Arizona Leaseback Provision in Sales Agreement

Description

How to fill out Leaseback Provision In Sales Agreement?

Are you situated in a location where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can depend on is challenging.

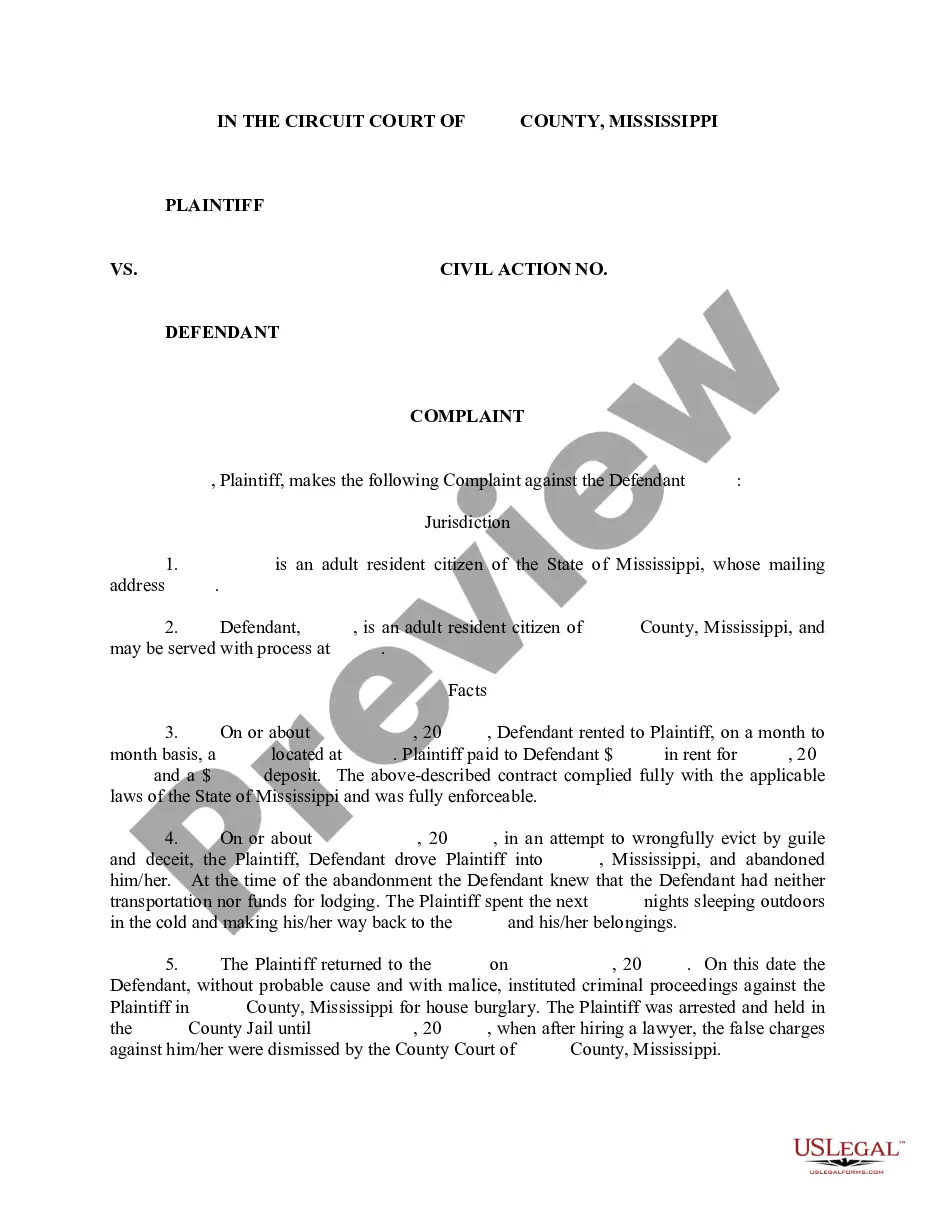

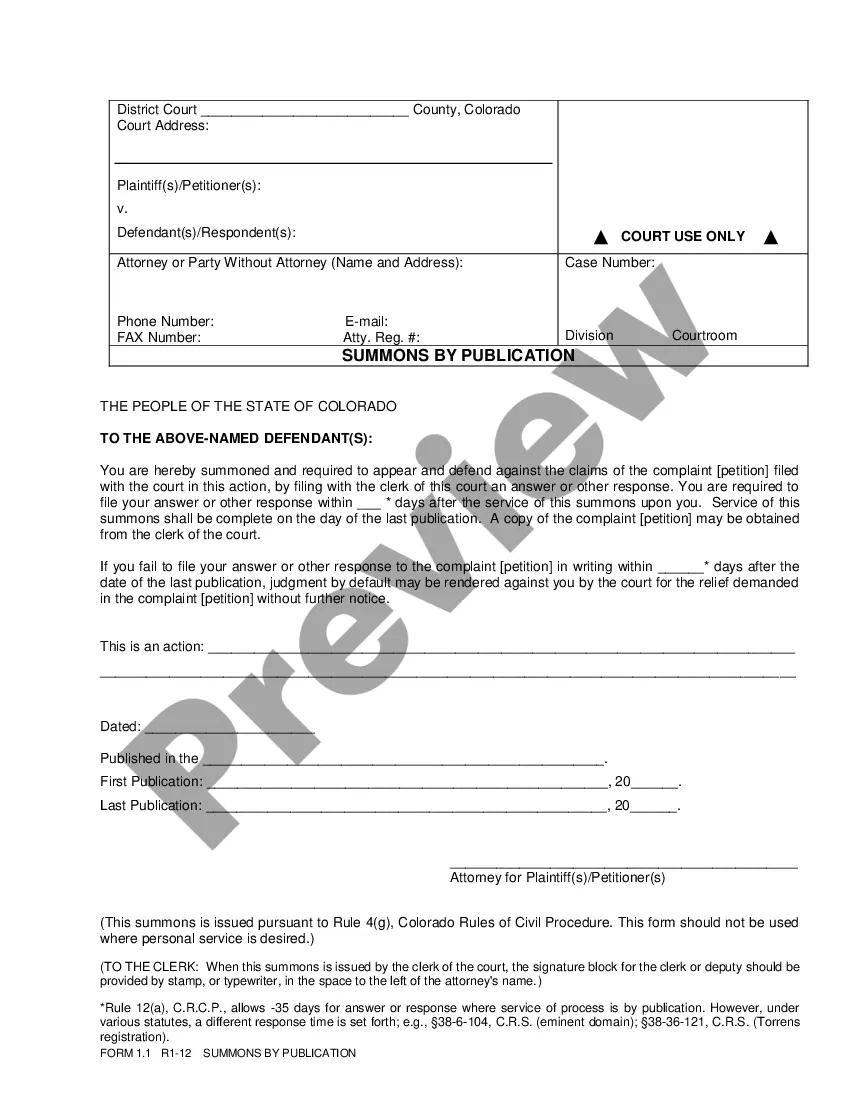

US Legal Forms offers thousands of templates, including the Arizona Leaseback Provision in Sales Agreement, designed to meet both state and federal requirements.

Once you find the correct document, click Acquire now.

Choose the payment plan you desire, complete the required information to create your account, and pay for your order using PayPal or a credit card. Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can download another copy of the Arizona Leaseback Provision in Sales Agreement any time you need to. Just click the necessary template to download or print the document design.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Arizona Leaseback Provision in Sales Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the template you need and ensure it is for the correct city/county.

- Utilize the Review option to inspect the form.

- Check the description to make certain you have selected the appropriate template.

- If the template is not what you are searching for, use the Search area to find the document that fits your needs.

Form popularity

FAQ

An example of a leaseback transaction could involve a retail company selling its storefront to an investor while leasing it back for continued operation. This scenario allows the business to access immediate capital while still using the property. In light of the Arizona Leaseback Provision in Sales Agreement, such transactions demonstrate the practical benefits of leasebacks for sellers.

To determine if a sale and leaseback qualifies as a sale, assess if the transaction follows the established criteria of a sale under Arizona law. This includes the transfer of ownership rights and the exchange of consideration. Understanding the specific details and the Arizona Leaseback Provision in Sales Agreement can help clarify whether your transaction meets these requirements.

In Arizona, a seller may back out of a contract under specific circumstances, such as mutual agreement or breach of contract by the buyer. However, this can lead to legal consequences, including potential lawsuits. Familiarizing yourself with the Arizona Leaseback Provision in Sales Agreement is crucial to understand your rights and obligations before making such a decision.

