Arizona Checklist - Leasing vs. Purchasing Equipment

Description

Every lease decision is unique so it's important to study the lease agreement carefully. When deciding to obtain equipment, you need to determine whether it is better to lease or purchase the equipment. You might use this checklist to compare the costs for each option.

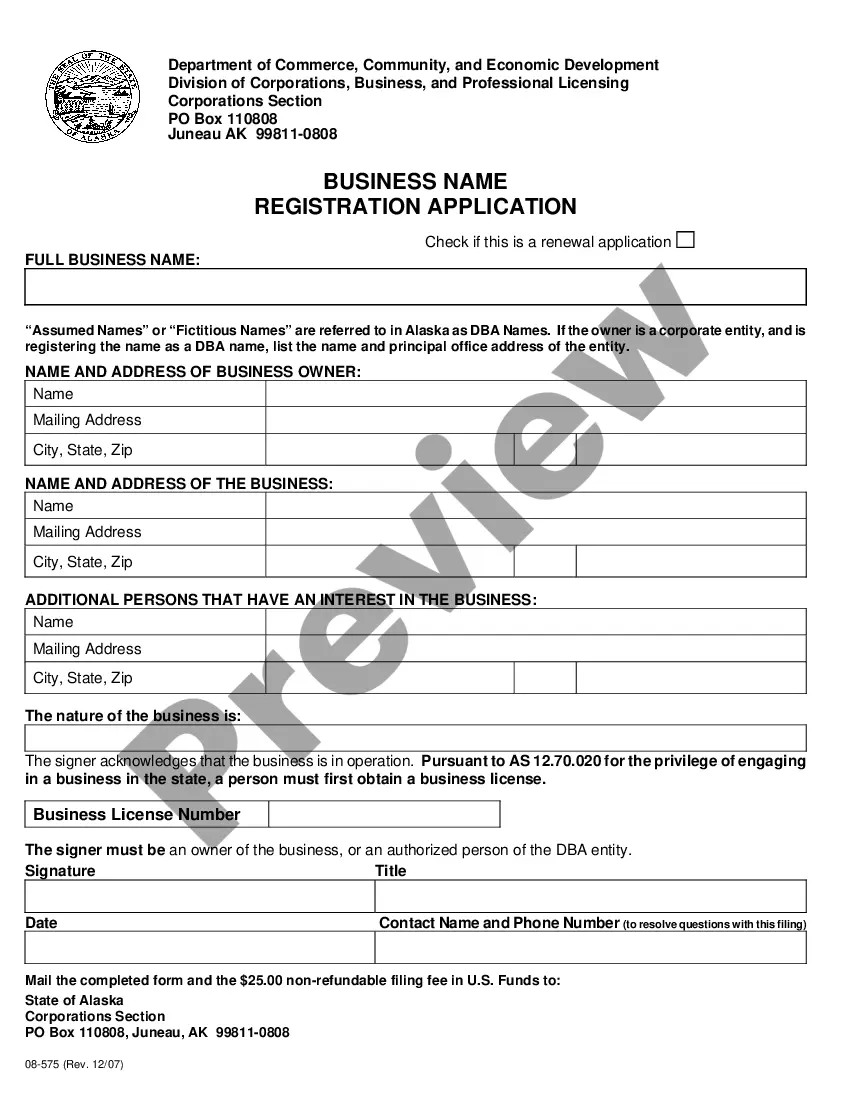

How to fill out Checklist - Leasing Vs. Purchasing Equipment?

You might spend time online searching for the legal documents template that meets the state and national requirements you seek.

US Legal Forms offers a vast array of legal templates that can be reviewed by experts.

It is easy to download or print the Arizona Checklist - Leasing vs. Purchasing Equipment from my service.

If available, use the Preview option to look through the document template simultaneously.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can fill out, modify, print, or sign the Arizona Checklist - Leasing vs. Purchasing Equipment.

- Each legal document template you obtain is yours to keep indefinitely.

- To acquire another copy of a purchased form, visit the My documents section and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your area/city of choice.

- Check the form summary to confirm you have selected the correct document.

Form popularity

FAQ

When considering the Arizona Checklist - Leasing vs. Purchasing Equipment, it's essential to understand the key differences between buying and leasing assets. Buying involves making a significant upfront payment to own the equipment outright, while leasing allows you to use the equipment for a specific period without ownership. Leasing typically requires lower initial costs and offers flexibility, making it ideal for businesses that need to stay current with technology. In contrast, purchasing can be beneficial for long-term usage and provides tax advantages.

The assessment ratio in Arizona is the percentage of the property value that is subject to property tax. For business personal property, the current assessment ratio is typically 20%. This ratio is crucial to consider when you're using the Arizona Checklist - Leasing vs. Purchasing Equipment, as it impacts your overall tax liability.

Yes, Arizona does have a business personal property tax applied to tangible assets owned by businesses. This tax is imposed at the local level and typically reflects the assessed value of the business's equipment. Knowing about this tax will help inform your choices when evaluating the Arizona Checklist - Leasing vs. Purchasing Equipment.

Certain entities, such as non-profit organizations and specific government agencies, may be exempt from paying property taxes in Arizona. Additionally, some agricultural properties may receive exemptions. If you're exploring options using the Arizona Checklist - Leasing vs. Purchasing Equipment, understanding these exemptions can lead to significant savings.

Yes, Arizona does impose personal property tax on vehicles that are used for business purposes. This tax is typically based on the vehicle's value. It's important to include this consideration in your financial planning when making decisions about leasing or purchasing equipment.

In Arizona, personal property tax for a business is assessed on tangible assets such as equipment and furniture. This tax varies based on the value of the property and local rates. Familiarizing yourself with the personal property tax implications is essential when considering the Arizona Checklist - Leasing vs. Purchasing Equipment.

AZ Form 5000 is used to report the Transaction Privilege Tax, while Form 5005 serves as an application for an exemption from the tax. Understanding these forms is key when you deal with taxes in Arizona, especially if you're evaluating the Arizona Checklist - Leasing vs. Purchasing Equipment to optimize your financial decisions.

Yes, subcontractors in Arizona are required to obtain a Transaction Privilege Tax (TPT) license. This license allows them to legally conduct business and ensures proper tax collection on sales or services rendered. If you are considering leasing or purchasing equipment for your subcontracting work, having a TPT license is crucial for compliance.

Leasing equipment provides flexibility and access to the latest technology without the large upfront costs of ownership. Also, leasing often includes maintenance packages that reduce additional expenses and downtime. This arrangement allows you to focus resources on your core business. Utilizing the Arizona Checklist - Leasing vs. Purchasing Equipment can help you weigh these advantages carefully.

Leasing might be more advantageous than buying for tax purposes, especially for dynamic industries. Lease payments are generally tax-deductible, which can lower your taxable income. However, tax benefits can also come from owning through depreciation. It’s wise to consider both strategies using the Arizona Checklist - Leasing vs. Purchasing Equipment to maximize your tax benefits.