Arizona Correction of Misapplied Payments is a process used to correct errors in payments that have been made to the wrong party or in the wrong amount. This process is used to ensure that payments are sent to the proper recipient and for the correct amount. There are two types of Arizona Correction of Misapplied Payments: voluntary and involuntary. Voluntary correction of misapplied payments is when a party voluntarily corrects an error in the payment before the state of Arizona has been made aware of it. Involuntary correction of misapplied payments is when a party is required by the state of Arizona to correct an error in the payment after the state has been made aware of it. In either case, the payment must be returned to the original payer and the correct payment must be made to the proper recipient.

Arizona Correction of Misapplied Payments

Description

How to fill out Arizona Correction Of Misapplied Payments?

Creating legal documents can be a significant source of anxiety if you lack accessible fillable formats. With the US Legal Forms online collection of official documents, you can trust the templates you acquire, as they all align with federal and state legislation and have been vetted by our specialists.

Obtaining your Arizona Correction of Misapplied Payments from our platform is as easy as pie. Existing users with an active subscription merely need to Log In and click the Download button once they locate the suitable form. Subsequently, if desired, users can retrieve the same document from the My documents section of their account. However, even newcomers to our service can sign up for a valid subscription in just a few moments. Here’s a quick guide for you.

Haven’t you experienced US Legal Forms yet? Sign up for our service today to receive any official document promptly and effortlessly whenever you require it, and maintain your paperwork in good order!

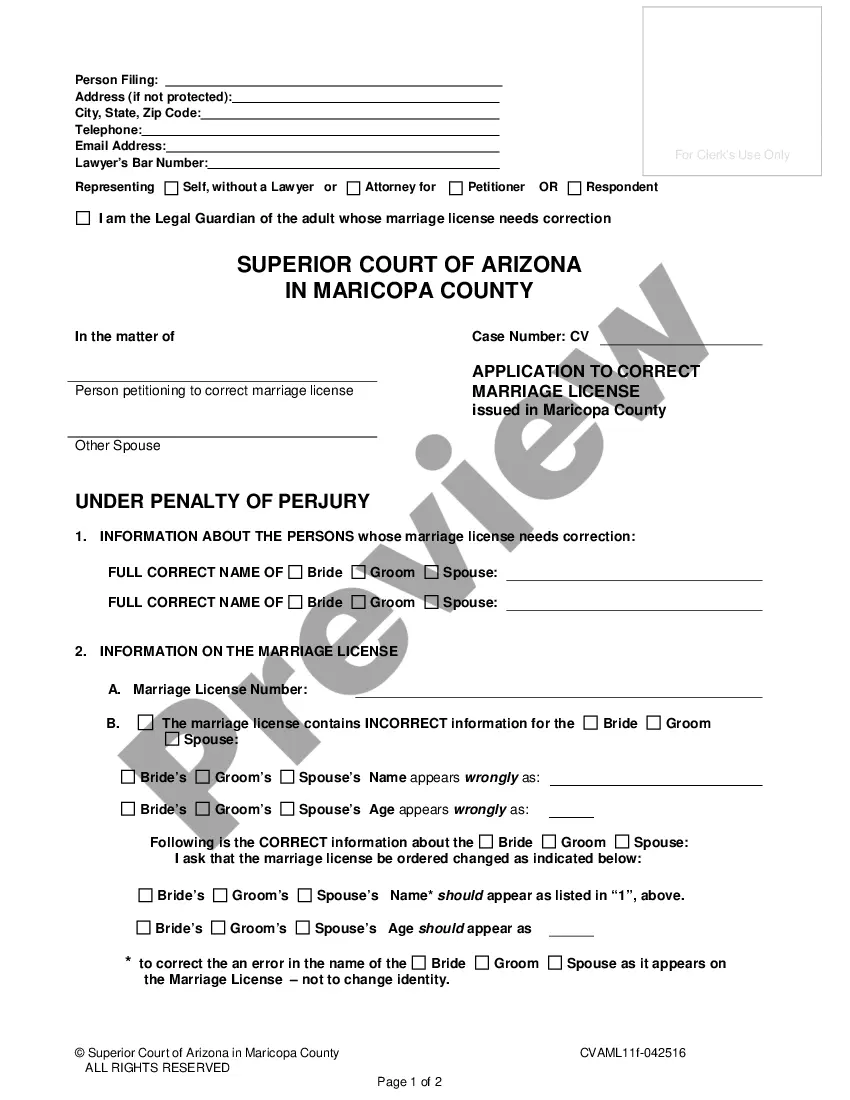

- Document compliance assessment. You should carefully examine the content of the form you wish to ensure that it meets your needs and adheres to your state law requirements. Previewing your document and reviewing its general overview will assist you in doing just that.

- Alternative searching (optional). If you discover any discrepancies, navigate the library using the Search tab at the top of the page until you find a suitable template, and click Buy Now upon locating the one you require.

- Account creation and document acquisition. Register for an account with US Legal Forms. After your account is validated, Log In and select your desired subscription option. Make a payment to continue (PayPal and credit card methods are available).

