Arkansas Amendment to the articles of incorporation to eliminate par value

Description

How to fill out Amendment To The Articles Of Incorporation To Eliminate Par Value?

It is possible to commit hours on the Internet attempting to find the legitimate file web template which fits the federal and state demands you need. US Legal Forms offers a huge number of legitimate kinds that happen to be reviewed by pros. You can easily download or print the Arkansas Amendment to the articles of incorporation to eliminate par value from our support.

If you currently have a US Legal Forms bank account, you can log in and click the Acquire key. Next, you can complete, edit, print, or sign the Arkansas Amendment to the articles of incorporation to eliminate par value. Every single legitimate file web template you acquire is your own eternally. To acquire one more version of any purchased kind, check out the My Forms tab and click the corresponding key.

Should you use the US Legal Forms site the first time, stick to the straightforward recommendations under:

- First, ensure that you have selected the best file web template for your county/area of your liking. See the kind description to ensure you have picked the correct kind. If readily available, use the Review key to check through the file web template as well.

- If you want to discover one more version from the kind, use the Look for industry to obtain the web template that suits you and demands.

- Once you have found the web template you need, simply click Acquire now to continue.

- Find the prices program you need, enter your credentials, and register for your account on US Legal Forms.

- Total the financial transaction. You can use your Visa or Mastercard or PayPal bank account to purchase the legitimate kind.

- Find the structure from the file and download it for your device.

- Make adjustments for your file if possible. It is possible to complete, edit and sign and print Arkansas Amendment to the articles of incorporation to eliminate par value.

Acquire and print a huge number of file themes using the US Legal Forms site, which offers the biggest collection of legitimate kinds. Use expert and status-certain themes to take on your small business or person demands.

Form popularity

FAQ

The Division completes most filings such as articles of incorporation, amendments, mergers or dissolutions within two business days of receipt.

Bylaws. (a) The incorporators or board of directors of a corporation shall adopt bylaws for the corporation. (b) The bylaws may contain any provision for regulating and managing the affairs of the corporation that is not inconsistent with law or the articles of incorporation.

A corporation's business and affairs are managed by or under the direction of its board of directors. Although the board has the power to make all decisions on behalf of its corporation, many business decisions are actually made by the corporation's officers.

Pennsylvania Business Corporation Law of 1988 defines Corporation or Domestic Corporation as a corporation incorporated for profit under the rules of the Commonwealth of Pennsylvania. One or more corporations for profit or not-for-profit or natural persons of full age may incorporate a business corporation.

The 1987 Act establishes simple and flexible corporate character- istics and requires the affirmative election of restrictive characteris- tics. The 1965 Act is considerably more prescriptive as to corporate characteristics.

The MBCA offers an opportunity for states to bring about uniformity in the corporate laws so that it becomes easier for corporations to operate in multiple states. In addition to legal uniformity, it promotes the use of identical terminology in different state laws, making it easier to interpret.

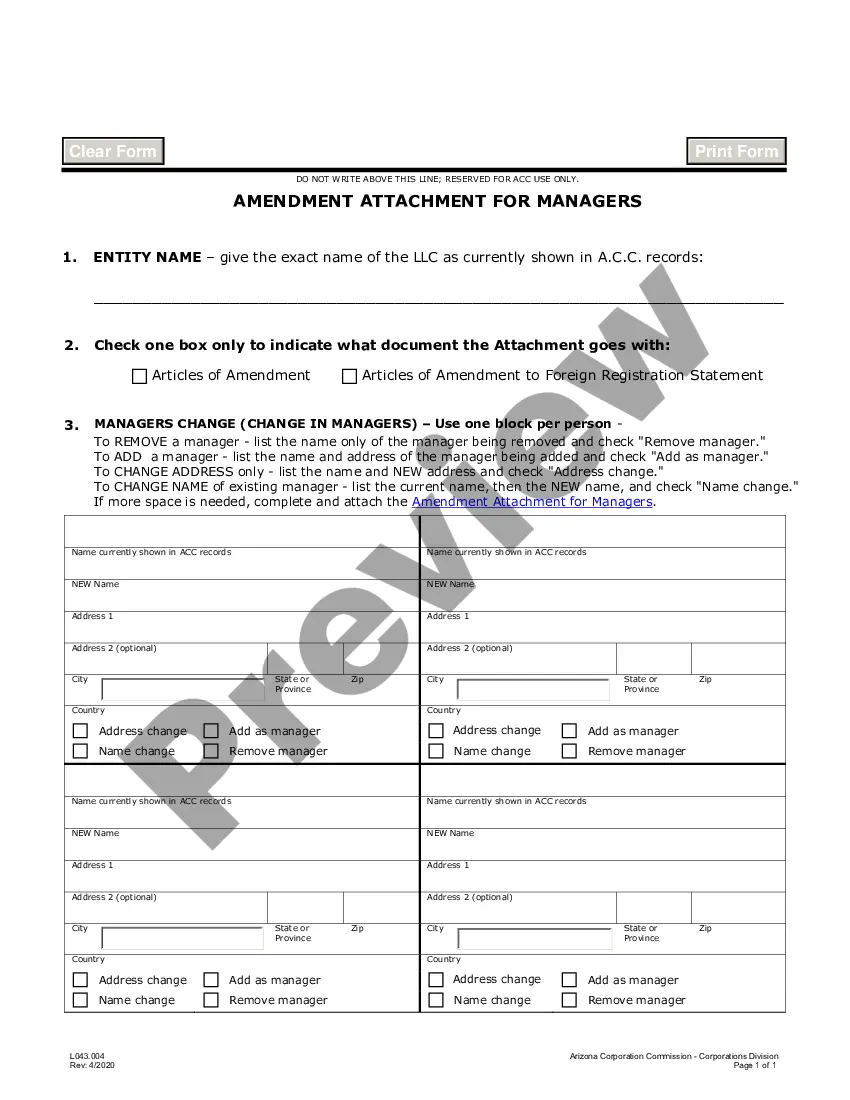

The Articles of Amendment, also sometimes called a Certificate of Amendment, is a document filed with your state of incorporation (or any states in which your company has foreign qualified to transact business), to enact a specific change to the information included in your company's incorporation or qualification ...

The Arkansas Nonprofit Corporation Act of 19931 (hereinafter the "Act") creates a comprehensive corporate code which applies to all Arkansas nonprofit corporations incorporated after 1993.2 Nonprofits chartered before 1994 may elect to become subject to the provisions of the Act by amending their articles of ...