Arizona Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals) is a form used by non-individual creditors to list all claims secured by property in Arizona. It is used to provide a detailed list of all claims secured by property, including the name of the creditor, the amount of the claim, and the type of security interest held. This form is filed as part of the bankruptcy process in Arizona and must be completed in its entirety and filed with the courts. There are two types of Arizona Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals). The first type is for secured creditors, which includes banks, credit unions, and other financial institutions. The second type is for unsecured creditors, which includes individuals and businesses that do not hold a security interest in the debtor’s property.

Arizona Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals)

Description

How to fill out Arizona Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals)?

If you're seeking a method to correctly prepare the Arizona Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals) without employing a legal expert, then you are in the ideal location.

US Legal Forms has established itself as the most comprehensive and dependable repository of formal templates for every individual and commercial situation. Each document you discover on our website is crafted in accordance with federal and state laws, ensuring your paperwork is accurate.

Another wonderful feature of US Legal Forms is that you will never misplace the documents you acquired - you can access any of your downloaded forms in the My documents section of your profile whenever you need them.

- Verify the document you see on the page meets your legal circumstances and state laws by reviewing its text description or browsing through the Preview mode.

- Enter the document name in the Search tab at the top of the page and select your state from the dropdown to find another template if there are any discrepancies.

- Repeat the content verification process and click Buy now when you are certain about the paperwork's adherence to all requirements.

- Log In to your account and click Download. Create an account with the service and choose a subscription plan if you do not possess one.

- Utilize your credit card or the PayPal option to settle your US Legal Forms subscription. The document will be available for download immediately after.

- Select the format in which you wish to save your Arizona Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals) and download it by pressing the corresponding button.

- Incorporate your template into an online editor to fill it out and sign swiftly or print it to prepare your physical copy manually.

Form popularity

FAQ

Claims secured by property refer to debts that have collateral backing them. This means that the creditor has a legal right to take possession of specific property if the debtor fails to fulfill their payment obligations. In the context of Arizona Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals), it is important to identify these claims to properly assess your financial situation. Understanding these claims helps you navigate your rights and responsibilities effectively.

Property exemptions in Arizona protect various assets from creditors when you face financial troubles. As outlined in the Arizona Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals), exemptions include your primary residence, personal belongings, and certain financial accounts. By understanding these protections, you can better manage your financial situation and reduce the stress associated with creditor claims.

In Arizona, Chapter 7 bankruptcy allows you to exempt certain properties from being liquidated. This includes personal property up to specific value limits, as well as your home equity under the Arizona Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals). Navigating Chapter 7 can be complex, so understanding your exemptions is crucial to retaining your assets while addressing debts effectively.

The property exemption in Arizona refers to specific assets that are protected from creditors under state law. These exemptions are outlined in the Arizona Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals) and include items such as personal property, tools of the trade, and a portion of your home’s equity. Knowing these exemptions can empower you to make informed decisions during financial hardship, ensuring you keep essential items.

In Arizona, creditors can potentially take your house, but there are protections in place under the Arizona Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals). If you have equity in your home, creditors may seek to lien or foreclose on the property, particularly in certain circumstances. However, understanding the exemptions can help safeguard your home from being taken, ensuring you maintain a secure living situation.

In Arizona, several assets are exempt from creditors under the Arizona Schedule D: Creditors Who Hold Claims Secured By Property (non-individuals). These exemptions include certain personal property, as well as equity in your home and some retirement accounts. This means that when you face creditors, specific assets are protected, allowing you to maintain some level of financial security. Understanding these exemptions helps you navigate potential risks more effectively.

