Arizona Corporations - Resolution for Any Corporate Action

Description

How to fill out Corporations - Resolution For Any Corporate Action?

You can spend hours online trying to locate the legal document template that meets both state and federal requirements you need.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can acquire or print the Arizona Corporations - Resolution for Any Corporate Action from this service.

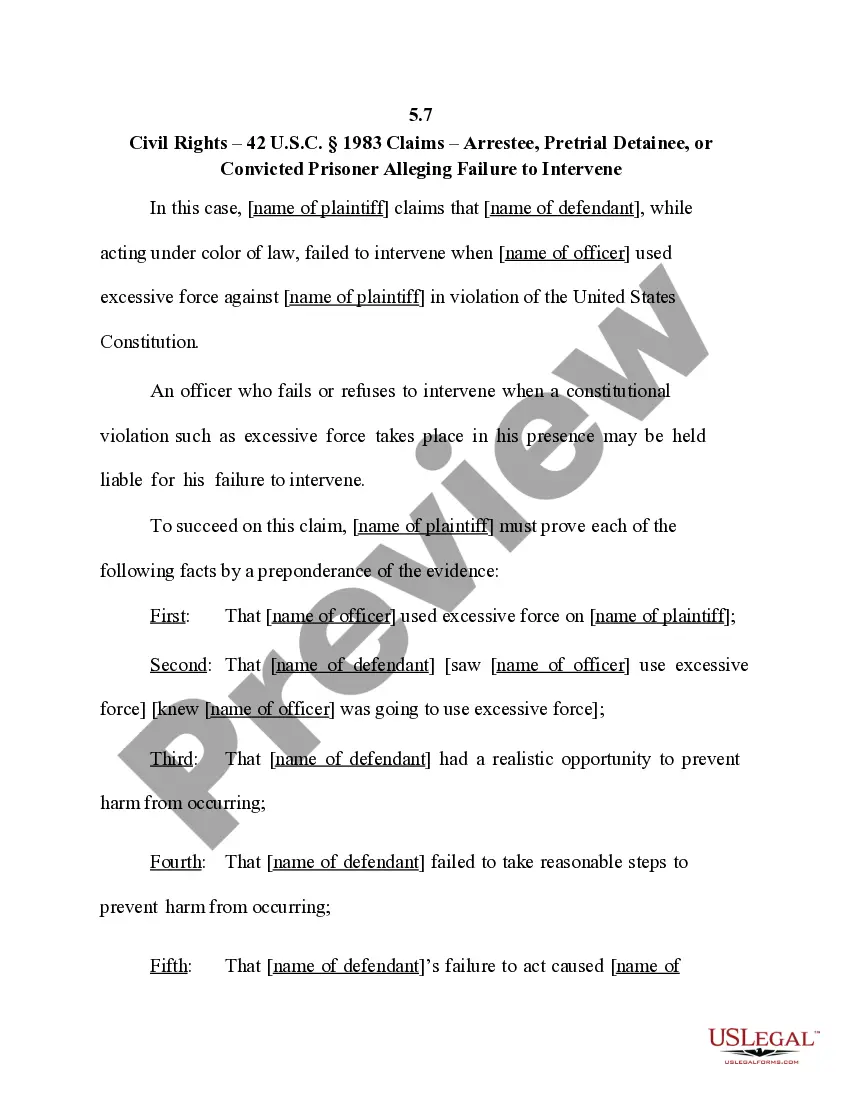

If available, utilize the Preview option to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download option.

- Afterward, you can complete, modify, print, or sign the Arizona Corporations - Resolution for Any Corporate Action.

- Every legal document template you purchase is yours for a long time.

- To obtain another copy of a purchased template, visit the My documents section and click the appropriate option.

- If you're using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the area/town of your choice.

- Review the template details to confirm you have chosen the right one.

Form popularity

FAQ

Certain types of licensees, including those in healthcare, real estate, and financial services, are required to submit proof of good standing when renewing their licenses with the Arizona Corporation Commission. This requirement ensures that all businesses operate within legal frameworks and maintain proper compliance. Submitting this proof demonstrates that your Arizona Corporation is in good standing, facilitating smooth resolutions for any corporate action necessary for continued operations.

You can check the status of your Arizona LLC by visiting the Arizona Corporation Commission website. They have a dedicated section where you can enter your business name or registration number to view its current status. This information is crucial for understanding your LLC's compliance and helps you take appropriate actions for any resolutions for any corporate action you may need.

To get a copy of your articles of incorporation in Arizona, you can request it through the Arizona Corporation Commission's website. They have an online tool where you can search for your corporation's records and download the articles directly. Having a copy on hand is essential for ensuring compliance and for any forthcoming resolutions for any corporate action your Arizona Corporation may undertake.

Yes, Arizona allows corporations to restate their articles of incorporation. The restatement process enables you to amend and clarify your existing articles, reflecting any necessary changes or updates. This is especially beneficial when you want to ensure your documents accurately represent your Arizona Corporation's current structure and goals, paving the way for effective resolutions for any corporate action.

Getting a certificate of good standing from the Arizona Corporation Commission involves submitting an online request or a mail application. Make sure to provide your corporation's name and identification number for accurate processing. This certificate serves as proof that your Arizona Corporation meets all legal requirements, making it essential for various business transactions and for demonstrating proper resolutions for any corporate action.

To obtain a certificate of good standing in Arizona, you need to request it through the Arizona Corporation Commission. You can easily do this online by visiting their website and following the steps outlined for obtaining your certificate. A certificate of good standing confirms that your Arizona Corporation has complied with all necessary regulations and required filings, ensuring a smooth resolution for any corporate action.

Yes, an Arizona LLC does need to file a tax return. However, the requirements may vary based on your LLC’s structure and income level. Filing correctly is crucial for compliance and can directly impact your Arizona Corporations - Resolution for Any Corporate Action. Utilizing platforms like US Legal Forms can simplify this process and guide you through any necessary paperwork.

Arizona form 120S is a specific form used for S-Corporations in Arizona. It is essential for those opting for S-Corporation status, allowing them to avoid double taxation. This form is integral to Arizona Corporations - Resolution for Any Corporate Action and should be filed with the Arizona Corporation Commission for proper compliance.

To file a complaint with the Arizona Corporation Commission, you can submit your complaint through their official website or contact their office directly. It is important to include all relevant details to expedite the process. If you're dealing with Arizona Corporations - Resolution for Any Corporate Action, ensuring all complaints are filed correctly can safeguard your corporate interests.

You should mail your Arizona state tax forms to the Arizona Department of Revenue. Make sure to verify the correct mailing address specified for your type of return. Proper submission will help avoid delays or complications, especially for those managing Arizona Corporations - Resolution for Any Corporate Action.