Arizona Computer Software Lease with License Agreement

Description

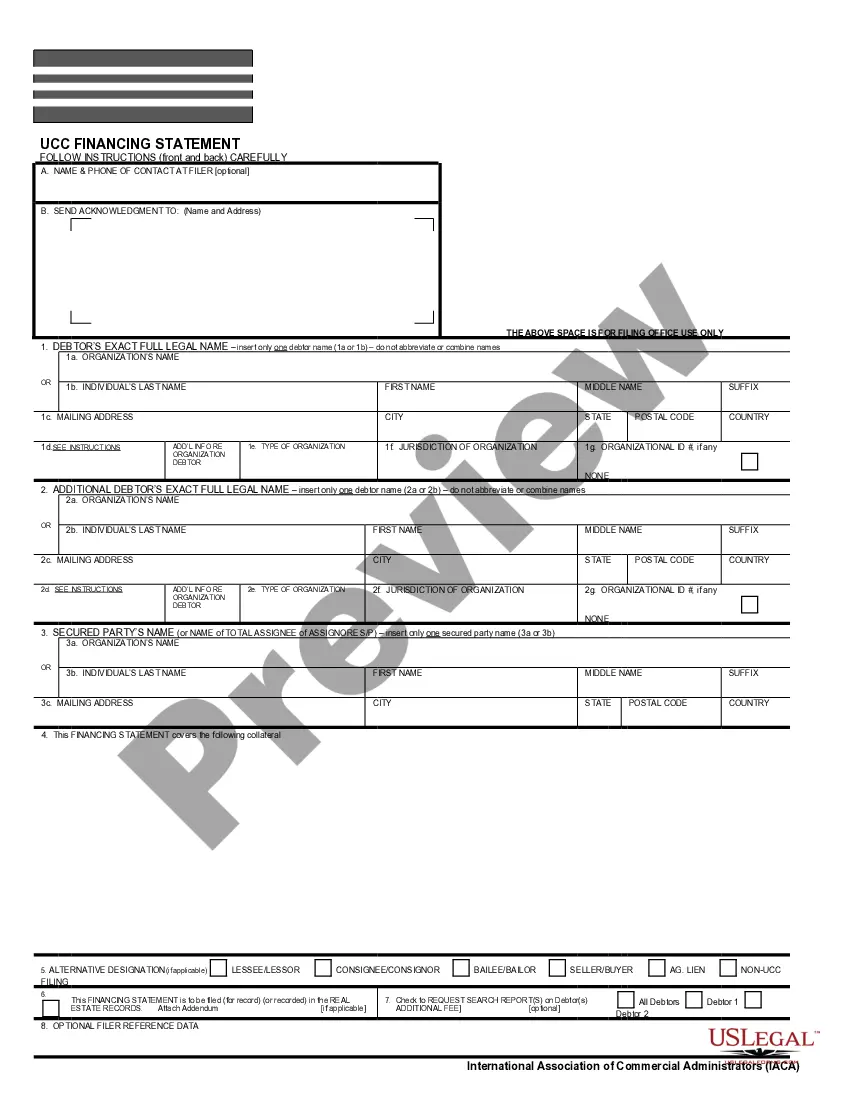

How to fill out Computer Software Lease With License Agreement?

You can dedicate hours online trying to locate the sanctioned document template that meets the requirements of both state and federal regulations you require.

US Legal Forms offers a vast array of legal documents that are assessed by experts.

You can easily acquire or print the Arizona Computer Software Lease with License Agreement through my service.

If available, utilize the Review button to check the document template simultaneously. If you wish to find another version of the form, take advantage of the Search section to locate the template that fulfills your needs and requirements.

- If you already have a US Legal Forms account, you can sign in and click the Obtain button.

- After that, you can complete, modify, print, or sign the Arizona Computer Software Lease with License Agreement.

- Every legal document template you purchase is yours forever.

- To get an additional copy of any acquired form, visit the My documents section and click the respective button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, confirm that you have selected the correct document template for your chosen state/area.

- Review the form outline to ensure you have chosen the appropriate form.

Form popularity

FAQ

Information services are generally considered taxable in Arizona. If you provide access to databases or reports as part of an Arizona Computer Software Lease with License Agreement, you should be aware of this tax requirement. Understanding how tax laws apply to information services can help ensure compliance.

Arizona does have several exemptions regarding taxable services. For example, specific professional services like consulting may not require taxes, unlike software leases. If your offerings involve an Arizona Computer Software Lease with License Agreement, assessing which services are exempt can benefit your financial planning.

Web hosting services can be taxable in Arizona. When you offer web hosting alongside an Arizona Computer Software Lease with License Agreement, this can influence your tax obligations. As tax laws can be intricate, consulting a professional can ease the complexities surrounding web hosting services.

In Arizona, software is often treated as tangible personal property when it is delivered on a tangible medium. This classification affects how you report and collect taxes. When your services involve an Arizona Computer Software Lease with License Agreement, understanding its classification can clarify your tax responsibilities.

Transaction Privilege Tax (TPT) in Arizona applies to various services. Digital products, including some types of software, can trigger TPT obligations. If you lease software or provide an Arizona Computer Software Lease with License Agreement, it’s essential to review the services that require tax collection.

Software as a Service (SaaS) is generally considered taxable in Arizona. When you provide an Arizona Computer Software Lease with License Agreement as part of a SaaS product, it may subject you to the state's tax rules. Understanding these tax implications can help you maintain compliance and avoid potential penalties.

In Arizona, some digital services are indeed taxable. For instance, if you offer a product like an Arizona Computer Software Lease with License Agreement, it may fall under taxable services. It is vital to check specific regulations to determine if your digital service qualifies as taxable, as there are exceptions based on usage and type.

Arizona does not tax many vital goods and services, such as prescription medications, most food items, and certain healthcare services. When considering an Arizona Computer Software Lease with License Agreement, it's important to identify any aspects of the software or service that may fall under tax-exempt categories. For more tailored information, consult with a tax professional to ensure compliance.

The state of Arizona has a base sales tax rate of 5.6%, but local jurisdictions can impose additional taxes, bringing the total to as high as 11.2%. This rate applies when you enter into an Arizona Computer Software Lease with License Agreement, so understanding the total rate relevant to your location is essential. Always check for updates, as tax rates can change.

Sales tax exemptions in Arizona can apply to certain types of transactions and items. For instance, a lease for machinery or equipment used in manufacturing might be exempt. When dealing with an Arizona Computer Software Lease with License Agreement, it’s important to evaluate whether your specific software and its uses qualify for any exemptions.