- Template retrieval and subsequent application. Choose the file format for your Arizona Correction of Misapplied Payments and click Download to store it on your device. Print it to manually complete your documents, or employ a feature-rich online editor to create an electronic version more swiftly and effectively.

Form popularity

FAQ

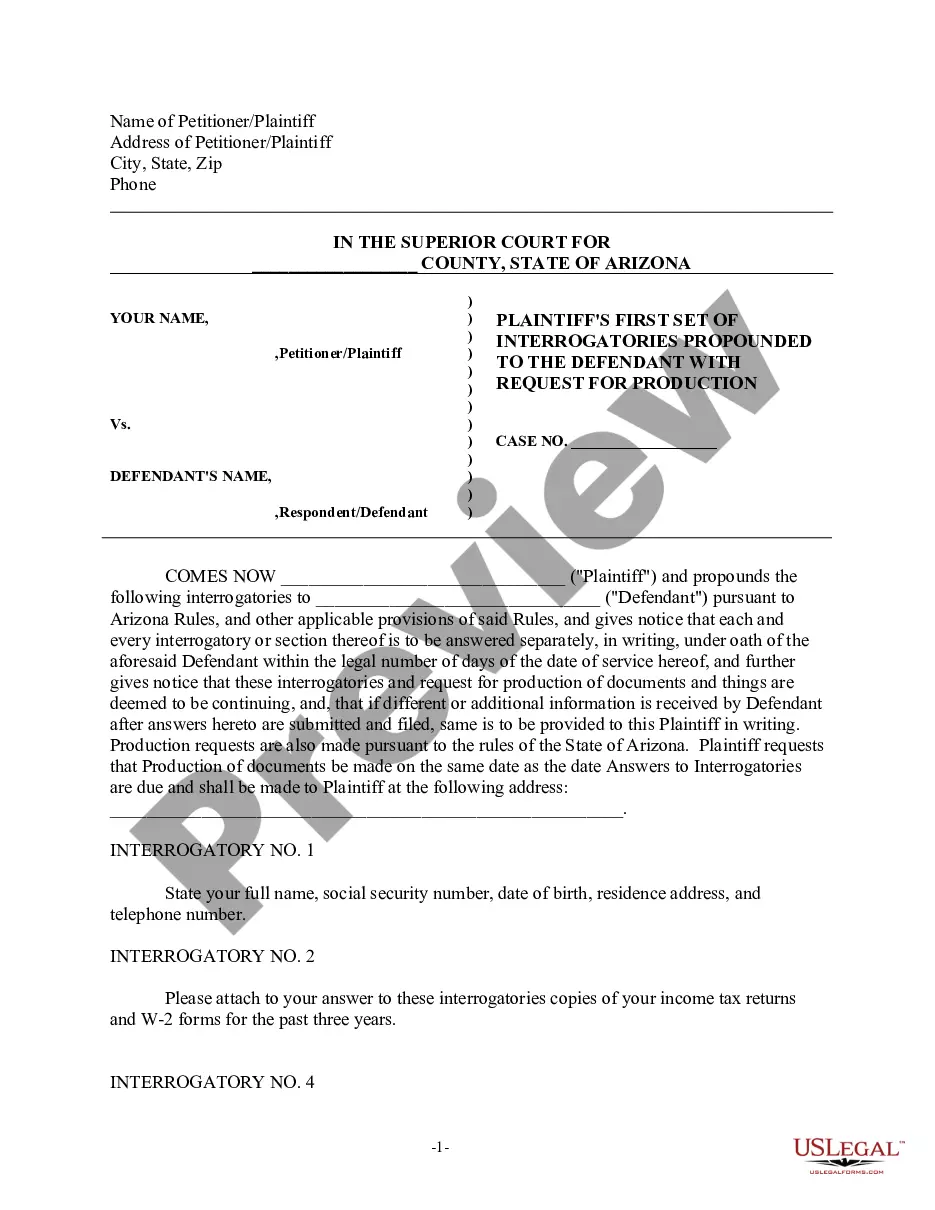

Currently, you cannot file an Arizona amended return electronically in the same way you file original returns. You must print the amended forms and send them by mail to the appropriate office. This process is vital for correcting Arizona Correction of Misapplied Payments, ensuring all details are reviewed and revised accurately during processing.

Yes, non-residents must file an Arizona tax return if they earn income from Arizona sources. This requirement helps to ensure compliance with state tax laws, regardless of your residency status. If you have concerns about Arizona Correction of Misapplied Payments, seeking clarity through filing can help you manage any obligations effectively.

To amend a filed return in Arizona, you must fill out the appropriate amended tax forms and submit them to the Arizona Department of Revenue. Be sure to clearly state the reason for the amendment, especially if it involves correcting Arizona Correction of Misapplied Payments. This process ensures your tax records are accurate and up-to-date, preventing any future tax-related complications.

Yes, you can file Arizona state taxes electronically using approved tax software or through a tax professional. This method streamlines the process and can lead to quicker processing times for your return. Additionally, electronic filing simplifies addressing issues such as Arizona Correction of Misapplied Payments, providing an efficient way to rectify any discrepancies.

