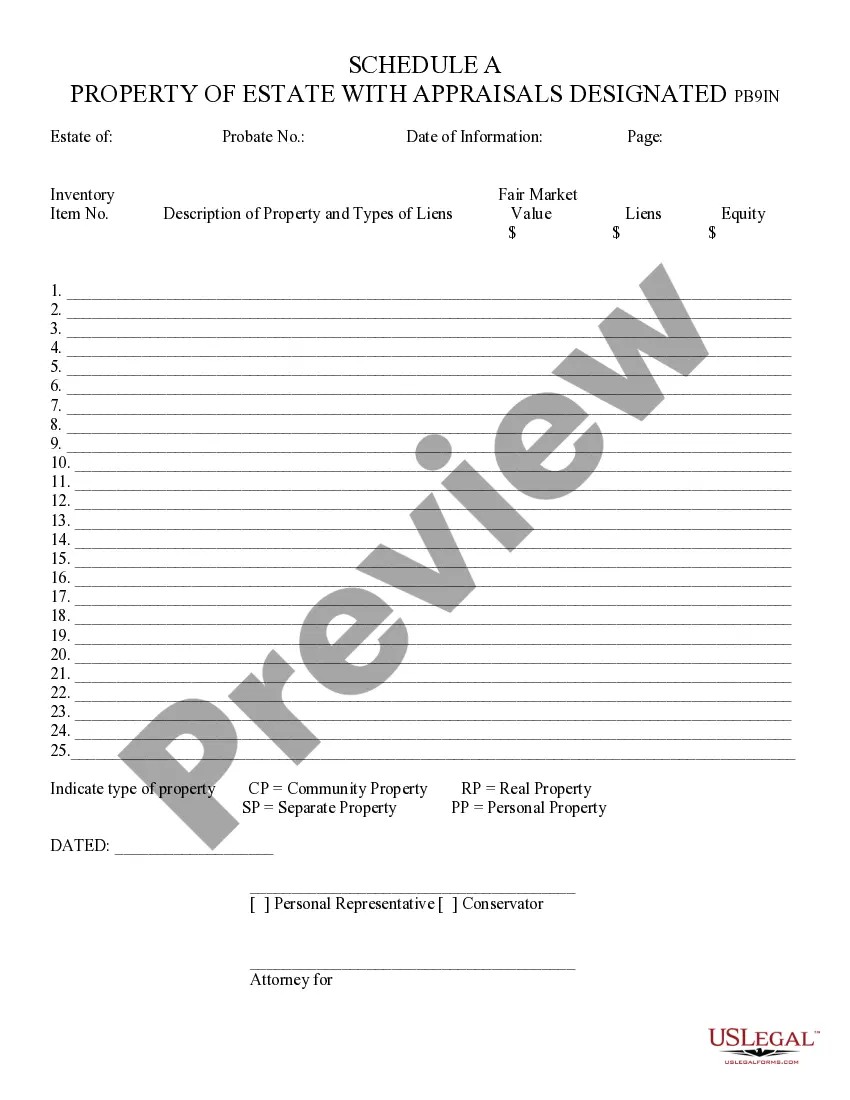

Property of Estate with Appraisals Designated - Schedule A - Arizona: This form is used when an administrator of an estate is called upon to list all the property, with appraisals of said property, of the estate. It is to be signed by the conservator, administrator in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Arizona Property of Estate with Appraisals Designated - Schedule A

Description

How to fill out Arizona Property Of Estate With Appraisals Designated - Schedule A?

If you are looking for the correct Arizona Property of Estate with Appraisals Designated - Schedule A duplicates, US Legal Forms is precisely what you require; access files supplied and verified by state-authorized legal experts.

Using US Legal Forms not only spares you from troubles regarding legitimate documents; in addition, you conserve time, effort, and funds! Downloading, printing, and filling out a professional template is definitely cheaper than hiring a lawyer to do it for you.

