Arizona Assignment and Transfer of Stock

Description

How to fill out Assignment And Transfer Of Stock?

If you need to obtain, acquire, or produce legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the website's user-friendly and convenient search feature to find the documents you require. Various templates for business and personal purposes are classified by categories and states, or keywords.

Utilize US Legal Forms to access the Arizona Assignment and Transfer of Stock with just a few clicks.

Every legal document template you download is yours permanently. You will have access to all forms you downloaded in your account.

Select the My documents section and choose a form to print or download again. Stay competitive and obtain and print the Arizona Assignment and Transfer of Stock with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are a current US Legal Forms user, Log In to your account and select the Get option to locate the Arizona Assignment and Transfer of Stock.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

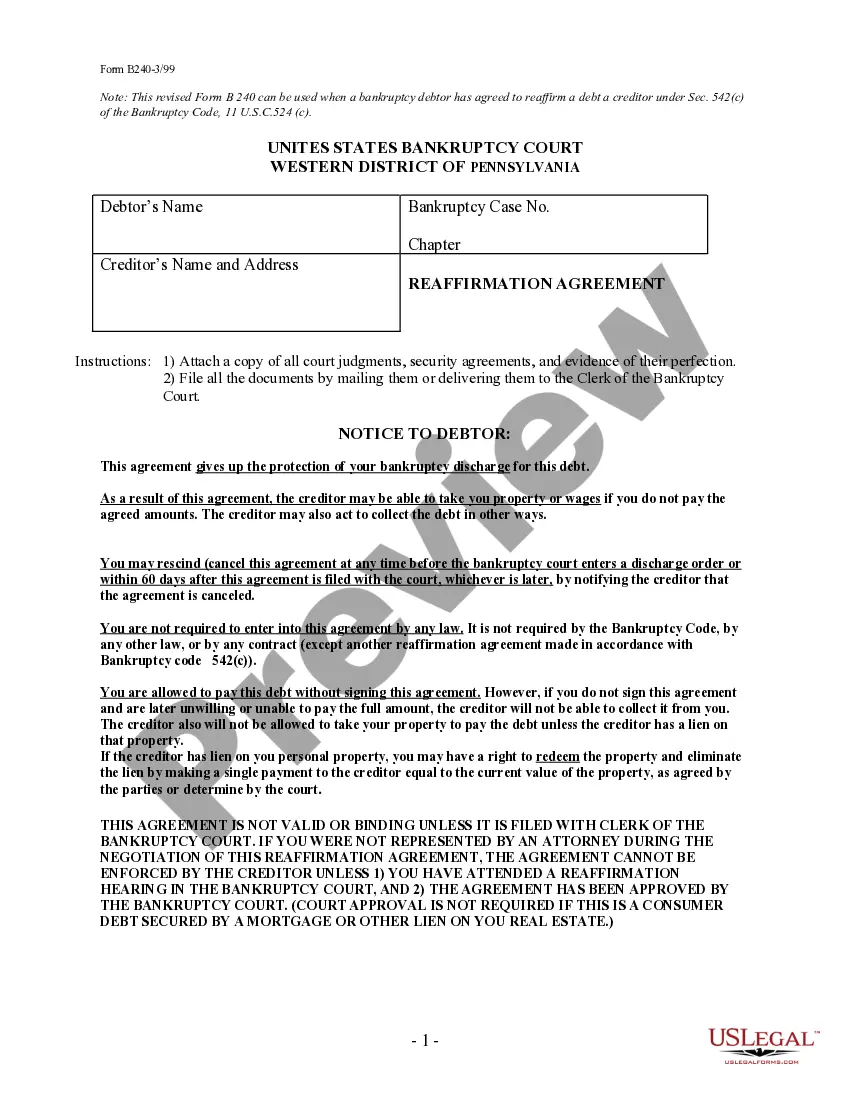

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative forms of your legal document template.

- Step 4. Once you have discovered the form you need, click the Get Now button. Choose your preferred pricing plan and enter your credentials to register for the account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Arizona Assignment and Transfer of Stock.

Form popularity

FAQ

An assignee generally receives the right to enforce the terms specified in the assignment agreement. This means they can expect to benefit from the rights and interests originally held by the assignor. In the context of the Arizona Assignment and Transfer of Stock, recognizing these rights ensures that parties understand their entitlements during stock transactions.

An example of an assignment in law would be when a creditor assigns their right to payment under a contract to another party. In the realm of stocks, this can relate to the assignment of rights to dividends or voting. Understanding such examples is beneficial when navigating the complexities of the Arizona Assignment and Transfer of Stock process.

An assignment does not necessarily equate to a transfer of ownership. Instead, it often involves transferring certain rights or interests associated with the ownership. To fully comprehend this distinction, especially in the context of Arizona Assignment and Transfer of Stock, reviewing the specific terms of the assignment is essential.

A Deed of assignment is a legal document that formalizes the assignment of rights, while a transfer document specifically signifies the change of ownership in stocks. Each serves a unique purpose in transactions, particularly during the Arizona Assignment and Transfer of Stock process. It is beneficial to consult with legal experts or tools like uslegalforms to ensure you have the correct documentation.

The main difference between assignment and transfer of shares lies in their legal implications. An assignment involves granting rights to receive the benefits of shares, while a transfer signifies the actual change of ownership. This distinction is significant when dealing with the Arizona Assignment and Transfer of Stock, as understanding each process can impact your legal rights.

The form needed for the transfer of stock ownership typically includes a stock transfer agreement or a stock assignment form. This document outlines the new owner's information and details about the stock being transferred. In Arizona, utilizing a well-structured form from platforms like uslegalforms ensures compliance with all local regulations related to the Arizona Assignment and Transfer of Stock.

An assignment in itself does not always transfer ownership. Instead, an assignment often conveys the rights to receive benefits associated with ownership, rather than the ownership itself. Therefore, in the case of Arizona Assignment and Transfer of Stock, it is crucial to examine the specific terms used in the assignment to determine ownership transfer.

An assignment and a transfer are closely related, yet they are not identical. In the context of Arizona Assignment and Transfer of Stock, an assignment refers to the act of passing rights from one party to another, while a transfer typically involves a more formal process of changing ownership. Understanding these nuances helps ensure clarity in legal transactions, particularly for stock ownership.

In Arizona, a certificate of good standing typically remains valid until the issuing authority revokes it or you neglect to meet ongoing compliance requirements. It is wise to check the specific expiration date printed on the certificate, as this varies depending on your business status. Keep this in mind during transactions involving Arizona Assignment and Transfer of Stock, as you may need an updated certificate for each significant deal.

If you cannot obtain a certificate of good standing, you may consider obtaining a certificate of existence or a similar document that signifies your business's legal compliance. This alternative may fulfill some requirements but check if it meets the necessary criteria for processes related to Arizona Assignment and Transfer of Stock. Always verify with relevant authorities to ensure compliance.