Arkansas Retainer Agreement

Description

How to fill out Retainer Agreement?

You may spend hours on-line looking for the authorized papers template that suits the federal and state specifications you need. US Legal Forms gives thousands of authorized types that happen to be evaluated by experts. You can easily down load or print the Arkansas Retainer Agreement from my services.

If you have a US Legal Forms bank account, you may log in and click the Download switch. Next, you may complete, revise, print, or sign the Arkansas Retainer Agreement. Every single authorized papers template you get is your own property for a long time. To get an additional version associated with a purchased develop, go to the My Forms tab and click the corresponding switch.

If you use the US Legal Forms site initially, follow the simple guidelines below:

- Very first, be sure that you have selected the correct papers template for your county/city of your choice. Look at the develop explanation to make sure you have selected the correct develop. If readily available, make use of the Review switch to search from the papers template also.

- In order to locate an additional edition of your develop, make use of the Research industry to obtain the template that fits your needs and specifications.

- When you have discovered the template you would like, just click Buy now to continue.

- Pick the pricing strategy you would like, key in your references, and register for an account on US Legal Forms.

- Comprehensive the purchase. You should use your bank card or PayPal bank account to pay for the authorized develop.

- Pick the file format of your papers and down load it for your device.

- Make alterations for your papers if needed. You may complete, revise and sign and print Arkansas Retainer Agreement.

Download and print thousands of papers templates making use of the US Legal Forms web site, that offers the biggest collection of authorized types. Use specialist and condition-distinct templates to deal with your organization or individual needs.

Form popularity

FAQ

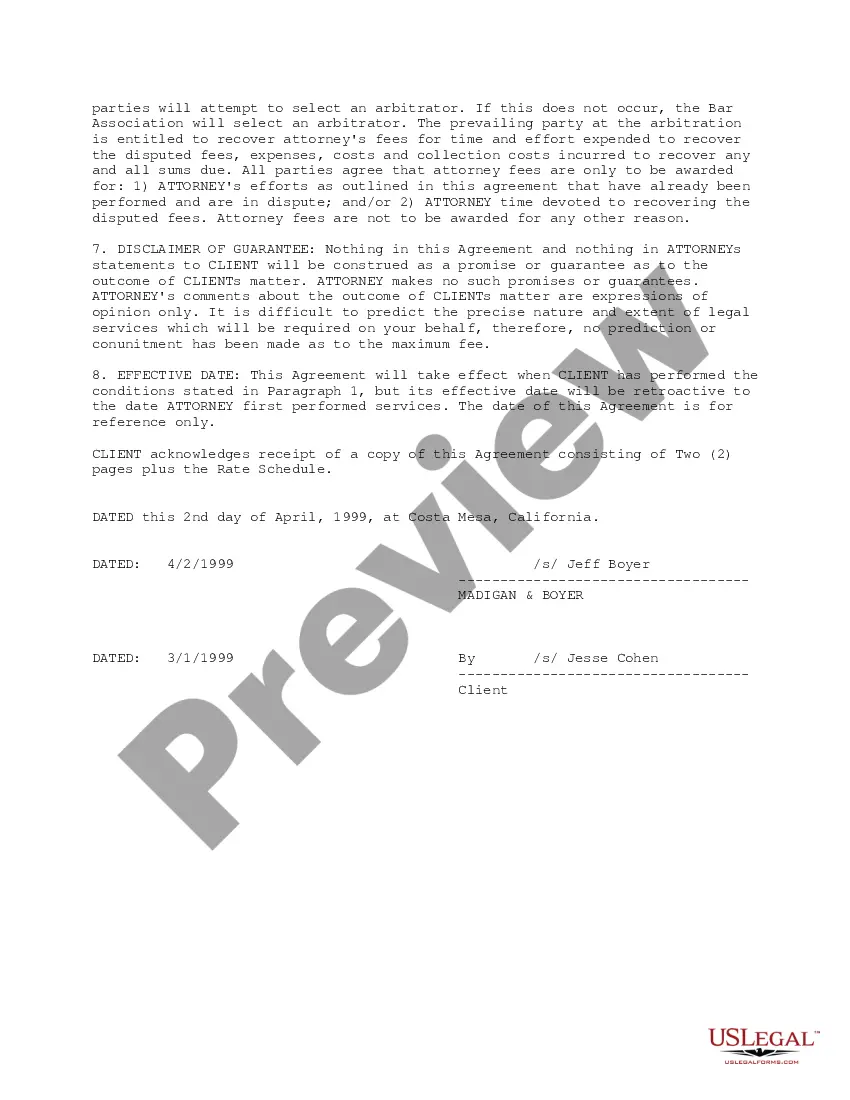

This agreement should cover elements like the services you'll provide, how long the working relationship will last, fees, pricing, confidentiality, and more. This sounds like a lot, but it's important to create a comprehensive agreement that protects your agency should anything go wrong.

The basic structure of retainer agreements is the same though: Agency agrees to provide a service(s) or a number of hours their client needs each month. In turn, the client agrees to the retainer payment that they'd pay in exchange for the agency reserving its time/service for them.

Make sure all the following details make it into your retainer contract: The amount you're to receive each month. The date you're to be paid by. Any invoicing procedures you're expected to follow. Exactly how much work and what type of work you expect to do. When your client needs to let you know about the month's work by.

After you schedule and attend your initial consultation, in many cases, the attorney will present you with a retainer agreement. It's a legal contract ? like any other legal contract ? that describes, in detail, how the relationship will work.

A lawyer may charge a $500 retainer fee. If the lawyer charges $100 an hour, the retainer covers all services up to the five-hour limit. The lawyer then bills the client for the cost of any additional hours they invest on behalf of the client.

The essential parts of the agreement include: Scope and nature of the work. What is the attorney expected to do for the client? ... Retainer fee. The retainer fee is the amount charged to the client. ... Client expenses. The client typically pays for some expenses, especially filing-related expenses, and travel costs.

Now that you know the basics about monthly retainers, let's take a look at how to properly set up an agreement for retainer work. Determine the Scope of Work. ... Agree on Deliverables. ... Calculate the Monthly Retainer Fee. ... Decide on the Payment Terms. ... Create a Communication Plan. ... Determine the Contract Duration.