Arizona Aging of Accounts Receivable

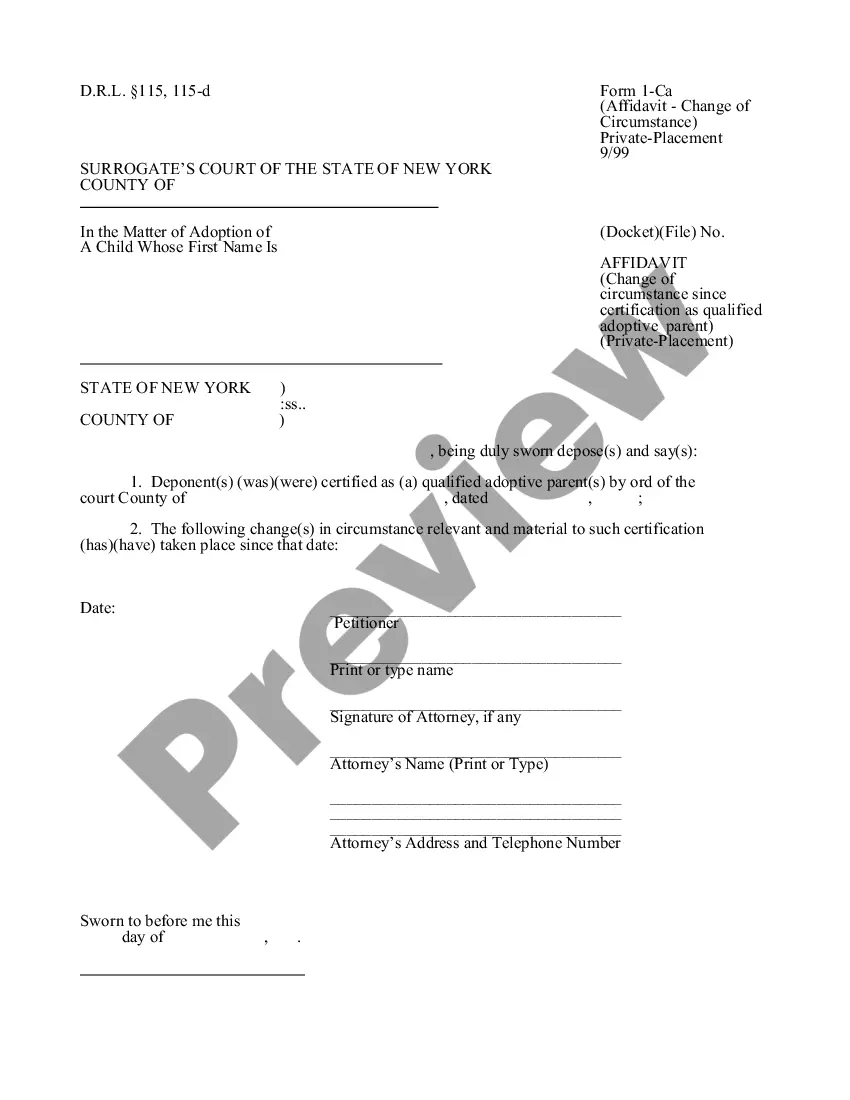

Description

How to fill out Aging Of Accounts Receivable?

Selecting the ideal legitimate document template can be quite a challenge.

Certainly, there is a plethora of templates accessible online, but how can you find the authentic one that you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple steps that you should follow: First, ensure you have selected the correct form for your city/region. You can browse the form using the Review button and read the form description to confirm this is the right one for you.

- The service offers an extensive collection of templates, including the Arizona Aging of Accounts Receivable, which can be utilized for both business and personal purposes.

- Each of the forms is verified by experts and meets state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the Arizona Aging of Accounts Receivable.

- Use your account to access the legitimate forms you have previously ordered.

- Navigate to the My documents tab in your account and obtain an additional copy of the document you need.

Form popularity

FAQ

Benchmarks for accounts receivable aging offer guidelines on what is considered normal or healthy for a business. Typically, a high percentage of receivables should be current, with minimal amounts in the 60-day and beyond categories. Monitoring these benchmarks helps businesses in Arizona assess their credit policies and collection efforts. Using a platform like US Legal Forms can enhance your tracking and reporting for accounts receivable aging.

The aging period of accounts receivable refers to the timeframe that invoices remain unpaid. It typically starts when an invoice is issued and lasts until payment is received. Commonly, this period is divided into intervals such as 30, 60, 90 days, and beyond. Understanding the aging period is crucial for Arizona businesses, as it impacts their liquidity and operational decisions.

The Ageing of accounts receivable method is a financial approach used to assess the time it takes for a business to collect payments from customers. It breaks down receivables into categories that reflect how long they have been outstanding, giving you clear insights into your debt recovery efficiency. This method is vital for businesses operating in Arizona, as it helps them manage their finances more effectively and remain competitive.

To calculate the aging of accounts receivable, first, categorize your outstanding invoices by the length of time they have been due. Typically, businesses group these into intervals such as 0-30 days, 31-60 days, 61-90 days, and over 90 days. Then, you sum the total amounts for each category to determine the overall health of your receivables. Utilizing a structured approach like this can help you understand the Arizona Aging of Accounts Receivable better.

Yes, if you earned income within Arizona while being a non-resident, you are generally required to file an Arizona non-resident tax return. This ensures that you meet your tax obligations and comply with state laws. Understanding your filing requirements can help you manage your financial responsibilities, particularly concerning your Arizona Aging of Accounts Receivable.

Arizona form A1 QRT is a quarterly withholding tax return required for employers to report income withheld from employee wages. This form ensures that the correct amount of state income tax is submitted to the Arizona Department of Revenue. Proper filing plays a crucial role in compliance and can directly impact your business's management of Arizona Aging of Accounts Receivable.

To mail form A1R, send it to the Arizona Department of Revenue at the designated address listed on the form itself. Verify that all information is complete and accurate before sending it. This careful approach aids in timely processing and contributes to effective management of your Arizona Aging of Accounts Receivable and tax responsibilities.

Mail your Arizona quarterly withholding tax return to the Arizona Department of Revenue at the address specified on the return form. Confirm that your mailing address is accurate to avoid issues and delays in processing. Timely submission helps ensure you stay compliant and can keep your Arizona Aging of Accounts Receivable in check, avoiding potential penalties.

You can file the Arizona form A1 QRT through the Arizona Department of Revenue's online services. Alternatively, you can submit it by mail to the appropriate address provided on the form. Ensure you follow the submission guidelines to avoid delays. Managing your Arizona Aging of Accounts Receivable effectively can simplify this process.

To record aging accounts receivable, you begin by categorizing your outstanding invoices based on the length of time they have been unpaid. This classification often includes periods such as 0-30 days, 31-60 days, and 61 days or more. Proper tracking helps you identify overdue accounts early, enhancing your efforts in collection. By maintaining accurate records, you can efficiently manage your Arizona Aging of Accounts Receivable.