And that's all. With just a few simple clicks, you acquire an editable Arizona Property of Estate with Appraisals Designated - Schedule A. Once you create your account, all future orders will be processed even more swiftly. If you have a US Legal Forms subscription, just Log In and click the Download option you see on the form's page. Then, whenever you wish to use this template again, you'll always be able to find it in the My documents menu. Don’t waste your time searching through numerous forms on various sites. Purchase precise documents from a single secure service!

- To begin, complete your registration process by entering your email and creating a secure password.

- Follow the directions below to set up your account and obtain the Arizona Property of Estate with Appraisals Designated - Schedule A template to address your needs.

- Make use of the Preview feature or check the document description (if available) to confirm that the template is what you need.

- Verify its legitimacy in your residing state.

- Click on Buy Now to place your order.

- Choose a preferred pricing plan.

- Create an account and pay using a credit card or PayPal.

Form popularity

FAQ

Line 5a on a 4506 C refers to the requestor’s name and Social Security number. This information is critical for verifying identity when requesting a copy of tax documents from the IRS. Completing this section correctly can streamline the process of obtaining important tax records, especially useful for those assessing the Arizona Property of Estate with Appraisals Designated - Schedule A. Using platforms like USLegalForms can simplify this process and provide essential guidance.

Line 5a on your tax return indicates the total wages, salaries, and tips that have been received. This line acts as a summary of your taxable income related to employment. Precise reporting here is vital as it forms the basis for calculating your overall tax obligations. For individuals dealing with Arizona Property of Estate with Appraisals Designated - Schedule A, accurate reporting ensures compliance with local tax laws.

In most cases, the appraisal is shared with both the buyer and the seller. This transparency helps both parties understand the property's value and negotiate more effectively. For transactions involving Arizona property of estate with appraisals designated - Schedule A, having access to the appraisal ensures everyone is informed about the true value of the estate.

In Arizona, the law typically allows an executor up to one year to settle an estate, although this period can vary depending on specific circumstances. Executors need to ensure they fulfill all financial obligations, including appraisals and debt settlements, to effectively manage the estate. Understanding the timeline is crucial for estates involving Arizona property of estate with appraisals designated - Schedule A, as accurate evaluations help expedite the process.

The appraiser usually coordinates the appraisal appointment with the property owners or their agents. This scheduling is crucial to access the property and gather all necessary information for a thorough evaluation. For properties under the Arizona property of estate with appraisals designated - Schedule A, precise scheduling helps establish an accurate estate assessment.

Typically, the seller schedules the appraisal in collaboration with their agent, especially as part of the sale process. However, sometimes the buyer may need to arrange it if they are securing financing. Regardless of who schedules it, clarity in the Arizona property of estate with appraisals designated - Schedule A is essential to ensure a smooth transaction.

An appraisal is usually conducted by a licensed real estate appraiser. These professionals are experts in valuing properties and must adhere to local and federal regulations. In the context of Arizona property of estate with appraisals designated - Schedule A, having a certified appraiser can ensure that the estate's value is accurately represented.

Schedule A allows for the deduction of various expenses including mortgage interest, charitable contributions, and certain medical expenses. When dealing with property in Arizona, especially Arizona Property of Estate with Appraisals Designated - Schedule A, it's wise to keep thorough records of all relevant expenses to maximize your deductions effectively. Utilizing platforms like uslegalforms can help streamline this process and provide clarity on allowable deductions.

Deductible items on Schedule A can include mortgage interest, state and local taxes, and certain medical expenses. Additionally, if you have made significant improvements to real estate, such costs may also relate to Arizona Property of Estate with Appraisals Designated - Schedule A. It's crucial to evaluate all potential deductions that can benefit your financial situation.

On Schedule A, medical expenses that are deductible include those that exceed 7.5% of your adjusted gross income. This may cover various costs such as doctors’ fees, hospital bills, and prescription medications. If you are managing an estate or property in Arizona, consider how these deductions affect the tax obligations related to Arizona Property of Estate with Appraisals Designated - Schedule A.