Arkansas Clauses Relating to Powers of Venture

Description

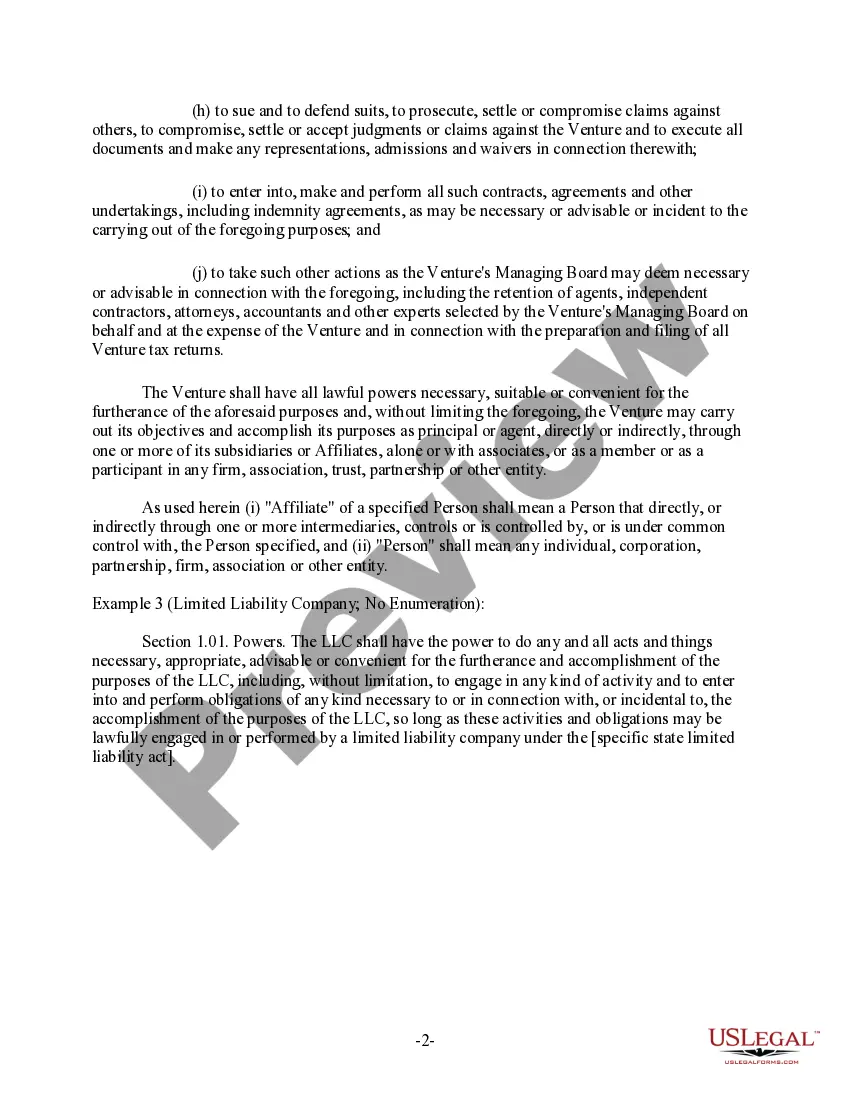

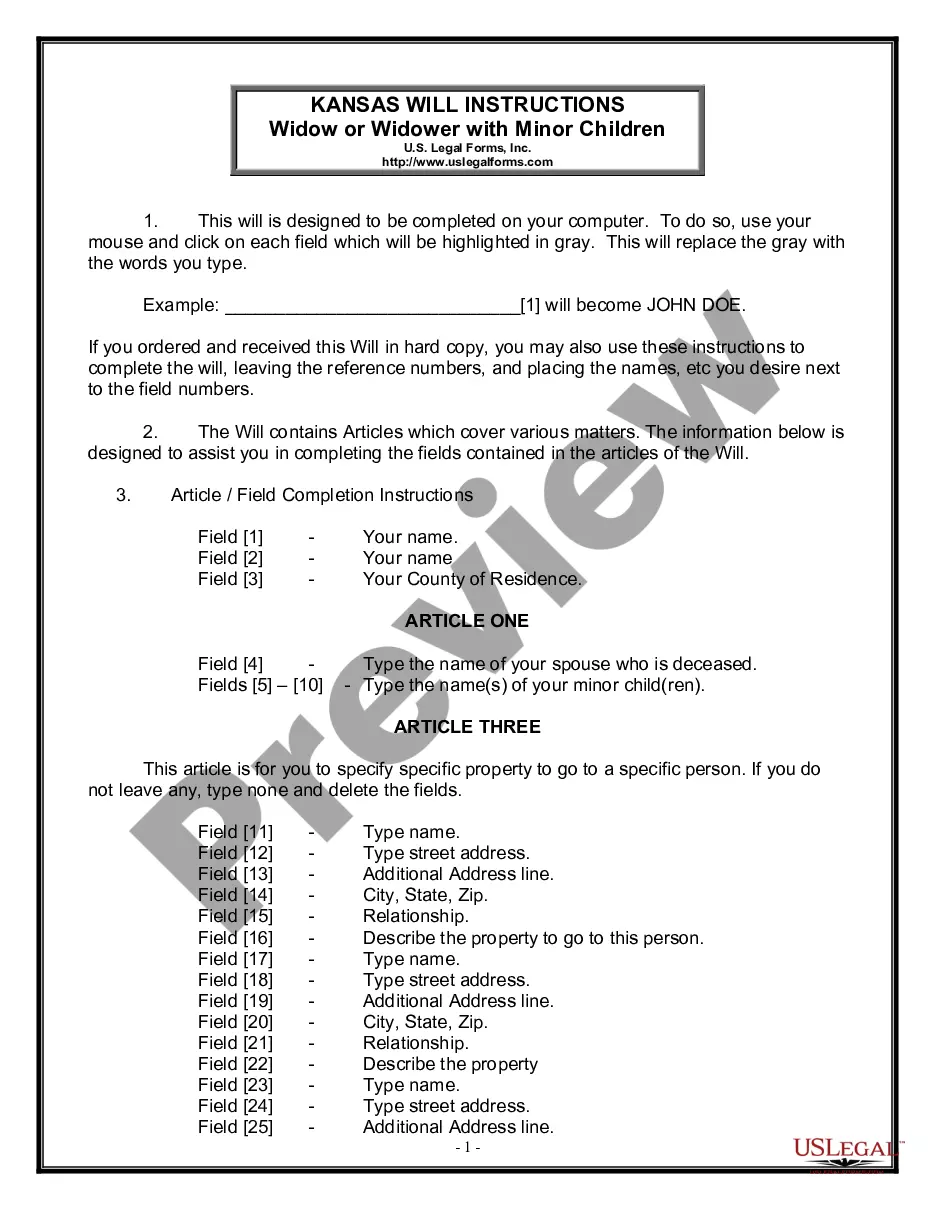

How to fill out Clauses Relating To Powers Of Venture?

You are able to commit time on-line trying to find the lawful file design that meets the federal and state needs you want. US Legal Forms gives 1000s of lawful types which are evaluated by professionals. It is possible to acquire or print the Arkansas Clauses Relating to Powers of Venture from our services.

If you already have a US Legal Forms account, you can log in and then click the Acquire key. Afterward, you can complete, edit, print, or indicator the Arkansas Clauses Relating to Powers of Venture. Each lawful file design you get is your own property forever. To have yet another version associated with a purchased form, check out the My Forms tab and then click the related key.

If you are using the US Legal Forms internet site the first time, stick to the simple directions listed below:

- First, be sure that you have selected the right file design for your region/area of your choosing. Look at the form explanation to ensure you have picked the proper form. If offered, utilize the Review key to search through the file design too.

- If you would like discover yet another model in the form, utilize the Lookup discipline to find the design that fits your needs and needs.

- Once you have located the design you desire, just click Get now to carry on.

- Choose the pricing program you desire, type in your references, and register for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your Visa or Mastercard or PayPal account to purchase the lawful form.

- Choose the file format in the file and acquire it to your product.

- Make adjustments to your file if necessary. You are able to complete, edit and indicator and print Arkansas Clauses Relating to Powers of Venture.

