Arizona Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

If you wish to full, down load, or print authorized document themes, use US Legal Forms, the largest selection of authorized varieties, which can be found online. Make use of the site`s simple and hassle-free look for to discover the papers you require. Various themes for enterprise and person purposes are sorted by types and claims, or key phrases. Use US Legal Forms to discover the Arizona Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust in just a handful of click throughs.

When you are already a US Legal Forms consumer, log in to your account and click on the Obtain button to obtain the Arizona Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust. You can also gain access to varieties you in the past acquired in the My Forms tab of the account.

If you work with US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the form for the right metropolis/nation.

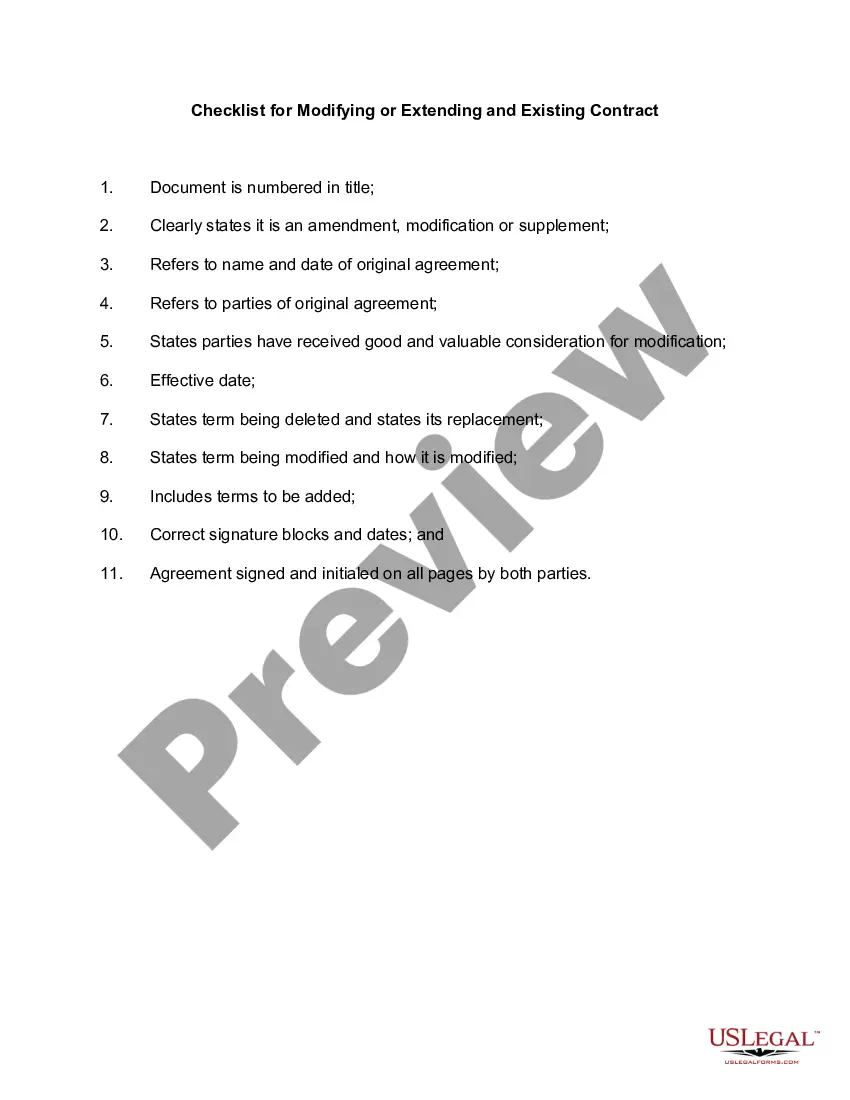

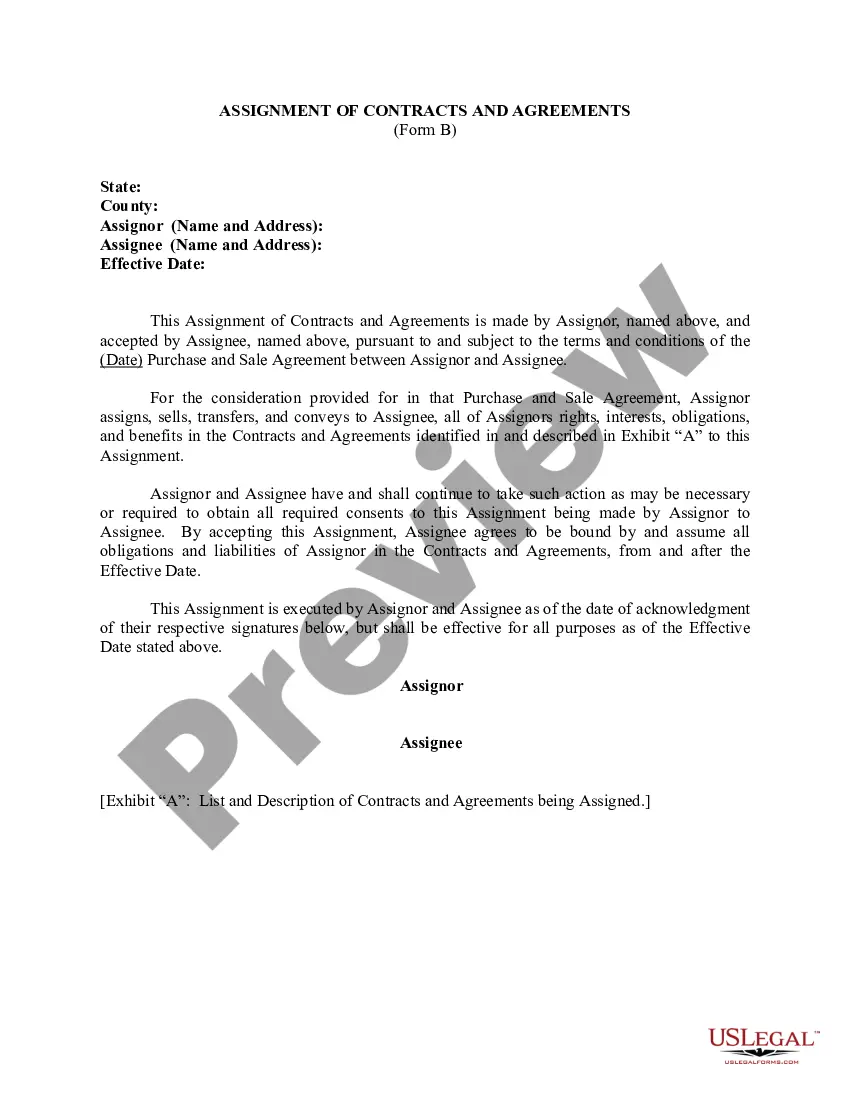

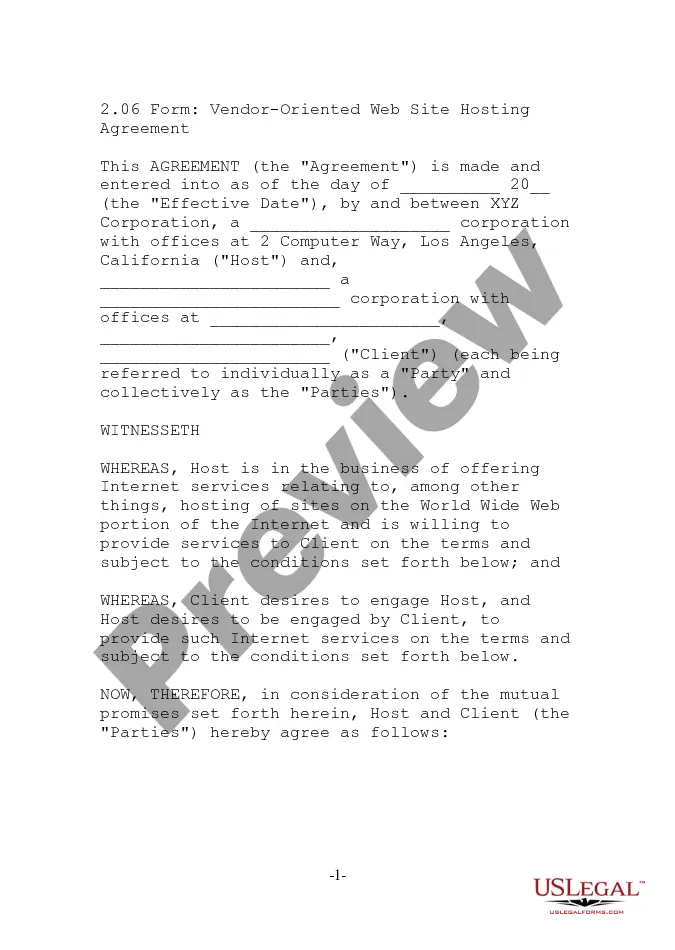

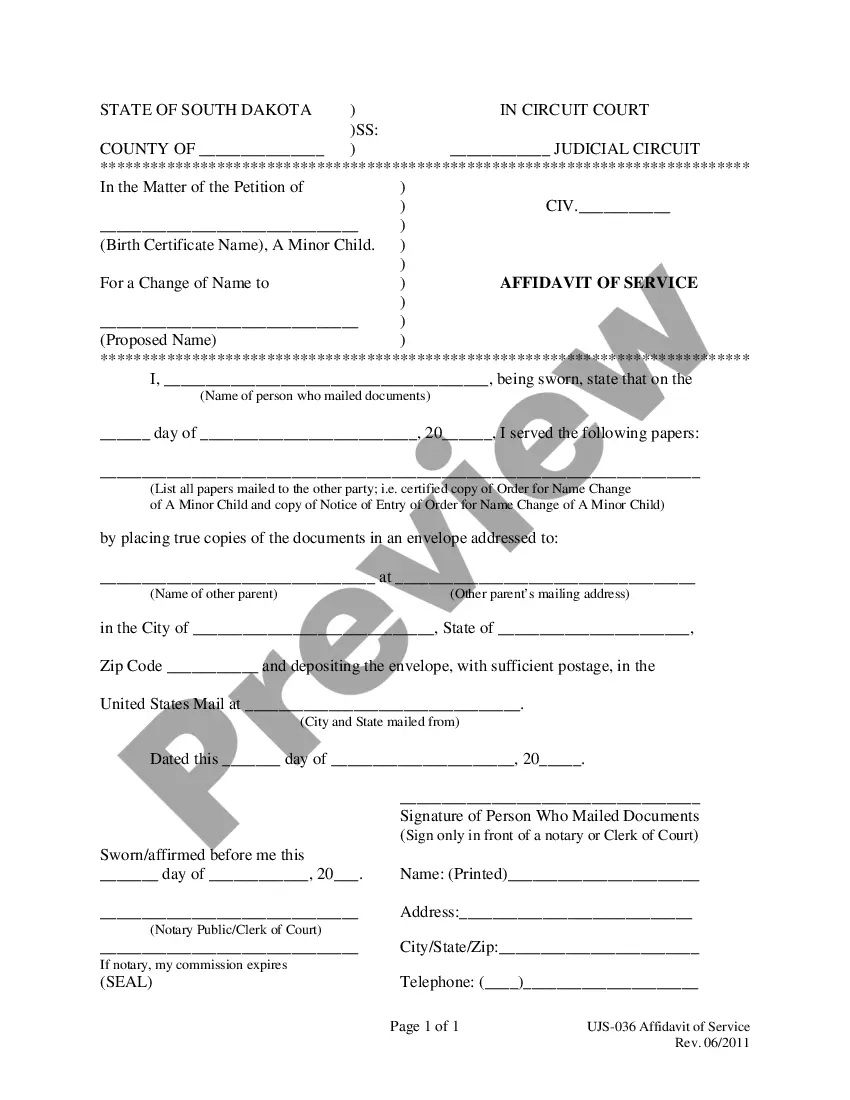

- Step 2. Utilize the Preview solution to look through the form`s information. Do not forget to learn the information.

- Step 3. When you are unsatisfied together with the type, make use of the Look for discipline towards the top of the display screen to discover other models of your authorized type format.

