Arkansas Guaranty without Pledged Collateral

Description

How to fill out Guaranty Without Pledged Collateral?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can obtain or print.

Utilizing the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords. You can find the latest versions of forms such as the Arkansas Guaranty without Pledged Collateral in just moments.

If you already possess a subscription, Log In and obtain the Arkansas Guaranty without Pledged Collateral from the US Legal Forms repository. The Download button will be visible on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded Arkansas Guaranty without Pledged Collateral. Every template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to obtain or print another copy, simply navigate to the My documents section and click on the form you desire. Access the Arkansas Guaranty without Pledged Collateral with US Legal Forms, the largest repository of legal document templates. Utilize a multitude of professional and state-specific templates that fulfill your business or personal requirements and expectations.

- If you are looking to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your area/county.

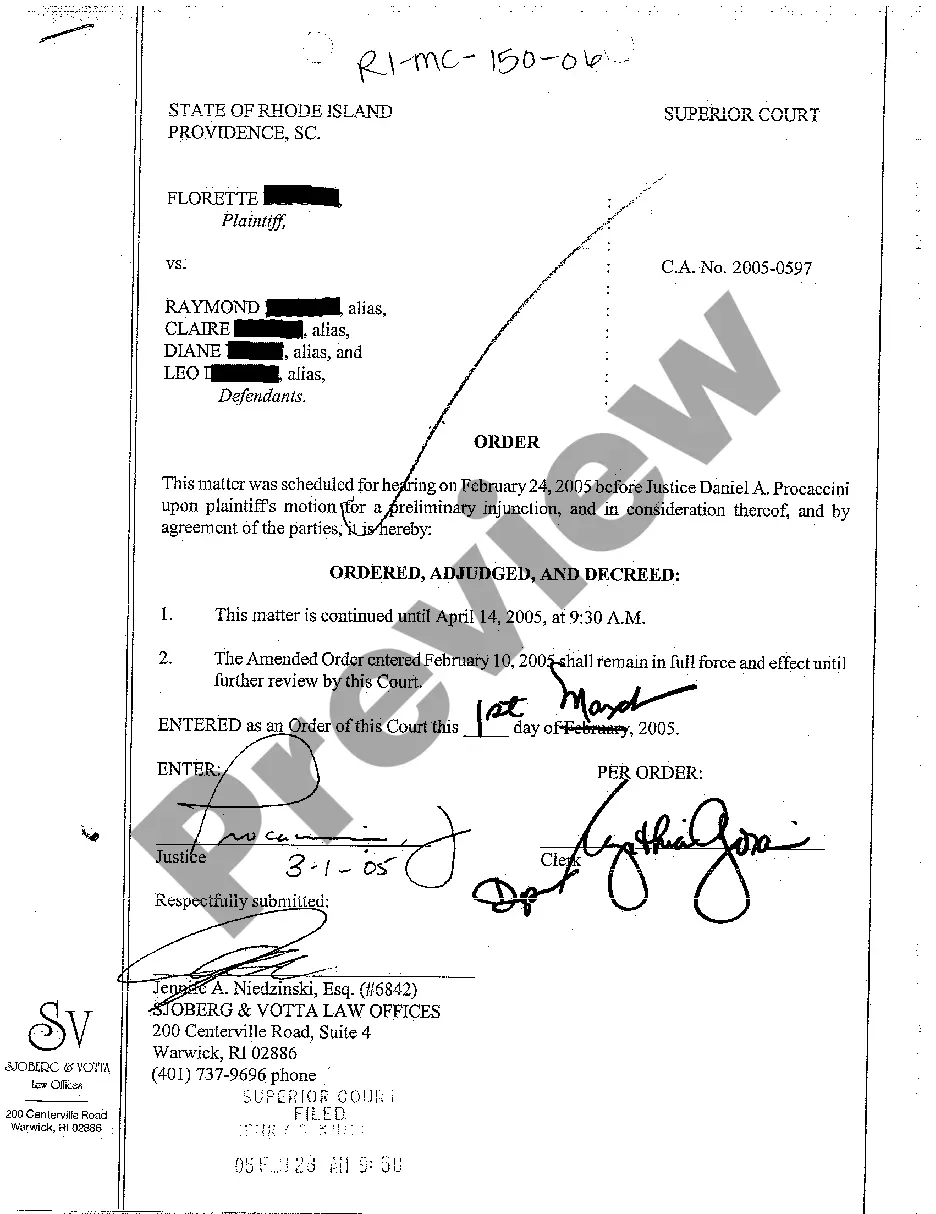

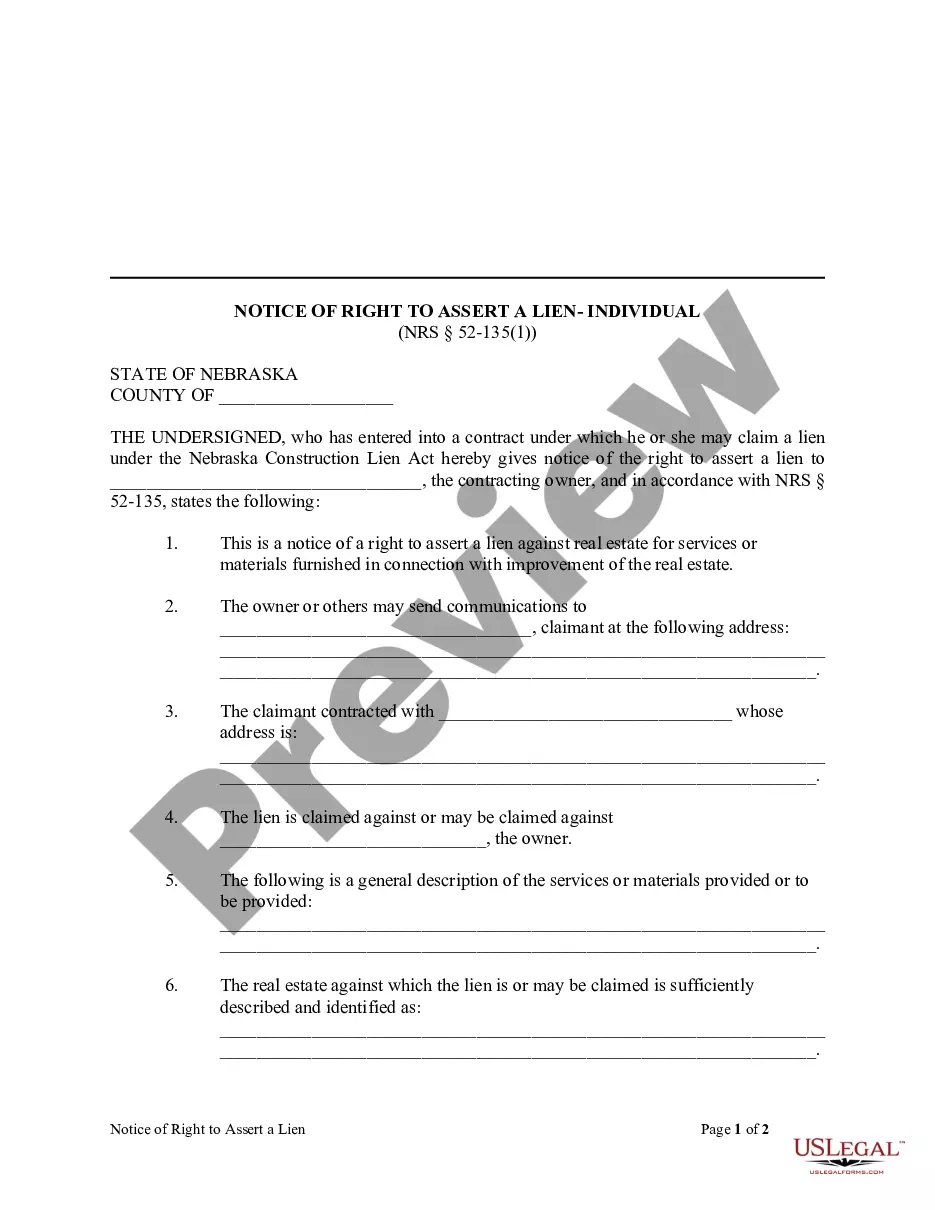

- Click the Review button to examine the form's content.

- Review the form details to confirm you have chosen the right form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

A pledged asset is a valuable possession that is transferred to a lender to secure a debt or loan. A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged.

Related Definitions Pledged Deposits means all time deposits of money, whether or not evidenced by certificates, which Borrower may from time to time designate as pledged to Agent, for the benefit of the Lenders, as security for any Obligation, and all rights to receive interest on said deposits.