Leaseback refers to an agreement where a seller sells an asset and simultaneously leases it back from the buyer. This allows the seller to maintain operational use of the asset while providing liquidity. In an Arizona Leaseback Provision in Sales Agreement, leaseback agreements can facilitate financial flexibility for sellers without losing control of their property.

The leaseback condition refers to an arrangement where a seller sells a property but continues to occupy it as a tenant. In the context of the Arizona Leaseback Provision in Sales Agreement, this condition allows the seller to retain use of the property while generating income from the sale. This setup can provide financial relief and flexibility for sellers in Arizona.

The disadvantages of the leasehold system include limited rights for the leaseholder and the inability to modify or improve the property significantly. Additionally, leaseholders often face uncertainty at the end of their lease term regarding renewal or relocation. Engaging with the Arizona Leaseback Provision in Sales Agreement can provide clarity and stability within this system.

The risks associated with leasebacks include market fluctuations that could affect rental rates and the potential loss of the property through foreclosure. Additionally, leasebacks can limit your ability to leverage the property for other financing options. Familiarizing yourself with the Arizona Leaseback Provision in Sales Agreement is crucial for navigating these risks effectively.

Two common disadvantages of leasing include potential high long-term costs and limited flexibility in property modifications. Many individual and business owners find that they cannot build equity through leasing. Additionally, the Arizona Leaseback Provision in Sales Agreement could add layers of complexity to lease arrangements you need to consider.

The disadvantages of leasebacks can include limited control over the property since the new owner retains legal title. Additionally, you might face higher costs related to renting compared to owning the property outright. When using the Arizona Leaseback Provision in Sales Agreement, it's vital to understand these risks to make informed decisions.

Sale and lease refer to a transaction where a property is sold and immediately leased back to the seller for a specific term. This arrangement allows the seller to retain possession of the property while freeing up capital. The Arizona Leaseback Provision in Sales Agreement commonly applies here, making it a popular choice when liquidity and continued use are essential.