Arkansas Resolution of Meeting of LLC Members to Dissolve the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Dissolve The Company?

Are you in the position where you require documents for both business and personal purposes nearly every working day.

There are numerous legitimate document templates accessible online, but finding reliable versions can be challenging.

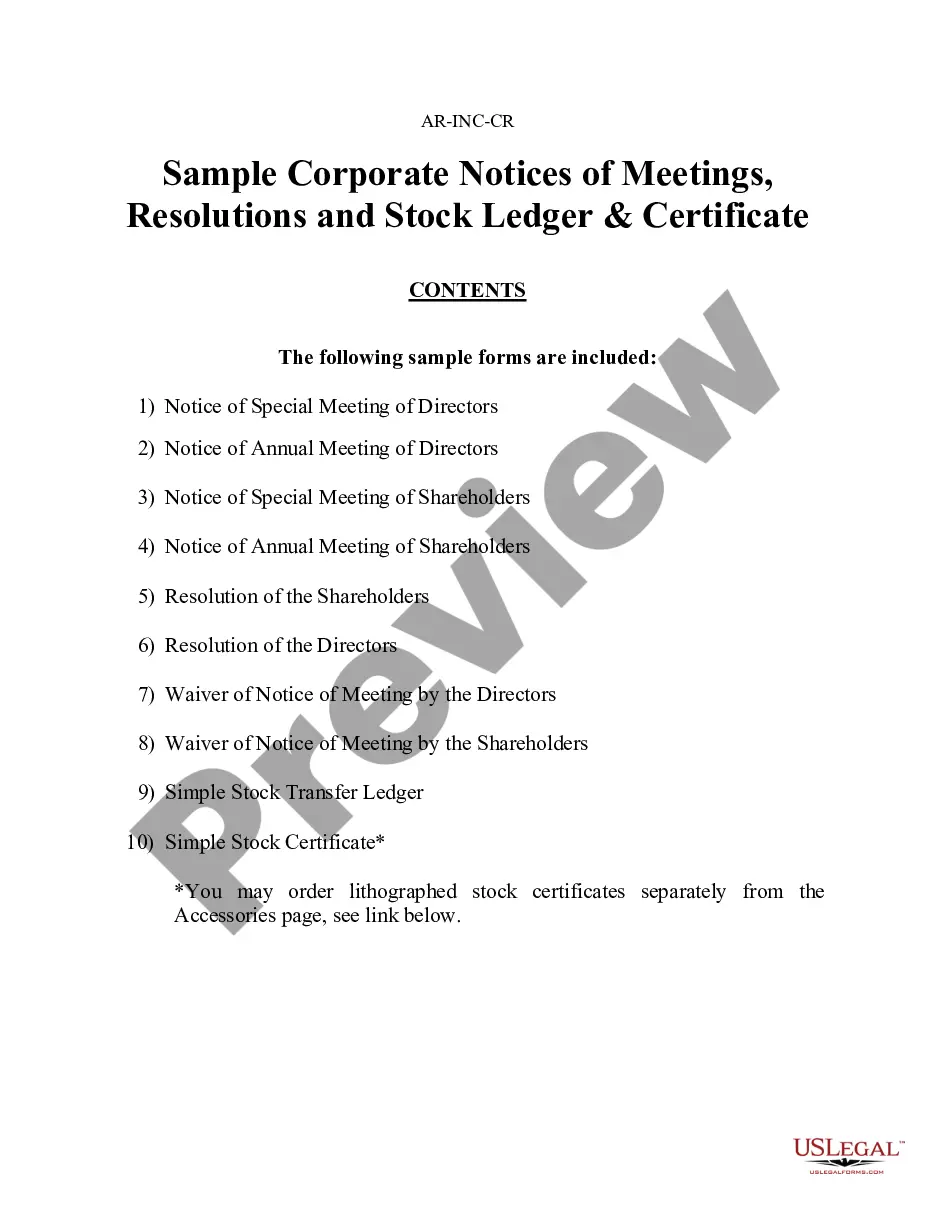

US Legal Forms provides a vast array of form templates, like the Arkansas Resolution of Meeting of LLC Members to Dissolve the Company, which are designed to fulfill state and federal requirements.

Once you have the correct form, click Purchase now.

Select the pricing plan you want, fill out the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can obtain the Arkansas Resolution of Meeting of LLC Members to Dissolve the Company template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

- Utilize the Review button to assess the form.

- Read the description to confirm that you have chosen the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that suits your needs and requirements.

Form popularity

FAQ

By dissolving an LLC properly, it means that the LLC is no longer a legal business entity so you won't be expected to pay any fees or taxes, or file any more documents. Despite no longer operating, it is possible for members to create a new LLC and run it in the same way as the dissolved company.

The dissolution is initiated by a resolution by the board of directors who submit it at a meeting of the shareholders. The shareholders each vote and if the resolution is approved, the directors have the authorization to proceed with the dissolution process.

Dissolving a company is a formal way of closing it. Dissolution refers to the process of 'striking off' (removing) a company from the Companies House register. It can be the most straightforward way of shutting a company down once its directors have decided it should no longer trade.

Dissolution generally occurs when the business purpose of the LLC is completed or ceases to be economically viable. The members may also agree to dissolve the LLC if they are at an impasse regarding fundamental decisions concerning the LLC's business operations.

A corporate resolution outlines the decisions and actions made by a company's board of directors. A corporation might use a corporate resolution to establish itself as an independent legal entity, which is separate from the owners.

Once you've followed the recommended steps, you're ready to apply to Companies House to strike off your company. The directors must formally agree to close down the company, either by passing a resolution at a board meeting or by written board resolution. You can then complete and file Companies House Form DS01.

Reasons for Dissolution of partnershipAdmission of a new partner. Insolvency of an existing partner. Early retirement of a partner. Due to expiry of a partnership period after a certain time as mutually agreed upon by all partners.

When you want to transfer LLC ownership in Arkansas, you have two options. You can sell the entire LLC, or you can conduct a partial sale of the ownership interests of one or more members. This is often known as a buyout.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets. Note that only those assets your company owns can be liquidated. Thus, you can't liquidate assets that are used as collateral for loans.

To dissolve your Arkansas LLC, you submit the completed form Articles of Dissolution for Limited Liability Company to the Arkansas Secretary of State, Business and Commercial Services (BCS) by mail or in person. You cannot file articles of dissolution online. Make checks payable to Arkansas Secretary of State.