A secured loan is a loan in which the borrower pledges some asset (e.g. a car or property) as collateral for the loan, which then becomes a secured debt owed to the creditor who gives the loan.

Hypothecation. Hypothecation is another term for pledging collateral to secure or guarantee a loan or other debt obligation. The borrower, or hypothecator, pledges, or hypothecates, property to the lender. The creditor then has a non-possessory claim against the hypothecated assets.

A deposit for retail clients, specifically to be used as collateral for a loan to be obtained by a company or self-employed person.

Bank Account Pledge Agreement means the pledge agreement entered into between the Issuer and the Trustee on or about the First Issue Date in respect of a first priority pledge over the Bank Account and all funds held on the Bank Account from time to time, granted in favour of the Trustee and the Bondholders (

Collateral, a borrower's pledge to a lender of something specific that is used to secure the repayment of a loan (see credit). The collateral is pledged when the loan contract is signed and serves as protection for the lender.

An agreement typically used to create a security interest in equity interests (including capital stock, LLC interests, and partnership interests) and promissory notes.

Collateral is an asset or property that an individual or entity offers to a lender as security for a loan. It is used as a way to obtain a loan, acting as a protection against potential loss for the lender should the borrower default.

Pledged-Asset Mortgage Homebuyers can sometimes pledge assets, such as securities, to lending institutions to reduce or eliminate the necessary down payment. With a traditional mortgage, the house itself is the collateral for the loan.