Arizona Business Deductions Checklist

Description

How to fill out Business Deductions Checklist?

If you wish to achieve, retrieve, or produce authentic document formats, utilize US Legal Forms, the largest collection of valid forms, accessible online.

Leverage the site's user-friendly and efficient search to find the papers you require.

A variety of templates for corporate and personal purposes are sorted by categories and states, or keywords.

Step 3. If you are unsatisfied with the form, use the Search box at the top of the screen to find alternative versions of the legitimate form design.

Step 4. Once you have found the form you need, select the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Utilize US Legal Forms to obtain the Arizona Business Deductions Checklist with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to get the Arizona Business Deductions Checklist.

- You can also access forms you previously obtained in the My documents tab in your account.

- If this is your first time using US Legal Forms, adhere to the instructions below.

- Step 1. Confirm you have selected the form for the correct city/state.

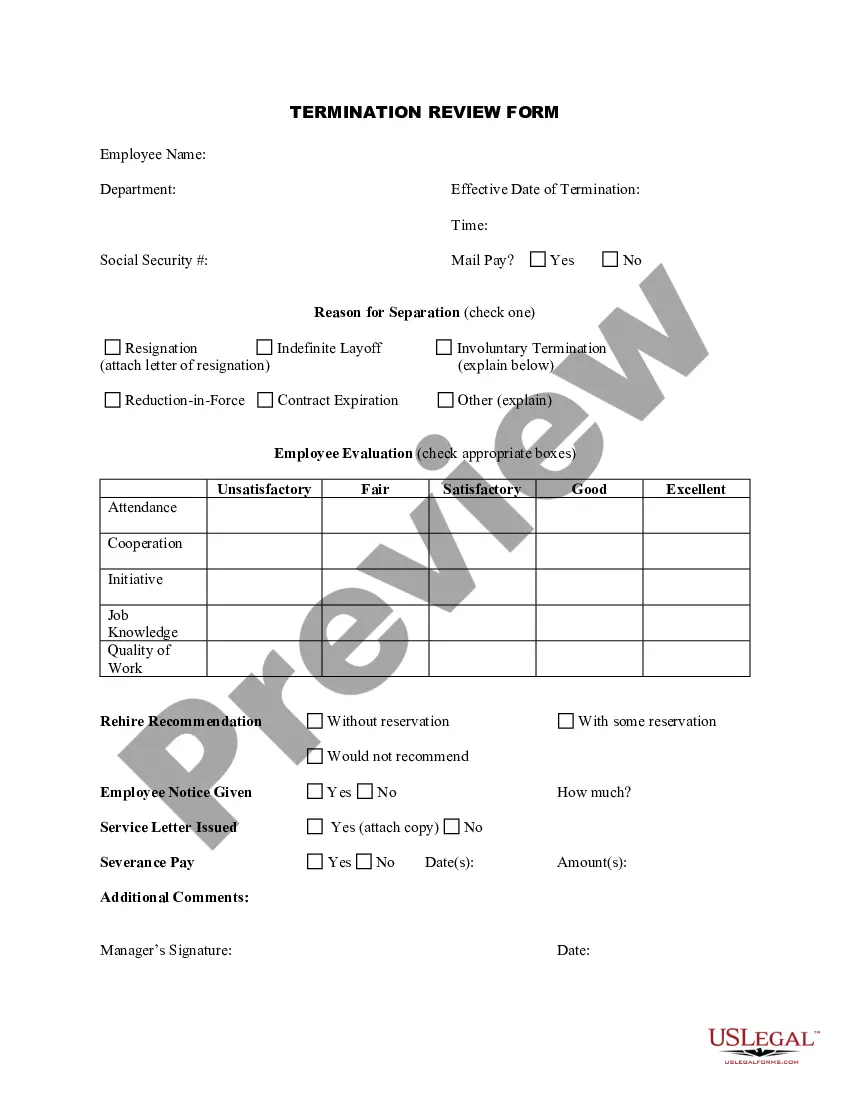

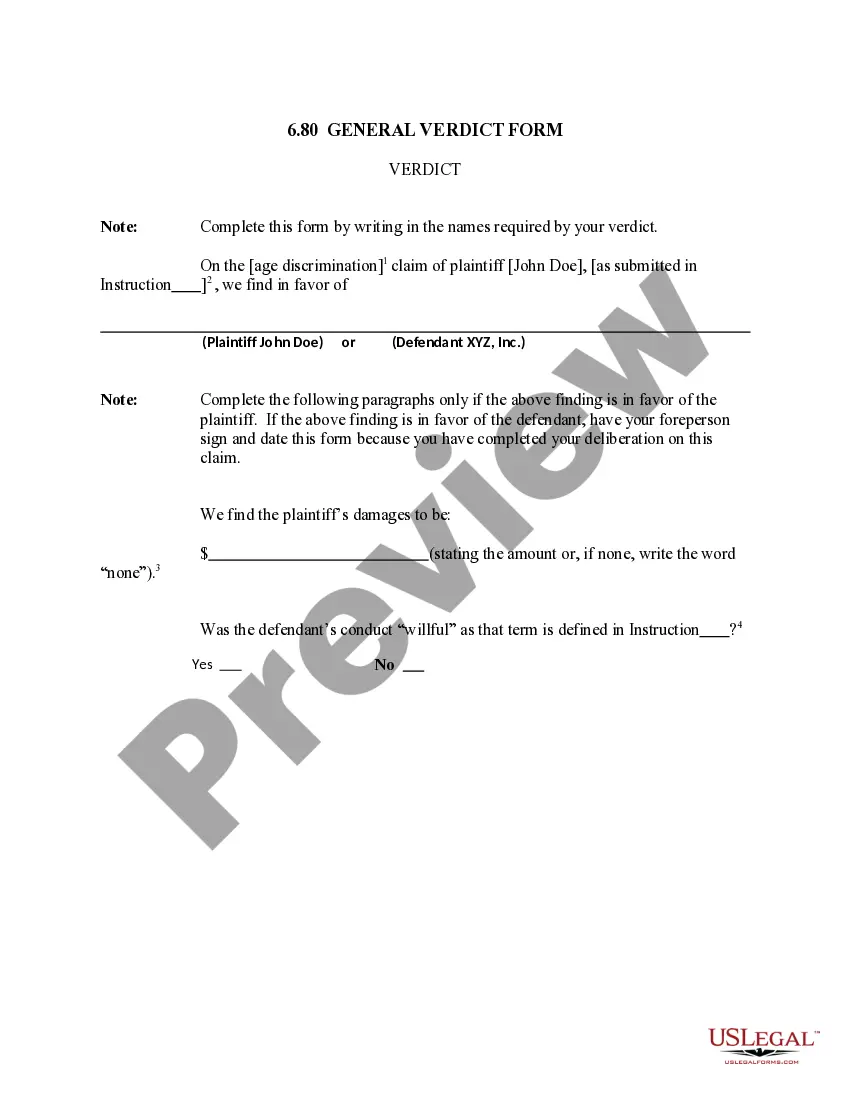

- Step 2. Utilize the Preview feature to examine the content of the form. Make sure to read the summary.

Form popularity

FAQ

To deduct business expenses, the costs must be ordinary and necessary to your business operations. It’s essential to maintain detailed records and receipts, as the IRS requires proof for all deductions. For a comprehensive overview, our Arizona Business Deductions Checklist can guide you through the specific criteria and help you streamline your tax preparation.

Many business owners overlook home office deductions, which can significantly lower your taxable income. If you use a portion of your home exclusively for your business, you may qualify for this deduction. To fully benefit, refer to the Arizona Business Deductions Checklist for detailed requirements and tips on maximizing your deductions.

Businesses such as sole proprietorships, partnerships, and S corporations are generally eligible for the 20% pass-through deduction. However, specific income limits and business types may apply. The Arizona Business Deductions Checklist offers detailed guidance on determining eligibility and maximizing your benefits.