- Step 4. Once you have identified the form you require, click the Acquire now button. Opt for the rates program you choose and add your references to register for an account.

- Step 5. Approach the deal. You should use your bank card or PayPal account to perform the deal.

- Step 6. Find the structure of your authorized type and down load it on your own gadget.

- Step 7. Total, revise and print or indicator the Arizona Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust.

Every authorized document format you buy is yours eternally. You possess acces to every single type you acquired with your acccount. Select the My Forms section and decide on a type to print or down load again.

Remain competitive and down load, and print the Arizona Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust with US Legal Forms. There are many specialist and condition-distinct varieties you may use for the enterprise or person requirements.

Form popularity

FAQ

A beneficiary can disclaim all or a portion of anything they are earmarked to receive.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

Disclaiming is the legal term for declining an inheritance. It's the process of refusing the physical or monetary assets you were set to receive as the named beneficiary of a will or trust inheritance. You also can decline funds held within a 401(k) retirement account, as well as the payout of a life insurance policy.

If you pass on and have children but no spouse, your children will inherit everything. If you have a spouse but no descendants, your spouse will receive your assets. For those who are married and have descendants with their spouse, the spouse will inherit everything.

Will disputes. The will is dated and does not reflect the decedent's wishes; Circumstances have changed since the will was made (i.e. a remarriage or the birth of a child); The decedent expressed different wishes verbally prior to death; The decedent leaves property to someone other than their spouse;

Often times inheritance disputes occur when there is a misunderstanding between siblings over what their parent intended to distribute to them upon their death. To preempt this, it is best to hire an Estate Planning lawyer who can sit down with your parent to discuss how they wish to distribute their estate.

A disclaimer is when the recipient (called the ?donee?) refuses a bequest, for example, the donee refuses an inheritance left in a will or trust, refuses the proceeds from an account labeled as pay-on-death account when the original owner dies, or refuses the surviving interest in jointly owned property when one joint ...

Trusts can be used in estate planning to give individuals and couples greater control over how assets are transferred to heirs with the fewest tax consequences. Sometimes, however, disclaiming assets makes the most sense. No special form or document must be completed to disclaim inherited assets.