This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arizona Assignment of Judgment to Attorney for Collection

Description

How to fill out Assignment Of Judgment To Attorney For Collection?

It is possible to commit time on-line searching for the lawful file web template that suits the federal and state specifications you want. US Legal Forms supplies 1000s of lawful types which are evaluated by experts. You can actually obtain or produce the Arizona Assignment of Judgment to Attorney for Collection from the support.

If you already possess a US Legal Forms accounts, you are able to log in and click on the Down load option. Next, you are able to complete, change, produce, or indication the Arizona Assignment of Judgment to Attorney for Collection. Each and every lawful file web template you purchase is your own property eternally. To have one more copy associated with a purchased form, proceed to the My Forms tab and click on the related option.

If you are using the US Legal Forms internet site the first time, adhere to the simple guidelines beneath:

- First, be sure that you have selected the proper file web template to the region/metropolis that you pick. See the form explanation to make sure you have chosen the proper form. If readily available, take advantage of the Preview option to search throughout the file web template as well.

- In order to get one more edition from the form, take advantage of the Research field to discover the web template that meets your requirements and specifications.

- After you have identified the web template you would like, simply click Acquire now to continue.

- Select the costs plan you would like, type in your references, and register for a free account on US Legal Forms.

- Total the transaction. You can use your credit card or PayPal accounts to cover the lawful form.

- Select the structure from the file and obtain it to your product.

- Make adjustments to your file if required. It is possible to complete, change and indication and produce Arizona Assignment of Judgment to Attorney for Collection.

Down load and produce 1000s of file web templates utilizing the US Legal Forms site, that provides the most important collection of lawful types. Use expert and condition-certain web templates to take on your company or personal needs.

Form popularity

FAQ

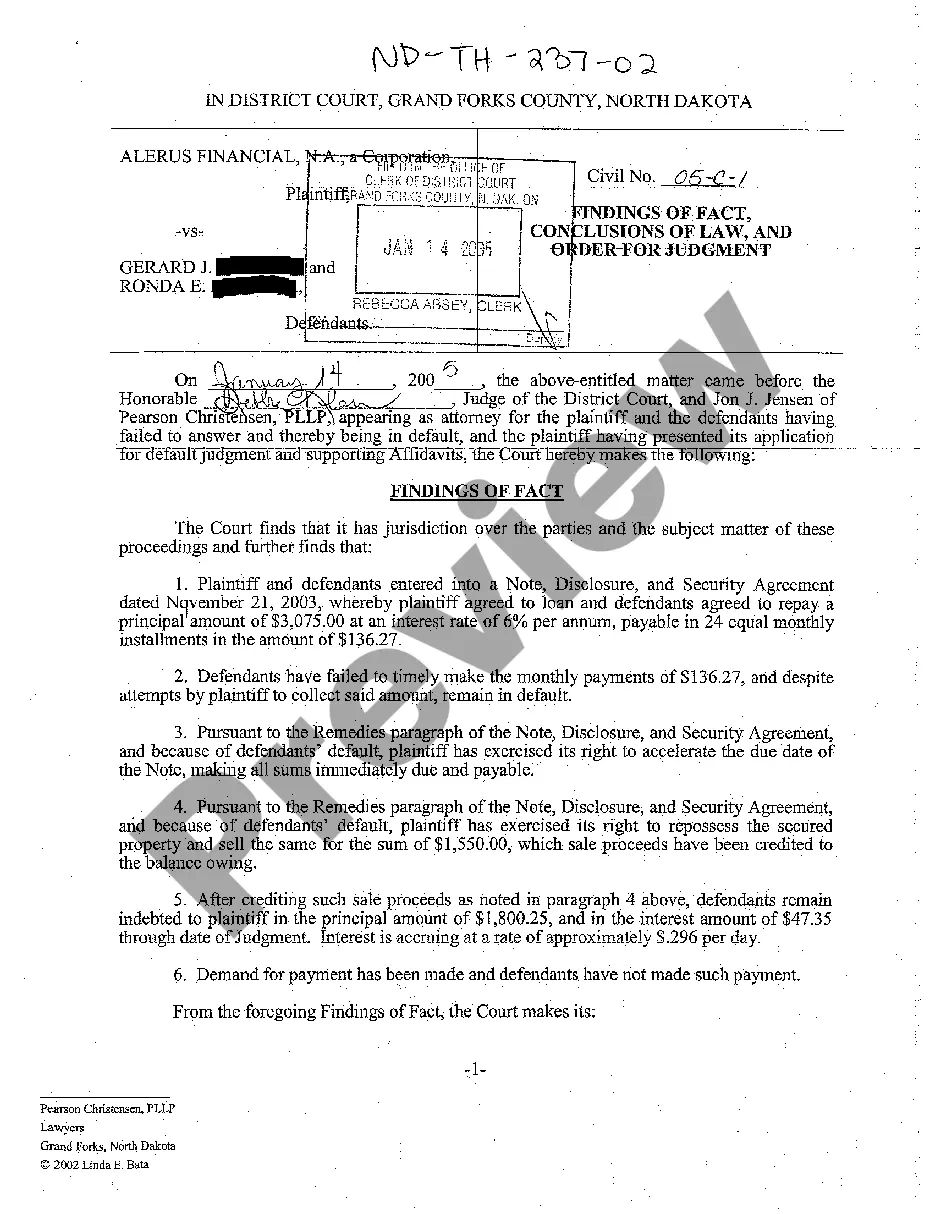

A party who rejects an offer, but does not obtain a more favorable judgment, must pay as a sanction twenty percent of the difference between the amount of the offer and the amount of the final judgment.

If a judgment is entered against you, a debt collector will have stronger tools, like garnishment, to collect the debt. A judgment is an official result of a lawsuit in court. In debt collection lawsuits, the judge may award the creditor or debt collector a judgment against you.

Once a debt buyer is armed with a default judgment they then have the power to garnish your wages or levy your bank account.

In Arizona, a judgment is initially effective for ten years after the date of its entry, and execution must be accomplished within that period. A.R.S. § 12-1551(B).

If they do not pay, at your request the court may provide you with forms you may file to try to collect. If the other party does not make full payment, you may file a request to have the writ issued. If these writs are not effective in collecting the judgment, obtaining the services of an attorney may be helpful.

All judgments must be in writing, and the court must mail copies to all parties. The judgment must clearly state the determination of the rights of the parties. The judgment is due and payable immediately after the judgment is rendered by the justice of the peace or a hearing officer in small claims court.

In Arizona, a judgment is initially effective for ten years after the date of its entry, and execution must be accomplished within that period.

Collection Methods There are 2 primary methods to collect a debt: Writ of Garnishment or Writ of Execution. Writ of Garnishment is often referred to as garnishing a debtor's wages. A written notice is served to both the debtor and the debtor's employer or financial institution.