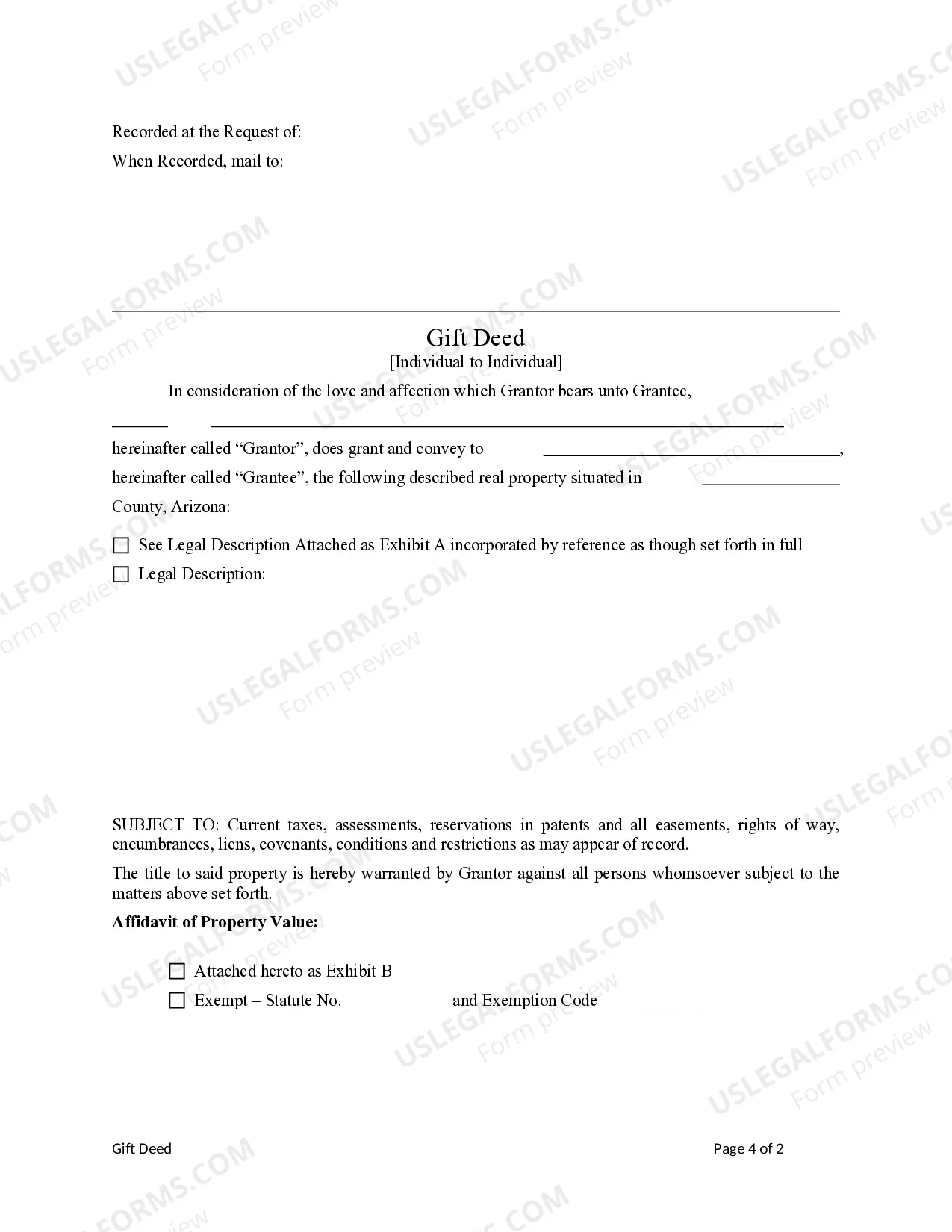

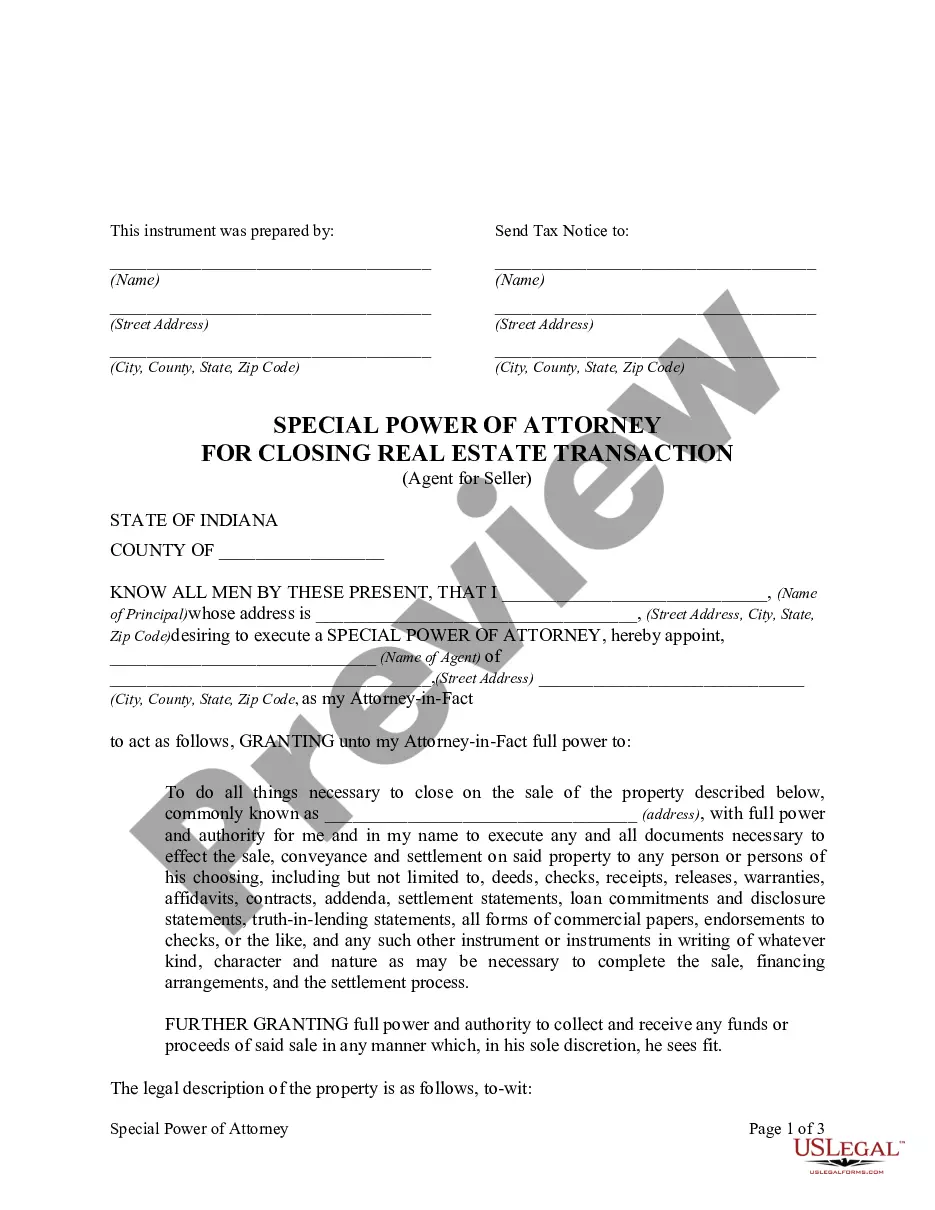

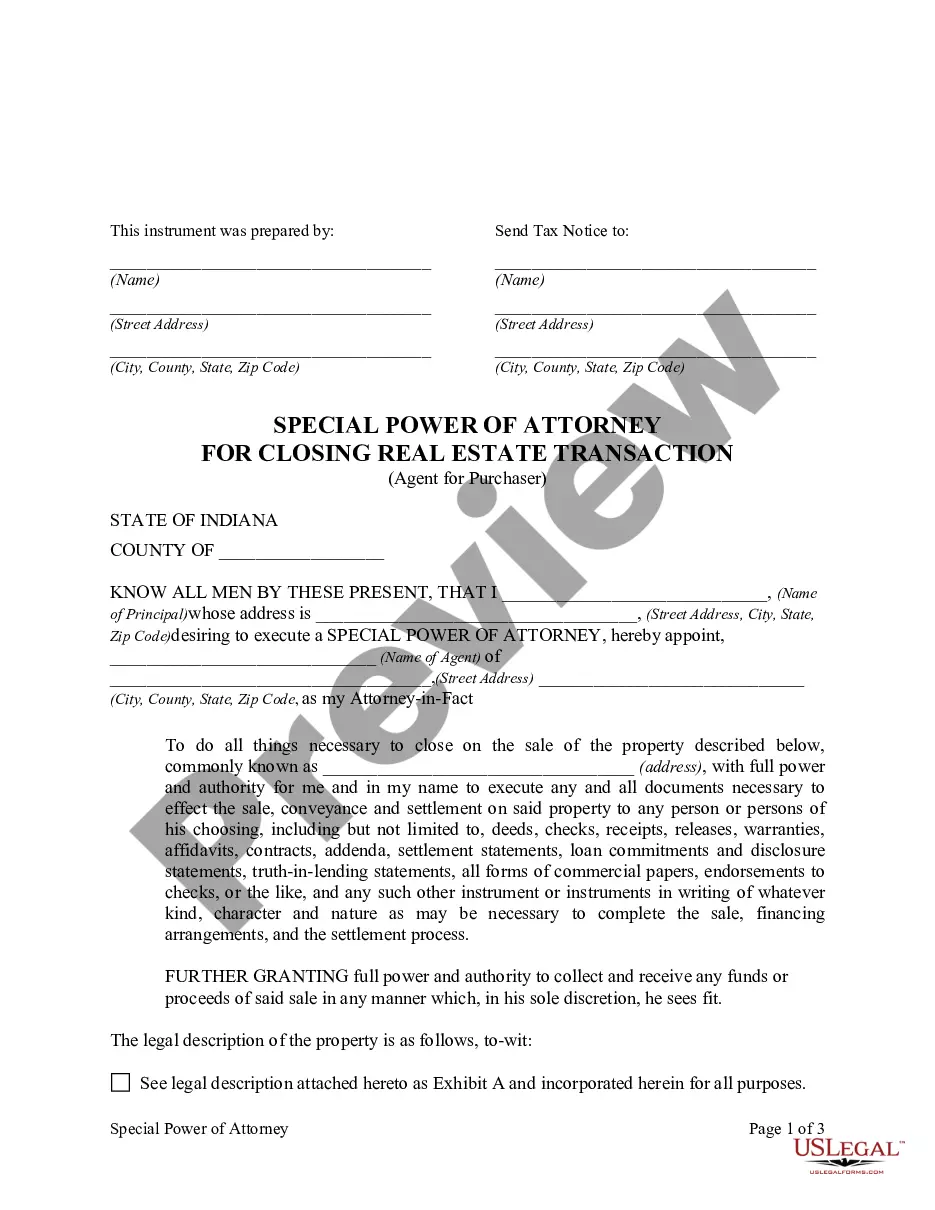

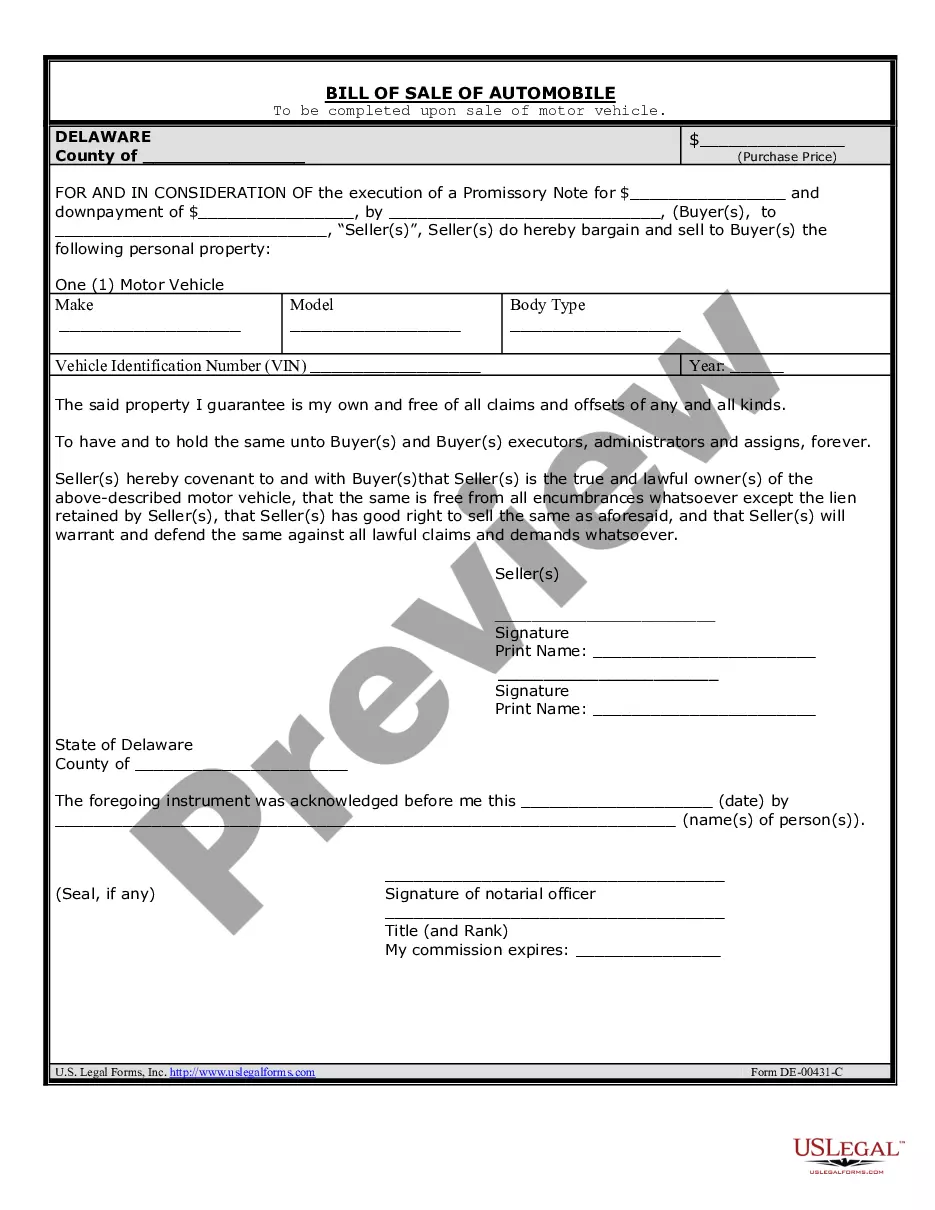

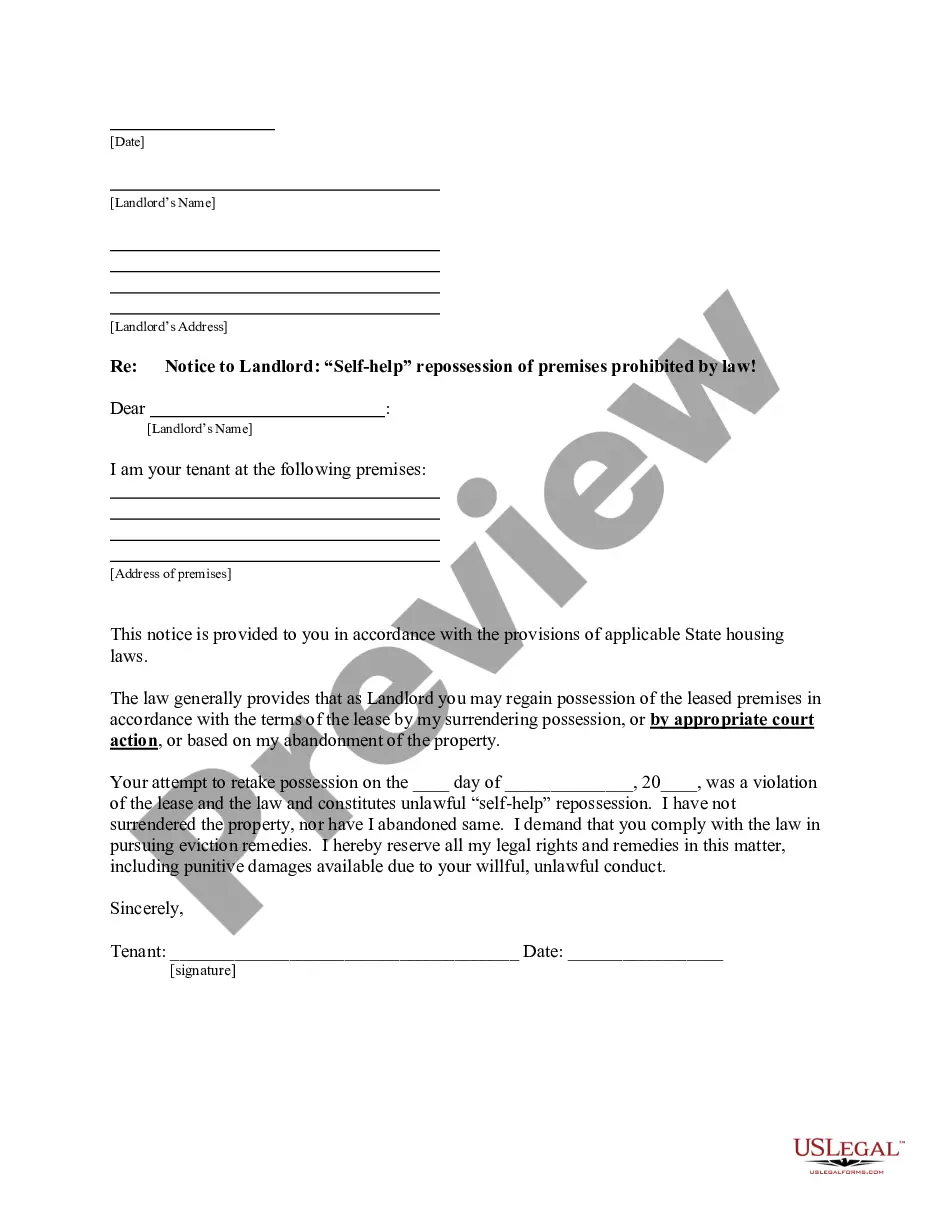

This form is a Gift Deed where the Grantor is an individual and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Arizona Gift Deed from an Individual to an Individual

Description

Key Concepts & Definitions

Gift Deed: A legal document used to transfer ownership of property from one individual (the donor) to another (the recipient) without any exchange