To file an amended sales tax return in Arizona, you will need to complete the correct form and clearly indicate the changes you are making. Ensure you include any supporting documents that explain why you are making the amendment. This process allows for the efficient handling of any Arizona Correction of Misapplied Payments, ensuring your tax records reflect accurate figures and avoiding potential penalties.

After taxes, $100,000 in Arizona can vary depending on your tax bracket and deductions. Generally, you can expect to keep around 70-75% of that amount, considering state and federal taxes. Understanding how taxes influence your income is essential, especially when addressing Arizona Correction of Misapplied Payments. Consult with a tax professional or use resources from US Legal Forms to navigate this efficiently.

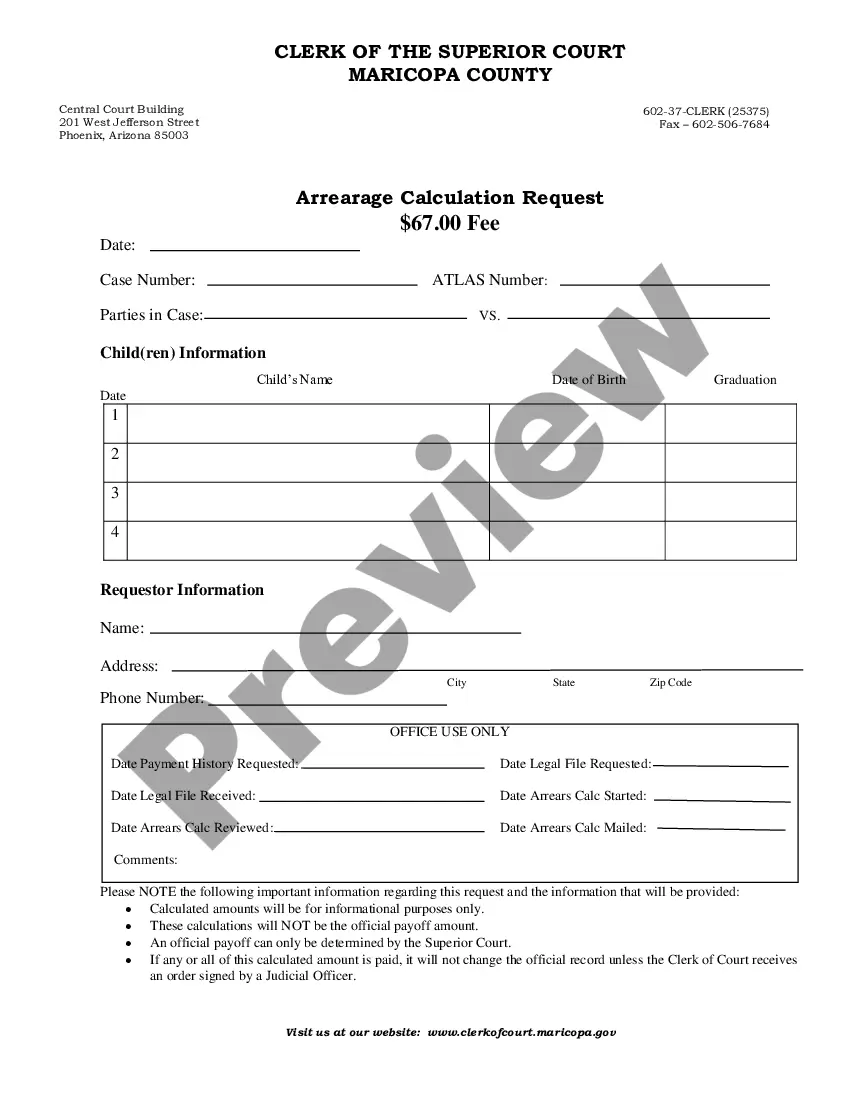

To get an atlas number in Arizona, you must reach out to the Arizona Department of Transportation. This number is crucial for registering your vehicle and ensuring that all payments are correctly applied. If you encounter any issues related to Arizona Correction of Misapplied Payments, using platforms like US Legal Forms can help streamline the documentation process and ensure compliance.

Yes, you can file Arizona taxes online using several platforms, including the US Legal Forms website. This convenient option simplifies the process and ensures that your forms are filled accurately. Filing online can also help you avoid common mistakes related to Arizona Correction of Misapplied Payments. Be sure to follow the instructions carefully to ensure a smooth experience.

Receiving a letter from the Arizona Department of Revenue usually indicates there is a need for clarification or action regarding your tax account. This could involve issues like tax returns, payments, or discrepancies noticed by the state. Review the letter carefully, as it may guide you on addressing potential Arizona Correction of Misapplied Payments, ensuring your records are up to date.

A tax correction notice in Arizona informs you about discrepancies detected by the state regarding your tax filings. The notice may indicate issues such as misapplied payments or missing documentation. Upon receiving a tax correction notice, it’s essential to respond promptly to rectify any misunderstandings, including those related to Arizona Correction of Misapplied Payments.