Arizona Subordination Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

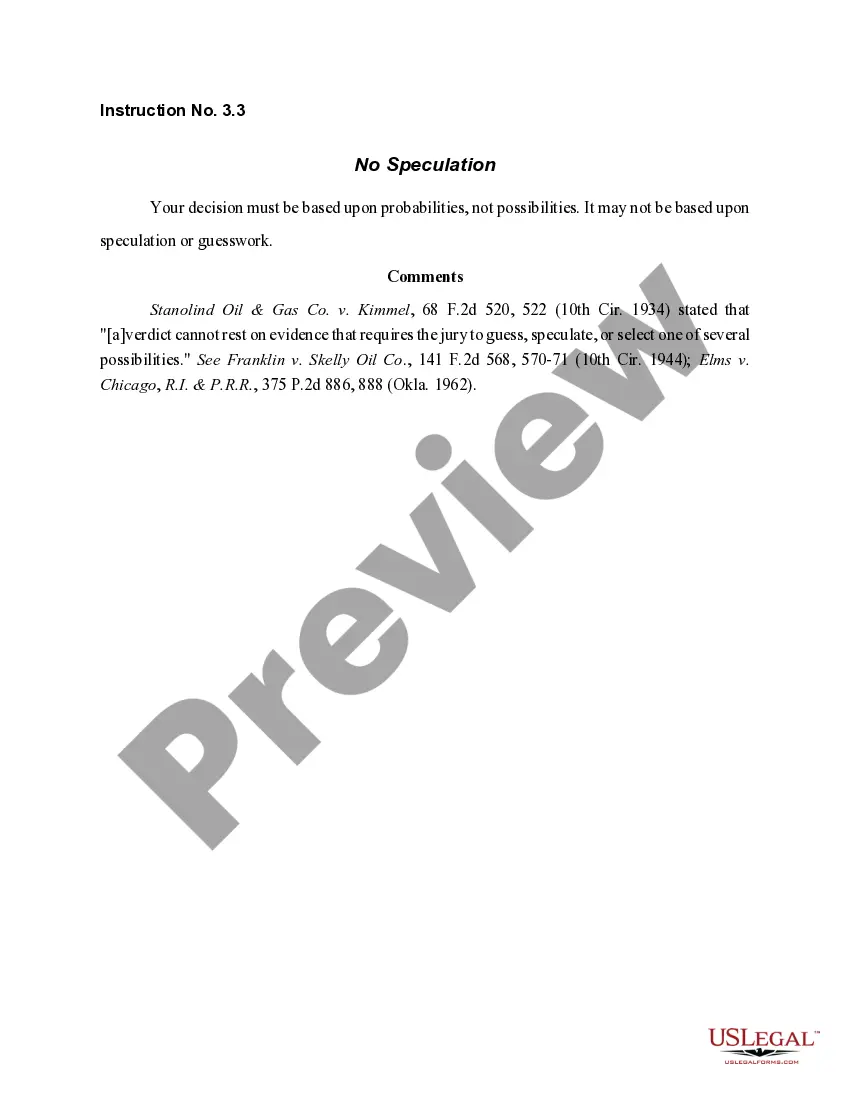

How to fill out Arizona Subordination Agreement?

If you're looking for precise Arizona Subordination Agreement replicas, US Legal Forms is precisely what you require; discover documents crafted and verified by state-certified legal professionals.

Utilizing US Legal Forms not only spares you from concerns related to legal paperwork; you also conserve time, energy, and money! Downloading, printing, and submitting a professional template is significantly less expensive than requesting legal advice to prepare it for you.

And there you have it! In just a few simple clicks, you will obtain an editable Arizona Subordination Agreement. After setting up your account, all subsequent orders will be processed even more easily. Once you have a US Legal Forms subscription, simply Log In to your account and click the Download button visible on the form's page. Then, whenever you need to use this template again, you'll always be able to find it in the My documents section. Don't spend your time comparing numerous forms on various sites. Acquire precise templates from a single secure platform!

- To start, complete your sign-up process by entering your email and setting a password.

- Follow the steps below to establish your account and locate the Arizona Subordination Agreement template to address your needs.

- Utilize the Preview option or review the document details (if available) to ensure that the form is what you require.

- Verify its relevance in your location.

- Click Buy Now to place your order.

- Select a recommended pricing plan.

- Create an account and pay using a credit card or PayPal.

- Choose a convenient file format and save the document.

