Arizona Triple Net Lease for Sale

Description

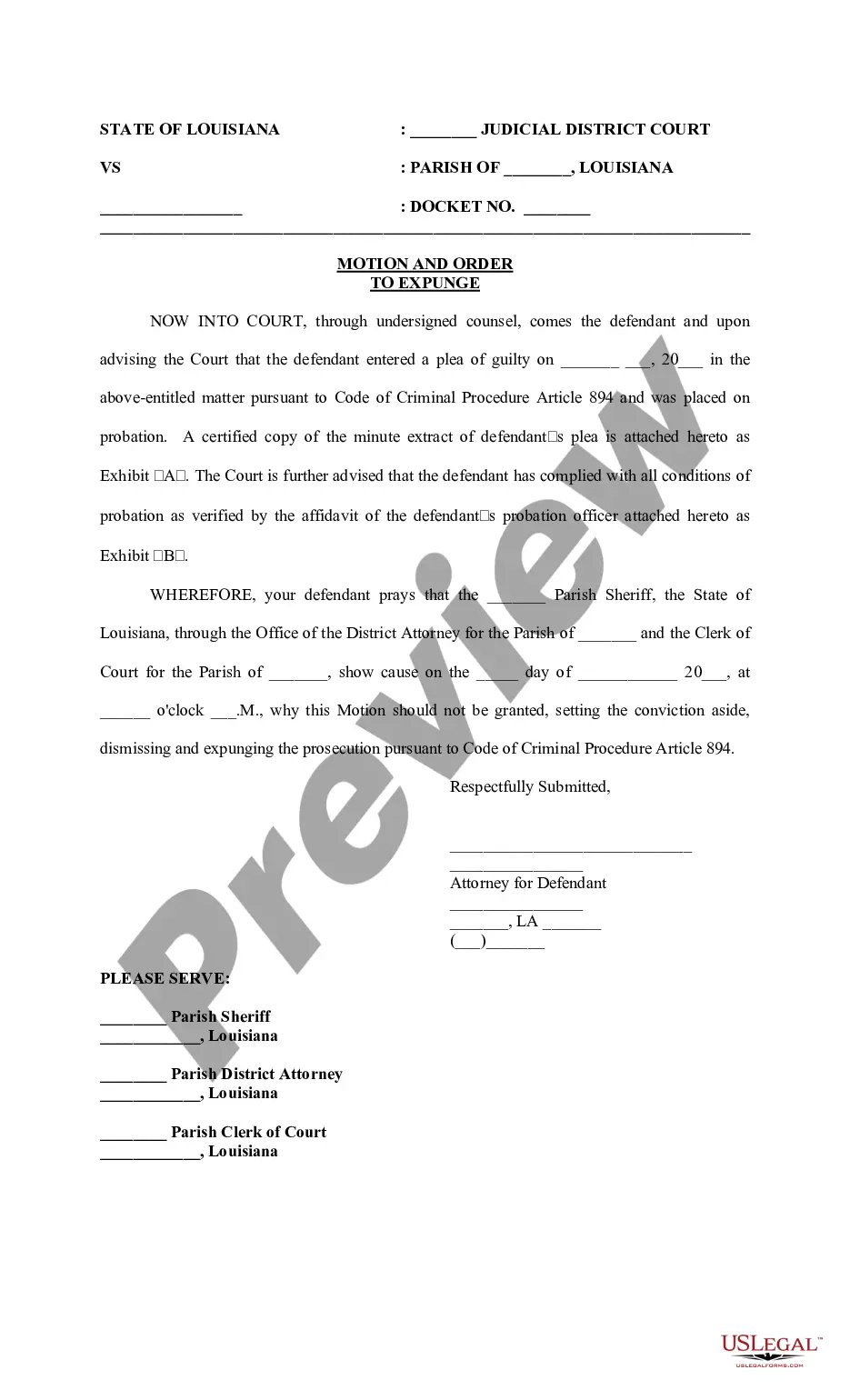

How to fill out Triple Net Lease For Sale?

