as they relate to any compensable work you performed. For help navigating this part of the form and ensuring compliance, consider the Arizona Compensable Work Chart with Explanation. This will assist in understanding how your income and benefits interact with tax obligations in Arizona.

Arizona workers' compensation operates as a no-fault system, meaning that employees can receive benefits regardless of who was at fault for the injury. When you file a claim, you may receive medical benefits, wage loss compensation, and rehabilitation support based on the nature of your injury. The Arizona Compensable Work Chart with Explanation can guide you through this process by clarifying what is compensable and how benefits are determined. Accessing this resource can help you make informed decisions about your claim.