For tax write-offs, you need to provide clear documentation, such as receipts and invoices for all expenses. Keeping well-organized records is essential to support your claims. Refer to the Arizona Business Deductions Checklist to understand specific documentation requirements for each deduction.

Taxpayers with income from qualifying pass-through entities, such as partnerships or S corporations, typically qualify for the 20% pass-through deduction. However, there are income thresholds and limitations based on the type of business. Utilizing the Arizona Business Deductions Checklist can clarify details and ensure you meet all criteria.

Eligible dividends for the 20% qualified business income deduction under section 199A are typically reported in Box 1 of Form 1099-DIV. This income can contribute to your overall deductions listed in the Arizona Business Deductions Checklist. Reviewing your forms carefully ensures you capture every potential deduction.

Qualifying businesses for the Qualified Business Income (QBI) deduction typically include sole proprietorships, partnerships, and S corporations. These entities must meet specific income thresholds and business criteria laid out in the Arizona Business Deductions Checklist. Understanding your business’s eligibility can lead to significant tax savings.

In Arizona, businesses can take advantage of various tax deductions that reduce taxable income. Common deductions include those for operating expenses, depreciation, and certain employee-related costs. For a complete overview, refer to the Arizona Business Deductions Checklist to ensure you maximize your deductions.

To obtain a business deduction, you need to keep thorough records of all eligible expenses. Start by categorizing your expenses according to the guidelines in the Arizona Business Deductions Checklist. Submitting the appropriate forms when filing your taxes will help you claim these deductions accurately.

Certain businesses, such as C corporations, do not qualify for the pass-through deduction. Generally, business types like specified service trades or businesses, which include health, law, and consulting services, may face limitations on this deduction. To ensure your business is eligible, refer to the Arizona Business Deductions Checklist for detailed insights.