Form popularity

FAQ

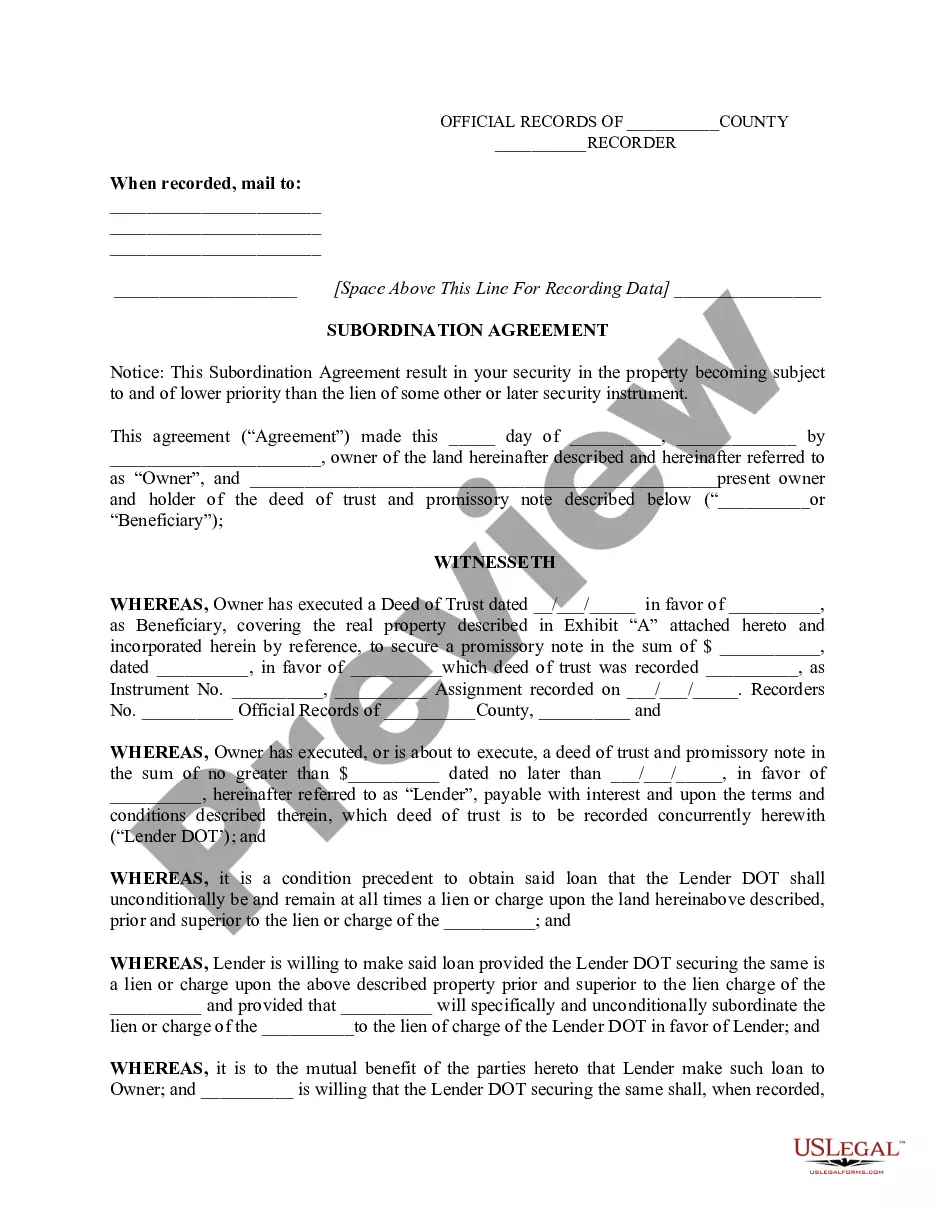

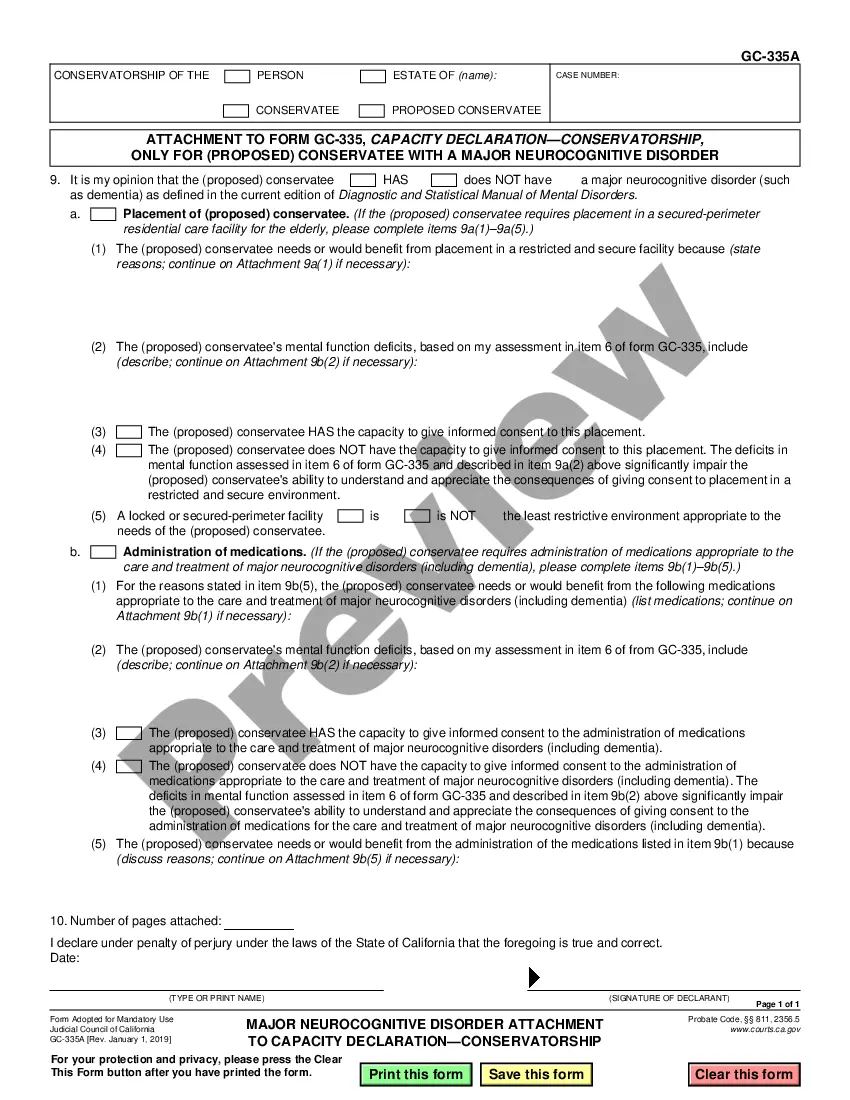

A subordination clause clearly defines the priorities of different creditors in a contract. In Arizona, this clause is particularly useful in real estate transactions, ensuring that one lender's rights are subordinate to another's. By incorporating a subordination clause, you can mitigate risks and protect your investment interests more effectively.