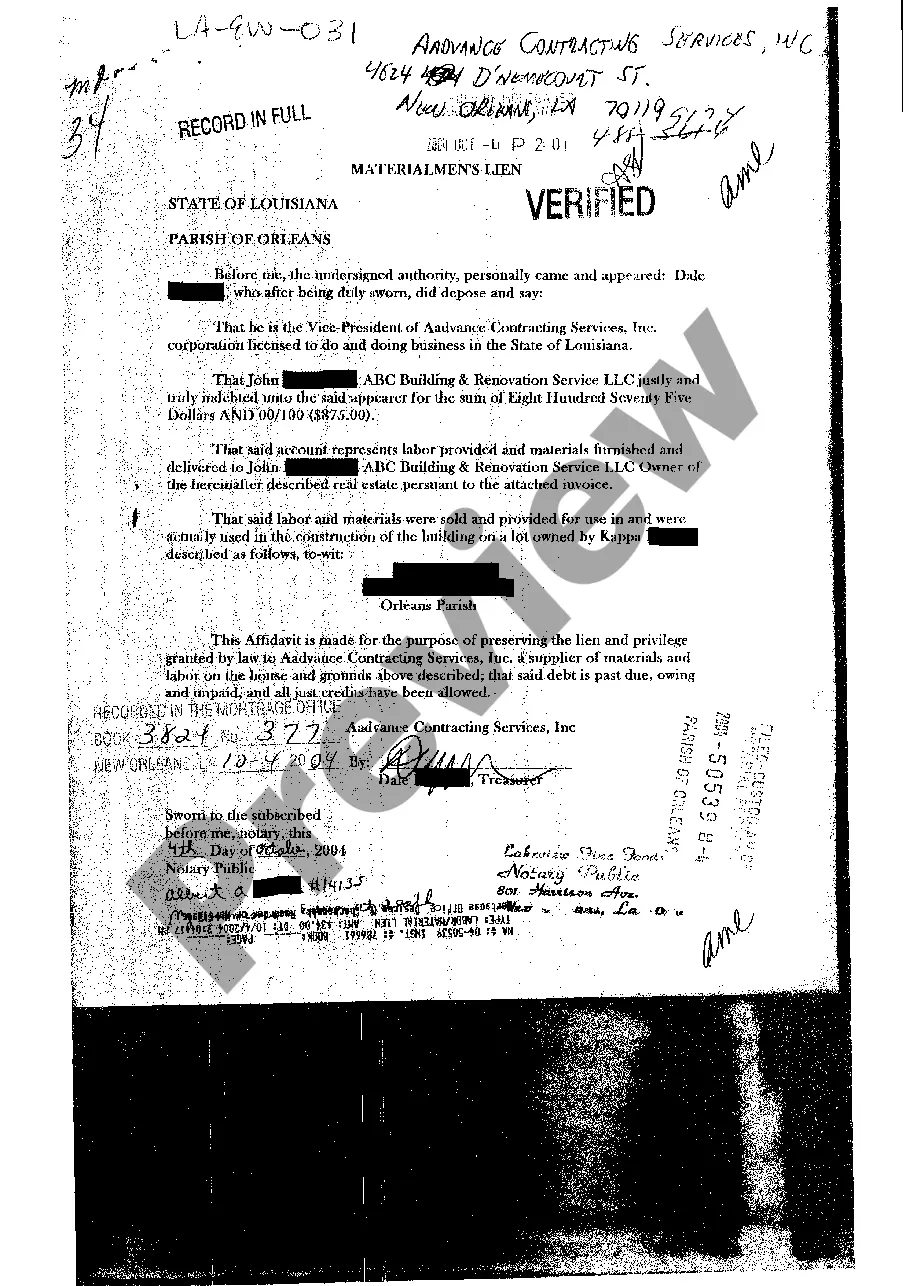

A secured debt is a debt that is secured by property. If you don't repay the debt ing to your contract?for example, you fail to make your monthly payment?the creditor has the right to take back the secured property, such as your home or car. In contrast, your unsecured creditors don't have the same rights.

Secured Creditors ? Creditors that are owed by the debtor and have an underlying security interest in the debtor's assets. The amount of a secured claim would depend on the value of the interest in the lien on the collateral.

Secured debt - A debt that is backed by real or personal property is a ?secured? debt. A creditor whose debt is ?secured? has a legal right to take the property as full or partial satisfaction of the debt. For example, most homes are burdened by a ?secured debt?.

Secured Creditors are creditors that hold a lien on its debtor's property, whether that property is real property or personal property. The lien gives the secured creditor an interest in its debtor's property that provides for the property to be sold to satisfy the debt in cases of default.