Acquire and print 1000s of file themes while using US Legal Forms website, which offers the biggest collection of lawful types. Use specialist and condition-certain themes to deal with your business or specific demands.

Form popularity

FAQ

New Arkansas tax cut bill The new 4.4% tax rate won't take effect until 2024, so taxpayers whose incomes fall into the top bracket are subject to the previously reduced rate of 4.7% for 2023. Still, this is a much lower tax rate than most states impose for their wealthiest earners.

Business corporations, nonprofit corporations, professional corporations, limited partnerships, limited liability partnerships and limited liability companies are formed in Arkansas by filing with the Business Services Division of the Office of Secretary of State.

In Arkansas, you can establish a sole proprietorship without filing any legal documents with the Arkansas state government.

Limited Liability Company Must file Articles of Organization with the Arkansas Secretary of State. Allow members to manage a company themselves or to elect managers.

A sole proprietorship has no existence separate from its owner. Therefore, the legal or true name of a sole proprietorship is its owner's full name. But if the business will be operating under a different name, most jurisdictions require that the name be registered.

A sole proprietorship is a non-registered, unincorporated business run solely by one individual proprietor with no distinction between the business and the owner. The owner of a sole proprietorship is entitled to all profits but is also responsible for the business's debts, losses, and liabilities.

Along with many states, Arkansas does not require every business to obtain a generic business license at the state level. The only statewide permit or license applicable to most businesses is the Arkansas sales tax permit, often called a seller's permit, which registers your business for the Arkansas sales and use tax.