of money. Estate Planning: Involves preparing tasks to manage an individual's asset base in the event of incapacitation or death. Includes the bequest of assets to heirs and the settlement of estate taxes. Real Estate: Refers to land plus any tangible improvement that rests upon it or is installed in it. Intellectual Property: Consists of creations of the mind, such as inventions; literary and artistic works; designs; and symbols, names, and images.

Step-by-Step Guide

- Determine Eligibility: Ensure both parties involved are legally competent to transfer and receive the gift.

- Document Preparation: Draft the gift deed with precise details of the property and parties involved.

- Validation by Witnesses: The deed must be signed by at least two witnesses as per most state laws in the United States.

- Notarization: Get the document notarized to validate its authenticity.

- Recording the Deed: File the deed with the local county's clerk's office to make it a matter of public record, thereby completing the transfer process.

Risk Analysis

- Legal Disputes: Improper documentation or lack of clarity in the deed can lead to disputes among family members or claims by third parties.

- Tax Implications: Though usually exempt, gift deeds may incur tax liabilities under certain circumstances.

- Irrevocability: Once executed, a gift deed is generally irrevocable, making it critical to be certain beforehand.

Common Mistakes & How to Avoid Them

- Avoiding Professional Help: Engaging estate agents or legal professionals can provide crucial assistance in navigating complex aspects of property transfer.

- Lack of Research: Failing to search property details or assess the property's exact value can affect the legality or financial implications of the deed.

- Ignoring Tax Consequences: Misunderstanding the tax obligations resulting from a gift deed could lead to unexpected financial burdens.

Best Practices

- Comprehensive Drafting: Include precise, clear descriptions of the property and terms in the gift deed.

- Consult Estate Planning Experts: Obtain advice from professionals specialized in estate planning and property laws.

- Proper Filing: Ensure the deed is filed correctly and timely at the relevant local office.

