Arkansas IRS 20 Quiz to Determine 1099 vs Employee Status

Description

How to fill out IRS 20 Quiz To Determine 1099 Vs Employee Status?

If you need to finalize, obtain, or print legal documents templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the website's simple and user-friendly search to locate the documents you require.

Different templates for corporate and individual purposes are categorized by groups and states, or keywords.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of your legal form and download it to your device.

- Use US Legal Forms to locate the Arkansas IRS 20 Quiz to Determine 1099 vs Employee Status in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and hit the Download button to access the Arkansas IRS 20 Quiz to Determine 1099 vs Employee Status.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the steps below.

- Step 1. Confirm you have selected the form for the appropriate city/state.

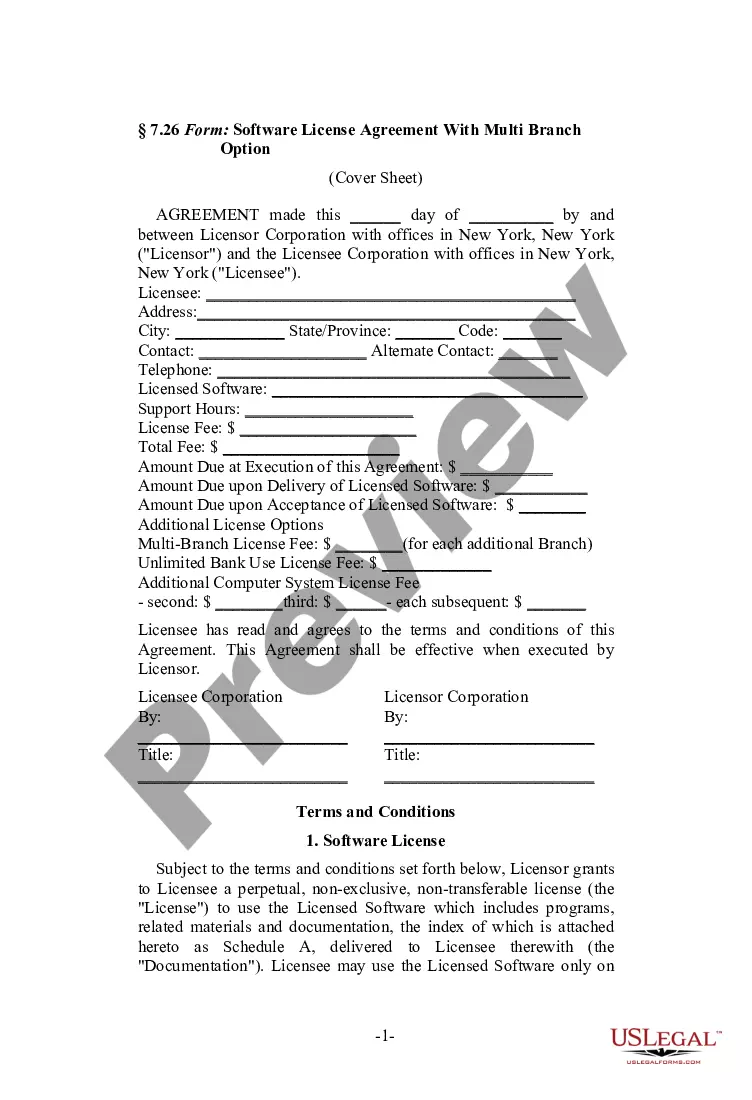

- Step 2. Use the Preview feature to review the form's content. Don't forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search bar at the top of the page to find other versions of your legal form template.

- Step 4. Once you have found the form you desire, click on the Buy now button. Choose your preferred pricing plan and input your details to register for an account.

Form popularity

FAQ

To determine if a person is an independent contractor, the IRS uses several factors that focus on the degree of control and independence involved in the work relationship. Primarily, they look at behavioral control, financial control, and the relationship between the parties. The Arkansas IRS 20 Quiz to Determine 1099 vs Employee Status effectively summarizes these criteria and helps users understand their status as independent contractors or employees. By using USLegalForms, you can navigate this quiz easily and ensure compliance with IRS regulations.

The three key tests include the Behavioral Control Test, Financial Control Test, and the Relationship Test. Each test evaluates various aspects of the working arrangement, such as supervision, financial investment, and the permanence of the relationship. Understanding these tests is essential, and the Arkansas IRS 20 Quiz to Determine 1099 vs Employee Status can provide valuable guidance.

Determining a person's status involves reviewing their work arrangements, the control exerted by the employer, and how compensation is handled. Additionally, assessing whether the worker provides their tools and decides how to execute their tasks can further clarify their status. Utilizing the Arkansas IRS 20 Quiz to Determine 1099 vs Employee Status can be beneficial in making a precise determination.

To determine if someone is a W-2 employee or a 1099 independent contractor, evaluate the relationship dynamics and payment structure. W-2 employees usually have a continuous relationship with the employer and receive regular paychecks, while 1099 contractors tend to have a short-term or project-based arrangement. The Arkansas IRS 20 Quiz to Determine 1099 vs Employee Status aids in making these distinctions clearer.

To determine independent contractor status, ask about the level of control the employer has, the method of payment, and whether the worker receives any benefits. It's also helpful to inquire if the worker has multiple clients or if they perform their work independently. This analysis can be streamlined using the Arkansas IRS 20 Quiz to Determine 1099 vs Employee Status.

Several criteria play a role in determining a person's status, including the nature of their work, how they are compensated, and the degree of control exercised by the employer. Evaluating these factors is crucial to classify workers properly. The Arkansas IRS 20 Quiz to Determine 1099 vs Employee Status can provide insights into these important distinctions.

In Arkansas, the main difference lies in the relationship dynamics. Employees typically receive benefits, receive constant supervision, and have taxes withheld from their paychecks. In contrast, independent contractors operate under more autonomy and manage their taxes independently. Understanding these differences can be guided by the Arkansas IRS 20 Quiz to Determine 1099 vs Employee Status.

The IRS relies on various factors to determine if someone is an independent contractor. Primarily, they look at the level of control the employer has over the worker and how the work is performed. The Arkansas IRS 20 Quiz to Determine 1099 vs Employee Status can help clarify these distinctions, ensuring compliance with tax regulations.

To determine if you were misclassified as a 1099 employee, consider the control your employer has over your work. The Arkansas IRS 20 Quiz to Determine 1099 vs Employee Status helps clarify this issue by evaluating the nature of your work relationship with your employer. If you primarily work under their direction and have set hours, you might actually be an employee. Using the quiz results, you can better understand your status and take appropriate steps to address any misclassification.