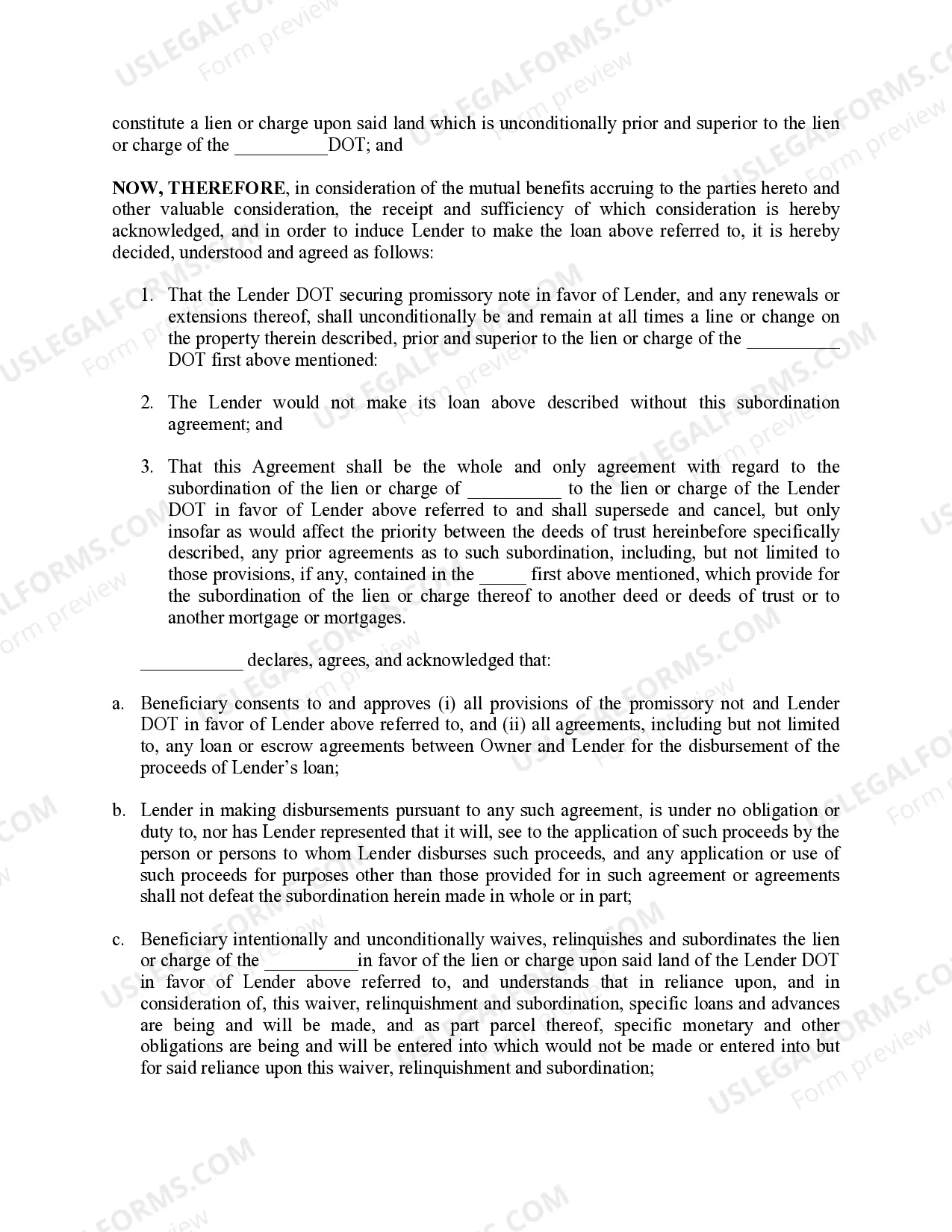

A subordination of a management agreement refers to an arrangement where the interests of property management are placed below those of the financing lender. In Arizona, this type of subordination can protect lenders by ensuring their rights come before the management fees or responsibilities. This arrangement is often crucial during refinancing or securing new loans.

A subordination agreement is a legal document that establishes the order of claims against a property. In Arizona, this agreement allows one creditor to take precedence over another regarding the mortgage or property interest. Typically, lenders will require a subordination agreement to ensure that their rights to repayment are protected.

To obtain an Arizona Subordination Agreement, contact your lender or legal professional for guidance. You can also find customizable templates on platforms like UsLegalForms. These resources can help you create an agreement tailored to your needs. Ensure you understand the terms and conditions before signing to protect your interests.

The subordination rule determines the order in which claims against an asset are addressed in Arizona. Lenders may agree to subordinate their interests to facilitate additional financing for a property. This rule helps create more favorable conditions for borrowing by allowing a new lender to take precedence. Understanding this rule is crucial for navigating the complexities of real estate financing.

An Arizona Subordination Agreement can be provided by lenders, legal professionals, or title companies. Lenders often issue the agreement as part of the financing terms. Additionally, legal experts can help draft custom agreements that protect your interests. Using a trusted platform like UsLegalForms can simplify this process and ensure compliance with local laws.

While not strictly required, it is advisable to record an Arizona Subordination Agreement. Recording serves as a public record, making the agreement enforceable against future lenders and buyers. This action clarifies the priority of liens and helps avoid potential legal disputes. Protect your interests by ensuring your agreement is properly recorded.

Yes, you typically record an Arizona Subordination Agreement to ensure its validity against third parties. Recording the agreement with your local county recorder's office provides public notice of the lien priorities. This protects the interests of the involved parties and lends credibility to the agreement. It is important to follow proper recording procedures to safeguard your rights.

Subordinated debt can take several forms, such as subordinated notes, preferred equity, and mezzanine debt. Each type involves different risks and reward structures for the lending party. For a better understanding and to access templates related to Arizona Subordination Agreements, US Legal Forms offers valuable resources that can simplify the process for you.

An Arizona Subordination Agreement typically addresses the rank of claims among creditors, whereas an Intercreditor Agreement defines the relationship between two or more creditors. The latter outlines how payments are prioritized when a borrower defaults. Understanding these differences can help you determine which document better suits your needs.