You can spend hours online trying to locate the authentic document template that satisfies the state and federal regulations you need.

US Legal Forms offers countless legitimate forms that are reviewed by experts.

You can easily download or print the Arizona Triple Net Lease for Sale from our resources.

If available, utilize the Preview option to review the document template at the same time.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Arizona Triple Net Lease for Sale.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click the corresponding option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, make sure you have selected the correct document template for your state/city of choice.

- Read the form description to ensure you have selected the appropriate form.

Form popularity

FAQ

Tenants often choose a triple net lease because it offers them more control over operational costs. With a lease of this type, tenants are responsible for property taxes, insurance, and maintenance, allowing them to manage expenses directly. This arrangement can lead to lower base rent, giving tenants the opportunity for long-term savings. Furthermore, the Arizona Triple Net Lease for Sale options provide varied properties that cater to different business needs, enhancing flexibility and investment potential.

Getting approved for a triple net lease often requires demonstrating your financial stability and business track record. Landlords will typically review your credit history, income, and sometimes even your previous lease agreements. By showing you understand the responsibilities involved, such as property taxes and maintenance costs, you enhance your chances of approval. Utilizing tools from US Legal Forms can help streamline the application process and provide clarity on lease terms.

To secure a triple net lease, you typically start by identifying a suitable property in the Arizona Triple Net Lease for Sale market. This involves researching available listings, analyzing the financials of the property, and understanding your investment goals. Once you find a property that meets your criteria, you move forward with negotiations and drafting the lease agreement. It's wise to consult with real estate professionals or platforms like US Legal Forms to ensure a smooth transaction.

Valuing a triple net lease involves assessing the property's net operating income and the current market conditions. Investors often use a capitalization rate to estimate the value based on the expected return on investment. By analyzing comparable properties and their lease terms, you can derive a fair market value. If you're looking to invest, explore the Arizona Triple Net Leases for Sale to find options that align with your valuation strategy.

Structuring an NNN lease involves clearly defining the financial obligations of both parties in the lease agreement. Both the landlord and tenant should outline the specific responsibilities for taxes, insurance, and maintenance upfront. Open communication ensures that expectations are set, and both parties understand their roles. For a successful transaction, examine available Arizona Triple Net Leases for Sale that meet your criteria.

A triple net lease typically includes the tenant's responsibility for property taxes, insurance, and maintenance costs. These expenses reduce the financial burden on the landlord while ensuring that the property remains well-maintained. Additionally, you might find stipulations concerning repairs and improvements included in the lease. If you're interested, there are many Arizona Triple Net Leases for Sale that offer these comprehensive terms.

To structure a triple net lease, both the landlord and tenant agree on terms that outline the shared responsibilities. In this agreement, the tenant typically covers property taxes, insurance, and maintenance costs, in addition to monthly rent. This type of lease reduces operational risks for the landlord and offers a clear financial picture for the tenant. If you're exploring options, consider an Arizona Triple Net Lease for Sale that fits your investment goals.

When reporting an Arizona triple net lease for sale on your tax return, you typically need to report rental income on Schedule E. Any property-related expenses, such as mortgage interest, property tax, and maintenance costs, can often be deducted, which may reduce your taxable income. It's advisable to work with a tax advisor to ensure you comply with all regulations and maximize your deductions.

One potential downside of an Arizona triple net lease for sale is that it places the financial burden of property management on the tenant. This could result in higher operating costs for tenants, especially if unexpected maintenance issues arise. Investors should carefully evaluate the tenant's financial stability and operational capabilities before committing to this lease structure.

In the context of an Arizona triple net lease for sale, taxes typically fall on the tenant who is responsible for property taxes, insurance, and maintenance. This structure often provides landlords with a more predictable income stream. It's essential for investors to consult a tax professional to understand specific tax implications related to their situation and ensure compliance with local laws.