Arizona Owner Financing Contract for Car

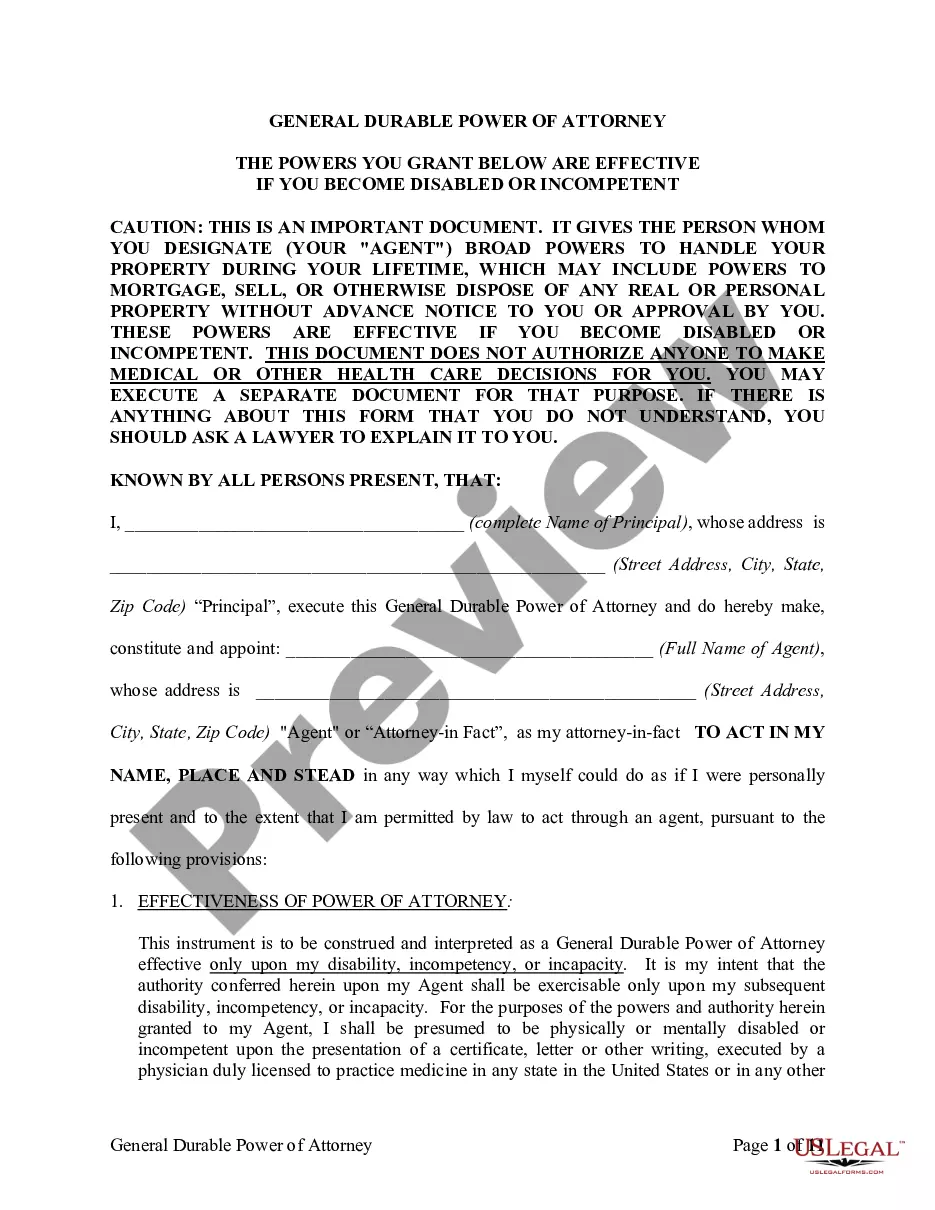

Description

How to fill out Owner Financing Contract For Car?

You have the ability to spend multiple hours online searching for the legal document template that complies with the federal and state requirements you require.

US Legal Forms offers a vast array of legal templates that have been reviewed by professionals.

You can conveniently download or print the Arizona Owner Financing Agreement for Vehicle from the service.

To find an alternative version of the document, utilize the Search field to discover the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you can sign in and then click the Download button.

- Subsequently, you can fill out, edit, print, or sign the Arizona Owner Financing Agreement for Vehicle.

- Every legal document template you purchase is permanently yours.

- To obtain an additional copy of a purchased document, navigate to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/town of your choice.

- Check the document details to confirm you have chosen the right template.

Form popularity

FAQ

Closing costs for owner financing can range from a few hundred to several thousand dollars, depending on the terms agreed upon by the buyer and seller. These costs may include title fees, document preparation fees, and any applicable taxes. It's wise to budget for these expenses when drafting your Arizona Owner Financing Contract for Car.

When reporting owner financing on your taxes, you need to consider the interest income you receive as well as any gains from the sale of the car. The seller must report this income annually using Form 1099 if applicable. Consulting a tax professional can help you accurately report details from your Arizona Owner Financing Contract for Car.

Setting up owner financing involves several steps, starting with discussing payment terms with the buyer. After agreeing on the details, both parties should document the agreement in writing to ensure clarity. Resources like USLegalForms can aid in completing the Arizona Owner Financing Contract for Car in a professional manner.

Typical terms for an owner financing contract can vary widely, but they often include a down payment of 10% to 20%, an interest rate ranging from 5% to 10%, and a repayment term of 3 to 5 years. These terms can be customized, allowing the seller to create a plan that works best for their financial situation. Consider drafting an Arizona Owner Financing Contract for Car that reflects these terms.

The seller of the car primarily establishes the criteria for owner financing. This includes deciding on payment terms, interest rates, and any specific qualifications for the buyer. As a seller, you have the flexibility to set criteria that align with your financial goals for an Arizona Owner Financing Contract for Car.

Typically, the seller of the car sets up owner financing in an Arizona Owner Financing Contract for Car. This process involves negotiating terms directly with the buyer, including interest rates and payment schedules. As a seller, you can create a custom agreement that fits your needs while offering the buyer an alternate financing option.

To secure your own financing for a car, start by reviewing your budget and determining how much you can afford. Next, you can explore options such as banks, credit unions, or even owner financing. When considering owner financing, finding an Arizona Owner Financing Contract for Car is crucial, as it helps to formalize the agreement and protect both you and the seller. Look for reputable tools like US Legal Forms to efficiently create this contract.

To owner finance a vehicle, you must first agree on the terms with the seller. Both parties should draft an Arizona Owner Financing Contract for Car, outlining the payment schedule, interest rate, and other essential details. This contract protects each party's interests and ensures clarity throughout the financing period. Using reliable templates on platforms like US Legal Forms can simplify this process.

Good terms for seller financing often include a reasonable interest rate, manageable monthly payments, and a timeframe that works for both buyer and seller. Being clear on these terms helps prevent misunderstandings later on. When drafting an Arizona Owner Financing Contract for Car, ensure that all parties fully understand their obligations and rights, as this clarity fosters a successful transaction.

Owner financing can offer several advantages, including the potential for lower closing costs and flexible payment terms. It can also be a viable option for buyers with less-than-perfect credit. However, it is important to thoroughly understand the Arizona Owner Financing Contract for Car and the responsibilities involved before proceeding, as this will help ensure a smooth transaction.