Arkansas Computer Repairman Services Contract - Self-Employed

Description

How to fill out Computer Repairman Services Contract - Self-Employed?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a broad selection of legal form formats that you can download or print.

By using the website, you will find thousands of forms available for business and personal purposes, organized by categories, states, or keywords.

You can access the latest forms such as the Arkansas Computer Repairman Services Agreement - Self-Employed within moments.

Examine the description of the form to confirm that you have chosen the appropriate one.

If the form does not meet your requirements, utilize the Search field located at the top of the page to find the one that does.

- If you already hold a subscription, sign in and retrieve the Arkansas Computer Repairman Services Agreement - Self-Employed from the US Legal Forms collection.

- The Download button will appear on every form you view.

- You will have access to all previously acquired forms under the My documents section of your account.

- If you are new to US Legal Forms, here are simple steps to help you begin.

- Ensure you have selected the correct form for your city/county.

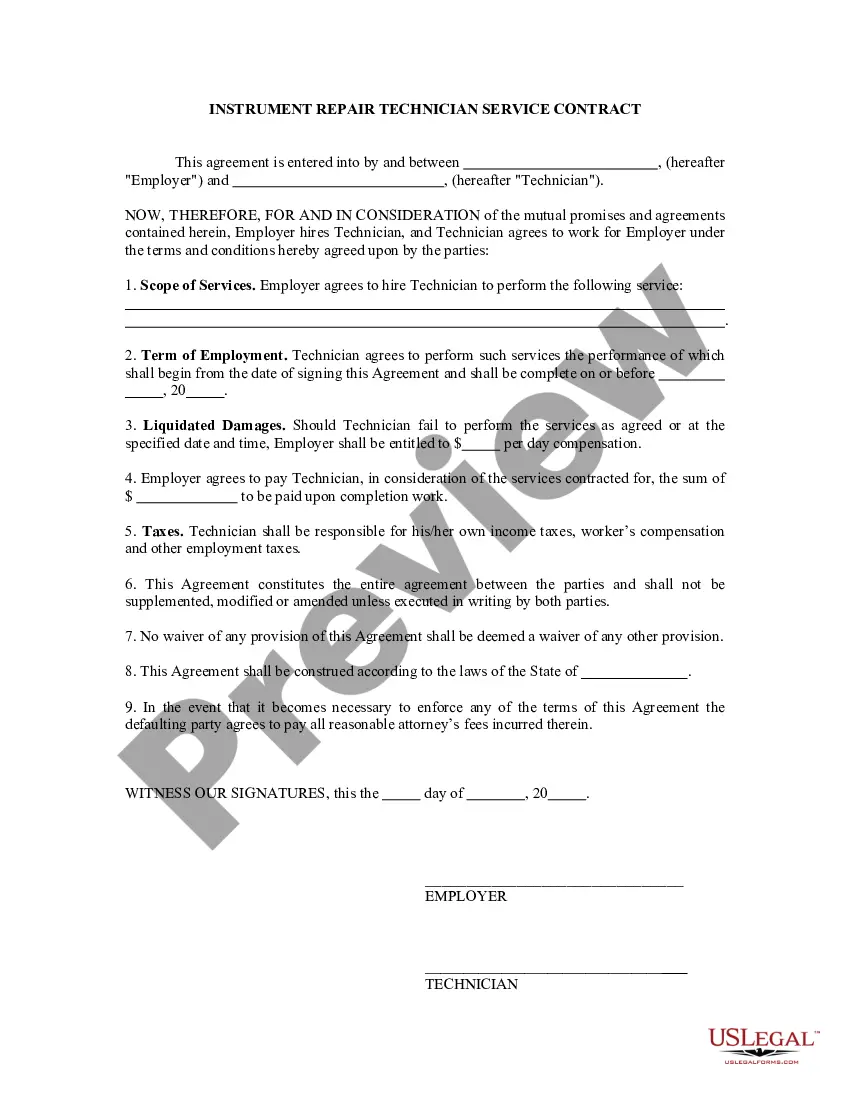

- Click on the Preview button to review the contents of the form.

Form popularity

FAQ

In Arkansas, the amount of work you can do without a contractor license varies, but generally, you can perform small jobs up to a certain monetary limit without needing a license. This includes various repairs and maintenance activities. If you engage in larger projects or more specialized tasks, you may need an Arkansas Computer Repairman Services Contract - Self-Employed to formalize your agreement with clients. Always consult local regulations to understand the specific thresholds that apply in your area.

Yes, a self-employed person can absolutely have a contract. In fact, having a well-drafted Arkansas Computer Repairman Services Contract - Self-Employed is crucial to outline the terms of your work, payments, and responsibilities. This contract protects both you and your clients, ensuring clarity in business transactions. Utilize resources like uslegalforms to create a comprehensive contract that meets legal standards.

In Arkansas, a handyman can perform a variety of tasks without a license, such as minor repairs, painting, and maintenance jobs. However, it is important to remember that specialized work like electrical or plumbing services may require a professional license. When considering an Arkansas Computer Repairman Services Contract - Self-Employed, ensure that the scope of work you plan to undertake aligns with the state regulations. Always check local laws to understand your specific obligations.

You do not need to have an LLC to operate as a self-employed contractor, including when you utilize an Arkansas Computer Repairman Services Contract - Self-Employed. While forming an LLC can offer liability protection and other benefits, many contractors successfully work as sole proprietors without one. It’s essential to consider your specific business needs and, if necessary, consult a legal expert. For reliable resources and templates like the Arkansas Computer Repairman Services Contract - Self-Employed, you can explore the US Legal Forms platform.

Repair services are generally subject to sales tax in Arkansas. This includes services that repair tangible personal property, like electronics or vehicles. If you’re entering an Arkansas Computer Repairman Services Contract - Self-Employed, reviewing tax obligations for repair services is crucial to maintaining compliance.

Certain services in Arkansas may be exempt from service tax, such as those considered non-taxable under state law. Educational services and healthcare might fall into this category. Understanding what’s exempt is essential, especially if you are planning to operate under an Arkansas Computer Repairman Services Contract - Self-Employed.

A freelance computer technician is a self-employed professional who provides computer repair and support services independently. They often work on a contract basis, offering flexible solutions tailored to clients’ needs. If you need assistance, an Arkansas Computer Repairman Services Contract - Self-Employed may be beneficial to solidify your agreements.

In Arkansas, repair labor can be taxable depending on the nature of the repair. If the repair is for tangible personal property, it usually incurs sales tax. When entering an Arkansas Computer Repairman Services Contract - Self-Employed, ensure that you understand your tax responsibilities for repair labor to avoid future liabilities.

To calculate tax on a service in Arkansas, you typically need to determine the service's taxable amount and then apply the appropriate sales tax rate. It’s important to check whether the service falls under taxable services, like some repair work. If you're unsure, an Arkansas Computer Repairman Services Contract - Self-Employed may help clarify any tax liabilities you might encounter.

In Arkansas, landscaping services may be subject to sales tax. However, the tax applies only to specific types of services, such as those involving real property improvements. If you are considering an Arkansas Computer Repairman Services Contract - Self-Employed, be aware that your service type might affect tax obligations.