Arkansas Heating Contractor Agreement - Self-Employed

Description

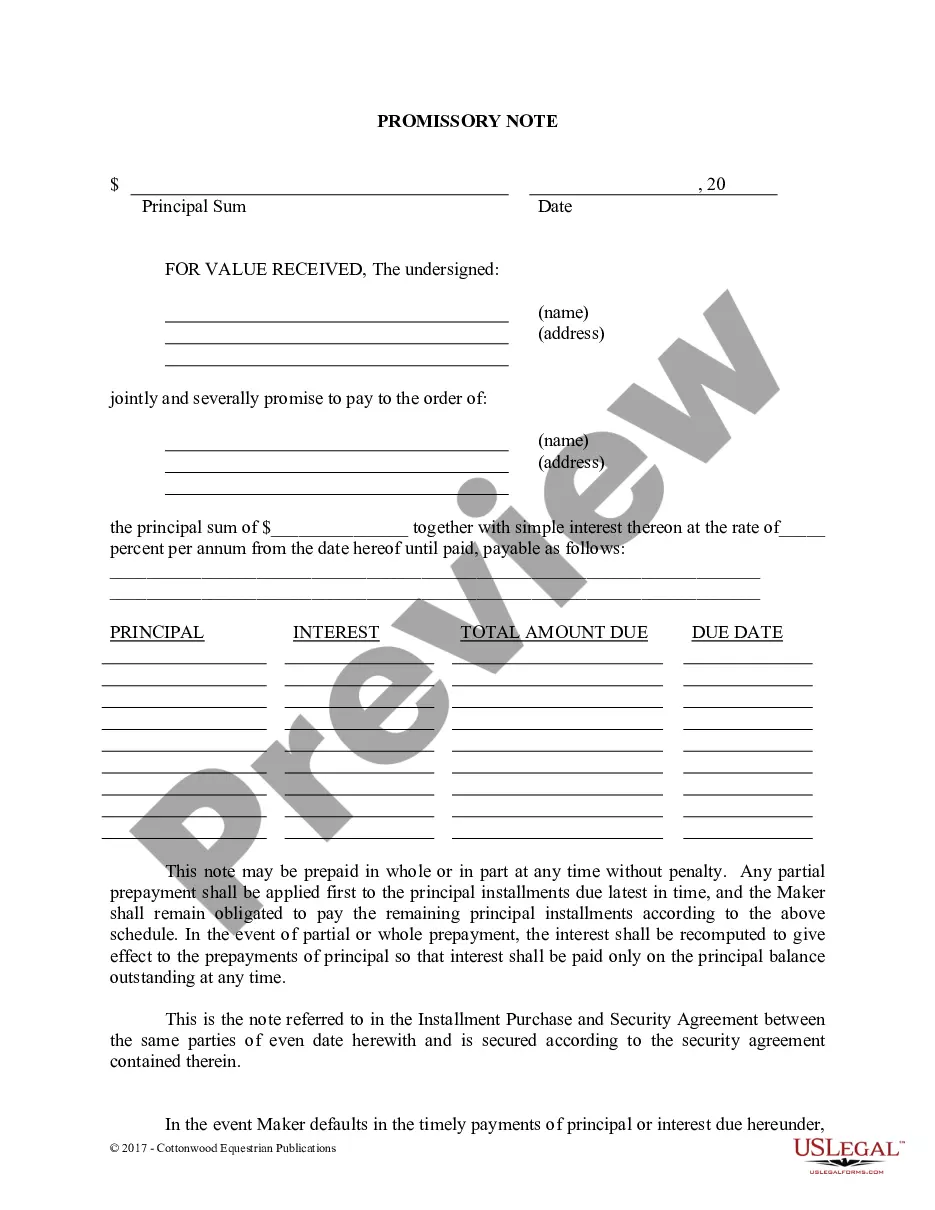

How to fill out Heating Contractor Agreement - Self-Employed?

You can dedicate time online searching for the legal document template that meets the state and federal standards you need.

US Legal Forms provides thousands of legal templates that have been assessed by experts.

It is easy to obtain or create the Arkansas Heating Contractor Agreement - Self-Employed from the platform.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- Subsequently, you can complete, modify, print, or sign the Arkansas Heating Contractor Agreement - Self-Employed.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of the purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your region or area of choice. Review the document outline to verify you have chosen the right one.

- If available, utilize the Review button to examine the document format as well.

Form popularity

FAQ

drafted selfemployed contract should include key components such as the project's scope, payment structure, deadlines, and termination clauses. It is important for the Arkansas Heating Contractor Agreement SelfEmployed to specify whether the contractor is responsible for their own taxes and insurance. Additionally, including confidentiality and dispute resolution clauses can further protect your interests. US Legal Forms offers detailed templates to ensure you cover all necessary elements in your contract.

The basic independent contractor agreement outlines the terms of work between a contractor and a client. This document defines the scope of work, payment terms, and the relationship between the parties involved. For self-employed individuals in Arkansas, having a clear understanding of the Arkansas Heating Contractor Agreement - Self-Employed is essential to protect both parties. Utilizing US Legal Forms can streamline this process by providing customized templates that fit your specific needs.

Creating an independent contractor agreement involves outlining the project specifics, payment terms, and responsibilities of each party. You should include clauses related to confidentiality, termination, and dispute resolution. Using a reliable platform like uslegalforms can help you draft a comprehensive Arkansas Heating Contractor Agreement - Self-Employed, ensuring all essential elements are included for your protection.

Independent contractors in Arkansas must adhere to specific legal requirements, including collecting necessary permits and paying taxes on their earnings. They need to ensure that contracts, like the Arkansas Heating Contractor Agreement - Self-Employed, clearly define the scope of work and payment terms. Additionally, it is beneficial to secure insurance to protect against liability and unforeseen circumstances.

In Arkansas, you may perform a limited amount of work without a contractor's license, typically for projects valued under a certain threshold. However, understanding the rules and regulations is crucial, especially when it comes to heating and HVAC systems. A well-drafted Arkansas Heating Contractor Agreement - Self-Employed can outline what work falls under this exemption and help you stay compliant with state requirements.

In Arkansas, an employee works under a contract where the employer controls the work and schedules, while an independent contractor operates with more autonomy. As an independent contractor, you typically manage your own business, set your own hours, and provide services to clients under a contractual agreement. Specifically, an Arkansas Heating Contractor Agreement - Self-Employed helps define the terms of your work, ensuring clarity and legal protection for both parties.

When filling out an independent contractor agreement, start with the contractor’s and client's information, followed by a clear description of services to be rendered. Specify the payment details, including amounts and due dates, and outline any additional terms that are important to the project. By using an Arkansas Heating Contractor Agreement - Self-Employed template, you can ensure that you do not miss any vital information, making your agreement both solid and effective.

To write an independent contractor agreement, begin by outlining the scope of work and the expectations of both parties. Include payment terms, timelines, and any necessary clauses regarding confidentiality or termination. Utilizing an Arkansas Heating Contractor Agreement - Self-Employed template can streamline this process and ensure you cover all essential points while maintaining professionalism.

You do not need an LLC to operate as a contractor; however, forming an LLC can provide liability protection and tax advantages. Many self-employed individuals choose this route for the added security it offers. Ultimately, having an Arkansas Heating Contractor Agreement - Self-Employed can also clarify your relationship with clients, whether you decide to form an LLC or not.

Filling out an independent contractor form is straightforward. Start by entering your personal information, including your name, address, and tax identification number. Next, provide details about the job, including the type of services you will offer as part of the Arkansas Heating Contractor Agreement - Self-Employed. Finally, review the form for accuracy before submitting.