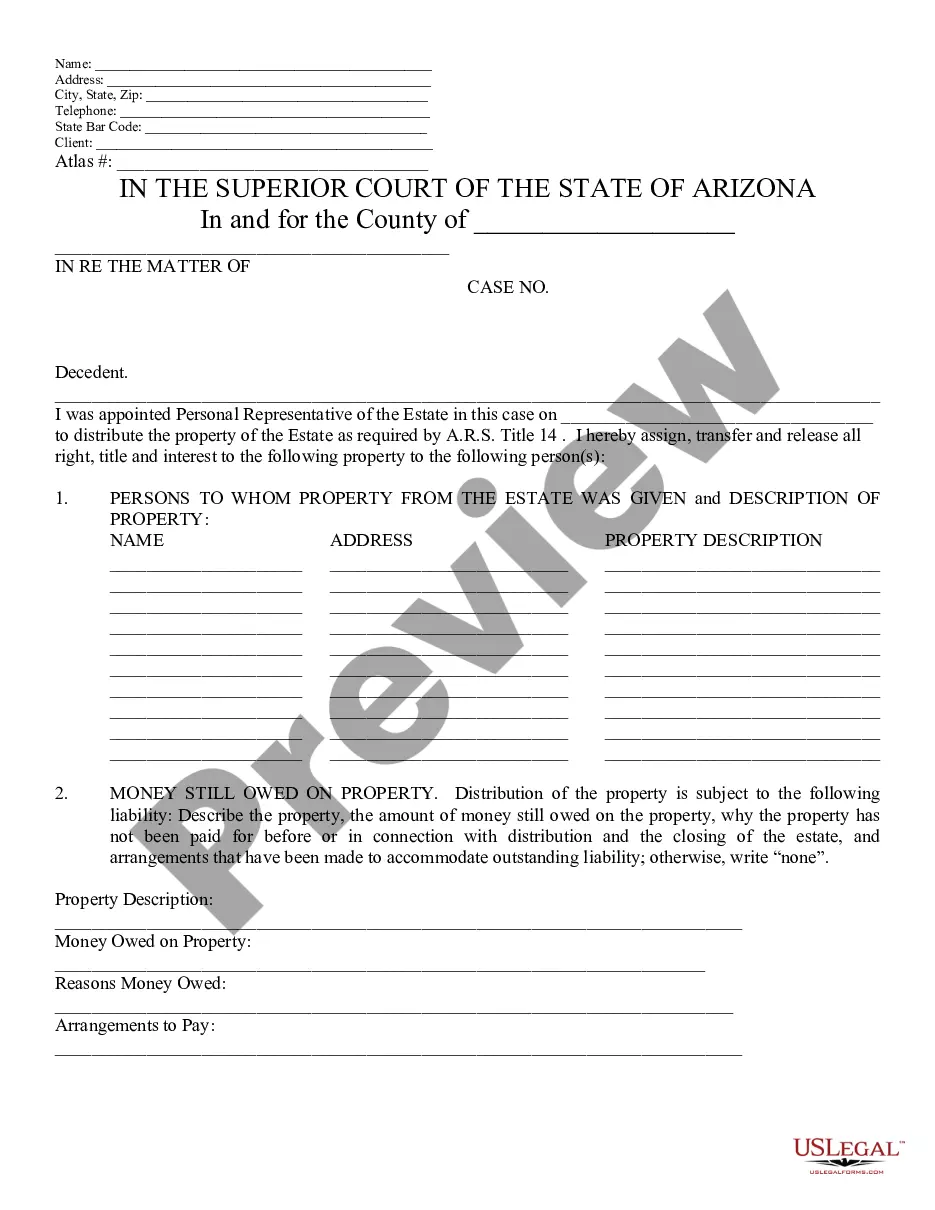

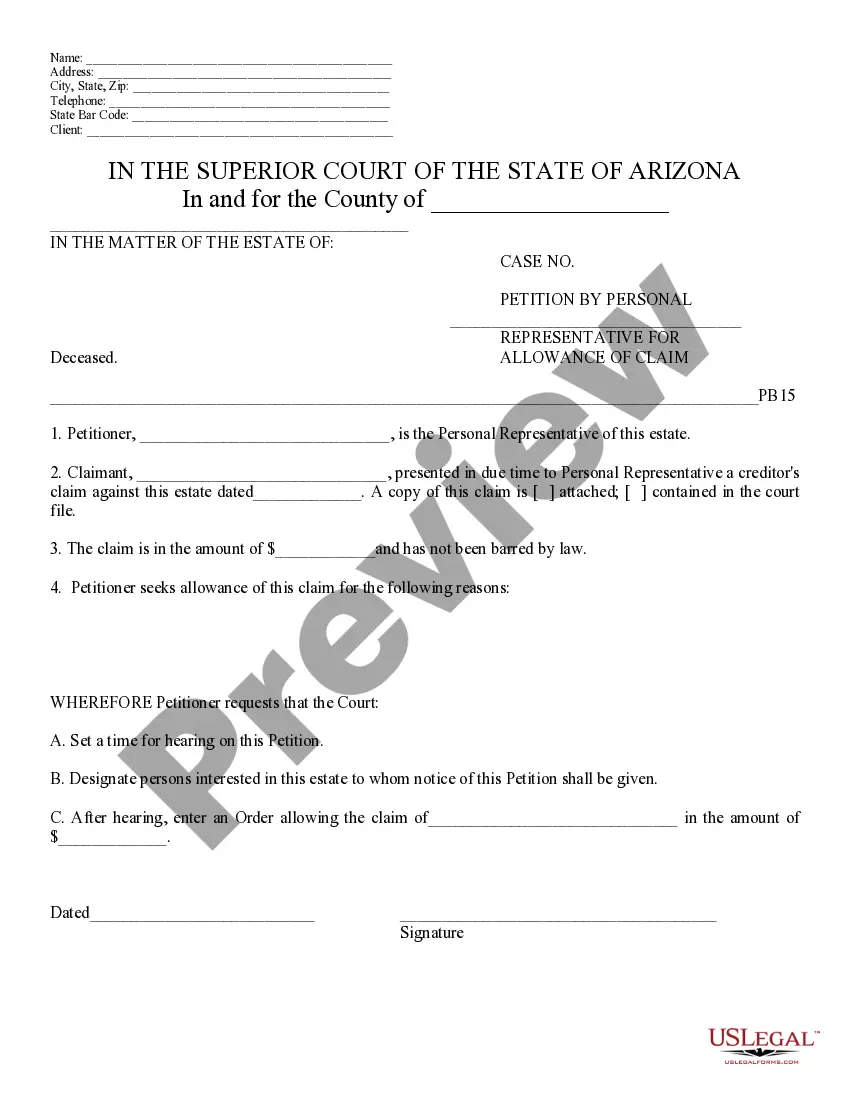

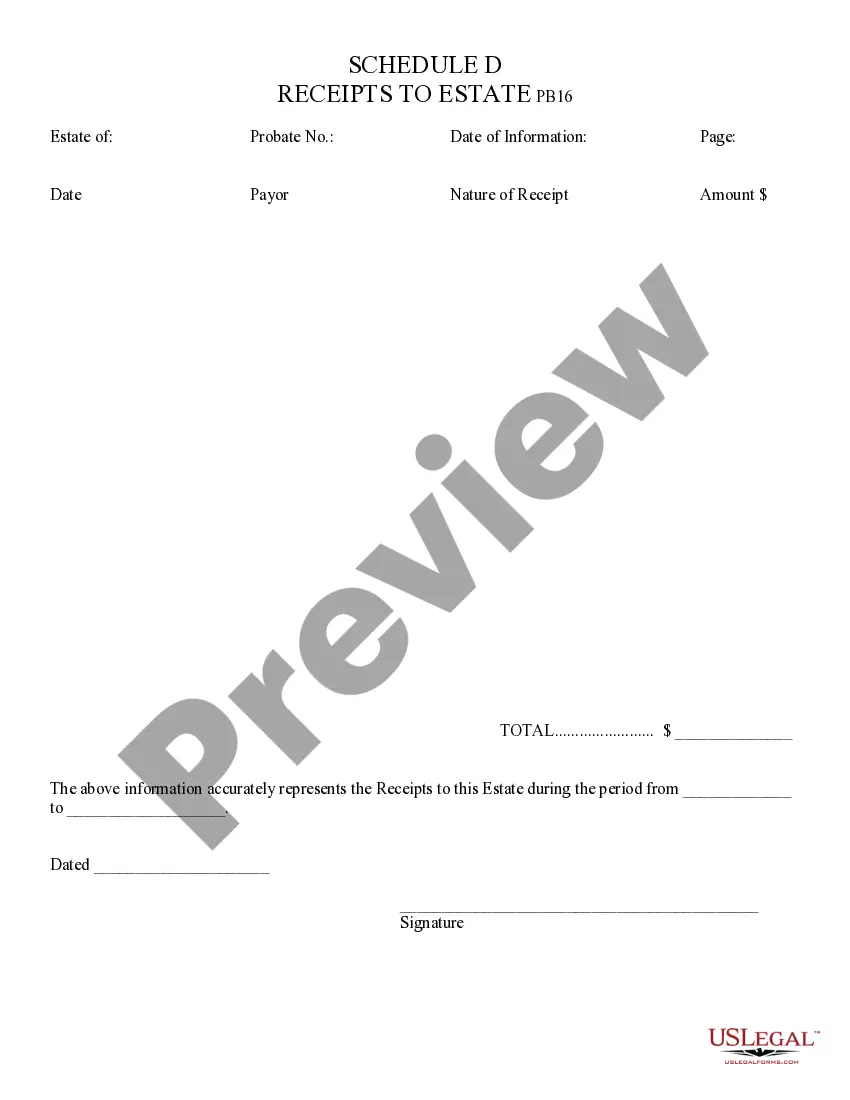

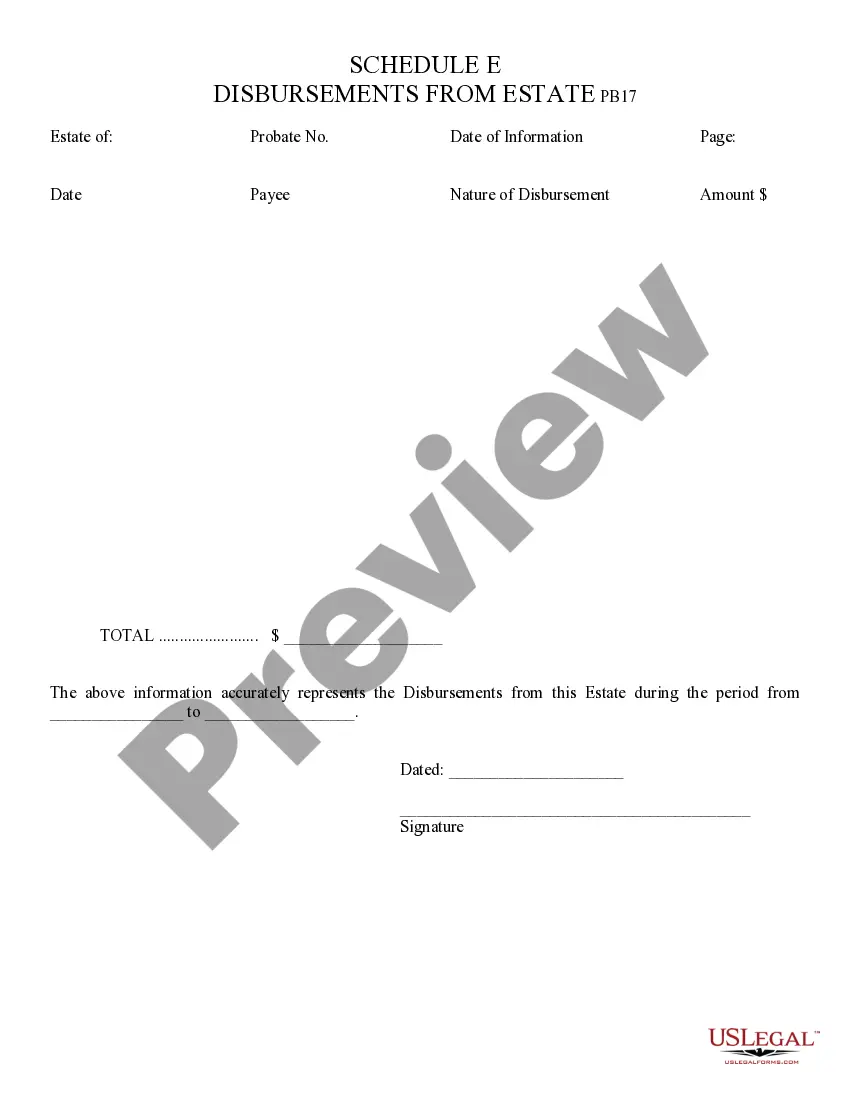

Disbursements from Estate Schedule E - Arizona: This document lists all of the disbursements, or payments, made by the estate during the year. It states the amount paid, as well as to who the payment was made. It is available for download in both Word and Rich Text formats.