How to fill out Arizona Gift Deed From An Individual To An Individual?

If you're seeking accurate Arizona Gift Deed from one Individual to another Individual web templates, US Legal Forms is what you require; find documents supplied and validated by state-authorized lawyers.

Utilizing US Legal Forms not only spares you from issues concerning legal paperwork; it also saves you time, effort, and money! Downloading, printing, and submitting a professional template is far more cost-effective than hiring a lawyer to do it for you.

And that's it. In just a few simple steps, you have an editable Arizona Gift Deed from one Individual to another Individual. Once you create your account, all subsequent requests will be managed even more effortlessly. With a US Legal Forms subscription, simply Log In and click the Download button you find on the form’s page. Then, whenever you wish to utilize this blank again, you will always be able to access it in the My documents section. Don’t waste your time searching through countless forms on various sites. Purchase professional versions from a single reliable service!

- To start, complete your registration process by entering your email and creating a secure password.

- Follow the instructions below to set up an account and obtain the Arizona Gift Deed from one Individual to another Individual template to address your concerns.

- Utilize the Preview option or check the document details (if available) to ensure the sample is the one you need.

- Verify its validity in your state.

- Click Buy Now to confirm your purchase.

- Choose a preferred payment plan.

- Create an account and pay with your credit card or PayPal.

Form popularity

FAQ

Filing a quit claim deed in Arizona requires filling out the quit claim deed form clearly, including all pertinent details like the names of the parties and the property description. After completing the form, sign it in the presence of a notary. Finally, present the notarized quit claim deed to the county recorder for filing. This process effectively removes any claim you have on the property, transferring it to the new owner.

To transfer a property deed in Arizona, you typically complete an Arizona Gift Deed from an Individual to an Individual. Begin by drafting the deed, including the legal descriptions and names involved. After getting the necessary signatures and notarization, file the deed with the county recorder’s office. This transfer process ensures that the new ownership is legally recognized.

The fastest way to transfer a deed is by using an Arizona Gift Deed from an Individual to an Individual, which allows for a simple transfer of ownership without the need for complex legal procedures. Ensure that both the giver and the recipient sign the deed in front of a notary. Once the deed is recorded with the county, the transfer is effective and immediate.

Gifting property in Arizona involves completing an Arizona Gift Deed from an Individual to an Individual. First, you need to fill out the deed form with your details and the recipient's information. Make sure to have the deed notarized before filing it with the county recorder. This process ensures that the gift is legally recognized and properly documented.

Filing a quitclaim deed in Arizona involves a few simple steps. First, prepare the deed with accurate details, including the names of the grantor and grantee, as well as the property description. After signing the document, you must record it with your county's recorder office to finalize the process. Utilizing an Arizona Gift Deed from an Individual to an Individual simplifies this task, ensuring all necessary elements are included for a smooth filing experience.

To add a person to a deed in Arizona, you typically need to execute a new deed that transfers ownership interests. This is often accomplished through a quitclaim deed, which is efficient and effective. When creating an Arizona Gift Deed from an Individual to an Individual, ensure you include both parties' names and the property's legal description. You should then file the new deed with the county recorder's office to make it official.

The primary beneficiaries of a quitclaim deed are individuals who wish to transfer property easily and quickly. This deed is often used among family members or close friends, especially in situations where trust exists. When you use an Arizona Gift Deed from an Individual to an Individual, the process becomes straightforward, allowing for a smooth ownership transfer without extensive paperwork. It's a suitable option for those wanting to change ownership without the complexities of a traditional real estate transaction.

To transfer property as a gift, you need to create a legal document that outlines the details of the transaction. Using an Arizona Gift Deed from an Individual to an Individual is a straightforward way to accomplish this, as it serves to clearly document the gift, making the transfer process seamless and recognized by the state.

The format of a gift declaration usually includes sections for the names of the donor and recipient, a description of the property, and a statement affirming that the property is a gift. Using an Arizona Gift Deed from an Individual to an Individual can simplify this process by providing a structured template.

A gift declaration form is a written instrument that formalizes the act of giving a gift. It should outline the details of the gift and may serve as proof of the transfer, especially when dealing with property transfers like an Arizona Gift Deed from an Individual to an Individual.