Arizona Disbursements from Estate Schedule E

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Disbursements From Estate Schedule E?

If you're looking for accurate copies of Arizona Disbursements from Estate Schedule E, US Legal Forms is what you require; obtain documents created and verified by state-approved legal experts.

Utilizing US Legal Forms not only protects you from issues related to legal documents; additionally, you save effort, time, and money! Downloading, printing, and filling out a reliable template is much more affordable than asking a lawyer to prepare it for you.

And that’s it. In just a few simple steps, you will obtain an editable Arizona Disbursements from Estate Schedule E. Once you create your account, all future purchases will be even more straightforward. If you have a US Legal Forms subscription, just Log In and click the Download button available on the form's page. Then, whenever you need to use this sample again, you'll always be able to find it in the My documents section. Don’t waste time comparing numerous templates on various sites. Purchase professional templates from one secure platform!

- To begin, complete your registration process by entering your email and creating a secure password.

- Follow the instructions below to set up an account and find the Arizona Disbursements from Estate Schedule E sample to meet your requirements.

- Utilize the Preview option or review the document details (if available) to ensure that the sample is the correct one for you.

- Verify its validity in your jurisdiction.

- Click Buy Now to place your order.

- Choose a preferred payment plan.

- Create an account and make your payment using a credit card or PayPal.

- Select a suitable format and save the form.

Form popularity

FAQ

The TPT rate in Arizona varies depending on the type of business activity and the specific locality. Generally, the state rate is 5.6%, but local jurisdictions may apply their rates, leading to a combined rate that can be higher. When dealing with Arizona Disbursements from Estate Schedule E, it's essential to stay informed about TPT rates to ensure accuracy in your financial planning and tax filings.

In Arizona, the Pass-Through Entity Tax (PTET) is generally not refundable. Instead, this tax allows certain entities to reduce their taxable income on Schedule E, optimizing the overall tax burden on disbursements from the estate. It's important for individuals dealing with estate distributions to consult a knowledgeable resource, like USLegalForms, to navigate these financial intricacies and ensure effective tax management.

The Pass-Through Entity (PTE) rate in Arizona impacts various disbursements from estate Schedule E. As of the latest guidelines, the PTE rate is designed to streamline tax processes for pass-through entities, ultimately benefiting estate management. Understanding this rate is crucial for the accurate preparation of tax filings and to ensure compliance with state laws regarding estate distributions.

Some Arizona tax credits are refundable, while others are not. Refundable credits allow you to receive a refund if the credits exceed your tax liability, which can provide significant financial relief. When considering Arizona disbursements from estate schedule E, understanding which credits apply can be critical. For more information on navigating these credits, uslegalforms offers helpful resources.

Yes, a reciprocal agreement exists between California and Arizona. This means that residents of either state are not subject to income tax on wages earned in the other state. However, this may affect how you handle Arizona disbursements from estate schedule E, so it's wise to verify your specific circumstances. Uslegalforms can assist in clarifying these tax obligations.

The Arizona Research and Development (R&D) credit is nonrefundable, which means it can only reduce your tax liability to zero, but you cannot receive a refund. Businesses engaging in qualifying R&D activities can benefit from this credit, but they should keep in mind the implications for Arizona disbursements from estate schedule E as well. If you need detailed assistance, uslegalforms can guide you through the credit's application process.

You can file Arizona Form 165, which is for partnerships, at the Arizona Department of Revenue. Mail the completed form to the designated address provided on the instruction sheet for the form. It is crucial to accurately report any Arizona disbursements from estate schedule E when completing this form. For assistance with filing, uslegalforms offers helpful templates and resources.

Yes, if you earn income sourced from Arizona as a non-resident, you need to file an Arizona tax return. This applies to various types of income, including wages and revenues from business endeavors. Being aware of Arizona disbursements from estate schedule E is important, as it may play a role in your filing obligations. Uslegalforms can help provide clarity on what forms to use and how to proceed.

AZ Form 355 is the Arizona Corporate Income Tax Return. This form is essential for businesses operating in Arizona as it helps report their income and calculate the amount owed. Proper completion of this form is crucial for compliance, especially when considering Arizona disbursements from estate schedule E, as it may impact overall tax responsibilities. For assistance, uslegalforms can provide templates and guidance for filing.